Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

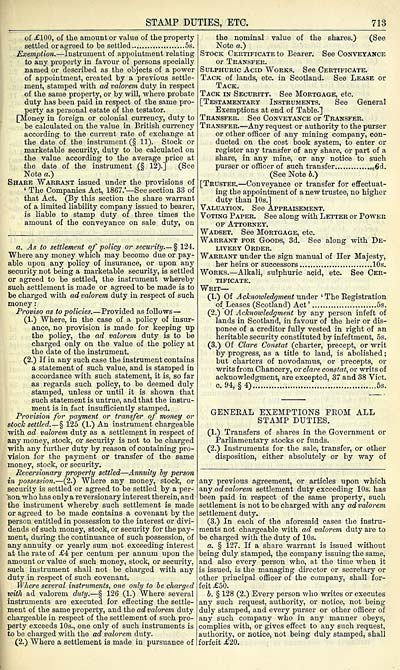

STAMP DUTIES, ETC.

713

of £100, of the amount or value of the property

settled or agreed to be settled 5s.

Exemption. — Instrument of appointment relating

to any property in favour of persons specially

named or described as the objects of a power

of appointment, created by a previous settle-

ment, stamped with ad valorem duty in respect

of the same property, or by will, where probate

duty has been paid in respect of the same pro-

perty as personal estate of the testator.

[Money in foreign or colonial currency, duty to

be calculated on the value in British cui'rency

according to the current rate of exchange at

the date of the instrument (§ 11). Stock or

marketable security, duty to be calculated on

the value according to the average price at

the date of the instrument (§ 12).] (See

Note a.)

Shake Warrant issued under the provisions of

' The Companies Act, 1867.' — See section 33 of

that Act. (By this section the share warrant

of a limited liability company issued to bearer,

is liable to stamp duty of three times the

amount of the conveyance on sale duty, on

a. As to settlement of policy or security — § 124.

Where any money which may become due or pay-

able upon any policy of insurance, or upon any

seciirity not being a marketable security, is settled

or agreed to be settled, the instrument whereby

such settlement is made or agreed to be made is to

be charged with ad valorem duty in respect of such

money :

Proviso as to policies. — Provided as follows —

(1.) Where, in the case of a policy of insur-

ance, no provision is made for keeping up

the policy, the ad valorem duty is to be

charged only on the value of the policy at

the date of the instrument.

(2.) If in any such case the instrument contains

a statement of such value, and is stamped in

accordance with such statement, it is, so far

as regards such policy, to be deemed duly

stamped, unless or until it is shown that

such statement is untrue, and that the instru-

ment is in fact insufficiently stamped.

Provision for payment or transfer of money or

stoch settled. — § 125 (1.) An instrument chargeable

with ad valorem duty as a settlement in respect of

any money, stock, or security is not to be charged

with any further duty by reason of containing pro-

vision for the payment or transfer of the same

money, stock, or security.

Reversionary property settled — Annuity hy person

in possession. — (2.) Where any money, stock, or

security is settled or agreed to be settled by a per-

'son who has only a reversionary interest therein, and

the instrument whereby such settlement is made

or agreed to be made contains a covenant by the

person entitled in possession to the interest or divi-

dends of such money, stock, or security for the pay-

ment, during the continuance of such possession, of

any annuity or yearly sum not exceeding interest

at the rate of £4 per centum per annum upon the

amount or value of such money, stock, or security,

such instrument shall not be charged with any

duty in respect of such covenant.

Where several instruments, one only to he charged

with ad valorem duty. — § 126 (1.) Where several

instruments are executed for effecting the settle-

ment of the same property, and the ad valorem duty

chargeable in respect of the settlement of such pro-

perty exceeds 10s., one only of such instruments is

to be charged with the ad valorem duty.

(2.) Where a settlement is made in pursuance of

the nominal value of the shares.) (See

Note a.)

Stock Certificate to Bearer. See Conveyance

or Transfer.

Sulphuric Acid Works. See Certificate.

Tack of lands, etc. in Scotland. See Lease or

Tack.

Tack in Security. See Mortgage, etc.

[Testamentary Instruments. See General

Exemptions at end of Table.]

Transfer. See Conveyance or Transfer.

Transfer. — Any request or authority to the purser

or other officer of any mining company, con-

ducted on the cost book system, to enter or

register any transfer of any share, or part of a

share, in any mine, or any notice to such

purser or officer of such transfer n:6d.

(See Note 6.)

[Trustee. — Conveyance or transfer for effectuat-

ing the appointment of a new trustee, no higher

duty than 10s.]

Valuation. See Appraisement.

Voting Paper. See along with Letter or Power

OF Attorney.

Wadset. See Mortgage, etc.

Warrant for Goods, 3d. See along with De-

livery Order.

Warrant under the sign manual of Her Majesty,

her heirs or successors 10s.

Works. — Alkali, sulphuric acid, etc. See Cer-

tificate.

Writ—

(1.) Of Acknowledgment rnxdiev ' The Eegistration

of Leases (Scotland) Act' 5s.

(2.) Of Acknoioledgment by any person infeft of

lands in Scotland, in favour of the heir or dis-

ponee of a creditor fully vested in right of an

heritable security constituted by infeftment, 5s.

(3.) Of Clare Constat (charter, precept, or writ

by progress, as a title to land, is abolished ;

but charters of novodamus, or precepts, or

writs from Chancery, or dare constat, or writs of

acknowledgment, are excepted, 37 and 88 Vict,

c. 94, § 4) 5s.

GENEEAL EXEMPTIONS FEOM ALL

STAMP DUTIES.

(1.) Transfers of shares in the Government or

Parliamentary stocks or funds.

(2.) Instruments for the sale, transfer, or other

disposition, either absolutely or by way of

any previous agreement, or articles upon which

Any ad valorem settlement duty exceeding 10s. has

been paid in respect of the same property, such

settlement is not to be charged with any ad valorem

settlement duty.

(3.) In each of the aforesaid cases the instru-

ments not chargeable with ad valorem duty are to

be charged with the duty of 10s.

a. § 127. If a share warrant is issued without

being duly stamped, the company issuing the same,

and also every person who, at the time when it

is issued, is the managing director or secretary or

other principal officer of the company, shall for-

feit £50.

h. § 128 (2.) Every person who writes or executes

any such request, authority, or notice, not being

duly stamped, and every purser or other officer of

any such company who in any manner obeys,

complies with, or gives effect to any such request,

authority, or notice, not being duly stamped, shall

forfeit £20.

713

of £100, of the amount or value of the property

settled or agreed to be settled 5s.

Exemption. — Instrument of appointment relating

to any property in favour of persons specially

named or described as the objects of a power

of appointment, created by a previous settle-

ment, stamped with ad valorem duty in respect

of the same property, or by will, where probate

duty has been paid in respect of the same pro-

perty as personal estate of the testator.

[Money in foreign or colonial currency, duty to

be calculated on the value in British cui'rency

according to the current rate of exchange at

the date of the instrument (§ 11). Stock or

marketable security, duty to be calculated on

the value according to the average price at

the date of the instrument (§ 12).] (See

Note a.)

Shake Warrant issued under the provisions of

' The Companies Act, 1867.' — See section 33 of

that Act. (By this section the share warrant

of a limited liability company issued to bearer,

is liable to stamp duty of three times the

amount of the conveyance on sale duty, on

a. As to settlement of policy or security — § 124.

Where any money which may become due or pay-

able upon any policy of insurance, or upon any

seciirity not being a marketable security, is settled

or agreed to be settled, the instrument whereby

such settlement is made or agreed to be made is to

be charged with ad valorem duty in respect of such

money :

Proviso as to policies. — Provided as follows —

(1.) Where, in the case of a policy of insur-

ance, no provision is made for keeping up

the policy, the ad valorem duty is to be

charged only on the value of the policy at

the date of the instrument.

(2.) If in any such case the instrument contains

a statement of such value, and is stamped in

accordance with such statement, it is, so far

as regards such policy, to be deemed duly

stamped, unless or until it is shown that

such statement is untrue, and that the instru-

ment is in fact insufficiently stamped.

Provision for payment or transfer of money or

stoch settled. — § 125 (1.) An instrument chargeable

with ad valorem duty as a settlement in respect of

any money, stock, or security is not to be charged

with any further duty by reason of containing pro-

vision for the payment or transfer of the same

money, stock, or security.

Reversionary property settled — Annuity hy person

in possession. — (2.) Where any money, stock, or

security is settled or agreed to be settled by a per-

'son who has only a reversionary interest therein, and

the instrument whereby such settlement is made

or agreed to be made contains a covenant by the

person entitled in possession to the interest or divi-

dends of such money, stock, or security for the pay-

ment, during the continuance of such possession, of

any annuity or yearly sum not exceeding interest

at the rate of £4 per centum per annum upon the

amount or value of such money, stock, or security,

such instrument shall not be charged with any

duty in respect of such covenant.

Where several instruments, one only to he charged

with ad valorem duty. — § 126 (1.) Where several

instruments are executed for effecting the settle-

ment of the same property, and the ad valorem duty

chargeable in respect of the settlement of such pro-

perty exceeds 10s., one only of such instruments is

to be charged with the ad valorem duty.

(2.) Where a settlement is made in pursuance of

the nominal value of the shares.) (See

Note a.)

Stock Certificate to Bearer. See Conveyance

or Transfer.

Sulphuric Acid Works. See Certificate.

Tack of lands, etc. in Scotland. See Lease or

Tack.

Tack in Security. See Mortgage, etc.

[Testamentary Instruments. See General

Exemptions at end of Table.]

Transfer. See Conveyance or Transfer.

Transfer. — Any request or authority to the purser

or other officer of any mining company, con-

ducted on the cost book system, to enter or

register any transfer of any share, or part of a

share, in any mine, or any notice to such

purser or officer of such transfer n:6d.

(See Note 6.)

[Trustee. — Conveyance or transfer for effectuat-

ing the appointment of a new trustee, no higher

duty than 10s.]

Valuation. See Appraisement.

Voting Paper. See along with Letter or Power

OF Attorney.

Wadset. See Mortgage, etc.

Warrant for Goods, 3d. See along with De-

livery Order.

Warrant under the sign manual of Her Majesty,

her heirs or successors 10s.

Works. — Alkali, sulphuric acid, etc. See Cer-

tificate.

Writ—

(1.) Of Acknowledgment rnxdiev ' The Eegistration

of Leases (Scotland) Act' 5s.

(2.) Of Acknoioledgment by any person infeft of

lands in Scotland, in favour of the heir or dis-

ponee of a creditor fully vested in right of an

heritable security constituted by infeftment, 5s.

(3.) Of Clare Constat (charter, precept, or writ

by progress, as a title to land, is abolished ;

but charters of novodamus, or precepts, or

writs from Chancery, or dare constat, or writs of

acknowledgment, are excepted, 37 and 88 Vict,

c. 94, § 4) 5s.

GENEEAL EXEMPTIONS FEOM ALL

STAMP DUTIES.

(1.) Transfers of shares in the Government or

Parliamentary stocks or funds.

(2.) Instruments for the sale, transfer, or other

disposition, either absolutely or by way of

any previous agreement, or articles upon which

Any ad valorem settlement duty exceeding 10s. has

been paid in respect of the same property, such

settlement is not to be charged with any ad valorem

settlement duty.

(3.) In each of the aforesaid cases the instru-

ments not chargeable with ad valorem duty are to

be charged with the duty of 10s.

a. § 127. If a share warrant is issued without

being duly stamped, the company issuing the same,

and also every person who, at the time when it

is issued, is the managing director or secretary or

other principal officer of the company, shall for-

feit £50.

h. § 128 (2.) Every person who writes or executes

any such request, authority, or notice, not being

duly stamped, and every purser or other officer of

any such company who in any manner obeys,

complies with, or gives effect to any such request,

authority, or notice, not being duly stamped, shall

forfeit £20.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1883-1884 > (749) |

|---|

| Permanent URL | https://digital.nls.uk/83330645 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|