Encyclopaedia Britannica > Volume 3, Anatomy-Astronomy

(247) Page 239

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

ANNUITIES.

Topular

View.

Solution.

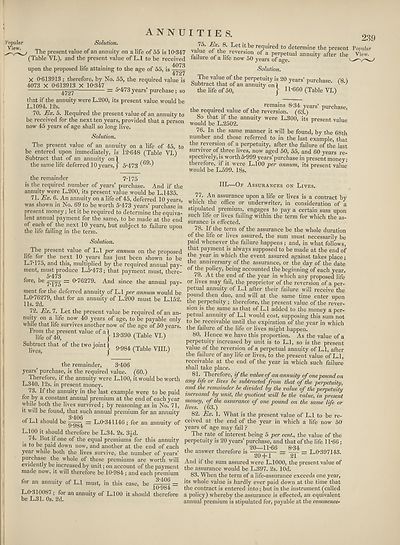

_ The present value of an annuity on a life of 55 is 1034<7

(Table VI.), and the present value of L.l to be received

4073

upon the proposed life attaining to the age of 55, is

X 0-613913 ; therefore, by No. 55, the required value is

4073 X 0-613913 X 10-347

4727 = ^years purchase; so

that if the annuity were L.200, its present value would be

L.l 094. 12s.

70. Ex. 5. Required the present value of an annuity to

be received for the next ten years, provided that a person

now 45 years of age shall so long live.

Solution.

The present value of an annuity on a life of 45, to

be entered upon immediately, is 12-648 (Table VI.)

Subtract that of an annuity on]^

the same life deferred 10years, j 5-473

the remainder 7-175

is the required number of years’ purchase. And if the

annuity were L.200, its present value would be L.1435.

71. Ex. 6. An annuity on a life of 45, deferred 10 years,

was shown in No. 69 to be worth 5-473 years’ purchase in

present money; let it be required to determine the equiva¬

lent annual payment for the same, to be made at the end

of each of the next 10 years, but subject to failure upon

the life failing in the term.

Solution.

The present value of L.l per annum on the proposed

life for the next 10 years has just been shown to be

L.7‘1 /5, and this, multiplied by the required annual pay¬

ment, must produce L.5-473; that payment must, there-

(% i 5*473

fore, be — 0-76279. And since the annual pay¬

ment for the deferred annuity of L.l per annum would be

L.0-76279, that for an annuity of L.200 must be L.152.

11s. 2d.

72. Ex. 7. Let the present value be required of an an¬

nuity on a life now 40 years of age, to be payable only

while that life survives another now of the age of 50 years.

F7”e ^rent ValUe °f 1 13-390 (“>'* VI->

Subtrac1 that of the two joint j ^ ^ vm)

the remainder, 3-406

years’ purchase, is the required value. (60.)

Therefore, if the annuity were L.100, it would be worth

L.340. 12s. in present money.

73. If the annuity in the last example were to be paid

for by a constant annual premium at the end of each year

while both the lives survived; by reasoning as in No. 71,

it will be found, that such annual premium for an annuity

3*406 J

of L.l should be = L.0-341146 ; for an annuity of

L.100 it should therefore be L.34. 2s. 3£d.

74. But if one of the equal premiums for this annuity

is to be paid down now, and another at the end of each

year while both the lives survive, the number of years’

purchase the whole of these premiums are worth will

evidently be increased by unit; on account of the payment

made now, it will therefore be 10-984 ; and each premium

for an annuity of L.l must, in this case, be =

10*984

L.0310087; for an annuity of L.100 it should therefore

be L.31. 0s. 2d.

75. Ex. %. Let it be required to determine the present

va ue of the reversion of a perpetual annuity after the

failure of a life now 50 years of age. ^ '

Solution.

The value of the perpetuity is 20 years’ purchase. (8.)

bubtract that of an annuity on 1 v y

the life of 50, | 11-660 (Table VI.)

-ii t remains 8-34 years’ purchase,

the required value of the reversion. (63.)

S?JtJatriLt^ annuity were L-3°0> its present value

would be L.2502.

76. In the same manner it will be found, by the 68th

number and those referred to in the last example, that

the reversion of a perpetuity, after the failure of the last

survivor of three lives, now aged 50, 55, and 60 years re¬

spectively, is worth 5-999 years’purchase in present money;

therefore, if it were L.100 per annum, its present value

would be L.599. 18s.

HI.—Of Assurances on Lives.

77. An assurance upon a life or lives is a contract by

which the office or underwriter, in consideration of a

stipulated premium, engages to pay a certain sum upon

such life or lives failing within the term for which the as¬

surance is effected.

78. If the term of the assurance be the whole duration

of the life or lives assured, the sum must necessarily be

paid whenever the failure happens ; and, in what follows,

that payment is always supposed to be made at the end of

the year in which the event assured against takes place ;

the anniversary of the assurance, or the day of the date'

of the policy, being accounted the beginning of each year.

79. At the end of the year in which any proposed life

or lives may fail, the proprietor of the reversion of a per¬

petual annuity of L.l after their failure will receive the

pound then due, and will at the same time enter upon

the perpetuity ; therefore, the present value of the rever¬

sion is the same as that of L.l added to the money a per¬

petual annuity of L.l would cost, supposing this sum not

to be receivable until the expiration of the year in which

the failure of the life or lives might happen.

80. Hence we have this proportion. As the value of a

perpetuity increased by unit is to L.l, so is the present

value of the reversion of a perpetual annuity of L.l, after

the failure of any life or lives, to the present value of L.l,

receivable at the end of the year in which such failure

shall take place.

81. Therefore, if the value of an annuity of one pound on

any life or lives he subtracted from that of the perpetuity,

and the remainder he divided hy the value of the perpetuity

increased hy unit, the quotient will he the value, in present

money, of the assurance of one pound on the same life or

lives. (63.)

82. Ex. 1. What is the present value of L.l to be re¬

ceived at the end of the year in which a life now 50

years of age may fail ?

The rate of interest being 5 per cent., the value of the

perpetuity is 20 years’ purchase, and that of the life 11-66 ;

the answer therefore is — L.0-397143.

And if the sum assured were L.1000, the present value of

the assurance would be L.397. 2s. lOd.

83. When the term of a life-assurance exceeds one year,

its whole value is hardly ever paid down at the time that

the contract is entered into; but in the instrument (called

a policy) whereby the assurance is effected, an equivalent

annual premium is stipulated for, payable at the commence’

2.39

Popular

View.

Topular

View.

Solution.

_ The present value of an annuity on a life of 55 is 1034<7

(Table VI.), and the present value of L.l to be received

4073

upon the proposed life attaining to the age of 55, is

X 0-613913 ; therefore, by No. 55, the required value is

4073 X 0-613913 X 10-347

4727 = ^years purchase; so

that if the annuity were L.200, its present value would be

L.l 094. 12s.

70. Ex. 5. Required the present value of an annuity to

be received for the next ten years, provided that a person

now 45 years of age shall so long live.

Solution.

The present value of an annuity on a life of 45, to

be entered upon immediately, is 12-648 (Table VI.)

Subtract that of an annuity on]^

the same life deferred 10years, j 5-473

the remainder 7-175

is the required number of years’ purchase. And if the

annuity were L.200, its present value would be L.1435.

71. Ex. 6. An annuity on a life of 45, deferred 10 years,

was shown in No. 69 to be worth 5-473 years’ purchase in

present money; let it be required to determine the equiva¬

lent annual payment for the same, to be made at the end

of each of the next 10 years, but subject to failure upon

the life failing in the term.

Solution.

The present value of L.l per annum on the proposed

life for the next 10 years has just been shown to be

L.7‘1 /5, and this, multiplied by the required annual pay¬

ment, must produce L.5-473; that payment must, there-

(% i 5*473

fore, be — 0-76279. And since the annual pay¬

ment for the deferred annuity of L.l per annum would be

L.0-76279, that for an annuity of L.200 must be L.152.

11s. 2d.

72. Ex. 7. Let the present value be required of an an¬

nuity on a life now 40 years of age, to be payable only

while that life survives another now of the age of 50 years.

F7”e ^rent ValUe °f 1 13-390 (“>'* VI->

Subtrac1 that of the two joint j ^ ^ vm)

the remainder, 3-406

years’ purchase, is the required value. (60.)

Therefore, if the annuity were L.100, it would be worth

L.340. 12s. in present money.

73. If the annuity in the last example were to be paid

for by a constant annual premium at the end of each year

while both the lives survived; by reasoning as in No. 71,

it will be found, that such annual premium for an annuity

3*406 J

of L.l should be = L.0-341146 ; for an annuity of

L.100 it should therefore be L.34. 2s. 3£d.

74. But if one of the equal premiums for this annuity

is to be paid down now, and another at the end of each

year while both the lives survive, the number of years’

purchase the whole of these premiums are worth will

evidently be increased by unit; on account of the payment

made now, it will therefore be 10-984 ; and each premium

for an annuity of L.l must, in this case, be =

10*984

L.0310087; for an annuity of L.100 it should therefore

be L.31. 0s. 2d.

75. Ex. %. Let it be required to determine the present

va ue of the reversion of a perpetual annuity after the

failure of a life now 50 years of age. ^ '

Solution.

The value of the perpetuity is 20 years’ purchase. (8.)

bubtract that of an annuity on 1 v y

the life of 50, | 11-660 (Table VI.)

-ii t remains 8-34 years’ purchase,

the required value of the reversion. (63.)

S?JtJatriLt^ annuity were L-3°0> its present value

would be L.2502.

76. In the same manner it will be found, by the 68th

number and those referred to in the last example, that

the reversion of a perpetuity, after the failure of the last

survivor of three lives, now aged 50, 55, and 60 years re¬

spectively, is worth 5-999 years’purchase in present money;

therefore, if it were L.100 per annum, its present value

would be L.599. 18s.

HI.—Of Assurances on Lives.

77. An assurance upon a life or lives is a contract by

which the office or underwriter, in consideration of a

stipulated premium, engages to pay a certain sum upon

such life or lives failing within the term for which the as¬

surance is effected.

78. If the term of the assurance be the whole duration

of the life or lives assured, the sum must necessarily be

paid whenever the failure happens ; and, in what follows,

that payment is always supposed to be made at the end of

the year in which the event assured against takes place ;

the anniversary of the assurance, or the day of the date'

of the policy, being accounted the beginning of each year.

79. At the end of the year in which any proposed life

or lives may fail, the proprietor of the reversion of a per¬

petual annuity of L.l after their failure will receive the

pound then due, and will at the same time enter upon

the perpetuity ; therefore, the present value of the rever¬

sion is the same as that of L.l added to the money a per¬

petual annuity of L.l would cost, supposing this sum not

to be receivable until the expiration of the year in which

the failure of the life or lives might happen.

80. Hence we have this proportion. As the value of a

perpetuity increased by unit is to L.l, so is the present

value of the reversion of a perpetual annuity of L.l, after

the failure of any life or lives, to the present value of L.l,

receivable at the end of the year in which such failure

shall take place.

81. Therefore, if the value of an annuity of one pound on

any life or lives he subtracted from that of the perpetuity,

and the remainder he divided hy the value of the perpetuity

increased hy unit, the quotient will he the value, in present

money, of the assurance of one pound on the same life or

lives. (63.)

82. Ex. 1. What is the present value of L.l to be re¬

ceived at the end of the year in which a life now 50

years of age may fail ?

The rate of interest being 5 per cent., the value of the

perpetuity is 20 years’ purchase, and that of the life 11-66 ;

the answer therefore is — L.0-397143.

And if the sum assured were L.1000, the present value of

the assurance would be L.397. 2s. lOd.

83. When the term of a life-assurance exceeds one year,

its whole value is hardly ever paid down at the time that

the contract is entered into; but in the instrument (called

a policy) whereby the assurance is effected, an equivalent

annual premium is stipulated for, payable at the commence’

2.39

Popular

View.

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Encyclopaedia Britannica > Encyclopaedia Britannica > Volume 3, Anatomy-Astronomy > (247) Page 239 |

|---|

| Permanent URL | https://digital.nls.uk/193760559 |

|---|

| Attribution and copyright: |

|

|---|---|

| Shelfmark | EB.16 |

|---|---|

| Description | Ten editions of 'Encyclopaedia Britannica', issued from 1768-1903, in 231 volumes. Originally issued in 100 weekly parts (3 volumes) between 1768 and 1771 by publishers: Colin Macfarquhar and Andrew Bell (Edinburgh); editor: William Smellie: engraver: Andrew Bell. Expanded editions in the 19th century featured more volumes and contributions from leading experts in their fields. Managed and published in Edinburgh up to the 9th edition (25 volumes, from 1875-1889); the 10th edition (1902-1903) re-issued the 9th edition, with 11 supplementary volumes. |

|---|---|

| Additional NLS resources: |

|