Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

4o -

Commission, the same source of income may be assessed at very different figures according to United

Kingdom legislation and according to Dominion legislation. The taxation of dividends on

shares also gives rise to complications. , . , ,,, ,,

As a matter of fact, neither the economists nor the Government experts think that the

system adopted within the British Empire can be brought into general use for international

purposes.

Method IV. Rome Convention or Simple Assignment of Income.

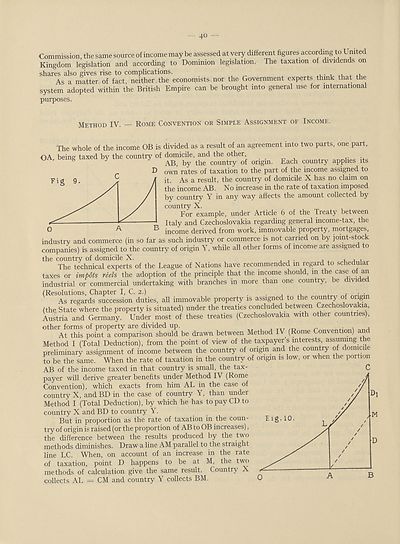

The whole of the income OB is divided as a result of an agreement into two parts, one part,

OA, being taxed by the country of domicile, and the other .. ..

S ^ ' AB, by the country of origin. Each country applies its

^ own rates of taxation to the part of the income assigned to

it. As a result, the country of domicile X has no claim on

the income AB. No increase in the rate of taxation imposed

by country Y in any way affects the amount collected by

country X.

For example, under Article 6 of the Treaty between

Italy and Czechoslovakia regarding general income-tax, the

income derived from work, immovable property, mortgages,

industry and commerce (in so far as such industry or commerce is not carried on by joint-stock

companies) is assigned to the country of origin Y, while all other forms of income are assigned to

the country of domicile X. j u j i ^

The technical experts of the League of Nations have recommended in regard to schedular

taxes or impots reels the adoption of the principle that the income should, in the case of an

industrial or commercial undertaking with branches in more than one country, be divi e

(Resolutions, Chapter I, C. 2.) . . , x , r ■ ■

As regards succession duties, all immovable property is assigned to the country of or g

(the State where the property is situated) under the treaties concluded between Czechoslovakia,

Austria and Germany. Under most of these treaties (Czechoslovakia with other countries),

other forms of property are divided up. r' ,• v „ j

At this point a comparison should be drawn between Method IV (Rome Convention) and

Method I (Total Deduction), from the point of view of the taxpayer’s interests, assuming t e

preliminary assignment of income between the country of origin and the country of domici e

to be the same. When the rate of taxation in the country of origin is low, or when the portion

AB of the income taxed in that country is small, the tax- C

payer will derive greater benefits under Method IV (Rome

Convention), which exacts from him AL in the case of

country X, and BD in the case of country Y, than under

Method I (Total Deduction), by which he has to pay CD to

country X and BD to country Y.

But in proportion as the rate of taxation in the coun¬

try of origin is raised (or the proportion of AB to OB increases),

the difference between the results produced by the two

methods diminishes. Draw a line AM parallel to the straight

line LC. When, on account of an increase in the rate

of taxation, point D happens to be at M, the two

methods of calculation give the same result. Country X

collects AL = CM and country Y collects BM.

Commission, the same source of income may be assessed at very different figures according to United

Kingdom legislation and according to Dominion legislation. The taxation of dividends on

shares also gives rise to complications. , . , ,,, ,,

As a matter of fact, neither the economists nor the Government experts think that the

system adopted within the British Empire can be brought into general use for international

purposes.

Method IV. Rome Convention or Simple Assignment of Income.

The whole of the income OB is divided as a result of an agreement into two parts, one part,

OA, being taxed by the country of domicile, and the other .. ..

S ^ ' AB, by the country of origin. Each country applies its

^ own rates of taxation to the part of the income assigned to

it. As a result, the country of domicile X has no claim on

the income AB. No increase in the rate of taxation imposed

by country Y in any way affects the amount collected by

country X.

For example, under Article 6 of the Treaty between

Italy and Czechoslovakia regarding general income-tax, the

income derived from work, immovable property, mortgages,

industry and commerce (in so far as such industry or commerce is not carried on by joint-stock

companies) is assigned to the country of origin Y, while all other forms of income are assigned to

the country of domicile X. j u j i ^

The technical experts of the League of Nations have recommended in regard to schedular

taxes or impots reels the adoption of the principle that the income should, in the case of an

industrial or commercial undertaking with branches in more than one country, be divi e

(Resolutions, Chapter I, C. 2.) . . , x , r ■ ■

As regards succession duties, all immovable property is assigned to the country of or g

(the State where the property is situated) under the treaties concluded between Czechoslovakia,

Austria and Germany. Under most of these treaties (Czechoslovakia with other countries),

other forms of property are divided up. r' ,• v „ j

At this point a comparison should be drawn between Method IV (Rome Convention) and

Method I (Total Deduction), from the point of view of the taxpayer’s interests, assuming t e

preliminary assignment of income between the country of origin and the country of domici e

to be the same. When the rate of taxation in the country of origin is low, or when the portion

AB of the income taxed in that country is small, the tax- C

payer will derive greater benefits under Method IV (Rome

Convention), which exacts from him AL in the case of

country X, and BD in the case of country Y, than under

Method I (Total Deduction), by which he has to pay CD to

country X and BD to country Y.

But in proportion as the rate of taxation in the coun¬

try of origin is raised (or the proportion of AB to OB increases),

the difference between the results produced by the two

methods diminishes. Draw a line AM parallel to the straight

line LC. When, on account of an increase in the rate

of taxation, point D happens to be at M, the two

methods of calculation give the same result. Country X

collects AL = CM and country Y collects BM.

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Economic and financial section > Double taxation and tax evasion > (46) |

|---|

| Permanent URL | https://digital.nls.uk/190911906 |

|---|

| Shelfmark | LN.II |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|