Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

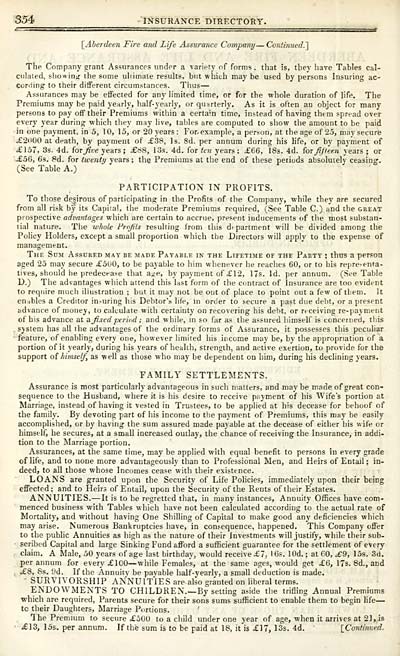

354 INSURANCE DIRECT ORY.

\_Aberdee?i Fire and Life Assurance Company — Continued.']

The Company grant Assurances under a variety of forms, that is, they have Tables cal-

culated, showing the some uhimate results, but which may be used by persons Insuring ac-

coniing to their different circumstances. Thus —

Assurances may be effected for any limited time, or for the whole duration of life. The

Premiums may be paid yearly, half-yearly, or quarterly. As it is often an object for many

persons to pay off their Premiums within a certain time, instead of having them spread over

every year during which they may live, tables are computed to show tlie amount to be paid

in one payment, in 5, 10, 13, or 20 years : For/ example, a person, at the age of 25, may secure

i£2i'00 at death, by payment of £38, Is. 8d. per annum during his life, or by payment of

£\al, 3s. 4d. for Jive years; £88, 13s. 4d. for ten years; £66, 18s. 4d. for JiJ teen years ; or

£36, 6s. 8d. for twenty years; the Premiums at the end of these periods absolutely ceasing.

(See Table A.)

PARTICIPATION IN PROFITS.

To those desirous of participating in the Profits of the Company, while they are secured

from all risk by its Capital, the moderate Premiums required, (See Table C.) and the great

prospective advantages which are certain to accrue, present inducements of the most substan-

tial nature. The whole Prcjiis resulting from this department will be divided among the

Policy Holders, except a small proportion which the Directors will apply to the expense of

management.

The Sum Assured may be made Payable in the Lifetime of the Party ; thus a person

aged 23 may secure £300, to be payable to him whenever he reaches 60, or to his representa-

tives, should he predecease that aiie, by payment of £12, 17s. Id. per annum. (See Table

D.) The advantages which attend this last form of the contract of Insurance are too evident

to require mucli illustration ; but it may not be out of place to point out a few of tliem. It

euibles a Creditor in-uring his Debtor's life, in order to secure a past due debt, or a present

advance of money, to calculate with certainty on recovering his debt, or receiving re-payment

of his advance at aji.redperi<d; and while, in so far as the assured himself is concerned, this

system has all the advantages of the ordinary forms of Assurance, it possesses this peculiar

feature, of enabling every one, however limited his income may be, by the appropriation of a

portion of it yearly, during his years of health, strength, and active exertion, to provide for the

support oi himself, as well as those who may be dependent on him, during his declining years.

FAMILY SETTLEMENTS.

Assurance is most particularly advantageous in such matters, and maybe made of great con-

sequence to the Husband, where it is his desire to receive payment of his Wife's portion at

Marriage, instead of having it vested in Trustees, to be applied at his decease for behoof of

the family. By devoting part of his income to the payment of Premiums, this may be easily

accomplished, or by having the sum assured made payable at the decease of either his wife or

himself, he secures, at a small increased outlay, the chance of receiving the Insurance, in addi-

tion to the Marriage portion.

Assurances, at the same time, may be applied with equal benefit to persons in every grade

of life, and to none more advantageously than to Professional Men, and Heirs of Entail; in-

deed, to all those whose Incomes cease with their existence.

LOANS are granted upon the Security of Life Policies, immediately upon their being

effected; and to Heirs of Entail, upon the Security of the Rents of their Estates.

ANNUITIES. — It is to be regretted that, in many instances, Annuity Offices have com-

menced business with Tables which have not been calculated according to the actual rate of

Mortality, and without having One ShiUing of Capital to make good any deficiencies which

may arise. Numerous Bankruptcies have, in consequence, happened. This Company offer

to the pubhc Annuities as high as the nature of their Investments will justify, while their sub-

- scribed Capital and large Sinking Fund afford a sufficient guarantee for the settlement of every

claim. A Male, 30 years of age last birthday, would receive £7, 16s. lOd. ; at 60, ^9, 13s. 3d.

per annum for every £100 — while Females, at the same ages, would get £6, 17s. 8d., and

£8, 8s. yd. If the Annuity be payable half-yearlv, a small deduction is made.

- SURVIVORSHIP ANNUITIES are alio sranted on hberal terms.

ENDOWMENTS TO CHILDREN.— By setting aside the trifling Annual Premiums

which are required. Parents secure for their sons sums sufficient to enable them to begin life —

tc their Daughters, Marriage Portions.

The Premium to secure £300 to a child under one year of age, when it arrives at 21, is

£13, 13s. per annum. If the sum is to be paid at 18, it is £17, 13s. 4d. iContinued.

\_Aberdee?i Fire and Life Assurance Company — Continued.']

The Company grant Assurances under a variety of forms, that is, they have Tables cal-

culated, showing the some uhimate results, but which may be used by persons Insuring ac-

coniing to their different circumstances. Thus —

Assurances may be effected for any limited time, or for the whole duration of life. The

Premiums may be paid yearly, half-yearly, or quarterly. As it is often an object for many

persons to pay off their Premiums within a certain time, instead of having them spread over

every year during which they may live, tables are computed to show tlie amount to be paid

in one payment, in 5, 10, 13, or 20 years : For/ example, a person, at the age of 25, may secure

i£2i'00 at death, by payment of £38, Is. 8d. per annum during his life, or by payment of

£\al, 3s. 4d. for Jive years; £88, 13s. 4d. for ten years; £66, 18s. 4d. for JiJ teen years ; or

£36, 6s. 8d. for twenty years; the Premiums at the end of these periods absolutely ceasing.

(See Table A.)

PARTICIPATION IN PROFITS.

To those desirous of participating in the Profits of the Company, while they are secured

from all risk by its Capital, the moderate Premiums required, (See Table C.) and the great

prospective advantages which are certain to accrue, present inducements of the most substan-

tial nature. The whole Prcjiis resulting from this department will be divided among the

Policy Holders, except a small proportion which the Directors will apply to the expense of

management.

The Sum Assured may be made Payable in the Lifetime of the Party ; thus a person

aged 23 may secure £300, to be payable to him whenever he reaches 60, or to his representa-

tives, should he predecease that aiie, by payment of £12, 17s. Id. per annum. (See Table

D.) The advantages which attend this last form of the contract of Insurance are too evident

to require mucli illustration ; but it may not be out of place to point out a few of tliem. It

euibles a Creditor in-uring his Debtor's life, in order to secure a past due debt, or a present

advance of money, to calculate with certainty on recovering his debt, or receiving re-payment

of his advance at aji.redperi<d; and while, in so far as the assured himself is concerned, this

system has all the advantages of the ordinary forms of Assurance, it possesses this peculiar

feature, of enabling every one, however limited his income may be, by the appropriation of a

portion of it yearly, during his years of health, strength, and active exertion, to provide for the

support oi himself, as well as those who may be dependent on him, during his declining years.

FAMILY SETTLEMENTS.

Assurance is most particularly advantageous in such matters, and maybe made of great con-

sequence to the Husband, where it is his desire to receive payment of his Wife's portion at

Marriage, instead of having it vested in Trustees, to be applied at his decease for behoof of

the family. By devoting part of his income to the payment of Premiums, this may be easily

accomplished, or by having the sum assured made payable at the decease of either his wife or

himself, he secures, at a small increased outlay, the chance of receiving the Insurance, in addi-

tion to the Marriage portion.

Assurances, at the same time, may be applied with equal benefit to persons in every grade

of life, and to none more advantageously than to Professional Men, and Heirs of Entail; in-

deed, to all those whose Incomes cease with their existence.

LOANS are granted upon the Security of Life Policies, immediately upon their being

effected; and to Heirs of Entail, upon the Security of the Rents of their Estates.

ANNUITIES. — It is to be regretted that, in many instances, Annuity Offices have com-

menced business with Tables which have not been calculated according to the actual rate of

Mortality, and without having One ShiUing of Capital to make good any deficiencies which

may arise. Numerous Bankruptcies have, in consequence, happened. This Company offer

to the pubhc Annuities as high as the nature of their Investments will justify, while their sub-

- scribed Capital and large Sinking Fund afford a sufficient guarantee for the settlement of every

claim. A Male, 30 years of age last birthday, would receive £7, 16s. lOd. ; at 60, ^9, 13s. 3d.

per annum for every £100 — while Females, at the same ages, would get £6, 17s. 8d., and

£8, 8s. yd. If the Annuity be payable half-yearlv, a small deduction is made.

- SURVIVORSHIP ANNUITIES are alio sranted on hberal terms.

ENDOWMENTS TO CHILDREN.— By setting aside the trifling Annual Premiums

which are required. Parents secure for their sons sums sufficient to enable them to begin life —

tc their Daughters, Marriage Portions.

The Premium to secure £300 to a child under one year of age, when it arrives at 21, is

£13, 13s. per annum. If the sum is to be paid at 18, it is £17, 13s. 4d. iContinued.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post-Office annual directory and calendar > 1843-44 > (380) |

|---|

| Permanent URL | https://digital.nls.uk/87110703 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|