Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

Insurance Compan les.

337

National Loan Fund Life Assurance Sociefi/ — Continued.

must tond to waste the resources out of which the industi-ious classes hiive to provide for the future.

It also in etfect throws tlie bui'tlieu of the pcrmaiieiitly sick on one class cxlusively, instead of society at

large; who are thus called on for an act of benevolence, while they are scarce able to do justice to the

claims of their own families. Resides this, no compensation is given out of tlie contribution for a

provision in sickness and old aije to the families of those who never reach the age of ()5, thouj;h death

should hai>pen immediately preceding it; and, if an assumed hypothesis is correct, tliat sickness be-

fore death is not more than five weeks, and taking bed-lyinij-pay at lOs. per week, it will riot unfre-

queiitly happen the only return a man may obtain as a long and steady contributor to a Benefit Society,

•will not exceed 60s., a sum scarcely equal to one year's payment at a shilling per week, while by his

death he leaves his family entirely unprovided for.

VI. It is to remedy these defects, inherent in the constitution of Benefit Societies, that the National

Loan Fund Life Assurance Society proposes to submit a plat: tif Deferr(Ml Annuities on a new princi-

ple, which will not only afford a more ample provision for old age, and protection against sickness and

misfortune — but in addition, the means, at all times, of putting his energies iu motion, and in the

event of premature death, a better protection to bis family.

The plan proposeil will embody several essential objects : —

1. To secure an increased provision for old age out of a given saving, by applying it exclusively to

the purchase of a Deferred Annuity.

2. To render the purchase of a protection in sickness unnecessary, by enabling the purchaser of a

Deferred Annuity to withdraw or borrow two thirds of his pr-evious payments.

3. By the use ot two-thirds of all his payments when required, to limit misfortune and want of em-

ployment, and extend the power of productiveness by an increasing command, in each year,

of capital, so that, while providing for old age, each successive contribution renders him more

secure against present misfortune.

4. To art'ord, at the age at which the Deferred Annuity would commence, without reference to

his then state ot health, the option of receiving, instead of his annuity, its value in money, ac-

cording to the value fixed on the contract, or a larger sum payable at his death.

5. In the event of death before the age at which he would be entitled to his Deferred Annuity, to

return two-thirds of his payments to his family, or such fixed Life Assurance as may be

settled on the contract,

(i. In all such cases where the power of productiveness fails, either from disease or accident, to

enable the assured on equal terms to coiivcrt his Deferred Annuity into a present Annuity.

VII. Notwithstanding the obvious and manifold advantages of this plan over every other hitherto

proposed, for securing present and future competence to the industrious population, still more striking

advantages will be exhibited by contrasting its prospective provision for old age with that offered by

Benefit Societies. This arises from the non-abstraction of a given sum for a separate benefit in sickness,

which protection by the operation of the Loan Fund on the Deferred Annuity, is not only more ample ;

but other misfortunes are provided against, which if calculated, and a separate contribution made for

each, whose duration equals th:it of sickness, the purchase of them would entirely absorb the means of

providing ibr old age, while such a system must tend to discourage productiveness, and afford no pro-

tection to a family in the event of premature death. The objt'ct this plan embraces is to open facilities

to the efforts of self-support, to stimulate the independence of one class above the forced benevolence of

another, while it recommends itself to the latter, by diminishing the burden of Poor-laws, which has

been at all times irksome, disturbing the harmony, and fomenting the mutual distrusts of society.

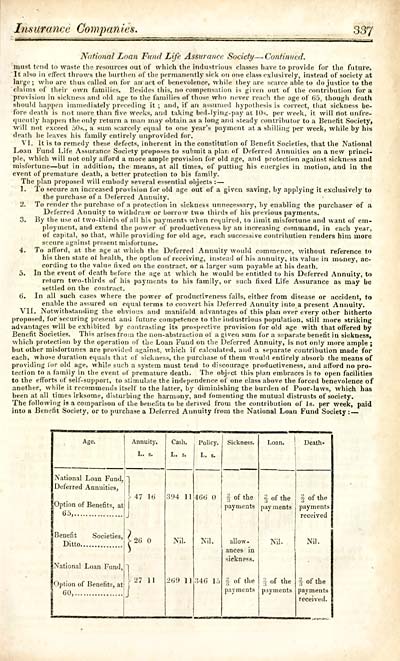

The following is a comparison of the benefits to be derived from the contribution of Is. per week, paid

into a Benefit Society, or to purchase a Deferred Annuity from the National Loan Fund Society : —

337

National Loan Fund Life Assurance Sociefi/ — Continued.

must tond to waste the resources out of which the industi-ious classes hiive to provide for the future.

It also in etfect throws tlie bui'tlieu of the pcrmaiieiitly sick on one class cxlusively, instead of society at

large; who are thus called on for an act of benevolence, while they are scarce able to do justice to the

claims of their own families. Resides this, no compensation is given out of tlie contribution for a

provision in sickness and old aije to the families of those who never reach the age of ()5, thouj;h death

should hai>pen immediately preceding it; and, if an assumed hypothesis is correct, tliat sickness be-

fore death is not more than five weeks, and taking bed-lyinij-pay at lOs. per week, it will riot unfre-

queiitly happen the only return a man may obtain as a long and steady contributor to a Benefit Society,

•will not exceed 60s., a sum scarcely equal to one year's payment at a shilling per week, while by his

death he leaves his family entirely unprovided for.

VI. It is to remedy these defects, inherent in the constitution of Benefit Societies, that the National

Loan Fund Life Assurance Society proposes to submit a plat: tif Deferr(Ml Annuities on a new princi-

ple, which will not only afford a more ample provision for old age, and protection against sickness and

misfortune — but in addition, the means, at all times, of putting his energies iu motion, and in the

event of premature death, a better protection to bis family.

The plan proposeil will embody several essential objects : —

1. To secure an increased provision for old age out of a given saving, by applying it exclusively to

the purchase of a Deferred Annuity.

2. To render the purchase of a protection in sickness unnecessary, by enabling the purchaser of a

Deferred Annuity to withdraw or borrow two thirds of his pr-evious payments.

3. By the use ot two-thirds of all his payments when required, to limit misfortune and want of em-

ployment, and extend the power of productiveness by an increasing command, in each year,

of capital, so that, while providing for old age, each successive contribution renders him more

secure against present misfortune.

4. To art'ord, at the age at which the Deferred Annuity would commence, without reference to

his then state ot health, the option of receiving, instead of his annuity, its value in money, ac-

cording to the value fixed on the contract, or a larger sum payable at his death.

5. In the event of death before the age at which he would be entitled to his Deferred Annuity, to

return two-thirds of his payments to his family, or such fixed Life Assurance as may be

settled on the contract,

(i. In all such cases where the power of productiveness fails, either from disease or accident, to

enable the assured on equal terms to coiivcrt his Deferred Annuity into a present Annuity.

VII. Notwithstanding the obvious and manifold advantages of this plan over every other hitherto

proposed, for securing present and future competence to the industrious population, still more striking

advantages will be exhibited by contrasting its prospective provision for old age with that offered by

Benefit Societies. This arises from the non-abstraction of a given sum for a separate benefit in sickness,

which protection by the operation of the Loan Fund on the Deferred Annuity, is not only more ample ;

but other misfortunes are provided against, which if calculated, and a separate contribution made for

each, whose duration equals th:it of sickness, the purchase of them would entirely absorb the means of

providing ibr old age, while such a system must tend to discourage productiveness, and afford no pro-

tection to a family in the event of premature death. The objt'ct this plan embraces is to open facilities

to the efforts of self-support, to stimulate the independence of one class above the forced benevolence of

another, while it recommends itself to the latter, by diminishing the burden of Poor-laws, which has

been at all times irksome, disturbing the harmony, and fomenting the mutual distrusts of society.

The following is a comparison of the benefits to be derived from the contribution of Is. per week, paid

into a Benefit Society, or to purchase a Deferred Annuity from the National Loan Fund Society : —

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post-Office annual directory and calendar > 1838-39 > (377) |

|---|

| Permanent URL | https://digital.nls.uk/83035518 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|