Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

60

STAMP DUTIES.

excluding executors, constituting the succession, '

or part of the succession, of any person who shall

have died on or after the 3rd day of April, 1860,

shall be liable to inventory-duty under the said

recited Act."

There are two modes of paying the duty provided

for— 23 and 24 Vict. c. 80, § 3 and 4—

1 , By a " Special Inventory " of the property, to

be lodged with the Solicitor of Inland Revenue

at Edinburgh (a form of which, with relative oath,

is given in the schedule to the Act), stamped

according to the amount of property contained in

it. The inventory stamp shall be testate or in-

testate according as the stamp on the inventory of

the personal estate shall denote the testate or in-

testate rate of duty.

2. By adding the amount of the property to the

inventory of the personal estate, and paying stamp-

duty upon the aggregate amount.

This second mode will generally be the most advan-

tageous for the tax payer, and will be followed

when the interest in the lieritable and movable

estate is the same, or when the heir and executor

can make an arrangement as to the payment of

the duty. As to both modes of paying the duty,

it is declared that the duty is ultimately to be

borne by the parties proportionally according to

their interests in the property.

The 5th sect, of 23 and 24 Vict. c. 80, provides,

that the inventory-duty shall be payable on the

property made liable by the Acts referred to, ac-

cording to the value of such property at the time

the inventory containing it shall be sworn to,

including the proceeds accrued thereon down to

that time.

It will be observed that the inventory-duty on

money secured on heritage, &c., is limited to such

property constituting the succession of a person

who shall have died on or after the 3rd April,

1860 (23 and 24 Vict. c. 80, § 1) ; but the pro-

vision for valuing property at the date of the affi-

davit to the inventory, and including the proceeds

down to that time, is retrospective and universal

in its operation, applying to all inventories sworn

to on or after that date without regard to the date

of death.

III. General Observations.

In the case of a person dying domiciled iu Scotland,

having personal property in Scotland, England,

and Ireland, and also money secured on heritage,

&c,, duty in respect of the whole may be paid on

the inventory required to be recorded in the Com-

missary Court; or inventory-duty may be paid

ou the personal property situated in Scotland, and

duty may be paid on a "special inventory" of

the money secured on the heritage, &c., and pro-

bate or administration may be obtained in Eng-

land and Ireland in respect of the personal estate

in these countries, and duty paid in respect of

such on these instruments.

In case of a person dying domiciled furth of the

United Kingdom leaving personal estate in Scot-

land, England, and Ireland, an inventory must be

given up in Scotland, probate or administration

taken out in England and Ireland, and duty

paid on such in respect of the property in each

Country,

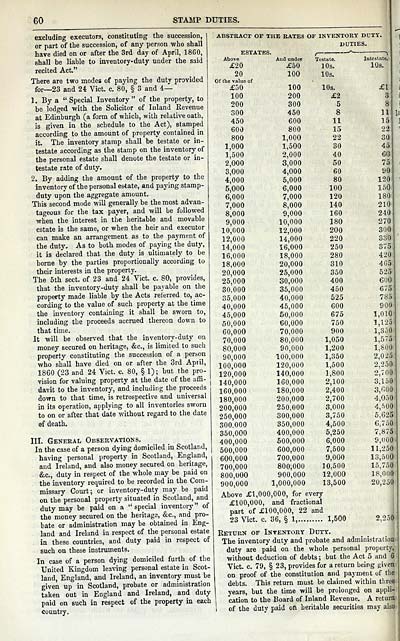

ABSTRACT OF THE RATES OF INVENTORY DUTX.

DUTIES.

ESTATES

Above

And under

Testate.

^

Intestate.:

£20

£50

lOs.

lOs.

20

100

10s.

Of tbe value of

£50

100

10s.

£1!

100

200

£2

3;

200

300

5

8'

300

450

8

Hi

450

600

11

15

600

800

15

22:

800

1,000

22

SO

1,000

1,500

30

45

1,500

2,000

40

60

2,000

3,000

50

75:

3,000

4,000

60

90(

4,000

5,000

80

1201

5,000

6,000

100

loOi

6,000

7,000

120

180

7,000

8,000

140

210

8,000

9,000

160

240

9,000

10,000

180

270

10,000

12,000

200

300

12,000

14,000

220

380

14,000

16,000

250

375

16,000

18,000

280

420

18,000

20,000

310

4G5

20,000

25,000

350

525

25,000

30,000

400

600

30,000

35,000

450

675

35,000

40,000

625

785

40,000

45,000

600

900

45,000

50,000

675

1,010

50,000

60,000

750

1,125

60,000

70,000

900

1,350

70,000

80,000

1,050

1,5T5

80,000

90,000

1,200

1,800

90,000

100,000

1,350

2,025

100,000

120,000

1,500

2,250

120,000

140,000

1,800

2,700

140,000

160,000

2,100

3,150

160,000

180,000

2,400

3,(^00

180,000

200,000

2,700

4,05 Q

200,000

250,000

3,000

4,n0fl

250,000

300,000

3,750

6,625

300,000

350,000

4,500

6,75fl

350,000

400,000

5,250

7,87S

400,000

500.000

6,000

9,00fl

500,000

600,000

7,500

11,25C

600,000

700,000

9,000

i3,5UC

700,000

800,000

10,500

15,75C

800,000

900,000

12,000

18,00C

900,000

1,000,000

13,600

2U,25(

Above £1,000,000, for every

£100,000,

and fractional

part of £100,000, 22

and

23 Vict. c.

36, § 1,....

1,500

2,25(

Return of Inventory Duty. i

The inventory duty and probate and administratioa^

duty are paid on the whole personal property,

without deduction of debts ; but the Act 5 and 6

Vict. c. 79, § 23, provides for a return being given

on proof of the constitution and payment of the

debts. This return must be claimed within tliree

years, but the time will be prolonged on appli-

cation to the Board of Inland Revenue. A return

1 of the duty paid on heritable securities may also

STAMP DUTIES.

excluding executors, constituting the succession, '

or part of the succession, of any person who shall

have died on or after the 3rd day of April, 1860,

shall be liable to inventory-duty under the said

recited Act."

There are two modes of paying the duty provided

for— 23 and 24 Vict. c. 80, § 3 and 4—

1 , By a " Special Inventory " of the property, to

be lodged with the Solicitor of Inland Revenue

at Edinburgh (a form of which, with relative oath,

is given in the schedule to the Act), stamped

according to the amount of property contained in

it. The inventory stamp shall be testate or in-

testate according as the stamp on the inventory of

the personal estate shall denote the testate or in-

testate rate of duty.

2. By adding the amount of the property to the

inventory of the personal estate, and paying stamp-

duty upon the aggregate amount.

This second mode will generally be the most advan-

tageous for the tax payer, and will be followed

when the interest in the lieritable and movable

estate is the same, or when the heir and executor

can make an arrangement as to the payment of

the duty. As to both modes of paying the duty,

it is declared that the duty is ultimately to be

borne by the parties proportionally according to

their interests in the property.

The 5th sect, of 23 and 24 Vict. c. 80, provides,

that the inventory-duty shall be payable on the

property made liable by the Acts referred to, ac-

cording to the value of such property at the time

the inventory containing it shall be sworn to,

including the proceeds accrued thereon down to

that time.

It will be observed that the inventory-duty on

money secured on heritage, &c., is limited to such

property constituting the succession of a person

who shall have died on or after the 3rd April,

1860 (23 and 24 Vict. c. 80, § 1) ; but the pro-

vision for valuing property at the date of the affi-

davit to the inventory, and including the proceeds

down to that time, is retrospective and universal

in its operation, applying to all inventories sworn

to on or after that date without regard to the date

of death.

III. General Observations.

In the case of a person dying domiciled iu Scotland,

having personal property in Scotland, England,

and Ireland, and also money secured on heritage,

&c,, duty in respect of the whole may be paid on

the inventory required to be recorded in the Com-

missary Court; or inventory-duty may be paid

ou the personal property situated in Scotland, and

duty may be paid on a "special inventory" of

the money secured on the heritage, &c., and pro-

bate or administration may be obtained in Eng-

land and Ireland in respect of the personal estate

in these countries, and duty paid in respect of

such on these instruments.

In case of a person dying domiciled furth of the

United Kingdom leaving personal estate in Scot-

land, England, and Ireland, an inventory must be

given up in Scotland, probate or administration

taken out in England and Ireland, and duty

paid on such in respect of the property in each

Country,

ABSTRACT OF THE RATES OF INVENTORY DUTX.

DUTIES.

ESTATES

Above

And under

Testate.

^

Intestate.:

£20

£50

lOs.

lOs.

20

100

10s.

Of tbe value of

£50

100

10s.

£1!

100

200

£2

3;

200

300

5

8'

300

450

8

Hi

450

600

11

15

600

800

15

22:

800

1,000

22

SO

1,000

1,500

30

45

1,500

2,000

40

60

2,000

3,000

50

75:

3,000

4,000

60

90(

4,000

5,000

80

1201

5,000

6,000

100

loOi

6,000

7,000

120

180

7,000

8,000

140

210

8,000

9,000

160

240

9,000

10,000

180

270

10,000

12,000

200

300

12,000

14,000

220

380

14,000

16,000

250

375

16,000

18,000

280

420

18,000

20,000

310

4G5

20,000

25,000

350

525

25,000

30,000

400

600

30,000

35,000

450

675

35,000

40,000

625

785

40,000

45,000

600

900

45,000

50,000

675

1,010

50,000

60,000

750

1,125

60,000

70,000

900

1,350

70,000

80,000

1,050

1,5T5

80,000

90,000

1,200

1,800

90,000

100,000

1,350

2,025

100,000

120,000

1,500

2,250

120,000

140,000

1,800

2,700

140,000

160,000

2,100

3,150

160,000

180,000

2,400

3,(^00

180,000

200,000

2,700

4,05 Q

200,000

250,000

3,000

4,n0fl

250,000

300,000

3,750

6,625

300,000

350,000

4,500

6,75fl

350,000

400,000

5,250

7,87S

400,000

500.000

6,000

9,00fl

500,000

600,000

7,500

11,25C

600,000

700,000

9,000

i3,5UC

700,000

800,000

10,500

15,75C

800,000

900,000

12,000

18,00C

900,000

1,000,000

13,600

2U,25(

Above £1,000,000, for every

£100,000,

and fractional

part of £100,000, 22

and

23 Vict. c.

36, § 1,....

1,500

2,25(

Return of Inventory Duty. i

The inventory duty and probate and administratioa^

duty are paid on the whole personal property,

without deduction of debts ; but the Act 5 and 6

Vict. c. 79, § 23, provides for a return being given

on proof of the constitution and payment of the

debts. This return must be claimed within tliree

years, but the time will be prolonged on appli-

cation to the Board of Inland Revenue. A return

1 of the duty paid on heritable securities may also

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1865-1866 > (716) |

|---|

| Permanent URL | https://digital.nls.uk/84379952 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|