Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

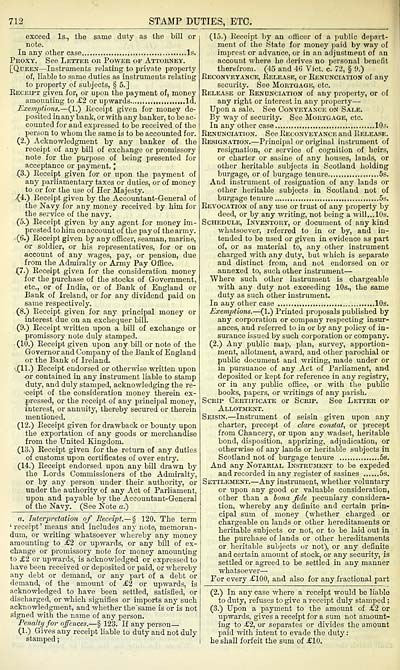

712

STAMP DUTIES, ETC.

exceed Is., the same duty as the bill or

note.

In any other case Is.

Proxy. See Letter or Power of Attorney.

[Queen — Instruments relating to private property

of, liable to same duties as instruments relating

to property of subjects, § 5.]

Receipt given for, or ujjon the payment of, money

amounting to £2 or upwards Id.

Exemptions. — (1.) Receipt given for money de-

posited in any bank, or with any banker, to be ac-

counted for and expressed to be received of the

person to whom the same is to be accounted for.

(2.) Acknowledgment by any banker of the

receipt of any bill of exchange or promissory

note for the purpose of being presented for

acceptance or payment. \

(S.) Receipt given for or upon the payment of

any pai-liamentary taxes or duties, or of money

to or for the use of Her Majesty.

y(4.) Receipt given by the Accountant-Geueral of

the Navy for any money received by him for

the service of the navy.

(5.) Receipt given by any agent for money im-

prcsted to him on account of the pay of the army.

(6.) Receipt given by any officer, seaman, marine,

or soldier, or his representatives, for or on

account of any wages, pay, or pension, due

from the Admiralty or Army Pay Office.

(7.) Receipt given for the consideration money

for the purchase of the stocks of Government,

etc., or of India, or of Bank of England or

Bank of Ireland, or for any dividend paid on

same respectively.

(8.) Receipt given for any principal money or

interest due on an exchequer bill.

(9.) Receipt written upon a bill of exchange or

promissoi-y note duly stamped.

(10.) Receipt given upon any bill or note of the

Governor and Company of the Bank of England

or the Bank of Ireland.

.,(11.) Receipt endorsed or otherwise written upon

-or contained in any instrument liable to stamp

duty, and duly stamped, acknowledging the re-

'ceipt of the consideration money therein ex-

pressed, or the receipt of any principal money,

interest, or annuity, thereby secured or therein

mentioned.

(12.) Receipt given for drawback or bounty upon

the exportation of any goods or merchandise

from the United Kingdom.

(13.) Receipt given for the return of any duties

of customs upon certificates of over entry.

(14.) Receipt endorsed upon any bill drawn by

the Lords Commissioners of the Admiralty,

or by any person under their authority, or

under the authority of any Act of Parliament,

upon and payable by the Accountant-General

of the Navy. (See Note a.)

a. Interpretation of Receipt. — § 120. The term

' receipt ' means and includes any note, memoran-

dum, or writing whatsoever whereby any money

amounting to £2 or upwards, or any bill of ex-

change or promissory note for money amounting

to £2 or upwards, is acknowledged or expressed to

have been received or dep)osited or paid, or whereby

any debt or demand, or any part of a debt or

demand, of the amount of £2 or upwards, is

acknowledged to have been settled, satisfied, or

discharged, or which signifies .or imports any such

acknowledgment, and whether the'same is or is not

signed with the name of any person.

Penalty for offences.— % 123. If any person—

(1.) Gives any receipt liable to duty and not duly

stamped ;

(15.) Receipt by an officer of a public depart-

ment of the State for money j^aid by way of

imprest or advance, or in an adjustment of an

account where he derives no personal benefit

therefrom. (45 and 46 Vict. c. 72, § 0.)

Reconveyance, Release, or Renunciation of any

security. See Mortgagic, etc.

Release or Renunciation of any property, or of

any right or interest in any property —

Upon a sale. See OoNVEYA^■CE on Sale.

By way of security. See Mortgage, etc.

In any other case 10s.

Renunciation. See Reconveyance and Release.

Resignation. — Principal or original instrument of

resignation, or service of cognition of heirs,

or charter or sasine of any houses, lands, or

other heritable subjects in Scotland holding

burgage, or of burgage tenure 5s.

And instrument of resignation of any lands or

other heritable subjects in Scotland not of

burgage tenure 5s.

Revocation of any use or trust of any property by

deed, or by any writing, not being a will. ..10s.

Schedule, Inventory, or document of any kind

whatsoever, referred to in or by, and in-

tended to be used or given in evidence as part

of, or as material to, any other insti-ument

charged with any duty, but which is separate

and distinct from, and not endorsed on or

annexed to, such other instrument —

Where such other instrument is chargeable

with any duty not exceeding 10s., the same

duty as such other instrument.

In any other case 10s.

Exemptions. — (1.) Printed proposals published by

any corporation or company respecting insur-

ances, and referred to in or by any policy of in-

surance issued by such corporation or company.

(2.) Any public map, plan, survey, apportion-

ment, allotment, award, and other parochial or

public document and writing, made under or

in pui'suance of any Act of Parliament, and

deposited or kept for reference in any registry,

or in any public office, or with the public

books, papers, or writings of any parish.

Scrip Certificate or Scrip. See Letter of

Allotment.

Seisin. — Instrument of seisin given upon any

charter, precept of dare constat., or precept

from Chancery, or upon any wadset, heritable

bond, disposition, apprizing, adjudication, or

otherwise of any lands or heritable subjects iu

Scotland not of burgage tenure 5s.

And any Notarial Instrument to be expeded

and recorded in any register of sasines 5s.

Settlement. — Any instrument, whether voluntary

or upon any good or valuable consideration,

other than a hona fide pecuniary considera-

tion, whereby any definite and certain prin-

cipal sum of money (whether charged or

chargeable on lands or other hereditaments or

heritable subjects or not, or to be laid out in

the purchase of lands or other hereditaments

or heritable subjects or not), or any definite

and certain amount of stock, or any security, is

settled or agreed to be settled in any manner

whatsoever—

For every £100, and also for any fractional part

(2.) In any case where a receipt would be liable

to duty, refuses to give a receipt duly stamped ;

(3.) Upon a payment to the amount of £2 or

upwards, gives a receipt for a sum not amount-

ing to £2, or separates or divides the amount

paid with intent to evade the duty :

he shall forfeit the sum of £10.

STAMP DUTIES, ETC.

exceed Is., the same duty as the bill or

note.

In any other case Is.

Proxy. See Letter or Power of Attorney.

[Queen — Instruments relating to private property

of, liable to same duties as instruments relating

to property of subjects, § 5.]

Receipt given for, or ujjon the payment of, money

amounting to £2 or upwards Id.

Exemptions. — (1.) Receipt given for money de-

posited in any bank, or with any banker, to be ac-

counted for and expressed to be received of the

person to whom the same is to be accounted for.

(2.) Acknowledgment by any banker of the

receipt of any bill of exchange or promissory

note for the purpose of being presented for

acceptance or payment. \

(S.) Receipt given for or upon the payment of

any pai-liamentary taxes or duties, or of money

to or for the use of Her Majesty.

y(4.) Receipt given by the Accountant-Geueral of

the Navy for any money received by him for

the service of the navy.

(5.) Receipt given by any agent for money im-

prcsted to him on account of the pay of the army.

(6.) Receipt given by any officer, seaman, marine,

or soldier, or his representatives, for or on

account of any wages, pay, or pension, due

from the Admiralty or Army Pay Office.

(7.) Receipt given for the consideration money

for the purchase of the stocks of Government,

etc., or of India, or of Bank of England or

Bank of Ireland, or for any dividend paid on

same respectively.

(8.) Receipt given for any principal money or

interest due on an exchequer bill.

(9.) Receipt written upon a bill of exchange or

promissoi-y note duly stamped.

(10.) Receipt given upon any bill or note of the

Governor and Company of the Bank of England

or the Bank of Ireland.

.,(11.) Receipt endorsed or otherwise written upon

-or contained in any instrument liable to stamp

duty, and duly stamped, acknowledging the re-

'ceipt of the consideration money therein ex-

pressed, or the receipt of any principal money,

interest, or annuity, thereby secured or therein

mentioned.

(12.) Receipt given for drawback or bounty upon

the exportation of any goods or merchandise

from the United Kingdom.

(13.) Receipt given for the return of any duties

of customs upon certificates of over entry.

(14.) Receipt endorsed upon any bill drawn by

the Lords Commissioners of the Admiralty,

or by any person under their authority, or

under the authority of any Act of Parliament,

upon and payable by the Accountant-General

of the Navy. (See Note a.)

a. Interpretation of Receipt. — § 120. The term

' receipt ' means and includes any note, memoran-

dum, or writing whatsoever whereby any money

amounting to £2 or upwards, or any bill of ex-

change or promissory note for money amounting

to £2 or upwards, is acknowledged or expressed to

have been received or dep)osited or paid, or whereby

any debt or demand, or any part of a debt or

demand, of the amount of £2 or upwards, is

acknowledged to have been settled, satisfied, or

discharged, or which signifies .or imports any such

acknowledgment, and whether the'same is or is not

signed with the name of any person.

Penalty for offences.— % 123. If any person—

(1.) Gives any receipt liable to duty and not duly

stamped ;

(15.) Receipt by an officer of a public depart-

ment of the State for money j^aid by way of

imprest or advance, or in an adjustment of an

account where he derives no personal benefit

therefrom. (45 and 46 Vict. c. 72, § 0.)

Reconveyance, Release, or Renunciation of any

security. See Mortgagic, etc.

Release or Renunciation of any property, or of

any right or interest in any property —

Upon a sale. See OoNVEYA^■CE on Sale.

By way of security. See Mortgage, etc.

In any other case 10s.

Renunciation. See Reconveyance and Release.

Resignation. — Principal or original instrument of

resignation, or service of cognition of heirs,

or charter or sasine of any houses, lands, or

other heritable subjects in Scotland holding

burgage, or of burgage tenure 5s.

And instrument of resignation of any lands or

other heritable subjects in Scotland not of

burgage tenure 5s.

Revocation of any use or trust of any property by

deed, or by any writing, not being a will. ..10s.

Schedule, Inventory, or document of any kind

whatsoever, referred to in or by, and in-

tended to be used or given in evidence as part

of, or as material to, any other insti-ument

charged with any duty, but which is separate

and distinct from, and not endorsed on or

annexed to, such other instrument —

Where such other instrument is chargeable

with any duty not exceeding 10s., the same

duty as such other instrument.

In any other case 10s.

Exemptions. — (1.) Printed proposals published by

any corporation or company respecting insur-

ances, and referred to in or by any policy of in-

surance issued by such corporation or company.

(2.) Any public map, plan, survey, apportion-

ment, allotment, award, and other parochial or

public document and writing, made under or

in pui'suance of any Act of Parliament, and

deposited or kept for reference in any registry,

or in any public office, or with the public

books, papers, or writings of any parish.

Scrip Certificate or Scrip. See Letter of

Allotment.

Seisin. — Instrument of seisin given upon any

charter, precept of dare constat., or precept

from Chancery, or upon any wadset, heritable

bond, disposition, apprizing, adjudication, or

otherwise of any lands or heritable subjects iu

Scotland not of burgage tenure 5s.

And any Notarial Instrument to be expeded

and recorded in any register of sasines 5s.

Settlement. — Any instrument, whether voluntary

or upon any good or valuable consideration,

other than a hona fide pecuniary considera-

tion, whereby any definite and certain prin-

cipal sum of money (whether charged or

chargeable on lands or other hereditaments or

heritable subjects or not, or to be laid out in

the purchase of lands or other hereditaments

or heritable subjects or not), or any definite

and certain amount of stock, or any security, is

settled or agreed to be settled in any manner

whatsoever—

For every £100, and also for any fractional part

(2.) In any case where a receipt would be liable

to duty, refuses to give a receipt duly stamped ;

(3.) Upon a payment to the amount of £2 or

upwards, gives a receipt for a sum not amount-

ing to £2, or separates or divides the amount

paid with intent to evade the duty :

he shall forfeit the sum of £10.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1883-1884 > (748) |

|---|

| Permanent URL | https://digital.nls.uk/83330633 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|