Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

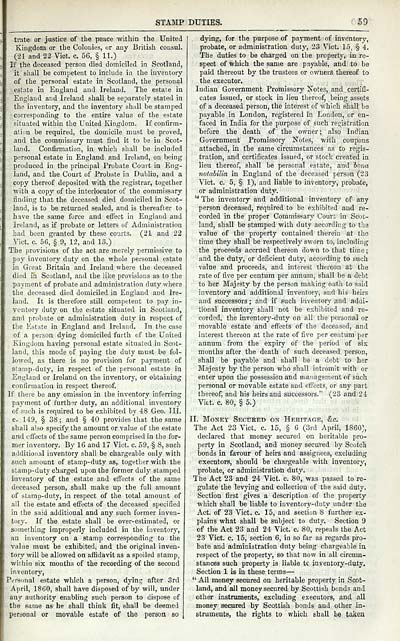

STAMP DUTIES.

59

trate or justice of the peace within the United

Kingdom or the Colonies, or any British consul.

(21 and 22 Vict. c. 56, § 11.)

If the deceased person died domiciled in Scotland,

it shall he competent to include in the inventory

of the personal estate in Scotland, the personal

estate in England and Ireland. The estate in

England and Ireland shall be separately stated in

the inventory, and the inventory shall be stamped

corresponding to the entire value of the estate

situated within the United Kingdom. If confirm-

ation be required, the domicile must be proved,

and the commissar}' must find it to be in Scot-

land. Confirmation, in which shall be included

personal estate in England and Ireland, on being

produced in the principal Probate Court in Eng-

land, and the Court of Probate in Dublin, and a

copy thereof deposited with the registrar, together

with a copy of the interlocutor of the commissary

finding that the deceased died domiciled in Scot-

land, is to be returned sealed, and is thereafter to

have the same force and effect in England and

Ireland, as if probate or letters of Administration

had been granted by these courts. (21 and 22

Vict. c. 56, § 9, 12, and 13.)

The provisions of the act are merely permissive to

pay inventory dutj' on the whole personal estate

in Great Britain and Ireland where the deceased

died in Scotland, and the like provisions as to the

payment of probate and administration duty where

the deceased died domiciled in England and Ire-

land. It is therefore still competent to pay in-

ventory duty on the estate situated in Scotland,

and probate or administration duty in respect of

the Estate in England and Ireland. In the case

of a person dying domiciled furth of the United

Kingdom having personal estate situated in Scot-

land, this mode of paying the duty must be fol-

lowed, as there is no provision for payment of

stamp-duty, in respect of the personal estate in

England or Ireland on the inventory, or obtaining

confirmation in respect thereof.

If there be any omission in the inventory inferring

payment of further duty, an additional inventory

of such is required to be exhibited by 48 Geo. III.

c. 149, § 38 ; and § 40 provides that the same

shall also specify the amount or value of the estate

and effects of the same person comprised in the for-

mer inventory. By 16 and 17 Vict. c. 59, § 8, such

additional inventory shall be chargeable only with

such amount of stamp-duty as, together with the

stamp-duty charged upon the former duly stamped

inventory of the estate and effects of the same

deceased person, shall make up the full amount

of stamp-duty, in respect of the total amount of

all the estate and effects of the deceased specified

in the said additional and any such former inven-

tory. If the estate shall be over-estimated, or

something improperly included in the inventory,

an inventory on a stamp corresponding to the

value must be exhibited, and the original inven-

tory will be allowed on affidavit as a spoiled stamp,

within six months of the recording of the second

inventory,

Personal estate which a person, dying after 3rd

April, 1860, shall have disposed of by will, under

any authority enabling such person to dispose of

the same as he shall think fit, shall be deemed

personal or movable estate of the person so

djang, for the purpose of payment of inventory,

probate, or administration dutj', 23 Vict. 15, § 4.

The duties to be charged on the property, in re-

spect of which the same are payable, and to be

paid thereout by the trustees or owners thereof to

the executor.

Indian Government Promissory Notes, and certifi-

cates issued, or stock in lieu thereof, being assets

of a deceased person, the interest of which shall be

payable in London, registered in London, or en-

faced in India for the purpose of such registration

before the death of the owner; also Indian

Government Promissory Notes, with coupons

attached, in the same circumstances as to regis-

tration, and certificates issued, or stock created in

lieu thereof, shall be personal estate, and hona

notdbilia in England of the deceased person (23

Vict. 0. 5, § 1), and liable to inventory, probate,

or administration duty.

''' The inventory and additional inventory of any

person deceased, required to be exhibited and re-

corded in the proper Commissary Court in Scot-

land, shall be stamped with duty according to the

value of the property contained therein at the

time they shall be respectively sworn to, including

the proceeds accrued thereon down to that time ;

and the duty, or deficient duty, according to such

value and proceeds, and interest thereon at the

rate of five per centum per annum, shall be a debt

to her Majesty by the person making oath to said

inventory and additional inventory, and his heirs

and successors ; and if such inventory and addi-

tional inventory shall not be exhibited and re-

corded, the inventory-duty on all the personal or

movable estate and effects of the deceased, and

interest thereon at the rate of five per centum per

annum from the expiry of the period of sis

months after the death of such deceased person,

shall be payable and shall be a debt to her

Majesty by the person who shall intromit with or

enter upon the possession and management of such

personal or movable estate and effects, or any part

thereof, and his heirs and successors." (23 and 24

Vitt. c. 80, § 5.)

II. Monet Secured on Heritage, &c.

The Act 23 Vict. c. 15, § 6 (3rd April, 1860),

declared that money secured on heritable pro-

perty in Scotland, and money secured by Scotch

bonds in favour of heirs and assignees, excluding

executors, should be chargeable with inventory,

probate, or administration duty.

The Act 23 and 24 Vict. c. 80, was passed to re-

gulate the levying and collection of the said duty,

Section first gives a description of the property

which shall be liable to inventory-duty under the

Act. of 23 Vict. c. 15, and section 8 further ex-

plains what shall be subject to duty. Section 9

of the Act 23 and 24 Vict. c. 80, repeals the Act

23 Vict. c. 15, section 6, in so far as regards pro-

bate and administration duty being chargeable in

respect of the property, so that now in all circum-

stances such property is liable tc inventory-duty.

Section 1 is in these terms —

" All money secured on heritable property in Scot-

land, and all money secured by Scottish bonds and

other instruments, excluding executors, and all

money secured by Scottish bonds and other in-

struments, the rights to which shall be taken

59

trate or justice of the peace within the United

Kingdom or the Colonies, or any British consul.

(21 and 22 Vict. c. 56, § 11.)

If the deceased person died domiciled in Scotland,

it shall he competent to include in the inventory

of the personal estate in Scotland, the personal

estate in England and Ireland. The estate in

England and Ireland shall be separately stated in

the inventory, and the inventory shall be stamped

corresponding to the entire value of the estate

situated within the United Kingdom. If confirm-

ation be required, the domicile must be proved,

and the commissar}' must find it to be in Scot-

land. Confirmation, in which shall be included

personal estate in England and Ireland, on being

produced in the principal Probate Court in Eng-

land, and the Court of Probate in Dublin, and a

copy thereof deposited with the registrar, together

with a copy of the interlocutor of the commissary

finding that the deceased died domiciled in Scot-

land, is to be returned sealed, and is thereafter to

have the same force and effect in England and

Ireland, as if probate or letters of Administration

had been granted by these courts. (21 and 22

Vict. c. 56, § 9, 12, and 13.)

The provisions of the act are merely permissive to

pay inventory dutj' on the whole personal estate

in Great Britain and Ireland where the deceased

died in Scotland, and the like provisions as to the

payment of probate and administration duty where

the deceased died domiciled in England and Ire-

land. It is therefore still competent to pay in-

ventory duty on the estate situated in Scotland,

and probate or administration duty in respect of

the Estate in England and Ireland. In the case

of a person dying domiciled furth of the United

Kingdom having personal estate situated in Scot-

land, this mode of paying the duty must be fol-

lowed, as there is no provision for payment of

stamp-duty, in respect of the personal estate in

England or Ireland on the inventory, or obtaining

confirmation in respect thereof.

If there be any omission in the inventory inferring

payment of further duty, an additional inventory

of such is required to be exhibited by 48 Geo. III.

c. 149, § 38 ; and § 40 provides that the same

shall also specify the amount or value of the estate

and effects of the same person comprised in the for-

mer inventory. By 16 and 17 Vict. c. 59, § 8, such

additional inventory shall be chargeable only with

such amount of stamp-duty as, together with the

stamp-duty charged upon the former duly stamped

inventory of the estate and effects of the same

deceased person, shall make up the full amount

of stamp-duty, in respect of the total amount of

all the estate and effects of the deceased specified

in the said additional and any such former inven-

tory. If the estate shall be over-estimated, or

something improperly included in the inventory,

an inventory on a stamp corresponding to the

value must be exhibited, and the original inven-

tory will be allowed on affidavit as a spoiled stamp,

within six months of the recording of the second

inventory,

Personal estate which a person, dying after 3rd

April, 1860, shall have disposed of by will, under

any authority enabling such person to dispose of

the same as he shall think fit, shall be deemed

personal or movable estate of the person so

djang, for the purpose of payment of inventory,

probate, or administration dutj', 23 Vict. 15, § 4.

The duties to be charged on the property, in re-

spect of which the same are payable, and to be

paid thereout by the trustees or owners thereof to

the executor.

Indian Government Promissory Notes, and certifi-

cates issued, or stock in lieu thereof, being assets

of a deceased person, the interest of which shall be

payable in London, registered in London, or en-

faced in India for the purpose of such registration

before the death of the owner; also Indian

Government Promissory Notes, with coupons

attached, in the same circumstances as to regis-

tration, and certificates issued, or stock created in

lieu thereof, shall be personal estate, and hona

notdbilia in England of the deceased person (23

Vict. 0. 5, § 1), and liable to inventory, probate,

or administration duty.

''' The inventory and additional inventory of any

person deceased, required to be exhibited and re-

corded in the proper Commissary Court in Scot-

land, shall be stamped with duty according to the

value of the property contained therein at the

time they shall be respectively sworn to, including

the proceeds accrued thereon down to that time ;

and the duty, or deficient duty, according to such

value and proceeds, and interest thereon at the

rate of five per centum per annum, shall be a debt

to her Majesty by the person making oath to said

inventory and additional inventory, and his heirs

and successors ; and if such inventory and addi-

tional inventory shall not be exhibited and re-

corded, the inventory-duty on all the personal or

movable estate and effects of the deceased, and

interest thereon at the rate of five per centum per

annum from the expiry of the period of sis

months after the death of such deceased person,

shall be payable and shall be a debt to her

Majesty by the person who shall intromit with or

enter upon the possession and management of such

personal or movable estate and effects, or any part

thereof, and his heirs and successors." (23 and 24

Vitt. c. 80, § 5.)

II. Monet Secured on Heritage, &c.

The Act 23 Vict. c. 15, § 6 (3rd April, 1860),

declared that money secured on heritable pro-

perty in Scotland, and money secured by Scotch

bonds in favour of heirs and assignees, excluding

executors, should be chargeable with inventory,

probate, or administration duty.

The Act 23 and 24 Vict. c. 80, was passed to re-

gulate the levying and collection of the said duty,

Section first gives a description of the property

which shall be liable to inventory-duty under the

Act. of 23 Vict. c. 15, and section 8 further ex-

plains what shall be subject to duty. Section 9

of the Act 23 and 24 Vict. c. 80, repeals the Act

23 Vict. c. 15, section 6, in so far as regards pro-

bate and administration duty being chargeable in

respect of the property, so that now in all circum-

stances such property is liable tc inventory-duty.

Section 1 is in these terms —

" All money secured on heritable property in Scot-

land, and all money secured by Scottish bonds and

other instruments, excluding executors, and all

money secured by Scottish bonds and other in-

struments, the rights to which shall be taken

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1865-1866 > (715) |

|---|

| Permanent URL | https://digital.nls.uk/84379940 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|