Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

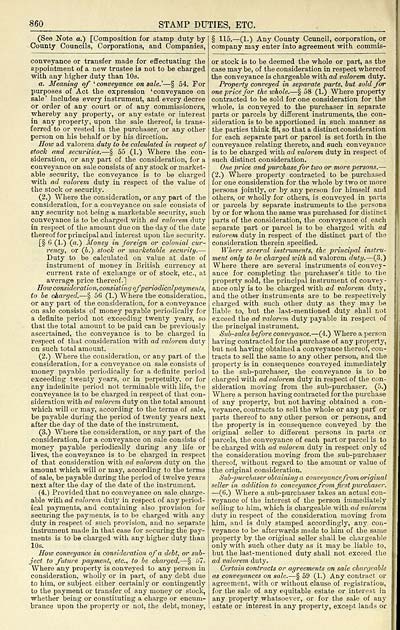

STAMP DUTIES, ETC.

(See Note a.) [Composition for stamp duty by

County Councils, Corporations, and Companies,

conveyance or transfer made for effectuating the

appointment of a new trustee is not to be charged

with any higher duty than 10s.

a. Meaning of 'conveyance on sale.' 1 — § 54. For

purposes of Act the expression 'conveyance on

sale' includes every instrument, and every decree

or order of any court or of any commissioners,

whereby any property, or any estate or interest

in any property, upon the sale thereof, is trans-

ferred to or vested in the purchaser, or any other

person on his behalf or by his direction.

Sow ad valorem duty to be calculated in respect of

stock and securities. — § 55 (1.) Where the con-

sideration, or any part of the consideration, for a

conveyance on sale consists of any stock or market-

able security, the conveyance is to be charged

with ad valorem duty in respect of the value of

the stock or security.

(2.) Where the consideration, or any part of the

consideration, for a conveyance on sale consists of

any security not being a marketable security, such

conveyance is to be charged with ad valorem duty

in respect of the amount due on the day of the date

thereof for principal and interest upon the security.

[§ 6 (1.) (a.) Money in foreign or colonial cur-

rency, or (6.) stock or marketable security. —

Duty to be calculated on value at date of

instrument of money in British currency at

current rate of exchange or of stock, etc., at

average price thereof.]

How consideration, consisting ofperiodicalpayments,

to be charged. — § 56 (1.) Where the consideration,

or any part of the consideration, for a conveyance

on sale consists of money payable periodically for

a definite period not exceeding twenty years, so

that the total amount to be paid can be previously

ascertained, the conveyance is to be charged in

respect of that consideration with ad valorem duty

on such total amount.

(2.) Where the consideration, or any part of the

consideration, for a conveyance on sale consists of

money payable periodically for a definite period

exceeding twenty years, or in perpetuity, or for

any indefinite period not terminable with life, the

conveyance is to be charged in respect of that con-

sideration with ad valorem duty on the total amount

which will or may, according to the terms of sale,

be payable during the period of twenty years next

after the day of the date of the instrument.

(3.) Where the consideration, or any part of the

consideration, for a conveyance on sale consists of

money payable periodically during any life or

lives, the conveyance is to be charged in respect

of that consideration with ad valorem duty on the

amount which will or may, according to the terms

of sale, be payable during the period of twelve years

next after the day of the date of the instrument.

(4.) Provided that no conveyance on sale charge-

able with ad valorem duty in respect of any period-

ical payments, and containing also provision for

securing the payments, is to be charged with any

duty in respect of such provision, and no separate

instrument made in that case for securing the pay-

ments is to be charged with any higher duty than

10s.

How conveyance in consideration of a debt, or sub-

ject to future payment, etc., to be charged. — § 67.

Where any property is conveyed to any person in

consideration, wholly or in part, of any debt due

to him, or subject either certainly or contingently

to the payment or transfer of any money or stock,

whether being or constituting a charge or encum-

brance upon the property or not, the debt, money,

§ 115. — (1.) Any County Council, corporation, or

company may enter into agreement with commis-

or stock is to be deemed the whole or part, as the

case may be, of the consideration in respect whereof

the conveyance is chargeable with ad valorem duty.

Property conveyed in separate parts, but sold for

one price for the whole.— -§ 58 (1.) Where property

contracted to be sold for one consideration for the

whole, is conveyed to the purchaser in separate

parts or parcels by different instruments, the con-

sideration is to be apportioned in such manner as

the parties think fit, so that a distinct consideration

for each sepai-ate part or parcel is set forth in the

conveyance relating thereto, and such conveyance

is to be charged with ad valorem duty in respect of

such distinct consideration.

One price and purchase for two or more persons. —

(2.) Where property contracted to be purchased

for one consideration for the whole by two or more

persons jointly, or by any person for himself and

others, or wholly for others, is conveyed in parts

or parcels by separate instruments to the persons

by or for whom the same was purchased for distinct

parts of the consideration, the conveyance of each

separate part or parcel is to be charged with ad

valorem duty in respect of the distinct part of the

consideration therein specified.

Where several instruments, the principal instru-

ment only to be charged with ad valorem duty. — (3.)

Where there are several instruments of convey-

ance for completing the purchaser's title to the

property sold, the principal instrument of convey-

ance only is to be charged with ad valorem duty,

and the other instruments are to be respectively

charged with such other duty as they may be

liable to, but the last-mentioned duty shall not

exceed the ad valorem duty payable in respect of

the principal instrument.

Sub-sales before conveyance. — (4.) Where a person

having contracted for the purchase of any property,

but not having obtained a conveyance thereof, con-

tracts to sell the same to any other person, and the

property is in consequence conveyed immediately

to the sub-purchaser, the conveyance is to be

charged with ad valorem duty in respect of the con-

sideration moving from the sub-purchaser. (5.)

Where a person having contracted for the purchase

of any property, but not having obtained a con-

veyance, contracts to sell the whole or any part or

parts thereof to any other person or persons, and

the property is in consequence conveyed by the

original seller to different persons in parts or

parcels, the conveyance of each part or parcel is to

be charged with ad valorem duty in respect only of

the consideration moving from the sub-purchaser

thereof, without regard to the amount or value of

the original consideration.

Sub-purchaser obtaining a conveyance from original

seller in addition to conveyance from first purchaser.

— (6.) Where a sub-purchaser takes an actual con-

veyance of the interest of the person immediately

selling to him, which is chargeable with ad valorem

duty in respect of the consideration moving from

him, and is duly stamped accordingly, any con-

veyance to be afterwards made to him of the same

property by the original seller shall be chargeable

only with such other duty as it may be liable to,

but the last-mentioned duty shall not exceed the

ad valorem duty.

Certain contracts or agreements on sale chargeable

as conveyances on sale. — § 59 (1.) Any contract or

agreement, with or without clause of registration,

for the sale of any equitable estate or interest in

any property whatsoever, or for the sale of any

estate or interest in any property, excejjt lands or

(See Note a.) [Composition for stamp duty by

County Councils, Corporations, and Companies,

conveyance or transfer made for effectuating the

appointment of a new trustee is not to be charged

with any higher duty than 10s.

a. Meaning of 'conveyance on sale.' 1 — § 54. For

purposes of Act the expression 'conveyance on

sale' includes every instrument, and every decree

or order of any court or of any commissioners,

whereby any property, or any estate or interest

in any property, upon the sale thereof, is trans-

ferred to or vested in the purchaser, or any other

person on his behalf or by his direction.

Sow ad valorem duty to be calculated in respect of

stock and securities. — § 55 (1.) Where the con-

sideration, or any part of the consideration, for a

conveyance on sale consists of any stock or market-

able security, the conveyance is to be charged

with ad valorem duty in respect of the value of

the stock or security.

(2.) Where the consideration, or any part of the

consideration, for a conveyance on sale consists of

any security not being a marketable security, such

conveyance is to be charged with ad valorem duty

in respect of the amount due on the day of the date

thereof for principal and interest upon the security.

[§ 6 (1.) (a.) Money in foreign or colonial cur-

rency, or (6.) stock or marketable security. —

Duty to be calculated on value at date of

instrument of money in British currency at

current rate of exchange or of stock, etc., at

average price thereof.]

How consideration, consisting ofperiodicalpayments,

to be charged. — § 56 (1.) Where the consideration,

or any part of the consideration, for a conveyance

on sale consists of money payable periodically for

a definite period not exceeding twenty years, so

that the total amount to be paid can be previously

ascertained, the conveyance is to be charged in

respect of that consideration with ad valorem duty

on such total amount.

(2.) Where the consideration, or any part of the

consideration, for a conveyance on sale consists of

money payable periodically for a definite period

exceeding twenty years, or in perpetuity, or for

any indefinite period not terminable with life, the

conveyance is to be charged in respect of that con-

sideration with ad valorem duty on the total amount

which will or may, according to the terms of sale,

be payable during the period of twenty years next

after the day of the date of the instrument.

(3.) Where the consideration, or any part of the

consideration, for a conveyance on sale consists of

money payable periodically during any life or

lives, the conveyance is to be charged in respect

of that consideration with ad valorem duty on the

amount which will or may, according to the terms

of sale, be payable during the period of twelve years

next after the day of the date of the instrument.

(4.) Provided that no conveyance on sale charge-

able with ad valorem duty in respect of any period-

ical payments, and containing also provision for

securing the payments, is to be charged with any

duty in respect of such provision, and no separate

instrument made in that case for securing the pay-

ments is to be charged with any higher duty than

10s.

How conveyance in consideration of a debt, or sub-

ject to future payment, etc., to be charged. — § 67.

Where any property is conveyed to any person in

consideration, wholly or in part, of any debt due

to him, or subject either certainly or contingently

to the payment or transfer of any money or stock,

whether being or constituting a charge or encum-

brance upon the property or not, the debt, money,

§ 115. — (1.) Any County Council, corporation, or

company may enter into agreement with commis-

or stock is to be deemed the whole or part, as the

case may be, of the consideration in respect whereof

the conveyance is chargeable with ad valorem duty.

Property conveyed in separate parts, but sold for

one price for the whole.— -§ 58 (1.) Where property

contracted to be sold for one consideration for the

whole, is conveyed to the purchaser in separate

parts or parcels by different instruments, the con-

sideration is to be apportioned in such manner as

the parties think fit, so that a distinct consideration

for each sepai-ate part or parcel is set forth in the

conveyance relating thereto, and such conveyance

is to be charged with ad valorem duty in respect of

such distinct consideration.

One price and purchase for two or more persons. —

(2.) Where property contracted to be purchased

for one consideration for the whole by two or more

persons jointly, or by any person for himself and

others, or wholly for others, is conveyed in parts

or parcels by separate instruments to the persons

by or for whom the same was purchased for distinct

parts of the consideration, the conveyance of each

separate part or parcel is to be charged with ad

valorem duty in respect of the distinct part of the

consideration therein specified.

Where several instruments, the principal instru-

ment only to be charged with ad valorem duty. — (3.)

Where there are several instruments of convey-

ance for completing the purchaser's title to the

property sold, the principal instrument of convey-

ance only is to be charged with ad valorem duty,

and the other instruments are to be respectively

charged with such other duty as they may be

liable to, but the last-mentioned duty shall not

exceed the ad valorem duty payable in respect of

the principal instrument.

Sub-sales before conveyance. — (4.) Where a person

having contracted for the purchase of any property,

but not having obtained a conveyance thereof, con-

tracts to sell the same to any other person, and the

property is in consequence conveyed immediately

to the sub-purchaser, the conveyance is to be

charged with ad valorem duty in respect of the con-

sideration moving from the sub-purchaser. (5.)

Where a person having contracted for the purchase

of any property, but not having obtained a con-

veyance, contracts to sell the whole or any part or

parts thereof to any other person or persons, and

the property is in consequence conveyed by the

original seller to different persons in parts or

parcels, the conveyance of each part or parcel is to

be charged with ad valorem duty in respect only of

the consideration moving from the sub-purchaser

thereof, without regard to the amount or value of

the original consideration.

Sub-purchaser obtaining a conveyance from original

seller in addition to conveyance from first purchaser.

— (6.) Where a sub-purchaser takes an actual con-

veyance of the interest of the person immediately

selling to him, which is chargeable with ad valorem

duty in respect of the consideration moving from

him, and is duly stamped accordingly, any con-

veyance to be afterwards made to him of the same

property by the original seller shall be chargeable

only with such other duty as it may be liable to,

but the last-mentioned duty shall not exceed the

ad valorem duty.

Certain contracts or agreements on sale chargeable

as conveyances on sale. — § 59 (1.) Any contract or

agreement, with or without clause of registration,

for the sale of any equitable estate or interest in

any property whatsoever, or for the sale of any

estate or interest in any property, excejjt lands or

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1892-1893 > (918) |

|---|

| Permanent URL | https://digital.nls.uk/83665590 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|