Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

44 —

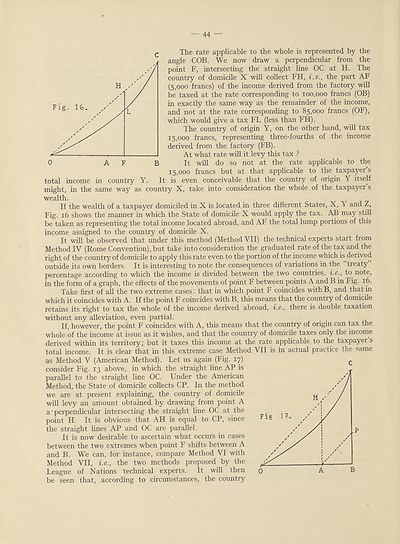

The rate applicable to the whole is represented by the

angle COB. We now draw a perpendicular from the

point F, intersecting the straight line OC at H. The

country of domicile X will collect FH, i.e., the part AF

(5,000 francs) of the income derived from the factory will

be taxed at the rate corresponding to 100,000 francs (OB)

in exactly the same way as the remainder of the income,

and not at the rate corresponding to 85,000 francs (OF),

which would give a tax FL (less than FH).

The country of origin Y, on the other hand, will tax

15,000 francs, representing three-fourths of the income

derived from the factory (FB).

At what rate will it levy this tax ?

It will do so not at the rate applicable to the

15,000 francs but at that applicable to the taxpayer’s

total income in country Y. It is even conceivable that the country of origin Y itself

might, in the same way as country X, take into consideration the whole of the taxpayer s

wealth.

If the wealth of a taxpayer domiciled in X is located in three different States, X, Y and Z,

Fig. 16 shows the manner in which the State of domicile X would apply the tax. AB may still

be taken as representing the total income located abroad, and AF the total lump portions of this

income assigned to the country of domicile X.

It will be observed that under this method (Method VII) the technical experts start from

Method IV (Rome Convention), but take into consideration the graduated rate of the tax and the

right of the country of domicile to apply this rate even to the portion of the income which is derived

outside its own borders. It is interesting to note the consequences of variations in the treaty

percentage according to which the income is divided between the two countries, i.e., to note,

in the form of a graph, the effects of the movements of point F between points A and B in Fig. 16.

Take first of all the two extreme cases: that in which point F coincides with B, and that in

which it coincides with A. If the point F coincides with B, this means that the country of domicile

retains its right to tax the whole of the income derived abroad, i.e., there is double taxation

without any alleviation, even partial.

If, however, the point F coincides with A, this means that the country of origin can tax the

whole of the income at issue as it wishes, and that the country of domicile taxes only the income

derived within its territory; but it taxes this income at the rate applicable to the taxpayer s

total income. It is clear that in this extreme case Method VII is in actual practice the same

as Method V (American Method). Let us again (Fig. 17)

consider Fig. 13 above, in which the straight line AP is

parallel to the straight line OC. Under the American

Method, the State of domicile collects CP. In the method

we are at present explaining, the country of domicile

will levy an amount obtained by drawing from point A

a • perpendicular intersecting the straight line OC at the

point H. It is obvious that AH is equal to CP, since

the straight lines AP and OC are parallel.

It is now desirable to ascertain what occurs in cases

between the two extremes when point F shifts between A

and B. We can, for instance, compare Method VI with

Method VII, i.e., the two methods proposed by the

League of Nations technical experts. It will then

be seen that, according to circumstances, the country

C

The rate applicable to the whole is represented by the

angle COB. We now draw a perpendicular from the

point F, intersecting the straight line OC at H. The

country of domicile X will collect FH, i.e., the part AF

(5,000 francs) of the income derived from the factory will

be taxed at the rate corresponding to 100,000 francs (OB)

in exactly the same way as the remainder of the income,

and not at the rate corresponding to 85,000 francs (OF),

which would give a tax FL (less than FH).

The country of origin Y, on the other hand, will tax

15,000 francs, representing three-fourths of the income

derived from the factory (FB).

At what rate will it levy this tax ?

It will do so not at the rate applicable to the

15,000 francs but at that applicable to the taxpayer’s

total income in country Y. It is even conceivable that the country of origin Y itself

might, in the same way as country X, take into consideration the whole of the taxpayer s

wealth.

If the wealth of a taxpayer domiciled in X is located in three different States, X, Y and Z,

Fig. 16 shows the manner in which the State of domicile X would apply the tax. AB may still

be taken as representing the total income located abroad, and AF the total lump portions of this

income assigned to the country of domicile X.

It will be observed that under this method (Method VII) the technical experts start from

Method IV (Rome Convention), but take into consideration the graduated rate of the tax and the

right of the country of domicile to apply this rate even to the portion of the income which is derived

outside its own borders. It is interesting to note the consequences of variations in the treaty

percentage according to which the income is divided between the two countries, i.e., to note,

in the form of a graph, the effects of the movements of point F between points A and B in Fig. 16.

Take first of all the two extreme cases: that in which point F coincides with B, and that in

which it coincides with A. If the point F coincides with B, this means that the country of domicile

retains its right to tax the whole of the income derived abroad, i.e., there is double taxation

without any alleviation, even partial.

If, however, the point F coincides with A, this means that the country of origin can tax the

whole of the income at issue as it wishes, and that the country of domicile taxes only the income

derived within its territory; but it taxes this income at the rate applicable to the taxpayer s

total income. It is clear that in this extreme case Method VII is in actual practice the same

as Method V (American Method). Let us again (Fig. 17)

consider Fig. 13 above, in which the straight line AP is

parallel to the straight line OC. Under the American

Method, the State of domicile collects CP. In the method

we are at present explaining, the country of domicile

will levy an amount obtained by drawing from point A

a • perpendicular intersecting the straight line OC at the

point H. It is obvious that AH is equal to CP, since

the straight lines AP and OC are parallel.

It is now desirable to ascertain what occurs in cases

between the two extremes when point F shifts between A

and B. We can, for instance, compare Method VI with

Method VII, i.e., the two methods proposed by the

League of Nations technical experts. It will then

be seen that, according to circumstances, the country

C

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Economic and financial section > Double taxation and tax evasion > (50) |

|---|

| Permanent URL | https://digital.nls.uk/190911958 |

|---|

| Shelfmark | LN.II |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|