Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

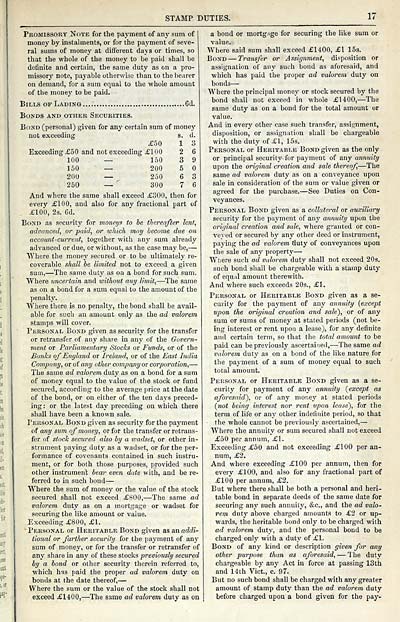

STAMP DUTIES.

17

Promissory Note for the payment of any sum of

money by instalments, or for the paj'ment of seve-

ral sums of money at different days or times, so

that the whole of the money to be paid shall be

detinite and certain, the same duty as on a pro-

missory note, payable otherwise than to the l)earer

on demand, for a sum equal to the -whole amount

of the money to be paid.

Bills of Lading 6d.

Bonds and other Securities.

Bond (personal) given for any certain sum of money

not exceeding s. d.

£50 1 3

Exceeding £50 and not exceeding £100 2 6

100 — 150 3 9

150 — 200 6

200 — 250 6 3

250 — ' 300 7 6

And where the same shall exceed £300, then for

every £100, and also for any fractional part of

£100, 2s. 6d.

Bond as security for moneys to he thereafter lent,

advanced, or paid, or which may become due on

account-current, together with any sum already

advanced or due, or without, as the case may be, —

"Where the money secured or to be ultimately re-

coverable shall be limited not to exceed a given

sum, — Tlie same duty as on a bond for such sum.

Where uncertain and without any Ihnit, — The same

as on a bond for a sum equal to the amount of the

penalty.

Where there is no penalty, the bond shall be avail-

able for sucii an amount only as the ad valorem

stamps will cover.

Personal Bond given as security for the transfer

or retransfer of any share in any of the Govern-

ment or Parliamentary Stocks or Funds, or of the

Banks of England or Ireland, or of the East India

Company, or of any other company or corporation, —

The same ad valorem duty as on a bond for a sum

of money equal to the value of the stock or fund

secured, according to the average price at the date

of the bond, or on either of the ten days preced-

ing: or the latest day preceding on which there

shall have been a known sale.

Personal Bond given as security for the payment

of any sum of money, or for the transfer or retrans-

fer of stock secured also by a wadset, or other in-

strument paying duty as a wadset, or for the per-

formance of covenants contained in such instru-

ment, or for both those purposes, provided such

other instrument bear even date with, and be re-

ferred to in such bond —

Where the sum of money or the value of the stock

secured shall not exceed £SO0, — The same ad

valorem duty as on a mortgage or wadset for

securing the like amount or value.

Exceeding £800, £1.

■ Personal or Heritable Bond given as an addi-

tional or farther security for the payment of any

sum of money, or for the transfer or retransfer of

any share in any of these stocks previously secured

by a bond or other security therein referred to,

which has paid the proper ad valorem duty on

bonds at the date thereof, —

Where the sum or the value of the stock shall not

exceed £1400, — The same ad valorem duty as on

a bond or mortgage for securing the like sum or

value.

Where said sum shall exceed £1400, £1 15s.

Bond — Transfer or Assignment, disposition or

assignation of any suih bond as aforesaid, and

which has paid the proper ad valorem duty on

bonds —

Where the principal money or stock secured by the

bond shall not exceed in whole £1400, — The

same duty as on a bond for the total amount or

value.

And in every other case such transfer, assignment,

disposition, or assignation shall be chargeable

with the duty of £1, 15s.

Personal or Heritable Bond given as the only

or principal security for payment of any annuity

upon the original creation and sale thereof, — The

same ad valorem duty as on a conveyance upon

sale in consideration of the sum or value given or

agreed for the purchase. — See Duties on Con-

veyances.

Personal Bond given as a collateral or auxiliary

security for the payment of any annuity upon the

original creation and sale, where granted or con-

veyed or secured by any other deed or instrument,

paying the ad valorem fluty of conveyances upon

the sale of any property —

Where such ad valorem duty shall not exceed 20s.

such bond shall be chargeable with a stamp duty

of equal amount therewith.

And where such exceeds 20s., £1.

Personal or Heritable Bond given as a se-

curity for the payment of any annuity [except

upon the original creation and sale), or of any

sum or sums of money at stated periods (not be-

ing interest or rent upon a lease), for any definite

and certain term, so that the total amount to be

paid can be previously ascertained, — The same ad

valorem duty as on a bond of the like nature for

the payment of a sum of money equal to such

total amount.

Personal or Heritable Bond given as a se-

curity for paj'inent of any annuity {except as

aforesaid), or of any nionej' at stated periods

{not being interest nor rent upon lease), for the

term of life or any other indefinite period, so that

the whole cannot be previously ascertained, —

Where the annuity or sum secured shall not exceed

£50 per annum, £1.

Exceeding £50 and not exceeding £100 per an-

num, £2.

And where exceeding £100 per annum, then for

every £100, and also for any fractional part of

£100 per annum, £2.

But where there shall be both a personal and heri-

table bond in separate deeds of the same date for

securhig any such annuity, &c., and the ad valo-

rem dutj' above charged amounts to £2 or up-

wards, the heritable bond only to be charged with

ad valorem duty, and the personal bond to be

charged only with a duty of £1.

Bond of any kind or description given for any

other purpose than as aforesaid, — The duty

chargeable by any Act in force at passing 13th

and 14th Vict., c. 97.

But no such bond shall be charged with any greater

amount of stamp duty than the ad valorem duty

before charged upon a bond given for the pay-

17

Promissory Note for the payment of any sum of

money by instalments, or for the paj'ment of seve-

ral sums of money at different days or times, so

that the whole of the money to be paid shall be

detinite and certain, the same duty as on a pro-

missory note, payable otherwise than to the l)earer

on demand, for a sum equal to the -whole amount

of the money to be paid.

Bills of Lading 6d.

Bonds and other Securities.

Bond (personal) given for any certain sum of money

not exceeding s. d.

£50 1 3

Exceeding £50 and not exceeding £100 2 6

100 — 150 3 9

150 — 200 6

200 — 250 6 3

250 — ' 300 7 6

And where the same shall exceed £300, then for

every £100, and also for any fractional part of

£100, 2s. 6d.

Bond as security for moneys to he thereafter lent,

advanced, or paid, or which may become due on

account-current, together with any sum already

advanced or due, or without, as the case may be, —

"Where the money secured or to be ultimately re-

coverable shall be limited not to exceed a given

sum, — Tlie same duty as on a bond for such sum.

Where uncertain and without any Ihnit, — The same

as on a bond for a sum equal to the amount of the

penalty.

Where there is no penalty, the bond shall be avail-

able for sucii an amount only as the ad valorem

stamps will cover.

Personal Bond given as security for the transfer

or retransfer of any share in any of the Govern-

ment or Parliamentary Stocks or Funds, or of the

Banks of England or Ireland, or of the East India

Company, or of any other company or corporation, —

The same ad valorem duty as on a bond for a sum

of money equal to the value of the stock or fund

secured, according to the average price at the date

of the bond, or on either of the ten days preced-

ing: or the latest day preceding on which there

shall have been a known sale.

Personal Bond given as security for the payment

of any sum of money, or for the transfer or retrans-

fer of stock secured also by a wadset, or other in-

strument paying duty as a wadset, or for the per-

formance of covenants contained in such instru-

ment, or for both those purposes, provided such

other instrument bear even date with, and be re-

ferred to in such bond —

Where the sum of money or the value of the stock

secured shall not exceed £SO0, — The same ad

valorem duty as on a mortgage or wadset for

securing the like amount or value.

Exceeding £800, £1.

■ Personal or Heritable Bond given as an addi-

tional or farther security for the payment of any

sum of money, or for the transfer or retransfer of

any share in any of these stocks previously secured

by a bond or other security therein referred to,

which has paid the proper ad valorem duty on

bonds at the date thereof, —

Where the sum or the value of the stock shall not

exceed £1400, — The same ad valorem duty as on

a bond or mortgage for securing the like sum or

value.

Where said sum shall exceed £1400, £1 15s.

Bond — Transfer or Assignment, disposition or

assignation of any suih bond as aforesaid, and

which has paid the proper ad valorem duty on

bonds —

Where the principal money or stock secured by the

bond shall not exceed in whole £1400, — The

same duty as on a bond for the total amount or

value.

And in every other case such transfer, assignment,

disposition, or assignation shall be chargeable

with the duty of £1, 15s.

Personal or Heritable Bond given as the only

or principal security for payment of any annuity

upon the original creation and sale thereof, — The

same ad valorem duty as on a conveyance upon

sale in consideration of the sum or value given or

agreed for the purchase. — See Duties on Con-

veyances.

Personal Bond given as a collateral or auxiliary

security for the payment of any annuity upon the

original creation and sale, where granted or con-

veyed or secured by any other deed or instrument,

paying the ad valorem fluty of conveyances upon

the sale of any property —

Where such ad valorem duty shall not exceed 20s.

such bond shall be chargeable with a stamp duty

of equal amount therewith.

And where such exceeds 20s., £1.

Personal or Heritable Bond given as a se-

curity for the payment of any annuity [except

upon the original creation and sale), or of any

sum or sums of money at stated periods (not be-

ing interest or rent upon a lease), for any definite

and certain term, so that the total amount to be

paid can be previously ascertained, — The same ad

valorem duty as on a bond of the like nature for

the payment of a sum of money equal to such

total amount.

Personal or Heritable Bond given as a se-

curity for paj'inent of any annuity {except as

aforesaid), or of any nionej' at stated periods

{not being interest nor rent upon lease), for the

term of life or any other indefinite period, so that

the whole cannot be previously ascertained, —

Where the annuity or sum secured shall not exceed

£50 per annum, £1.

Exceeding £50 and not exceeding £100 per an-

num, £2.

And where exceeding £100 per annum, then for

every £100, and also for any fractional part of

£100 per annum, £2.

But where there shall be both a personal and heri-

table bond in separate deeds of the same date for

securhig any such annuity, &c., and the ad valo-

rem dutj' above charged amounts to £2 or up-

wards, the heritable bond only to be charged with

ad valorem duty, and the personal bond to be

charged only with a duty of £1.

Bond of any kind or description given for any

other purpose than as aforesaid, — The duty

chargeable by any Act in force at passing 13th

and 14th Vict., c. 97.

But no such bond shall be charged with any greater

amount of stamp duty than the ad valorem duty

before charged upon a bond given for the pay-

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1860-1861 > (49) |

|---|

| Permanent URL | https://digital.nls.uk/83905971 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|