Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

— 42 —

Method VI.

The technical experts propose that the State of domicile shall deduct from the general income-

tax a sum which will be:

(a) Either the tax calculated according to the State’s own scale and charged exclusively on income

produced in the other countries, each of the latter being taken separately ;

(b) Or the tax actually paid abroad on income arising abroad; this sum may be limited to the amount

to be deducted in accordance with paragraph (a).

In order to prevent a taxpayer whose entire income arises abroad from escaping all taxation

in his State of domicile, the amount to be deducted on the above basis should in all cases be

restricted to some fraction of the total tax chargeable in the State of domicile.

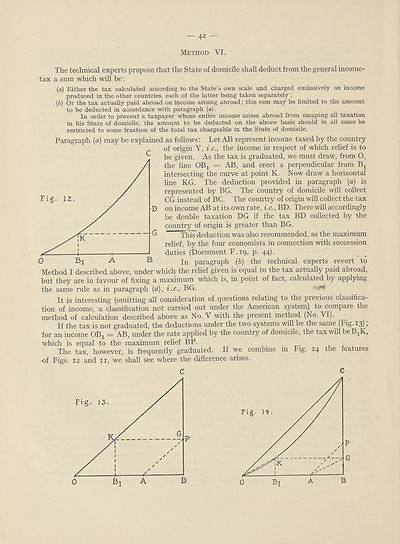

Paragraph (a) may be explained as follows: Let AB represent income taxed by the country

of origin Y, i.e., the income in respect of which relief is to

be given. As the tax is graduated, we must draw, from O,

the line OBj = AB, and erect a perpendicular from Bj^

intersecting the curve at point K. Now draw a horizontal

line KG. The deduction provided in paragraph (a) is

represented by BG. The country of domicile will collect

CG instead of BC. The country of origin will collect the tax

on income AB at its own rate, i.e., BD. There will accordingly

be double taxation DG if the tax BD collected by the

country of origin is greater than BG.

Tins'deduction was also recommended, as the maximum

relief, by the four economists in connection with succession

duties (Document F.19, p. 44).

In paragraph (b) the technical experts revert to

Method I described above, under which the relief given is equal to the tax actually paid abioad,

but they are in favour of fixing a maximum which is, in point of fact, calculated by applying

the same rule as in paragraph (a), i.e., BG. ^4,

It is interesting (omitting all consideration of questions relating to the previous classifica¬

tion of income, a classification not carried out under the American system) to compare the

method of calculation described above as No. V with the present method (No. VI).

If the tax is not graduated, the deductions under the two systems will be the same (Fig. 13);

for an income OBi = AB, under the rate applied by the country of domicile, the tax will be B^,

which is equal to the maximum relief BP. ...

The tax, however, is frequently graduated. If we combine in Fig. 14 the features

of Figs. 12 and 11, we shall see where the difference arises.

C

Method VI.

The technical experts propose that the State of domicile shall deduct from the general income-

tax a sum which will be:

(a) Either the tax calculated according to the State’s own scale and charged exclusively on income

produced in the other countries, each of the latter being taken separately ;

(b) Or the tax actually paid abroad on income arising abroad; this sum may be limited to the amount

to be deducted in accordance with paragraph (a).

In order to prevent a taxpayer whose entire income arises abroad from escaping all taxation

in his State of domicile, the amount to be deducted on the above basis should in all cases be

restricted to some fraction of the total tax chargeable in the State of domicile.

Paragraph (a) may be explained as follows: Let AB represent income taxed by the country

of origin Y, i.e., the income in respect of which relief is to

be given. As the tax is graduated, we must draw, from O,

the line OBj = AB, and erect a perpendicular from Bj^

intersecting the curve at point K. Now draw a horizontal

line KG. The deduction provided in paragraph (a) is

represented by BG. The country of domicile will collect

CG instead of BC. The country of origin will collect the tax

on income AB at its own rate, i.e., BD. There will accordingly

be double taxation DG if the tax BD collected by the

country of origin is greater than BG.

Tins'deduction was also recommended, as the maximum

relief, by the four economists in connection with succession

duties (Document F.19, p. 44).

In paragraph (b) the technical experts revert to

Method I described above, under which the relief given is equal to the tax actually paid abioad,

but they are in favour of fixing a maximum which is, in point of fact, calculated by applying

the same rule as in paragraph (a), i.e., BG. ^4,

It is interesting (omitting all consideration of questions relating to the previous classifica¬

tion of income, a classification not carried out under the American system) to compare the

method of calculation described above as No. V with the present method (No. VI).

If the tax is not graduated, the deductions under the two systems will be the same (Fig. 13);

for an income OBi = AB, under the rate applied by the country of domicile, the tax will be B^,

which is equal to the maximum relief BP. ...

The tax, however, is frequently graduated. If we combine in Fig. 14 the features

of Figs. 12 and 11, we shall see where the difference arises.

C

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Economic and financial section > Double taxation and tax evasion > (48) |

|---|

| Permanent URL | https://digital.nls.uk/190911932 |

|---|

| Shelfmark | LN.II |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|