Communications and transit > Convention sur le régime fiscal des véhicules automobiles étrangers (avec Protocole annexe)

(3)

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

2

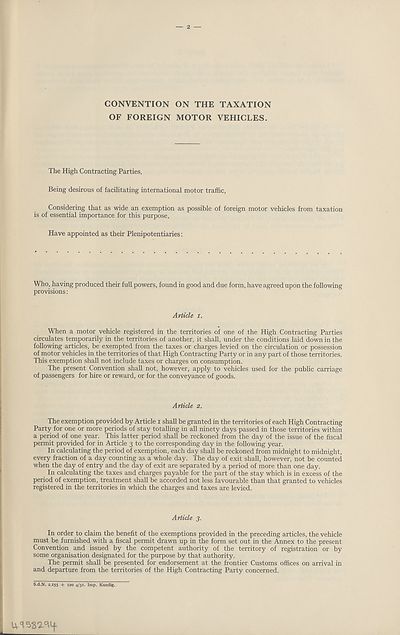

CONVENTION ON THE TAXATION

OF FOREIGN MOTOR VEHICLES.

The High Contracting Parties,

Being desirous of facilitating international motor traffic,

Considering that as wide an exemption as possible of foreign motor vehicles from taxation

is of essential importance for this purpose,

Have appointed as their Plenipotentiaries:

Who, having produced their full powers, found in good and due form, have agreed upon the following-

provisions :

Article i.

When a motor vehicle registered in the territories of one of the High Contracting Parties

circulates temporarily in the territories of another, it shall, under the conditions laid down in the

following articles, be exempted from the taxes or charges levied on the circulation or possession

of motor vehicles in the territories of that High Contracting Party or in any part of those territories.

This exemption shall not include taxes or charges on consumption.

The present Convention shall not, however, apply to vehicles used for the public carriage

of passengers for hire or reward, or for the conveyance of goods.

Article 2.

The exemption provided by Article i shall be granted in the territories of each High Contracting

Party for one or more periods of stay totalling in all ninety days passed in those territories within

a period of one year. This latter period shall be reckoned from the day of the issue of the fiscal

permit provided for in Article 3 to the corresponding day in the following year.

In calculating the period of exemption, each day shall be reckoned from midnight to midnight,

every fraction of a day counting as a whole day. The day of exit shall, however, not be counted

when the day of entry and the day of exit are separated by a period of more than one day.

In calculating the taxes and charges payable for the part of the stay which is in excess of the

period of exemption, treatment shall be accorded not less favourable than that granted to vehicles

registered in the territories in which the charges and taxes are levied.

Article 3.

In order to claim the benefit of the exemptions provided in the preceding articles, the vehicle

must be furnished with a fiscal permit drawn up in the form set out in the Annex to the present

Convention and issued by the competent authority of the territory of registration or by

some organisation designated for the purpose by that authority.

The permit shall be presented for endorsement at the frontier Customs offices on arrival in

and departure from the territories of the High Contracting Party concerned.

S.d.N. 2.155 + 120 4/31. Imp. Kundig.

CONVENTION ON THE TAXATION

OF FOREIGN MOTOR VEHICLES.

The High Contracting Parties,

Being desirous of facilitating international motor traffic,

Considering that as wide an exemption as possible of foreign motor vehicles from taxation

is of essential importance for this purpose,

Have appointed as their Plenipotentiaries:

Who, having produced their full powers, found in good and due form, have agreed upon the following-

provisions :

Article i.

When a motor vehicle registered in the territories of one of the High Contracting Parties

circulates temporarily in the territories of another, it shall, under the conditions laid down in the

following articles, be exempted from the taxes or charges levied on the circulation or possession

of motor vehicles in the territories of that High Contracting Party or in any part of those territories.

This exemption shall not include taxes or charges on consumption.

The present Convention shall not, however, apply to vehicles used for the public carriage

of passengers for hire or reward, or for the conveyance of goods.

Article 2.

The exemption provided by Article i shall be granted in the territories of each High Contracting

Party for one or more periods of stay totalling in all ninety days passed in those territories within

a period of one year. This latter period shall be reckoned from the day of the issue of the fiscal

permit provided for in Article 3 to the corresponding day in the following year.

In calculating the period of exemption, each day shall be reckoned from midnight to midnight,

every fraction of a day counting as a whole day. The day of exit shall, however, not be counted

when the day of entry and the day of exit are separated by a period of more than one day.

In calculating the taxes and charges payable for the part of the stay which is in excess of the

period of exemption, treatment shall be accorded not less favourable than that granted to vehicles

registered in the territories in which the charges and taxes are levied.

Article 3.

In order to claim the benefit of the exemptions provided in the preceding articles, the vehicle

must be furnished with a fiscal permit drawn up in the form set out in the Annex to the present

Convention and issued by the competent authority of the territory of registration or by

some organisation designated for the purpose by that authority.

The permit shall be presented for endorsement at the frontier Customs offices on arrival in

and departure from the territories of the High Contracting Party concerned.

S.d.N. 2.155 + 120 4/31. Imp. Kundig.

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Communications and transit > Convention sur le régime fiscal des véhicules automobiles étrangers (avec Protocole annexe) > (3) |

|---|

| Permanent URL | https://digital.nls.uk/194729150 |

|---|

| Shelfmark | LN.VIII |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|