Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

POSTAL DIRECTORY— EATES.

663

Controller of tlie Post Office Savings Bank De-

partment in London, in order that it may be

compared with the books of that department, and

the interest due to the depositor inserted in it.

When a depositor wishes to withdi-aw the whole

or any part of the sum due to him, he must make

application for the same in a form which may be

obtained at any Post Office Savings Bank. On

receipt of this form at the G.P.O., London, a

warrant for the amount required, payable at the

Post Office Bank named by the depositor, will be

sent him by return of post.

Postmasters and other officers of the Postmaster-

General employed ia the receipt or payment of

deposits, are strictly forbidden to disclose the name

of any depositor, or the amount deposited or with-

drawn, except to the Postmaster-General, or to

such of his officers as are appointed to assist in

carrying on Savings Banks business.

A statement of the regulations of the Post Office

Banks may be seen at any Money Order Office.

INVESTMENTS AND SALES OF GOVERN-

MENT STOCK.

A depositor in the Post Office Savings Bank

who desires either to invest a certain sum (not

being less than £10) in Government Stock, or to

purchase a certain amount of Government Stock

(not being less than £10 Stock), must send to the

Controller of the Savings Bank Department,

General Post Office, London, together with his

deposit book, an application signed by him on a

form to be obtained at any Post Office Savings

Bank. Such investments can be made in Con-

solidated, Reduced, or New Three per Cent. Bank

Annuities.

Within seven days from the receipt of such

application the depositor's account will be charged

with the current price of the Stock purchased and

the commission, the necessary entries being made

in his deposit book; and the depositor will be

credited in the Government Stock Eegister of the

Post Office Savings Bank with the equivalent

amount of Stock, and a certificate thereof sent

him.

The sum invested must not be less than £10, or

the amount of the current price of £10 Stock with

the addition of the commission, whichever sum is

least, and not more than £100 Stock can be credited

to an account in any year ending .31st December,

or £.300 in all.

For an immediate investment in Government

Stock a deposit to an amount not exceeding the

value of £100 Stock with the commission may be

made in one year ending the 31st December.

Dividends in respect of Stock standing to a

depositor's credit will be carried to his deposit

account.

A depositor who desires to sell the Stock standing

to his credit, or part of the Stock, must send to

the Controller of the Savings Bank Department,

London, together with his deposit book and invest-

ment certificate, an application signed by him on

a form obtainable at any Post Office Savings

Bank.

Within seven days of the receipt of such appli-

cation the sale will be effected at the ctirrent price

of the day of sale, and a warrant will be sent the

depositor for the amount realized, less commission.

The commission chargeable on investment, in-

cluding the receipt of dividends, and on the sale

of Stock, is 9d. for the first £25, and 6d. for every

additional £25.

Particulars regarding Stock cerfijicaies may be

learned at any Money Order Office.

GOVERNMENT INSURANCE AND ANNUITY

OFFICE.

The Postmaster-General is empowered to insure

the lives of persons of either sex, between the ages

of 16 and 60, for not less than £20 or more than £100.

He is also empowered to grant immediate orde-

ferred annixities of not more than £50 on the lives

of persons of either sex, and of the age of 10 years

and upwards. The persons whose lives are in-

sured, or to whom annuities are granted, have direct

Government security for the payment of the money

at the proper time.

Tables of the premiums to be charged for the

insurance of lives, for the grant of immediate

annuities, for the grant of deferred annuities or

deferred monthly allowances, without return of

purchase money, or for the grant of deferred an-

nuities or deferred hionthly allowances, with return

of purchase money, may be seen at the G.P.O.

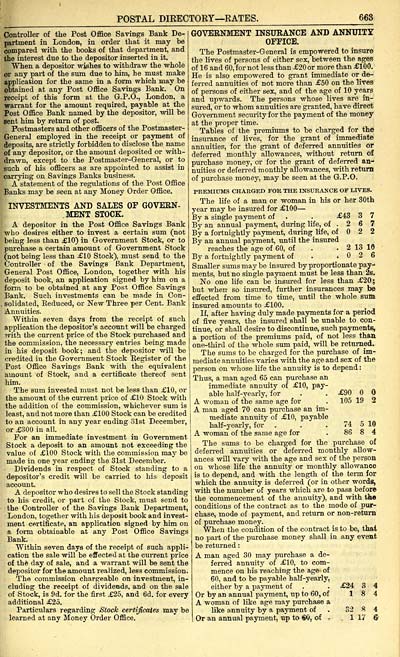

PREMIUMS CHARGED FOR THE INSURANCE OF LIVES.

The life of a man or woman in his or her 30th

year may be insured for £100 —

By a single payment of . . £43 3 7

By an annual payment, during life, of . 2 6 7

By a fortnightly payment, during life, of 2 2

By an annual payment, until the insured

reaches the age of 60, of . . 2 13 16

By a fortnightlj' payment of . .026

Smaller sums may be insured by proportionate pay-

ments, but no single payment must be less than 2s.

No one life can be insured for less than £20;

but when so insured, further insurances may be

effected from time to time, until the whole sum

insured amounts to £100.

If, after having duly made payments for a period

of five years, the insured shall be unable to con-

tinue, or shall desire to discontinue, such payments,

a portion of the premiums paid, of not less than

one-third of the whole sum paid, will be returned.

The sums to be charged for the purchase of im-

mediate annuities varies with the age and sex of the

person on whose life the annuity is to depend:

Thus, a man aged 65 can purchase an

immediate annuity of £10, pay-

able half-yearly, for . . £90

A woman of the same age for . 105 19 2

A man aged 70 can purchase an im-

mediate annuity of £10, payable

half-yearly, for . . . 74 5 10

A woman of the same age for . 86 8 4

The sums to be charged for the purchase of

deferred annuities or deferred monthly allow-

ances will vary with the age and sex of the person

on whose life the annuity or monthly allowance

is to depend, and with the length of the tenn for

which the annuity is deferred (or in other words,

with the number of years which are to pass before

the commencement of the annuity), and with the

conditions of the contract as to the mode of pur-

chase, mode of payment, and return or non-return

of purchase money.

When the condition of the contract is to be, that

no part of the purchase money shall in any event

be returned :

A man aged 30 may purchase a de-

ferred annuity of £10, to com-

mence on his i-eaching the age of

60, and to be payable half-yearly,

either by a payment of . . £24 3 4

Or by an annual payment, up to 60, of 18 4

A woman of like age may purchase a

like annuity by a payment of . 32 8 4

Or an annual payment, up to €0, of r .1 17 6

663

Controller of tlie Post Office Savings Bank De-

partment in London, in order that it may be

compared with the books of that department, and

the interest due to the depositor inserted in it.

When a depositor wishes to withdi-aw the whole

or any part of the sum due to him, he must make

application for the same in a form which may be

obtained at any Post Office Savings Bank. On

receipt of this form at the G.P.O., London, a

warrant for the amount required, payable at the

Post Office Bank named by the depositor, will be

sent him by return of post.

Postmasters and other officers of the Postmaster-

General employed ia the receipt or payment of

deposits, are strictly forbidden to disclose the name

of any depositor, or the amount deposited or with-

drawn, except to the Postmaster-General, or to

such of his officers as are appointed to assist in

carrying on Savings Banks business.

A statement of the regulations of the Post Office

Banks may be seen at any Money Order Office.

INVESTMENTS AND SALES OF GOVERN-

MENT STOCK.

A depositor in the Post Office Savings Bank

who desires either to invest a certain sum (not

being less than £10) in Government Stock, or to

purchase a certain amount of Government Stock

(not being less than £10 Stock), must send to the

Controller of the Savings Bank Department,

General Post Office, London, together with his

deposit book, an application signed by him on a

form to be obtained at any Post Office Savings

Bank. Such investments can be made in Con-

solidated, Reduced, or New Three per Cent. Bank

Annuities.

Within seven days from the receipt of such

application the depositor's account will be charged

with the current price of the Stock purchased and

the commission, the necessary entries being made

in his deposit book; and the depositor will be

credited in the Government Stock Eegister of the

Post Office Savings Bank with the equivalent

amount of Stock, and a certificate thereof sent

him.

The sum invested must not be less than £10, or

the amount of the current price of £10 Stock with

the addition of the commission, whichever sum is

least, and not more than £100 Stock can be credited

to an account in any year ending .31st December,

or £.300 in all.

For an immediate investment in Government

Stock a deposit to an amount not exceeding the

value of £100 Stock with the commission may be

made in one year ending the 31st December.

Dividends in respect of Stock standing to a

depositor's credit will be carried to his deposit

account.

A depositor who desires to sell the Stock standing

to his credit, or part of the Stock, must send to

the Controller of the Savings Bank Department,

London, together with his deposit book and invest-

ment certificate, an application signed by him on

a form obtainable at any Post Office Savings

Bank.

Within seven days of the receipt of such appli-

cation the sale will be effected at the ctirrent price

of the day of sale, and a warrant will be sent the

depositor for the amount realized, less commission.

The commission chargeable on investment, in-

cluding the receipt of dividends, and on the sale

of Stock, is 9d. for the first £25, and 6d. for every

additional £25.

Particulars regarding Stock cerfijicaies may be

learned at any Money Order Office.

GOVERNMENT INSURANCE AND ANNUITY

OFFICE.

The Postmaster-General is empowered to insure

the lives of persons of either sex, between the ages

of 16 and 60, for not less than £20 or more than £100.

He is also empowered to grant immediate orde-

ferred annixities of not more than £50 on the lives

of persons of either sex, and of the age of 10 years

and upwards. The persons whose lives are in-

sured, or to whom annuities are granted, have direct

Government security for the payment of the money

at the proper time.

Tables of the premiums to be charged for the

insurance of lives, for the grant of immediate

annuities, for the grant of deferred annuities or

deferred monthly allowances, without return of

purchase money, or for the grant of deferred an-

nuities or deferred hionthly allowances, with return

of purchase money, may be seen at the G.P.O.

PREMIUMS CHARGED FOR THE INSURANCE OF LIVES.

The life of a man or woman in his or her 30th

year may be insured for £100 —

By a single payment of . . £43 3 7

By an annual payment, during life, of . 2 6 7

By a fortnightly payment, during life, of 2 2

By an annual payment, until the insured

reaches the age of 60, of . . 2 13 16

By a fortnightlj' payment of . .026

Smaller sums may be insured by proportionate pay-

ments, but no single payment must be less than 2s.

No one life can be insured for less than £20;

but when so insured, further insurances may be

effected from time to time, until the whole sum

insured amounts to £100.

If, after having duly made payments for a period

of five years, the insured shall be unable to con-

tinue, or shall desire to discontinue, such payments,

a portion of the premiums paid, of not less than

one-third of the whole sum paid, will be returned.

The sums to be charged for the purchase of im-

mediate annuities varies with the age and sex of the

person on whose life the annuity is to depend:

Thus, a man aged 65 can purchase an

immediate annuity of £10, pay-

able half-yearly, for . . £90

A woman of the same age for . 105 19 2

A man aged 70 can purchase an im-

mediate annuity of £10, payable

half-yearly, for . . . 74 5 10

A woman of the same age for . 86 8 4

The sums to be charged for the purchase of

deferred annuities or deferred monthly allow-

ances will vary with the age and sex of the person

on whose life the annuity or monthly allowance

is to depend, and with the length of the tenn for

which the annuity is deferred (or in other words,

with the number of years which are to pass before

the commencement of the annuity), and with the

conditions of the contract as to the mode of pur-

chase, mode of payment, and return or non-return

of purchase money.

When the condition of the contract is to be, that

no part of the purchase money shall in any event

be returned :

A man aged 30 may purchase a de-

ferred annuity of £10, to com-

mence on his i-eaching the age of

60, and to be payable half-yearly,

either by a payment of . . £24 3 4

Or by an annual payment, up to 60, of 18 4

A woman of like age may purchase a

like annuity by a payment of . 32 8 4

Or an annual payment, up to €0, of r .1 17 6

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1884-1885 > (699) |

|---|

| Permanent URL | https://digital.nls.uk/84012929 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|