Encyclopaedia Britannica > Volume 3, Anatomy-Astronomy

(248) Page 240

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

240

ANNUITIES.

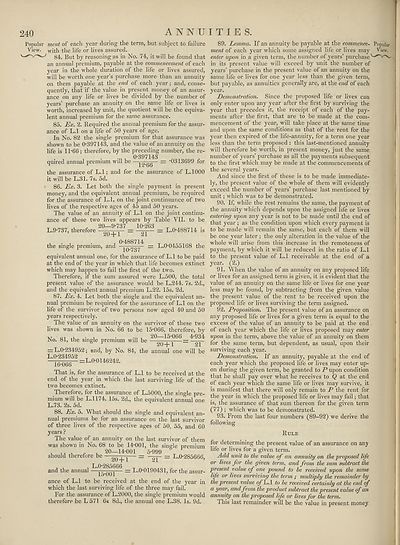

Popular merit of each year during the term, but subject to failure

View. with the life or lives assured.

84. But by reasoning as in No. 74, it will be found that

an annual premium, payable at the commencement of each

year in the whole duration of the life or lives assured,

will be worth one year’s purchase more than an annuity

on them payable at the end of each year; and, conse¬

quently, that if the value in present money of an assur¬

ance on any life or lives be divided by the number of

years’ purchase an annuity on the same life or lives is

worth, increased by unit, the quotient will be the equiva¬

lent annual premium for the same assurance.

85. Ex. 2. Required the annual premium for the assur¬

ance of L.l on a life of 50 years of age.

In No. 82 the single premium for that assurance was

shown to be 0'397143, and the value of an annuity on the

life is 11-66; therefore, by the preceding number, the re-

0-397143

quired annual premium will be = f°r

the assurance of L.l; and for the assurance of L.1000

it will be L.31. 7s. 5d.

86. Ex. 3. Let both the single payment in present

money, and the equivalent annual premium, be required

for the assurance of L.l, on the joint continuance of two

lives of the respective ages of 45 and 50 years.

The value of an annuity of L.l on the joint continu¬

ance of these two lives appears by Table VII. to be

T n nnn u r 20—9'737 10-263 TA/1DQ„1/1 .

L.9-737, therefore ■ 20+1 ~ —21— ^ IS

0-488714

the single premium, and iQ.737 = L.0-0455168 the

equivalent annual one, for the assurance of L.l to be paid

at the end of the year in which that life becomes extinct

which may happen to fail the first of the two.

Therefore, if the sum assured were L.500, the total

present value of the assurance would be L.244. 7s. 2d.,

and the equivalent annual premium L.22. 15s. 2d.

87. Ex. 4. Let both the single and the equivalent an¬

nual premium be required for the assurance of L.l on the

life of the survivor of two persons now aged 40 and 50

years respectively.

The value of an annuity on the survivor of these two

lives was shown in No. 66 to be 15-066, therefore, by

20—15-066 4-934

No. 81, the single premium will be — _ ——

20 —j— 1 21

= L.0-234952; and, by No. 84, the annual one will be

L.0-234952 T ____

16-066 -L-0'0146242-

That is, for the assurance of L.l to be received at the

end of the year in which the last surviving life of the

two becomes extinct.

Therefore, for the assurance of L.5000, the single pre¬

mium will be L.l 174. 15s. 2d., the equivalent annual one

L.73. 2s. 5d.

88. Ex. b. What should the single and equivalent an¬

nual premiums be for an assurance on the last survivor

of three lives of the respective ages of 50, 55, and 60

years ?

The value of an annuity on the last survivor of them

was shown in No. 68 to be 14-001, the single premium

, 1 . , 20—14-001 5-999

should therefore be =z L.0-285666,

, , , L.0-285666 _ A _

and the annual —— = L.0-0190431, for the assur¬

ance of L.l to be received at the end of the year in

which the last surviving life of the three may fail.

For the assurance of L.2000, the single premium would

therefore be L571 6s 8d., the annual one L.38. Is. 9d.

89. Lemma. If an annuity be payable at the commence- Popular

ment of each year which some assigned life or lives may View.

enter upon in a given term, the number of years’ purchase

in its present value will exceed by unit the number of

years’ purchase in the present value of an annuity on the

same life or lives for one year less than the given term,

but payable, as annuities generally are, at the end of each

year.

Demonstration. Since the proposed life or lives can

only enter upon any year after the first by surviving the

year that precedes it, the receipt of each of the pay¬

ments after the first, that are to be made at the com¬

mencement of the year, will take place at the same time

and upon the same conditions as that of the rent for the

year then expired of the life-annuity, for a term one year

less than the term proposed : this last-mentioned annuity

will therefore be worth, in present money, just the same

number of years’ purchase as all the payments subsequent

to the first which may be made at the commencements of

the several years.

And since the first of these is to be made immediate¬

ly, the present value of the whole of them will evidently

exceed the number of years’ purchase last mentioned by

unit; which was to be demonstrated.

90. If, while the rest remains the same, the payment of

the annuity which depends upon the assigned life or lives

entering upon any year is not to be made until the end of

that year ; as the condition upon which every payment is

to be made will remain the same, but each of them will

be one year later; the only alteration in the value of the

whole will arise from this increase in the remoteness of

payment, by which it will be reduced in the ratio of L.l

to the present value of L.l receivable at the end of a

year. (2.)

91. When the value of an annuity on any proposed life

or lives for an assigned term is given, it is evident that the

value of an annuity on the same life or lives for one year

less may be found, by subtracting from the given value

the present value of the rent to be received upon the

proposed life or lives surviving the term assigned.

92. Proposition. The present value of an assurance on

any proposed life or lives for a given term is equal to the

excess of the value of an annuity to be paid at the end

of each year which the life or lives proposed may enter

upon in the term, above the value of an annuity on them

for the same term, but dependent, as usual, upon their

surviving each year.

Demonstration. If an annuity, payable at the end of

each year which the proposed life or lives may enter up¬

on during the given term, be granted to P upon condition

that he shall pay over what he receives to Q at the end

of each year which the same life or lives may survive, it

is manifest that there will only remain to P the rent for

the year in which the proposed life or lives may fail; that

is, the assurance of that sum thereon for the given term

(77) ; which was to be demonstrated.

93. From the last four numbers (89-92) we derive the

following

Rule

for determining the present value of an assurance on any

life or lives for a given term.

Add unit to the value of an annuity on the proposed life

or lives for the given term, and from the sum subtract the

present value of one pound to be received upon the same

life or lives surviving the term ; multiply the remainder by

the present value of Ju.l to be received certainly at the end of

a year, and from the product subtract the present value of an

annuity on the proposed life or lives for the term.

This last remainder will be the value in present money

ANNUITIES.

Popular merit of each year during the term, but subject to failure

View. with the life or lives assured.

84. But by reasoning as in No. 74, it will be found that

an annual premium, payable at the commencement of each

year in the whole duration of the life or lives assured,

will be worth one year’s purchase more than an annuity

on them payable at the end of each year; and, conse¬

quently, that if the value in present money of an assur¬

ance on any life or lives be divided by the number of

years’ purchase an annuity on the same life or lives is

worth, increased by unit, the quotient will be the equiva¬

lent annual premium for the same assurance.

85. Ex. 2. Required the annual premium for the assur¬

ance of L.l on a life of 50 years of age.

In No. 82 the single premium for that assurance was

shown to be 0'397143, and the value of an annuity on the

life is 11-66; therefore, by the preceding number, the re-

0-397143

quired annual premium will be = f°r

the assurance of L.l; and for the assurance of L.1000

it will be L.31. 7s. 5d.

86. Ex. 3. Let both the single payment in present

money, and the equivalent annual premium, be required

for the assurance of L.l, on the joint continuance of two

lives of the respective ages of 45 and 50 years.

The value of an annuity of L.l on the joint continu¬

ance of these two lives appears by Table VII. to be

T n nnn u r 20—9'737 10-263 TA/1DQ„1/1 .

L.9-737, therefore ■ 20+1 ~ —21— ^ IS

0-488714

the single premium, and iQ.737 = L.0-0455168 the

equivalent annual one, for the assurance of L.l to be paid

at the end of the year in which that life becomes extinct

which may happen to fail the first of the two.

Therefore, if the sum assured were L.500, the total

present value of the assurance would be L.244. 7s. 2d.,

and the equivalent annual premium L.22. 15s. 2d.

87. Ex. 4. Let both the single and the equivalent an¬

nual premium be required for the assurance of L.l on the

life of the survivor of two persons now aged 40 and 50

years respectively.

The value of an annuity on the survivor of these two

lives was shown in No. 66 to be 15-066, therefore, by

20—15-066 4-934

No. 81, the single premium will be — _ ——

20 —j— 1 21

= L.0-234952; and, by No. 84, the annual one will be

L.0-234952 T ____

16-066 -L-0'0146242-

That is, for the assurance of L.l to be received at the

end of the year in which the last surviving life of the

two becomes extinct.

Therefore, for the assurance of L.5000, the single pre¬

mium will be L.l 174. 15s. 2d., the equivalent annual one

L.73. 2s. 5d.

88. Ex. b. What should the single and equivalent an¬

nual premiums be for an assurance on the last survivor

of three lives of the respective ages of 50, 55, and 60

years ?

The value of an annuity on the last survivor of them

was shown in No. 68 to be 14-001, the single premium

, 1 . , 20—14-001 5-999

should therefore be =z L.0-285666,

, , , L.0-285666 _ A _

and the annual —— = L.0-0190431, for the assur¬

ance of L.l to be received at the end of the year in

which the last surviving life of the three may fail.

For the assurance of L.2000, the single premium would

therefore be L571 6s 8d., the annual one L.38. Is. 9d.

89. Lemma. If an annuity be payable at the commence- Popular

ment of each year which some assigned life or lives may View.

enter upon in a given term, the number of years’ purchase

in its present value will exceed by unit the number of

years’ purchase in the present value of an annuity on the

same life or lives for one year less than the given term,

but payable, as annuities generally are, at the end of each

year.

Demonstration. Since the proposed life or lives can

only enter upon any year after the first by surviving the

year that precedes it, the receipt of each of the pay¬

ments after the first, that are to be made at the com¬

mencement of the year, will take place at the same time

and upon the same conditions as that of the rent for the

year then expired of the life-annuity, for a term one year

less than the term proposed : this last-mentioned annuity

will therefore be worth, in present money, just the same

number of years’ purchase as all the payments subsequent

to the first which may be made at the commencements of

the several years.

And since the first of these is to be made immediate¬

ly, the present value of the whole of them will evidently

exceed the number of years’ purchase last mentioned by

unit; which was to be demonstrated.

90. If, while the rest remains the same, the payment of

the annuity which depends upon the assigned life or lives

entering upon any year is not to be made until the end of

that year ; as the condition upon which every payment is

to be made will remain the same, but each of them will

be one year later; the only alteration in the value of the

whole will arise from this increase in the remoteness of

payment, by which it will be reduced in the ratio of L.l

to the present value of L.l receivable at the end of a

year. (2.)

91. When the value of an annuity on any proposed life

or lives for an assigned term is given, it is evident that the

value of an annuity on the same life or lives for one year

less may be found, by subtracting from the given value

the present value of the rent to be received upon the

proposed life or lives surviving the term assigned.

92. Proposition. The present value of an assurance on

any proposed life or lives for a given term is equal to the

excess of the value of an annuity to be paid at the end

of each year which the life or lives proposed may enter

upon in the term, above the value of an annuity on them

for the same term, but dependent, as usual, upon their

surviving each year.

Demonstration. If an annuity, payable at the end of

each year which the proposed life or lives may enter up¬

on during the given term, be granted to P upon condition

that he shall pay over what he receives to Q at the end

of each year which the same life or lives may survive, it

is manifest that there will only remain to P the rent for

the year in which the proposed life or lives may fail; that

is, the assurance of that sum thereon for the given term

(77) ; which was to be demonstrated.

93. From the last four numbers (89-92) we derive the

following

Rule

for determining the present value of an assurance on any

life or lives for a given term.

Add unit to the value of an annuity on the proposed life

or lives for the given term, and from the sum subtract the

present value of one pound to be received upon the same

life or lives surviving the term ; multiply the remainder by

the present value of Ju.l to be received certainly at the end of

a year, and from the product subtract the present value of an

annuity on the proposed life or lives for the term.

This last remainder will be the value in present money

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Encyclopaedia Britannica > Encyclopaedia Britannica > Volume 3, Anatomy-Astronomy > (248) Page 240 |

|---|

| Permanent URL | https://digital.nls.uk/193760572 |

|---|

| Attribution and copyright: |

|

|---|---|

| Shelfmark | EB.16 |

|---|---|

| Description | Ten editions of 'Encyclopaedia Britannica', issued from 1768-1903, in 231 volumes. Originally issued in 100 weekly parts (3 volumes) between 1768 and 1771 by publishers: Colin Macfarquhar and Andrew Bell (Edinburgh); editor: William Smellie: engraver: Andrew Bell. Expanded editions in the 19th century featured more volumes and contributions from leading experts in their fields. Managed and published in Edinburgh up to the 9th edition (25 volumes, from 1875-1889); the 10th edition (1902-1903) re-issued the 9th edition, with 11 supplementary volumes. |

|---|---|

| Additional NLS resources: |

|