Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

— 43 —

The maximum BP laid down by American law is obtained by drawing, from point A,

a line parallel to the straight line OC; the maximum proposed by the League of Nations experts

is obtained by drawing a line parallel to the straight line OK. The curve OC being concave,

it is clear that any point K taken between O and C on the curve will give an angle KOB, which

is less than the angle COB. The American maximum BP is therefore always greater than the

maximum BG, no matter what may be the ratio between the income assigned to the country

of origin and the country of domicile respectively, i.e., no matter what may be the position

of point A on the line OB.

The idea which forms the starting-point for determining the maximum is the same in both

methods, i.e., the country of domicile should not, by reason of the fact that a part (AB) of the

taxpayer’s property is invested abroad, remit a sum larger than the tax on that portion

calculated at its own rate of taxation. Under Method V, however, the rate adopted for

the purpose of this calculation is that applicable to the taxpayer’s total income; under Method VI

the rate is that applicable only to the portion invested abroad. It is this difference which is

illustrated by the graph Fig. 14.

It is necessary also to discuss the last paragraph of the recommendations of the technical

experts quoted above. The paragraph is as follows:

“In order to prevent a taxpayer whose entire income arises abroad from escaping all taxation

in his State of domicile, the amount to be deducted on the above basis should in all cases be

restricted to some fraction of the total tax chargeable in the .State of domicile.”

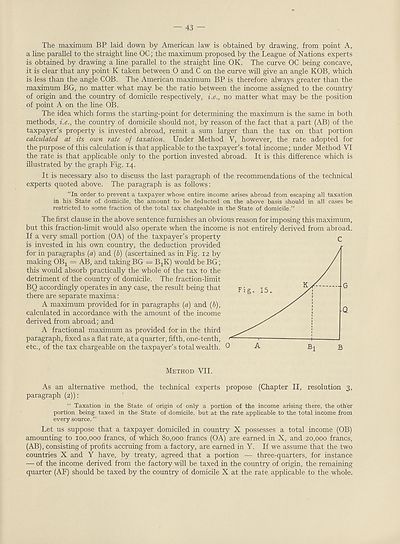

The first clause in the above sentence furnishes an obvious reason for imposing this maximum,

but this fraction-limit would also operate when the income is not entirely derived from abroad.

If a very small portion (OA) of the taxpayer’s property

is invested in his own country, the deduction provided

for in paragraphs {a) and (b) (ascertained as in Fig. 12 by

making OB-l = AB, and taking BG — BjK) would be BG;

this would absorb practically the whole of the tax to the

detriment of the country of domicile. The fraction-limit

BQ accordingly operates in any case, the result being that

there are separate maxima:

A maximum provided for in paragraphs {a) and (b),

calculated in accordance with the amount of the income

derived from abroad; and

A fractional maximum as provided for in the third

paragraph, fixed as a flat rate, at a quarter, fifth, one-tenth,

etc., of the tax chargeable on the taxpayer’s total wealth.

Method VII.

As an alternative method, the technical experts

paragraph (2)):

“ Taxation in the State of origin of only a portion of the income arising there, the other

portion being taxed in the State of domicile, but at the rate applicable to the total income from

every source. ”

Let us suppose that a taxpayer domiciled in country X possesses a total income (OB)

amounting to 100,000 francs, of which 80,000 francs (OA) are earned in X, and 20,000 francs,

(AB), consisting of profits accruing from a factory, are earned in Y. If we assume that the two

countries X and Y have, by treaty, agreed that a portion — three-quarters, for instance

— of the income derived from the factory will be taxed in the country of origin, the remaining

quarter (AF) should be taxed by the country of domicile X at the rate applicable to the whole.

C

propose (Chapter II, resolution 3,

The maximum BP laid down by American law is obtained by drawing, from point A,

a line parallel to the straight line OC; the maximum proposed by the League of Nations experts

is obtained by drawing a line parallel to the straight line OK. The curve OC being concave,

it is clear that any point K taken between O and C on the curve will give an angle KOB, which

is less than the angle COB. The American maximum BP is therefore always greater than the

maximum BG, no matter what may be the ratio between the income assigned to the country

of origin and the country of domicile respectively, i.e., no matter what may be the position

of point A on the line OB.

The idea which forms the starting-point for determining the maximum is the same in both

methods, i.e., the country of domicile should not, by reason of the fact that a part (AB) of the

taxpayer’s property is invested abroad, remit a sum larger than the tax on that portion

calculated at its own rate of taxation. Under Method V, however, the rate adopted for

the purpose of this calculation is that applicable to the taxpayer’s total income; under Method VI

the rate is that applicable only to the portion invested abroad. It is this difference which is

illustrated by the graph Fig. 14.

It is necessary also to discuss the last paragraph of the recommendations of the technical

experts quoted above. The paragraph is as follows:

“In order to prevent a taxpayer whose entire income arises abroad from escaping all taxation

in his State of domicile, the amount to be deducted on the above basis should in all cases be

restricted to some fraction of the total tax chargeable in the .State of domicile.”

The first clause in the above sentence furnishes an obvious reason for imposing this maximum,

but this fraction-limit would also operate when the income is not entirely derived from abroad.

If a very small portion (OA) of the taxpayer’s property

is invested in his own country, the deduction provided

for in paragraphs {a) and (b) (ascertained as in Fig. 12 by

making OB-l = AB, and taking BG — BjK) would be BG;

this would absorb practically the whole of the tax to the

detriment of the country of domicile. The fraction-limit

BQ accordingly operates in any case, the result being that

there are separate maxima:

A maximum provided for in paragraphs {a) and (b),

calculated in accordance with the amount of the income

derived from abroad; and

A fractional maximum as provided for in the third

paragraph, fixed as a flat rate, at a quarter, fifth, one-tenth,

etc., of the tax chargeable on the taxpayer’s total wealth.

Method VII.

As an alternative method, the technical experts

paragraph (2)):

“ Taxation in the State of origin of only a portion of the income arising there, the other

portion being taxed in the State of domicile, but at the rate applicable to the total income from

every source. ”

Let us suppose that a taxpayer domiciled in country X possesses a total income (OB)

amounting to 100,000 francs, of which 80,000 francs (OA) are earned in X, and 20,000 francs,

(AB), consisting of profits accruing from a factory, are earned in Y. If we assume that the two

countries X and Y have, by treaty, agreed that a portion — three-quarters, for instance

— of the income derived from the factory will be taxed in the country of origin, the remaining

quarter (AF) should be taxed by the country of domicile X at the rate applicable to the whole.

C

propose (Chapter II, resolution 3,

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Economic and financial section > Double taxation and tax evasion > (49) |

|---|

| Permanent URL | https://digital.nls.uk/190911945 |

|---|

| Shelfmark | LN.II |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|