Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

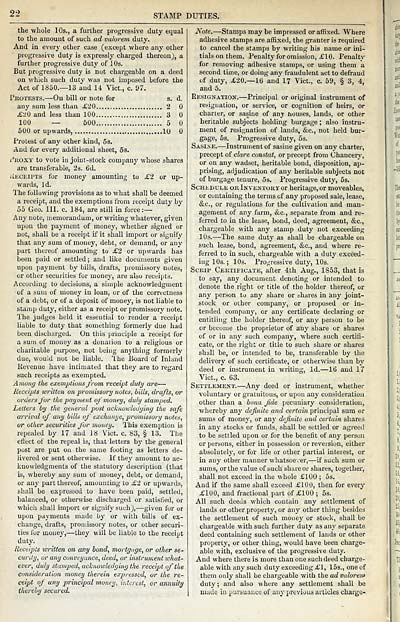

22

STAMP DUTIES,

the whole 10s., a further progressive duty equal

to the amount of such ad valorem duty.

And in every other case (except where any other

progressive duty is expressly charged thereon), a

further progressive duty of 10s.

But progressive duty is not chargeable on a deed

on which such duty was not imposed before the

Act of 1850.— 13 and 1-k Vict., c. 97.

i'EOTESTS. — Oil bill or note for s. d.

any sum less than £20 2

£20 and less than 100 3

100 — 500 6

500 or upwards, lU

Protest of any other kind, 5s.

And for every additional sheet, 5s.

i.-'eoxy to vote in joiut-stock company whose shares

are transferable, 2s. 6d.

liKCEiPTS for money amounting to £2 or up-

wards, Id.

The following provisions as to what shall be deemed

a receipt, and the exemptions from receipt duty by

55 Geo. III. c. 184, are still in force : —

Any note, memorandum, or writing whatever, given

upon the payment of money, whether signed or

not, shall be a receipt if it shall import or signify

that any sum of money, debt, or demand, or any

part thereof amounting to £2 or upwards has

been paid or settled ; and like documents given

upon payment by bills, drafts, promissory notes,

or other securities for money, are also receipts.

According to decisions, a simple acknowledgment

of a sum of money in loan, or of the correctness

of a debt, or of a deposit of money, is not liable to

stamp duty, either as a receipt or promissory note.

The judges held it essential to render a receipt

liable to duty that something formerly due had

been discharged. On this principle a receipt for

a sum of money as a donation to a religious or

charitable purpose, not being anything formerly

due, would not be liable. The Board of Inland

Revenue have intimated that they are to regard

such receipts as exempted.

Among the exemptions J'rom receipt duty are —

Receipts written on promissory notes, bills, drafts, or

orders for the payment of money, duly stamped.

Letters by the general post achnowledging the safe

arrival of any bills of exchange, promissory notes,

or other securities for money. I'his exemption is

repealed by 17 and 18 Vict. c. 83, § 13. The

eflect of tlie repeal is, that letters by the general

post are put on the same footing as letters de-

livered or sent otherwise. If they amount to ac-

knowledgments of the statutory description (that

is, whereby any sum of money, debt, or demand,

or any part thereof, amounting to £2 or upwards,

shall be expressed to have been paid, settled,

balanced, or otherwise discharged or satisHed, or

which shall import or signify such), — given for or

upon payments made by or with bills of ex-

change, drafts, promissory notes, or other securi-

ties for money, — they will be liable to the receipt

duty.

Receipts written on any bond, mortgage, or other se-

curity, or any conveyance, deed, or instrument what-

ever, duly sia^nped, acknowledging the receipjt of the

consideration money therein expressed, or the re-

ceipt of any principal money, interest, or annuity

thereby secured.

Note. — Stamps may be impressed or affixed. Where

adhesive stamps are affixed, the granter is required

to cancel the stamps by writing his name or ini-

tials on them. Penaltj- for omission, £10. Penalty

for removing adhesive stamps, or using them a

second time, or doing any fraudulent act to defraud

cf duty, £20.-16 and 17 Vict., c. 59, § 3, 4,

and 5.

Resignation. — Principal or original instrument of

resignation, or service, or cognition of heirs, or

charter, or sasine of any houses, lands, or other

heritable subjects holding burgage ; also instru-

ment of resi5;,uation of lands, &c., not held bur-

gage, 6s. Progressive duty, 5s.

Sasi:se. — Instrument of sasine given on any charter,

precept of dare constat, or precept from Chancerj',

or on any wadset, heritable bond, disposition, ap-

prising, adjudication of any heritable subjects not

of burgage tenure, 5s. Progressive duty, 6s.

ScHtDULK OR Inventoky or heritage, or moveables,

or containing the terms cf any proposed sale, lease,

&c., or regulations for the cultivation and man-

agement of any farm, &c., separate from and re-

ferred to in the lease, bond, deed, agreement, &c.,

chargeable with any stamp duty not exceeding

10s. — The same duty as shall be chargeable on

such lease, bond, agreement, &c., and where re-

ferred to in such, chargeable with a duty exceed-

ing 10s.; 10s. Progressive duty, 10s.

Scrip Certificate, after 4th Aug., 1S53, that is

to say, any document denoting or intended to

denote the right or title of the holder thereof, or

any person to any share or shares in any joint-

stock or other company, or proposed or in-

tended company, or any certificate declaring or

entitling the holder thereof, or any person to be

or become the proprietor of any share or shares

of or in any such company, where such certifi-

cate, or the right or title to such share or shares

shall be, or intended to be, transferable by the

delivery of such certificate, or otherwise than by

deed or instrument in writing, Id. — 16 and 17

Vict., c. 63.

Settlement. — Any deed or instrument, whether

voluntary or gratuitous, or upon any consideration

other than a bona fide pecuniary consideration,

whereby any definite and certain princijjal sum or

sums of monej', or any definite and certain shares

in any stocks or funds, shall be settled or agreed

to be settled upon or for the benefit of any person

or persons, either in possession or reversion, either

absolutely, or for life or other partial interest, or

in any other manner whatsoever, — if such sum or

sums, or the value of such share or shares, together,

shall not exceed in the whole £100 ; 5s.

And if the same shall exceed £100, then for every

£100, and fractional part of £100 ; os.

All such deeds which contain any settlement of

lands or other property, or any other thing besides

the settlement of such monej' or stock, shall be

chargeable with such further duty as any separate

deed containing such settlement of lands or other

property, or other thing, would have been charge-

able with, exclusive of the progressive duty.

And where there is more than one such deed charge-

able with any such duty exceeding £1, 15s., one of

them only shall be chargeable with the ad valorem

duty ; and also where any settlement shall be

made in pursuance of any previous articles charge-

STAMP DUTIES,

the whole 10s., a further progressive duty equal

to the amount of such ad valorem duty.

And in every other case (except where any other

progressive duty is expressly charged thereon), a

further progressive duty of 10s.

But progressive duty is not chargeable on a deed

on which such duty was not imposed before the

Act of 1850.— 13 and 1-k Vict., c. 97.

i'EOTESTS. — Oil bill or note for s. d.

any sum less than £20 2

£20 and less than 100 3

100 — 500 6

500 or upwards, lU

Protest of any other kind, 5s.

And for every additional sheet, 5s.

i.-'eoxy to vote in joiut-stock company whose shares

are transferable, 2s. 6d.

liKCEiPTS for money amounting to £2 or up-

wards, Id.

The following provisions as to what shall be deemed

a receipt, and the exemptions from receipt duty by

55 Geo. III. c. 184, are still in force : —

Any note, memorandum, or writing whatever, given

upon the payment of money, whether signed or

not, shall be a receipt if it shall import or signify

that any sum of money, debt, or demand, or any

part thereof amounting to £2 or upwards has

been paid or settled ; and like documents given

upon payment by bills, drafts, promissory notes,

or other securities for money, are also receipts.

According to decisions, a simple acknowledgment

of a sum of money in loan, or of the correctness

of a debt, or of a deposit of money, is not liable to

stamp duty, either as a receipt or promissory note.

The judges held it essential to render a receipt

liable to duty that something formerly due had

been discharged. On this principle a receipt for

a sum of money as a donation to a religious or

charitable purpose, not being anything formerly

due, would not be liable. The Board of Inland

Revenue have intimated that they are to regard

such receipts as exempted.

Among the exemptions J'rom receipt duty are —

Receipts written on promissory notes, bills, drafts, or

orders for the payment of money, duly stamped.

Letters by the general post achnowledging the safe

arrival of any bills of exchange, promissory notes,

or other securities for money. I'his exemption is

repealed by 17 and 18 Vict. c. 83, § 13. The

eflect of tlie repeal is, that letters by the general

post are put on the same footing as letters de-

livered or sent otherwise. If they amount to ac-

knowledgments of the statutory description (that

is, whereby any sum of money, debt, or demand,

or any part thereof, amounting to £2 or upwards,

shall be expressed to have been paid, settled,

balanced, or otherwise discharged or satisHed, or

which shall import or signify such), — given for or

upon payments made by or with bills of ex-

change, drafts, promissory notes, or other securi-

ties for money, — they will be liable to the receipt

duty.

Receipts written on any bond, mortgage, or other se-

curity, or any conveyance, deed, or instrument what-

ever, duly sia^nped, acknowledging the receipjt of the

consideration money therein expressed, or the re-

ceipt of any principal money, interest, or annuity

thereby secured.

Note. — Stamps may be impressed or affixed. Where

adhesive stamps are affixed, the granter is required

to cancel the stamps by writing his name or ini-

tials on them. Penaltj- for omission, £10. Penalty

for removing adhesive stamps, or using them a

second time, or doing any fraudulent act to defraud

cf duty, £20.-16 and 17 Vict., c. 59, § 3, 4,

and 5.

Resignation. — Principal or original instrument of

resignation, or service, or cognition of heirs, or

charter, or sasine of any houses, lands, or other

heritable subjects holding burgage ; also instru-

ment of resi5;,uation of lands, &c., not held bur-

gage, 6s. Progressive duty, 5s.

Sasi:se. — Instrument of sasine given on any charter,

precept of dare constat, or precept from Chancerj',

or on any wadset, heritable bond, disposition, ap-

prising, adjudication of any heritable subjects not

of burgage tenure, 5s. Progressive duty, 6s.

ScHtDULK OR Inventoky or heritage, or moveables,

or containing the terms cf any proposed sale, lease,

&c., or regulations for the cultivation and man-

agement of any farm, &c., separate from and re-

ferred to in the lease, bond, deed, agreement, &c.,

chargeable with any stamp duty not exceeding

10s. — The same duty as shall be chargeable on

such lease, bond, agreement, &c., and where re-

ferred to in such, chargeable with a duty exceed-

ing 10s.; 10s. Progressive duty, 10s.

Scrip Certificate, after 4th Aug., 1S53, that is

to say, any document denoting or intended to

denote the right or title of the holder thereof, or

any person to any share or shares in any joint-

stock or other company, or proposed or in-

tended company, or any certificate declaring or

entitling the holder thereof, or any person to be

or become the proprietor of any share or shares

of or in any such company, where such certifi-

cate, or the right or title to such share or shares

shall be, or intended to be, transferable by the

delivery of such certificate, or otherwise than by

deed or instrument in writing, Id. — 16 and 17

Vict., c. 63.

Settlement. — Any deed or instrument, whether

voluntary or gratuitous, or upon any consideration

other than a bona fide pecuniary consideration,

whereby any definite and certain princijjal sum or

sums of monej', or any definite and certain shares

in any stocks or funds, shall be settled or agreed

to be settled upon or for the benefit of any person

or persons, either in possession or reversion, either

absolutely, or for life or other partial interest, or

in any other manner whatsoever, — if such sum or

sums, or the value of such share or shares, together,

shall not exceed in the whole £100 ; 5s.

And if the same shall exceed £100, then for every

£100, and fractional part of £100 ; os.

All such deeds which contain any settlement of

lands or other property, or any other thing besides

the settlement of such monej' or stock, shall be

chargeable with such further duty as any separate

deed containing such settlement of lands or other

property, or other thing, would have been charge-

able with, exclusive of the progressive duty.

And where there is more than one such deed charge-

able with any such duty exceeding £1, 15s., one of

them only shall be chargeable with the ad valorem

duty ; and also where any settlement shall be

made in pursuance of any previous articles charge-

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1860-1861 > (54) |

|---|

| Permanent URL | https://digital.nls.uk/83906034 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|