Towns > Edinburgh > 1832-1838 - Gray's annual directory > 1834-1835

(322)

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

322

GRAY'S ANNUAL DIRECTORY,

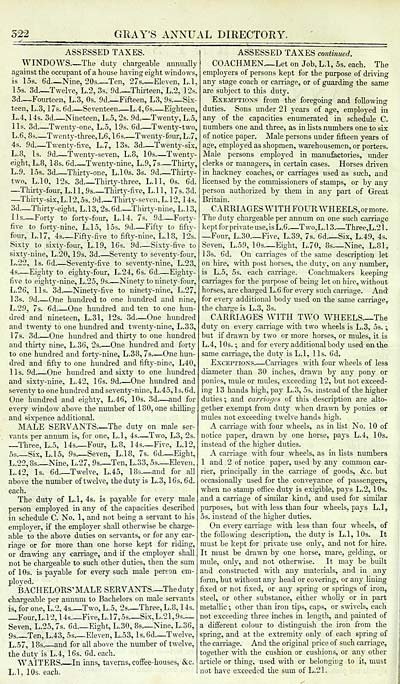

ASSESSED TAXES.

WINDOWS Tlie duty chargeable annually

against the occupant of a house having eight windows,

is 15s. 6d — Nine, 203 Ten, 27s Eleven, L.l,

15s. 3d Twelve, L.2,3s. 9d Thirteen, L.2, 12s.

3d — Foiu:teen, L.3, Os. 9d.— Fifteen, L3, 9s Six-

teen, L.3, 1 7s. 6d Seventeen. — L.4,6s Eighteen,

L.4, 14s. 3d Nineteen, L.5, 2s. 9d Twenty, L.5,

lis. 3d Twenty-one, L.5, 19s. 6d Twenty-two,

L.6, 8s — Twenty- three, L6, 16s Twenty-four, L.7,

4s. 9d — Twenty-five, L.7, 13s. 3d — Twenty-sLx,

L.8, Is. 9d Twenty-seven, L.8, 10s Twenty-

eight,L.8, 18s. 6d Twenty-nine, L.9,7s Thirty,

L.9. 15s. 3d Thirty-one, L.lOs. 3s. 9d Thirtv-

two, L.IO, 12s. ad._Thirty-three, L.ll, Os. 6d.

—Thirty-four, L.l 1, 9s Tlnrty-five, L.l 1, 17s. 3d.

— Thirtv-six,L.12,5s. 9d Thirt.y-sevcn,L.12, I4s.

3d — Thirty-eight, L.13, 2s.6d ^Thirty-nine, L.13,

lis — Forty to forty-four, L.14. 7s. 9d Forty-

five to forty-nine, L.15, las. 9d Fifty to fifiv-

four, L.l 7, "4s Fifty-five to fifty-nine, L.l 8, 12"s.

Sixty to sixty-four, L.l 9, 16s. 9d Sixty-five to

sixty-nine, L.20, 19s. 3d Seventy to seventy-four,

L.22, Is. Cd Seventy-five to seventy-nine, L.23,

4s — Eighty to eighty-four, L.24, 6s. 6d Eighty-

five to eighty-nine, L.25, 9s Ninety to ninety-four,

L.26, lis. 3d Ninety-five to ninety-nine, L.27,

13s. 9d One hundred to one hundred and nine,

L.29, 7s. 6d One hundred and ten to one hun-

dred and nineteen, L.31, 12s. 3d One hundred

and twenty to one hundred and twenty-nine, L.33,

17s. 3d One hundred and thirty to one hundred

and thii-ty nine, L.36, 2s One hundred and forty

to one hundred and forty-nine, L.38, 7s — One hun-

dred and fifty to one hundred and fifty-nine, L40,

lis. 9d One hundred and sixty to one hundred

and sixty-nine, L.42, IGs. 9d One hundred and

seventy to one hundred and seventy-nine, L.45, 1 s. 6d.

One hundred and eighty, L.46, 10s. 3d — and for

ever)' window above the number of 1 80, one shilling

and sixpence additional.

MALE SERVANTS The duty on male ser-

vants per annum is, for one, L.l, 4s — Two, L3, 2s.

— ITiree, L.5, 14s.— Foiu-, L.8, 14s Five, L.12,

6s Six, L.15, 9s Seven, L.l 8, 7s. 6d — Eight,

L.22, 8s Nine, L.27, 9s Ten, L.33, Ss — Eleven,

L.42, Is. 6d Twelve, L.45, 18s — and for aU

above the number of twelve, the duty is L.3, 1 6s. 6d.

each.

The duty of L.l, 46. is payable for every male

person employed in any of the capacities described

in schedule C. No. 1, and not being a servant to his

employer, if the employer shall otherwise be charge-

able to the above duties on servants, or for any car-

riage or for more than one horse kept for riding,

or drawing any carriage, and if the employer shall

not be chargeable to such other duties, then the sum

of 1 Os. is payable for every such male person em-

BACHELORS'MALE SERVANTS.— Theduty

chargeable per annum to Bachelors on male servants

is, for one, L.2, 4s Two, L.5, 2s — Three, L.8, 14s.

— Four,L.12,Us Five,L.17,5s Six,L.21,9s —

Seven, L.25, 7s. 6d Eight, L.30, 8s — Nine, L.36,

9s Ten, L.43, Ss Eleven, L.53, Is. 6d — Twelve,

L.S7, 1 8s. — and for all above the number of twelve,

the duty is L.4, 1 6s. 6d. each.

AVAITERS, In inns, taverns, coffee-houses, &c.

L.l. 10s. each.

ASSESSED TAXES continued.

COACHMEN.— Let on Job, L.l, 5s. each. The

employers of persons kept for the purpose of driving

any stage coach or carriage, or of guarding the same

are subject to this duty.

E.KEMPTioxs from the foregoing and following

duties. Sons under 2 1 years of age, employed ii»

any of the capacities enumerated in schedide C.

numbers one and three, as in lists numbers one to six

of notice paper. Male persons under fifteen years of

age, employed as shopmen, warehousemen, or porters.

Male persons employed in manufectoiies, imder

clerks or managers, in certain cases. Horses driven

in hackney coaches, or carriages used as siich, and

licensed by the commissioners of stamps, or by any

person authorized by them in any part of Great

Britain.

CARRIAGES WITH FOUR WHEELS, or more.

The duty chargeable per annum on one such carriage

kept forprivateuse,is L.6 Two,L.13 Thi-ee,L.2l.

—Four, L.30 Five, L.39, 7s. 6d Six, L.49, 4s.

Seven, L.59, 10s — Eight, L.70, 8s Nine, L.81,

1 3s. 6d. On caniages of the same description let

on hu'e, with post horses, the duty, on any nmnber,

is L.S, 5s. each carriage. Coachmakers keeping

carriages for the purpose of being let on hire, without

horses, are charged L.6 for every such carriage. And

for every additional body used on the same carriage,

the charge is L.S, 3s.

CARRIAGES WITH TWO WHEELS.— The

duty on every carnage with two wheels is L.3, 5s. ;

but if drawn by two or more horses, or mules, it is

L.4, 1 Os. ; and for every additional bodj' used on the

same carriage, the duty is L.I, lis. 6d.

ExcEiTioNS Carriages with four wlieels of less

diameter than 30 inches, dra^\^l by any pony or

ponies, mule or mules, exceeding 12, but not exceed-

ing 13 hands high, paj' L.3, 53. instead of the higher

duties ; and carriages of this description are alto-

gether exempt from dutj' when dra^vn by ponies or

nmles not exceeding twelve hands high.

A carnage with four wheels, as in list No. 10 of

notice paper, drawn by one horse, pays L.4, 10s.

instead of the higher duties.

A carriage with four wheels, as in lists numbers

1 and , 2 of notice paper, used by any common car-

rier, principally in the carriage of goods, &:c. but

occasionally used for the conveyance of passengers,

when no stamp oflfice duty is exigible, pays L.2, 10s.

and a carriage of similar kind, and used for similar

purposes, but mth less than four wheels, pays L.l,

5s. instead of the higher duties.

On every carnage with less than four wheels, of

the following description, the duty is L.l, 10s. It

must be kept for private use only, and not for hire.

It must be drawn by one horse, mare, gelding, or

mule, only, and not otherwise. It may be built

and constructed with any materials, and in any

form, but without any head or covering, or any lining

fixed or not fixed, or any spring or springs of iron,

steel, or other substance, either wholly or in part

metallic ; other than iron tips, caps, or swivels, each

not exceeding three inches in length, and painted of

a different colour to distinguish the iron ii'om the

spring, and at the extremity only of each spring of

the carriage. And the original price of such carriage,

together with the cushion or cushions, or any other

article or thing, used with or belonging to it, must

not have e-xceeded the sum of L.21.

GRAY'S ANNUAL DIRECTORY,

ASSESSED TAXES.

WINDOWS Tlie duty chargeable annually

against the occupant of a house having eight windows,

is 15s. 6d — Nine, 203 Ten, 27s Eleven, L.l,

15s. 3d Twelve, L.2,3s. 9d Thirteen, L.2, 12s.

3d — Foiu:teen, L.3, Os. 9d.— Fifteen, L3, 9s Six-

teen, L.3, 1 7s. 6d Seventeen. — L.4,6s Eighteen,

L.4, 14s. 3d Nineteen, L.5, 2s. 9d Twenty, L.5,

lis. 3d Twenty-one, L.5, 19s. 6d Twenty-two,

L.6, 8s — Twenty- three, L6, 16s Twenty-four, L.7,

4s. 9d — Twenty-five, L.7, 13s. 3d — Twenty-sLx,

L.8, Is. 9d Twenty-seven, L.8, 10s Twenty-

eight,L.8, 18s. 6d Twenty-nine, L.9,7s Thirty,

L.9. 15s. 3d Thirty-one, L.lOs. 3s. 9d Thirtv-

two, L.IO, 12s. ad._Thirty-three, L.ll, Os. 6d.

—Thirty-four, L.l 1, 9s Tlnrty-five, L.l 1, 17s. 3d.

— Thirtv-six,L.12,5s. 9d Thirt.y-sevcn,L.12, I4s.

3d — Thirty-eight, L.13, 2s.6d ^Thirty-nine, L.13,

lis — Forty to forty-four, L.14. 7s. 9d Forty-

five to forty-nine, L.15, las. 9d Fifty to fifiv-

four, L.l 7, "4s Fifty-five to fifty-nine, L.l 8, 12"s.

Sixty to sixty-four, L.l 9, 16s. 9d Sixty-five to

sixty-nine, L.20, 19s. 3d Seventy to seventy-four,

L.22, Is. Cd Seventy-five to seventy-nine, L.23,

4s — Eighty to eighty-four, L.24, 6s. 6d Eighty-

five to eighty-nine, L.25, 9s Ninety to ninety-four,

L.26, lis. 3d Ninety-five to ninety-nine, L.27,

13s. 9d One hundred to one hundred and nine,

L.29, 7s. 6d One hundred and ten to one hun-

dred and nineteen, L.31, 12s. 3d One hundred

and twenty to one hundred and twenty-nine, L.33,

17s. 3d One hundred and thirty to one hundred

and thii-ty nine, L.36, 2s One hundred and forty

to one hundred and forty-nine, L.38, 7s — One hun-

dred and fifty to one hundred and fifty-nine, L40,

lis. 9d One hundred and sixty to one hundred

and sixty-nine, L.42, IGs. 9d One hundred and

seventy to one hundred and seventy-nine, L.45, 1 s. 6d.

One hundred and eighty, L.46, 10s. 3d — and for

ever)' window above the number of 1 80, one shilling

and sixpence additional.

MALE SERVANTS The duty on male ser-

vants per annum is, for one, L.l, 4s — Two, L3, 2s.

— ITiree, L.5, 14s.— Foiu-, L.8, 14s Five, L.12,

6s Six, L.15, 9s Seven, L.l 8, 7s. 6d — Eight,

L.22, 8s Nine, L.27, 9s Ten, L.33, Ss — Eleven,

L.42, Is. 6d Twelve, L.45, 18s — and for aU

above the number of twelve, the duty is L.3, 1 6s. 6d.

each.

The duty of L.l, 46. is payable for every male

person employed in any of the capacities described

in schedule C. No. 1, and not being a servant to his

employer, if the employer shall otherwise be charge-

able to the above duties on servants, or for any car-

riage or for more than one horse kept for riding,

or drawing any carriage, and if the employer shall

not be chargeable to such other duties, then the sum

of 1 Os. is payable for every such male person em-

BACHELORS'MALE SERVANTS.— Theduty

chargeable per annum to Bachelors on male servants

is, for one, L.2, 4s Two, L.5, 2s — Three, L.8, 14s.

— Four,L.12,Us Five,L.17,5s Six,L.21,9s —

Seven, L.25, 7s. 6d Eight, L.30, 8s — Nine, L.36,

9s Ten, L.43, Ss Eleven, L.53, Is. 6d — Twelve,

L.S7, 1 8s. — and for all above the number of twelve,

the duty is L.4, 1 6s. 6d. each.

AVAITERS, In inns, taverns, coffee-houses, &c.

L.l. 10s. each.

ASSESSED TAXES continued.

COACHMEN.— Let on Job, L.l, 5s. each. The

employers of persons kept for the purpose of driving

any stage coach or carriage, or of guarding the same

are subject to this duty.

E.KEMPTioxs from the foregoing and following

duties. Sons under 2 1 years of age, employed ii»

any of the capacities enumerated in schedide C.

numbers one and three, as in lists numbers one to six

of notice paper. Male persons under fifteen years of

age, employed as shopmen, warehousemen, or porters.

Male persons employed in manufectoiies, imder

clerks or managers, in certain cases. Horses driven

in hackney coaches, or carriages used as siich, and

licensed by the commissioners of stamps, or by any

person authorized by them in any part of Great

Britain.

CARRIAGES WITH FOUR WHEELS, or more.

The duty chargeable per annum on one such carriage

kept forprivateuse,is L.6 Two,L.13 Thi-ee,L.2l.

—Four, L.30 Five, L.39, 7s. 6d Six, L.49, 4s.

Seven, L.59, 10s — Eight, L.70, 8s Nine, L.81,

1 3s. 6d. On caniages of the same description let

on hu'e, with post horses, the duty, on any nmnber,

is L.S, 5s. each carriage. Coachmakers keeping

carriages for the purpose of being let on hire, without

horses, are charged L.6 for every such carriage. And

for every additional body used on the same carriage,

the charge is L.S, 3s.

CARRIAGES WITH TWO WHEELS.— The

duty on every carnage with two wheels is L.3, 5s. ;

but if drawn by two or more horses, or mules, it is

L.4, 1 Os. ; and for every additional bodj' used on the

same carriage, the duty is L.I, lis. 6d.

ExcEiTioNS Carriages with four wlieels of less

diameter than 30 inches, dra^\^l by any pony or

ponies, mule or mules, exceeding 12, but not exceed-

ing 13 hands high, paj' L.3, 53. instead of the higher

duties ; and carriages of this description are alto-

gether exempt from dutj' when dra^vn by ponies or

nmles not exceeding twelve hands high.

A carnage with four wheels, as in list No. 10 of

notice paper, drawn by one horse, pays L.4, 10s.

instead of the higher duties.

A carriage with four wheels, as in lists numbers

1 and , 2 of notice paper, used by any common car-

rier, principally in the carriage of goods, &:c. but

occasionally used for the conveyance of passengers,

when no stamp oflfice duty is exigible, pays L.2, 10s.

and a carriage of similar kind, and used for similar

purposes, but mth less than four wheels, pays L.l,

5s. instead of the higher duties.

On every carnage with less than four wheels, of

the following description, the duty is L.l, 10s. It

must be kept for private use only, and not for hire.

It must be drawn by one horse, mare, gelding, or

mule, only, and not otherwise. It may be built

and constructed with any materials, and in any

form, but without any head or covering, or any lining

fixed or not fixed, or any spring or springs of iron,

steel, or other substance, either wholly or in part

metallic ; other than iron tips, caps, or swivels, each

not exceeding three inches in length, and painted of

a different colour to distinguish the iron ii'om the

spring, and at the extremity only of each spring of

the carriage. And the original price of such carriage,

together with the cushion or cushions, or any other

article or thing, used with or belonging to it, must

not have e-xceeded the sum of L.21.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Gray's annual directory > 1834-1835 > (322) |

|---|

| Permanent URL | https://digital.nls.uk/84910194 |

|---|

| Description | Edinburgh : J. Gray, 1832-1837. |

|---|---|

| Shelfmark | Various |

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|