Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

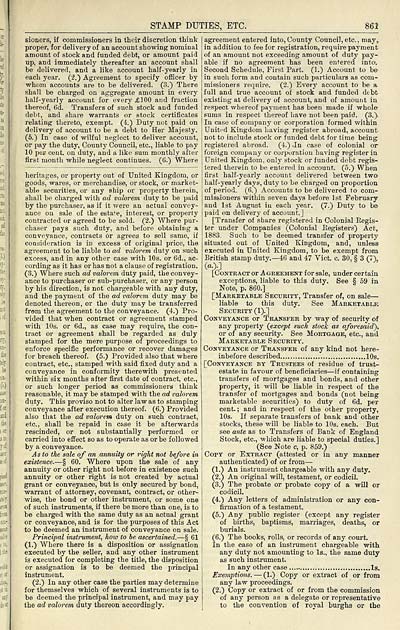

STAMP DUTIES, ETC.

861

sioners, if commissioners in their discretion think

proper, for delivery of an account showing nominal

amount of stock and funded debt, or amount paid

up, and immediately thereafter an account shall

be delivered, and a like account half-yearly in

each year. (2.) Agreement to specify officer by

whom accounts are to be delivered. (3.) There

shall be charged on aggregate amount in every

half-yearly account for every £100 and fraction

thereof, 6d. Transfers of such stock and funded

debt, and share warrants or stock certificates

relating thereto, exempt. (4.) Duty not paid on

delivery of account to be a debt to Her Majesty.

(5.) In case of wilful neglect to deliver account,

or pay the duty, County Council, etc., liable to pay

10 per cent, on duty, and a like sum monthly after

first month while neglect continues. (6.) Where

heritages, or property out of United Kingdom, or

goods, wares, or merchandise, or stock, or market-

able securities, or any ship or property therein,

shall be charged with ad valorem duty to be paid

by the purchaser, as if it were an actual convey-

ance on sale of the estate, interest, or property

contracted or agreed to be sold. (2.) Where pur-

chaser pays such duty, and before obtaining a

conveyance, contracts or agrees to sell same, if

consideration is in excess of original price, the

agreement to be liable to ad valorem duty on such

excess, and in any other case with 10s. or 6d., ac-

cording as it has or has not a clause of registration.

(3.) Where such ad valorem duty paid, the convey-

ance to purchaser or sub- purchaser, or any person

by his direction, is not chargeable with any duty,

and the payment of the ad valorem duty may be

denoted thereon, or the duty may be transferred

frem the agreement to the conveyance. (4.) Pro-

vided that when contract or agreement stamped

with 10s. or 6d., as case may require, the con-

tract or agreement shall be regarded as duly

stamped for the mere purpose of proceedings to

enforce specific performance or recover damages

for breach thereof. (5.) Provided also that where

contract, etc., stamped with said fixed duty and a

conveyance in conformity therewith presented

within six months after first date of contract, etc.,

or such longer period as commissioners think

reasonable, it may be stamped with the ad valorem

duty. This proviso not to alter law as to stamping

conveyance after execution thereof. (6.) Provided

also that the ad valorem duty on such contract,

etc., shall be repaid in case it be afterwards

rescinded, or not substantially performed or

carried into effect so as to operate as or be followed

by a conveyance.

As to the sale of an annuity or right not before in

existence. — § 60. Where upon the sale of any

annuity or other right not before in existence such

annuity or other right is not created by actual

grant or conveyance, but is only secured by bond,

warrant of attorney, covenant, contract, or other-

wise, the bond or other instrument, or some one

of such instruments, if there be more than one, is to

be charged with the same duty as an actual grant

or conveyance, and is for the purposes of this Act

to be deemed an instrument of conveyance on sale.

Principal instrument, how to be ascertained. — § 61

(1.) Where there is a disposition or assignation

executed by the seller, and any other instrument

is executed for completing the title, the disposition

or assignation is to be deemed the principal

instrument.

(2.) In any other case the parties may determine

for themselves which of several instruments is to

be deemed the principal instrument, and may pay

the ad valorem duty thereon accordingly.

agreement entered into, County Council, etc., may,

in addition to fee for registration, require payment

of an amount not exceeding amount of duty pay-

able if no agreement has been entered into-.

Second Schedule, First Part. (1.) Account to be-

in such form and contain such particulars as com-

missioners require. (2.) Every account to be a

full and true account of stock and funded debt

existing at delivery of account, and of amount in

respect whereof payment has been made if whole

sums in respect thereof have not been paid. (3.}

In case of company or corporation formed within

United Kingdom having register abroad, account

not to include stock or funded debt for time being

registered abroad. (4.) In case of colonial or

foreign company or corporation having register in

United Kingdom, only stock or funded debt regis-

tered therein to be entered in account. (5.) When

first half-yearly account delivered between two>

half-yearly days, duty to be charged on proportion

of period. (6.) Accounts to be delivered to com-

missioners within seven days before 1st February

and 1st August in each year. (7.) Duty to be

paid on delivery of account.]

[Transfer of share registered in Colonial Regis-

ter under Companies (Colonial Registers) Act,

1883. Such to be deemed transfer of property

situated out of United Kingdom, and, unless

executed in United Kingdom, to be exempt from

British stamp duty.— 46 and 47 Vict. c. 30, § 3 (7),

[Contract or Agreement for sale, under certain

exceptions, liable to this duty. See § 59 in

Note, p. 860.]

[Marketable Security, Transfer of, on sale —

liable to this duty. See Marketable

Security (1).]

Conveyance or Transfer by way of security of

any property (except such stock as aforesaid"),

or of any security. See Mortgage, etc., and

Marketable Security.

Conveyance or Transfer of any kind not here-

inbefore described 10s.

[Conveyance by Trustees of residue of trust-

estate in favour of beneficiaries — if containing

transfers of mortgages and bonds, and other

property, it will be liable in respect of the

transfer of mortgages and bonds (not being

marketable securities) to duty of 6d. per

cent. ; and in respect of the other property,

10s. If separate transfers of bank and other

stocks, these will be liable to 10s. each. But

see ante as to Transfers of Bank of England

Stock, etc., which are liable to special duties.]

(See Note c, p. 859.)

Copy or Extract (attested or in any manner

authenticated) of or from —

(1.) An instrument chargeable with any duty.

(2.) An original will, testament, or codicil.

(3.) The probate or probate copy of a will or

codicil.

(4.) Any letters of administration or any con-

firmation of a testament.

(5.) Any public register (except any register

of births, baptisms, marriages, deaths, or

burials.

(6.) The books, rolls, or records of any court.

In the case of an instrument chargeable with

any duty not amounting to Is., the same duty

as such instrument.

In any other case Is.

Exemptions. — (1.) Copy or extract of or from

any law proceedings.

(2.) Copy or extract of or from the commission

of any person as a delegate or representative

to the convention of royal burghs or the

861

sioners, if commissioners in their discretion think

proper, for delivery of an account showing nominal

amount of stock and funded debt, or amount paid

up, and immediately thereafter an account shall

be delivered, and a like account half-yearly in

each year. (2.) Agreement to specify officer by

whom accounts are to be delivered. (3.) There

shall be charged on aggregate amount in every

half-yearly account for every £100 and fraction

thereof, 6d. Transfers of such stock and funded

debt, and share warrants or stock certificates

relating thereto, exempt. (4.) Duty not paid on

delivery of account to be a debt to Her Majesty.

(5.) In case of wilful neglect to deliver account,

or pay the duty, County Council, etc., liable to pay

10 per cent, on duty, and a like sum monthly after

first month while neglect continues. (6.) Where

heritages, or property out of United Kingdom, or

goods, wares, or merchandise, or stock, or market-

able securities, or any ship or property therein,

shall be charged with ad valorem duty to be paid

by the purchaser, as if it were an actual convey-

ance on sale of the estate, interest, or property

contracted or agreed to be sold. (2.) Where pur-

chaser pays such duty, and before obtaining a

conveyance, contracts or agrees to sell same, if

consideration is in excess of original price, the

agreement to be liable to ad valorem duty on such

excess, and in any other case with 10s. or 6d., ac-

cording as it has or has not a clause of registration.

(3.) Where such ad valorem duty paid, the convey-

ance to purchaser or sub- purchaser, or any person

by his direction, is not chargeable with any duty,

and the payment of the ad valorem duty may be

denoted thereon, or the duty may be transferred

frem the agreement to the conveyance. (4.) Pro-

vided that when contract or agreement stamped

with 10s. or 6d., as case may require, the con-

tract or agreement shall be regarded as duly

stamped for the mere purpose of proceedings to

enforce specific performance or recover damages

for breach thereof. (5.) Provided also that where

contract, etc., stamped with said fixed duty and a

conveyance in conformity therewith presented

within six months after first date of contract, etc.,

or such longer period as commissioners think

reasonable, it may be stamped with the ad valorem

duty. This proviso not to alter law as to stamping

conveyance after execution thereof. (6.) Provided

also that the ad valorem duty on such contract,

etc., shall be repaid in case it be afterwards

rescinded, or not substantially performed or

carried into effect so as to operate as or be followed

by a conveyance.

As to the sale of an annuity or right not before in

existence. — § 60. Where upon the sale of any

annuity or other right not before in existence such

annuity or other right is not created by actual

grant or conveyance, but is only secured by bond,

warrant of attorney, covenant, contract, or other-

wise, the bond or other instrument, or some one

of such instruments, if there be more than one, is to

be charged with the same duty as an actual grant

or conveyance, and is for the purposes of this Act

to be deemed an instrument of conveyance on sale.

Principal instrument, how to be ascertained. — § 61

(1.) Where there is a disposition or assignation

executed by the seller, and any other instrument

is executed for completing the title, the disposition

or assignation is to be deemed the principal

instrument.

(2.) In any other case the parties may determine

for themselves which of several instruments is to

be deemed the principal instrument, and may pay

the ad valorem duty thereon accordingly.

agreement entered into, County Council, etc., may,

in addition to fee for registration, require payment

of an amount not exceeding amount of duty pay-

able if no agreement has been entered into-.

Second Schedule, First Part. (1.) Account to be-

in such form and contain such particulars as com-

missioners require. (2.) Every account to be a

full and true account of stock and funded debt

existing at delivery of account, and of amount in

respect whereof payment has been made if whole

sums in respect thereof have not been paid. (3.}

In case of company or corporation formed within

United Kingdom having register abroad, account

not to include stock or funded debt for time being

registered abroad. (4.) In case of colonial or

foreign company or corporation having register in

United Kingdom, only stock or funded debt regis-

tered therein to be entered in account. (5.) When

first half-yearly account delivered between two>

half-yearly days, duty to be charged on proportion

of period. (6.) Accounts to be delivered to com-

missioners within seven days before 1st February

and 1st August in each year. (7.) Duty to be

paid on delivery of account.]

[Transfer of share registered in Colonial Regis-

ter under Companies (Colonial Registers) Act,

1883. Such to be deemed transfer of property

situated out of United Kingdom, and, unless

executed in United Kingdom, to be exempt from

British stamp duty.— 46 and 47 Vict. c. 30, § 3 (7),

[Contract or Agreement for sale, under certain

exceptions, liable to this duty. See § 59 in

Note, p. 860.]

[Marketable Security, Transfer of, on sale —

liable to this duty. See Marketable

Security (1).]

Conveyance or Transfer by way of security of

any property (except such stock as aforesaid"),

or of any security. See Mortgage, etc., and

Marketable Security.

Conveyance or Transfer of any kind not here-

inbefore described 10s.

[Conveyance by Trustees of residue of trust-

estate in favour of beneficiaries — if containing

transfers of mortgages and bonds, and other

property, it will be liable in respect of the

transfer of mortgages and bonds (not being

marketable securities) to duty of 6d. per

cent. ; and in respect of the other property,

10s. If separate transfers of bank and other

stocks, these will be liable to 10s. each. But

see ante as to Transfers of Bank of England

Stock, etc., which are liable to special duties.]

(See Note c, p. 859.)

Copy or Extract (attested or in any manner

authenticated) of or from —

(1.) An instrument chargeable with any duty.

(2.) An original will, testament, or codicil.

(3.) The probate or probate copy of a will or

codicil.

(4.) Any letters of administration or any con-

firmation of a testament.

(5.) Any public register (except any register

of births, baptisms, marriages, deaths, or

burials.

(6.) The books, rolls, or records of any court.

In the case of an instrument chargeable with

any duty not amounting to Is., the same duty

as such instrument.

In any other case Is.

Exemptions. — (1.) Copy or extract of or from

any law proceedings.

(2.) Copy or extract of or from the commission

of any person as a delegate or representative

to the convention of royal burghs or the

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1892-1893 > (919) |

|---|

| Permanent URL | https://digital.nls.uk/83665602 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|