Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

STAMP DUTIES.

23

able with, and which shall have paid any such

duty exceeding £1, 15s., it is not chargeable with

the ad valorem duty ; and the deeds not charge-

able with the ad valorem duty shall be charged

with the duty to which the}' are liable under any

more general description iti the stamp schedules ;

and on the whole being produced, duly executed

and stamped, the latter shall also be stamped with

a particular stamp for denoting the payment of

the said ad valorem duty.

Exemption from this ad valorem duty. — Wills, tes-

taments, and testamentary instrumeuts, and dis-

positions mortis catisa.

Writ of Acknowledgment by any person infeft

of lands in Scotland, in favour of the heir or dis-

ponee of a creditor fully vested in right of an

heritable securitv constituted by iufeftmeut, 10s.

— 16 and 17 Vict.,' c. 63, § 6.

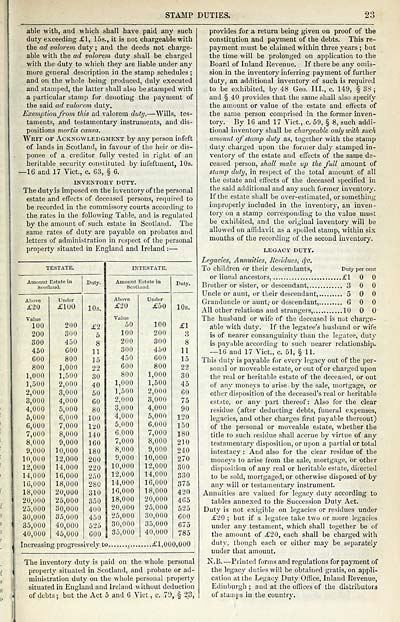

INVEUTORY DUTY.

The duty is imposed on the inventory of the personal

estate and efifects of deceased persons, required to

be recorded in the commissory courts according to

the rates in the following Table, and is regulated

by the amoimt of such estate in Scotland. The

same rates of duty are payable on probates and

letters of administration in respect of the personal

property situated in England and Ireland : —

TESTATE,

INTESTATE.

Amotmt Estate in

Duty.

Amount Estate in

Duty.

acotland.

Scot

aud.

Above

L'nder

Above

Under

£20

£100

lOs.

£20

£50

IDs.

Value

Value

100

200

£2

50

100

£1

200

300

5

100

200

S

300

450

8

200

300

8

460

COO

11

300

450

11

GOO

800

15

450

600

15

800

1,000

22

600

800

22

1,000

1,500

30

800

1,000

30

1,500

2,000

40

1,000

1,500

45

2,000

3,000

50

1,500

2,000

60

3,000

4,000

60

2,000

3,000

75

4,000

5,000

80

3,000

4,000

90

5,000

6,000

100

4,000

5,000

120

6,000

7,000

120

5,000

6,000

150

7,000

8,000

140

6,000

7,000

180

8,000

9,000

160

7,000

8,000

210

9,000

10,000

180

8,000

9,000

240

10,000

12,000

200

9,000

10,000

270

12,000

14,000

220

10,000

12,000

300

14,000

16,000

250

12,000

14,000

330

16,000

18,000

280

14,000

16,000

375

18,000

20,000

310

16,000

18,000

420

20,000

25,000

350

18,000

20,000

465

25,000

30,000

400

20,000

25,000

525

30,000

35,000

450

25,000

30,000

600

35,000

40,000

625

30,000

35,000

675

40,000

45,000

600

35,000

40,000

785

Increasin

g progress

ively t(

)

....£1,00

0,000

The inventory duty is paid on the. whole personal

property situated in Scotland, and probate or ad-

ministration duty on the whole personal propert}'

situated in England and Ireland without deduction

of debts; but the Act 5 and 6 Vict., c. 79, § 23,

provides for a return being given on proof of the

constitution and pajmient of the debts. This re-

paj'ment must be claimed within three years ; but

the time will be prolonged on application to the

Board of Inland Revenue. If there be any omis-

sion in the inventory inferring payment of further

duty, an additional inventory of such is required

to be exhibited, by 48 Geo. III., c. 149, § 38 ;

and § 40 provides that the same shall also specify

the amount or value of the estate and eft'ects of

the same person comprised in the former inven-

tory. By 16 and 17 Vict., c. 59, § 8, such addi-

tional inventory shall be chargeable only with such

amount of stump duty as, together with the stamp

duty charged upon the former duly stamped in-

ventory of the estate and effects of the same de-

ceased person, shall make up the full amount of

3ta7np duty, in respect of the total amount of all

the estate and effects of the deceased specified in

the said additional and any such former inventory.

If the estate shall be over-estimated, or something

improperly included in the inventor^-, an inven-

tory on a stamp corresponding to the value must

be exhibited, and the original inventory will be

allowed on affidavit as a spoiled stamp, within six

mouths of the recording of the second inventory.

LEGACY DUTY.

Legacies, Annuities, Reddues, <J'C.

To children nr their descendants, Duty per cent

or lineal ancestors, £1

Brother or sister, or descendant, 3

Uncle or aunt, or their descendant, 5

Granduncle or aunt,- or descendant, GOO

All other relations and strangers, 10

The husband or wife of the deceased is not charge-

able with duty. If the legatee's husband or wife

is of nearer consanguinity than the legatee, duty

is pavable according to such nearer relationship.

—16' and 17 Vict., c. 51, § 11.

This duty is payable for every legacy out of the per-

sonal or moveable estate, or out of or charged upon

the real or heritable estate of the deceased, or out

of any moneys to arise by the sale, mortgage, or

other disposition of the deceased's real or heritable

estate, or any part thereof: Also for the clear

residue (after deducting debts, funeral expenses,

legacies, and other charges first payable thereout)

of the personal or moveable estate, whether the

title to such residue shall accrue by virtue of any

testamentary disposition, or upon a partial or total

intestacy : And also for the clear residue of the

moneys to arise from the sale, mortgage, or other

disposition of any real or heritable estate, diiectetl

to be sold, mortgaged, or otherwise disposed of by

anj' will or testamentary instrument.

Annuities are valued for legacy duty according to

tables annexed to the Succession Duty Act.

Duty is not exigible on legacies or residues under

£20 ; but if a legatee take two or more legacies

under anj' testament, which shall together be of

the amount of £20, each shall be charged with

duty, though each or either maj' be separately

under that amount.

N.B. — Printed forms and regulations for payment of

the legacy duties will be obtained gratis, on appli-

cation at the Legacy Duty Office, Inland Revenue,

Edinburgh ; and at the ofKces of the distributors

of stamps in the country.

23

able with, and which shall have paid any such

duty exceeding £1, 15s., it is not chargeable with

the ad valorem duty ; and the deeds not charge-

able with the ad valorem duty shall be charged

with the duty to which the}' are liable under any

more general description iti the stamp schedules ;

and on the whole being produced, duly executed

and stamped, the latter shall also be stamped with

a particular stamp for denoting the payment of

the said ad valorem duty.

Exemption from this ad valorem duty. — Wills, tes-

taments, and testamentary instrumeuts, and dis-

positions mortis catisa.

Writ of Acknowledgment by any person infeft

of lands in Scotland, in favour of the heir or dis-

ponee of a creditor fully vested in right of an

heritable securitv constituted by iufeftmeut, 10s.

— 16 and 17 Vict.,' c. 63, § 6.

INVEUTORY DUTY.

The duty is imposed on the inventory of the personal

estate and efifects of deceased persons, required to

be recorded in the commissory courts according to

the rates in the following Table, and is regulated

by the amoimt of such estate in Scotland. The

same rates of duty are payable on probates and

letters of administration in respect of the personal

property situated in England and Ireland : —

TESTATE,

INTESTATE.

Amotmt Estate in

Duty.

Amount Estate in

Duty.

acotland.

Scot

aud.

Above

L'nder

Above

Under

£20

£100

lOs.

£20

£50

IDs.

Value

Value

100

200

£2

50

100

£1

200

300

5

100

200

S

300

450

8

200

300

8

460

COO

11

300

450

11

GOO

800

15

450

600

15

800

1,000

22

600

800

22

1,000

1,500

30

800

1,000

30

1,500

2,000

40

1,000

1,500

45

2,000

3,000

50

1,500

2,000

60

3,000

4,000

60

2,000

3,000

75

4,000

5,000

80

3,000

4,000

90

5,000

6,000

100

4,000

5,000

120

6,000

7,000

120

5,000

6,000

150

7,000

8,000

140

6,000

7,000

180

8,000

9,000

160

7,000

8,000

210

9,000

10,000

180

8,000

9,000

240

10,000

12,000

200

9,000

10,000

270

12,000

14,000

220

10,000

12,000

300

14,000

16,000

250

12,000

14,000

330

16,000

18,000

280

14,000

16,000

375

18,000

20,000

310

16,000

18,000

420

20,000

25,000

350

18,000

20,000

465

25,000

30,000

400

20,000

25,000

525

30,000

35,000

450

25,000

30,000

600

35,000

40,000

625

30,000

35,000

675

40,000

45,000

600

35,000

40,000

785

Increasin

g progress

ively t(

)

....£1,00

0,000

The inventory duty is paid on the. whole personal

property situated in Scotland, and probate or ad-

ministration duty on the whole personal propert}'

situated in England and Ireland without deduction

of debts; but the Act 5 and 6 Vict., c. 79, § 23,

provides for a return being given on proof of the

constitution and pajmient of the debts. This re-

paj'ment must be claimed within three years ; but

the time will be prolonged on application to the

Board of Inland Revenue. If there be any omis-

sion in the inventory inferring payment of further

duty, an additional inventory of such is required

to be exhibited, by 48 Geo. III., c. 149, § 38 ;

and § 40 provides that the same shall also specify

the amount or value of the estate and eft'ects of

the same person comprised in the former inven-

tory. By 16 and 17 Vict., c. 59, § 8, such addi-

tional inventory shall be chargeable only with such

amount of stump duty as, together with the stamp

duty charged upon the former duly stamped in-

ventory of the estate and effects of the same de-

ceased person, shall make up the full amount of

3ta7np duty, in respect of the total amount of all

the estate and effects of the deceased specified in

the said additional and any such former inventory.

If the estate shall be over-estimated, or something

improperly included in the inventor^-, an inven-

tory on a stamp corresponding to the value must

be exhibited, and the original inventory will be

allowed on affidavit as a spoiled stamp, within six

mouths of the recording of the second inventory.

LEGACY DUTY.

Legacies, Annuities, Reddues, <J'C.

To children nr their descendants, Duty per cent

or lineal ancestors, £1

Brother or sister, or descendant, 3

Uncle or aunt, or their descendant, 5

Granduncle or aunt,- or descendant, GOO

All other relations and strangers, 10

The husband or wife of the deceased is not charge-

able with duty. If the legatee's husband or wife

is of nearer consanguinity than the legatee, duty

is pavable according to such nearer relationship.

—16' and 17 Vict., c. 51, § 11.

This duty is payable for every legacy out of the per-

sonal or moveable estate, or out of or charged upon

the real or heritable estate of the deceased, or out

of any moneys to arise by the sale, mortgage, or

other disposition of the deceased's real or heritable

estate, or any part thereof: Also for the clear

residue (after deducting debts, funeral expenses,

legacies, and other charges first payable thereout)

of the personal or moveable estate, whether the

title to such residue shall accrue by virtue of any

testamentary disposition, or upon a partial or total

intestacy : And also for the clear residue of the

moneys to arise from the sale, mortgage, or other

disposition of any real or heritable estate, diiectetl

to be sold, mortgaged, or otherwise disposed of by

anj' will or testamentary instrument.

Annuities are valued for legacy duty according to

tables annexed to the Succession Duty Act.

Duty is not exigible on legacies or residues under

£20 ; but if a legatee take two or more legacies

under anj' testament, which shall together be of

the amount of £20, each shall be charged with

duty, though each or either maj' be separately

under that amount.

N.B. — Printed forms and regulations for payment of

the legacy duties will be obtained gratis, on appli-

cation at the Legacy Duty Office, Inland Revenue,

Edinburgh ; and at the ofKces of the distributors

of stamps in the country.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1860-1861 > (55) |

|---|

| Permanent URL | https://digital.nls.uk/83906046 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|