Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

— 45 —

of domicile will, purely from the point of view of taxation, choose one or other of these

methods. This means that Method VII, which rests on the division of income with a maximum

rate, will afford greater or lesser advantages than Method VI, according to the percentage

adopted by agreement for the division of the income.

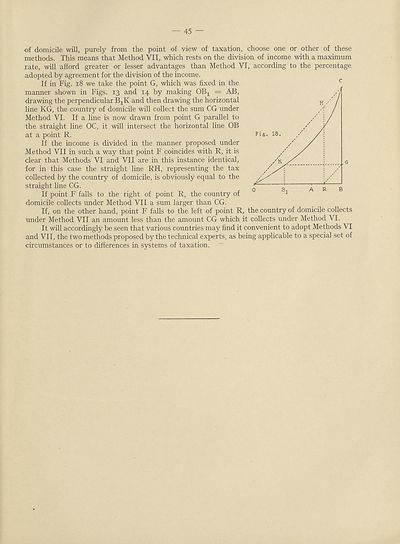

If in Fig. 18 we take the point G, which was fixed in the

manner shown in Figs. 13 and 14 by making OBj = AB,

drawing the perpendicular BjK and then drawing the horizontal

line KG, the country of domicile will collect the sum CG under

Method VI. If a line is now drawn from point G parallel to

the straight line OC, it will intersect the horizontal line OB

at a point R.

If the income is divided in the manner proposed under

Method VII in such a way that point F coincides with R, it is

clear that Methods VI and VII are in this instance identical,

for in this case the straight line RH, representing the tax

collected by the country of domicile, is obviously equal to the

straight line CG.

If point F falls to the right of point R, the country of

domicile collects under Method VII a sum larger than CG.

If, on the other hand, point F falls to the left of point R,

under Method VII an amount less than the amount CG which it collects under Method VI.

It will accordingly be seen that various countries may find it convenient to adopt Methods VI

and VII, the two methods proposed by the technical experts, as being applicable to a special set of

circumstances or to differences in systems of taxation.

c

the country of domicile collects

of domicile will, purely from the point of view of taxation, choose one or other of these

methods. This means that Method VII, which rests on the division of income with a maximum

rate, will afford greater or lesser advantages than Method VI, according to the percentage

adopted by agreement for the division of the income.

If in Fig. 18 we take the point G, which was fixed in the

manner shown in Figs. 13 and 14 by making OBj = AB,

drawing the perpendicular BjK and then drawing the horizontal

line KG, the country of domicile will collect the sum CG under

Method VI. If a line is now drawn from point G parallel to

the straight line OC, it will intersect the horizontal line OB

at a point R.

If the income is divided in the manner proposed under

Method VII in such a way that point F coincides with R, it is

clear that Methods VI and VII are in this instance identical,

for in this case the straight line RH, representing the tax

collected by the country of domicile, is obviously equal to the

straight line CG.

If point F falls to the right of point R, the country of

domicile collects under Method VII a sum larger than CG.

If, on the other hand, point F falls to the left of point R,

under Method VII an amount less than the amount CG which it collects under Method VI.

It will accordingly be seen that various countries may find it convenient to adopt Methods VI

and VII, the two methods proposed by the technical experts, as being applicable to a special set of

circumstances or to differences in systems of taxation.

c

the country of domicile collects

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Economic and financial section > Double taxation and tax evasion > (51) |

|---|

| Permanent URL | https://digital.nls.uk/190911971 |

|---|

| Shelfmark | LN.II |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|