Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

— 4i —

If point Dx is above M, and if the country of origin collects BD1; the country of

domicile collects AL = CM under Method IV (Rome Convention) and CDj (which is less

than CM) under Method I, the method described as the “total deduction” system.

Method V. — American Legislation.

Under this system, just as in Methods I and III above, there is no assignment of income

as between any two countries. Taking the income exactly as it is taxed, American legislation

recognises the principle of deduction, as in Method I, but sets a limit to its action. Instead

of dividing up the tax, as in Method III, American law lays down a maximum limit of deduction,

calculated solely in accordance with the laws of the country of domicile.

Any income-tax paid to a foreign country by a taxpayer who is a citizen of the United

States on his income derived from a foreign country is deducted from the total amount of the

Federal tax (Section 222 (a), paragraph 2, of the Federal law).

A maximum, however, is imposed in paragraph 5:

“The amount of the credit taken under this subdivision shall not exceed the same

proportion of the tax against which such credit is taken, which the taxpayer’s net

income .... from sources without the United States bears to his entire net income ...

for the same taxable year.”

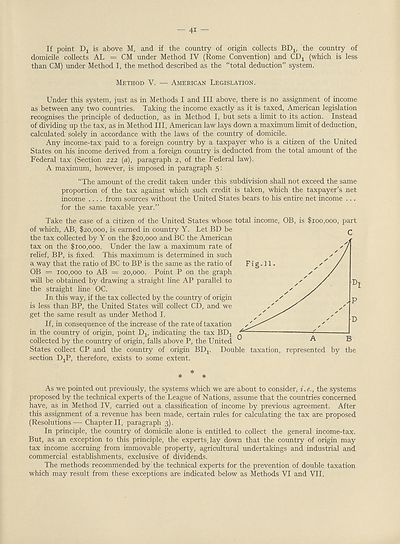

Fig.11

Take the case of a citizen of the United States whose total income, OB, is $100,000, part

of which, AB, $20,000, is earned in country Y. Let BD be f

the tax collected by Y on the $20,000 and BC the American

tax on the $100,000. Under the law a maximum rate of

relief, BP, is fixed. This maximum is determined in such

a way that the ratio of BC to BP is the same as the ratio of

OB = 100,000 to AB = 20,000. Point P on the graph

will be obtained by drawing a straight line AP parallel to

the straight line OC.

In this way, if the tax collected by the country of origin

is less than BP, the United States will collect CD, and we

get the same result as under Method I.

If, in consequence of the increase of the rate of taxation

in the country of origin, point Dj, indicating the tax BDj^

collected by the country of origin, falls above P, the United

States collect CP and the country of origin

section DjP, therefore, exists to some extent.

BDj. Double taxation, represented

*

* *

As we pointed out previously, the systems which we are about to consider, i.e., the systems

proposed by the technical experts of the League of Nations, assume that the countries concerned

have, as in Method IV, carried out a classification of income by previous agreement. After

this assignment of a revenue has been made, certain rules for calculating the tax are proposed

(Resolutions— Chapter II, paragraph 3).

In principle, the country of domicile alone is entitled to collect the general income-tax.

But, as an exception to this principle, the experts, lay down that the country of origin may

tax income accruing from immovable property, agricultural undertakings and industrial and

commercial establishments, exclusive of dividends.

The methods recommended by the technical experts for the prevention of double taxation

which may result from these exceptions are indicated below as Methods VI and VII.

If point Dx is above M, and if the country of origin collects BD1; the country of

domicile collects AL = CM under Method IV (Rome Convention) and CDj (which is less

than CM) under Method I, the method described as the “total deduction” system.

Method V. — American Legislation.

Under this system, just as in Methods I and III above, there is no assignment of income

as between any two countries. Taking the income exactly as it is taxed, American legislation

recognises the principle of deduction, as in Method I, but sets a limit to its action. Instead

of dividing up the tax, as in Method III, American law lays down a maximum limit of deduction,

calculated solely in accordance with the laws of the country of domicile.

Any income-tax paid to a foreign country by a taxpayer who is a citizen of the United

States on his income derived from a foreign country is deducted from the total amount of the

Federal tax (Section 222 (a), paragraph 2, of the Federal law).

A maximum, however, is imposed in paragraph 5:

“The amount of the credit taken under this subdivision shall not exceed the same

proportion of the tax against which such credit is taken, which the taxpayer’s net

income .... from sources without the United States bears to his entire net income ...

for the same taxable year.”

Fig.11

Take the case of a citizen of the United States whose total income, OB, is $100,000, part

of which, AB, $20,000, is earned in country Y. Let BD be f

the tax collected by Y on the $20,000 and BC the American

tax on the $100,000. Under the law a maximum rate of

relief, BP, is fixed. This maximum is determined in such

a way that the ratio of BC to BP is the same as the ratio of

OB = 100,000 to AB = 20,000. Point P on the graph

will be obtained by drawing a straight line AP parallel to

the straight line OC.

In this way, if the tax collected by the country of origin

is less than BP, the United States will collect CD, and we

get the same result as under Method I.

If, in consequence of the increase of the rate of taxation

in the country of origin, point Dj, indicating the tax BDj^

collected by the country of origin, falls above P, the United

States collect CP and the country of origin

section DjP, therefore, exists to some extent.

BDj. Double taxation, represented

*

* *

As we pointed out previously, the systems which we are about to consider, i.e., the systems

proposed by the technical experts of the League of Nations, assume that the countries concerned

have, as in Method IV, carried out a classification of income by previous agreement. After

this assignment of a revenue has been made, certain rules for calculating the tax are proposed

(Resolutions— Chapter II, paragraph 3).

In principle, the country of domicile alone is entitled to collect the general income-tax.

But, as an exception to this principle, the experts, lay down that the country of origin may

tax income accruing from immovable property, agricultural undertakings and industrial and

commercial establishments, exclusive of dividends.

The methods recommended by the technical experts for the prevention of double taxation

which may result from these exceptions are indicated below as Methods VI and VII.

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Economic and financial section > Double taxation and tax evasion > (47) |

|---|

| Permanent URL | https://digital.nls.uk/190911919 |

|---|

| Shelfmark | LN.II |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|