Towns > Dundee > 1809-1912 - Dundee directory > 1910-1911

(92)

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

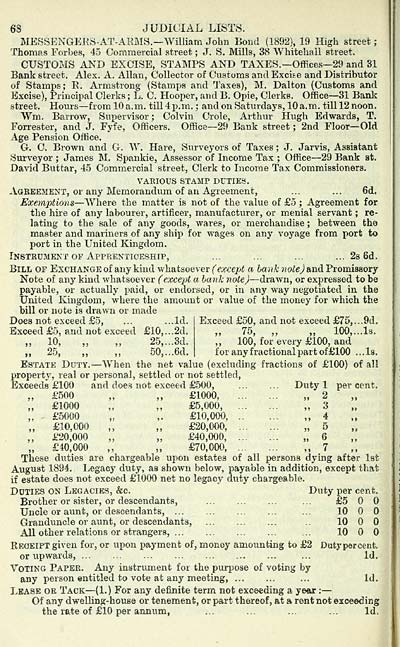

68 JUDICIAL LISTS.

MESSENGERS-AT-AEMS.— WiUiam John Bond (1892), 19 High street ;

Thomas Forbes, 45 Commercial street ; J. S. Mills, 38 Whitehall street,

CUSTOMS AND EXCISE, STAMPS AND TAXES.— Offices— 29 and 31

Bank street. Alex. A. Allan, Collector of Customs and Excise and Distributor

of Stamps; E, Armstrong (Stamps and Taxes), M. Dalton (Customs and

Excise), Principal Clerks ; L. C. Hooper, and B. Opie, Clerks. Office — 31 Bank

street. Hours — from 10 a.m. till 4 p.m. ; and on Saturdays, 10a.m. till 12 noon.

Wm. Barrow, Supervisor ; Colvin Crole, Arthur Hugh Edwards, T.

Forrester, and J. Fyfe, Officers. Office— 29 Bank street ; 2nd Floor— Old

Age Pension Office.

G. C. Brown and G. W. Hare, Surveyors of Taxes ; J. Jarvis, Assistant

Surveyor ; James M. Spankie, Assessor of Income Tax ; Office — 29 Bank st.

David Buttar, 45 Commercial street, Clerk to Income Tax Commissioners.

VARIOUS STAMP DUTIES.

Agbeement, or any Memorandum of an Agreement, ... ... 6d.

Exeinptions — "Where the matter is not of the value of £5 ; Agreement for

the hire of any labourer, artificer, manufacturer, or menial servant ; re-

lating to the sale of any goods, wares, or merchandise ; between fcho

master and mariners of any ship for wages on any voyage from port to

port in the United Kingdom.

Instrument OF Apprenticeship, ... ... ... ... 23 6d,

Bill op Exchange of any kind whatsoever (ex-cept a hank note)hndi Promissory

Note of any kind Avhatsoever (except a hank note) — drawn, or expressed to be

payable, or actually paid, or endorsed, or in any way negotiated in the

United Kingdom, where the amovmt or value of the money for which the

bill or note is drawn or made

Does not exceed £5, ... ...Id.

Exceed £5, and not exceed £10,... 2d.

„ 10, „ „ 25,. ..3d.

„ 25, „ „ 50,. ..6d.

Exceed £50, and not exceed £75,... 9d,

„ 75, „ „ 100,. ..Is.

,, 100, for every £100, and

for any fractional part of £100 ... Is.

Estate Duty. — When the net value (excluding fractions of £100) of all

property, real or personal, settled or not settled,

Exceeds £100 and does not exceed £500, Duty 1 per cent.

„ £500 „ ,, £1000, „ 2

„ £1000 ,. „ £5,000, „ 3

,, - £5000 „ ,. £10,000, ,, 4

£10,000 „ „ £20,000, „ 5

„ £20,000 „ „ £40,000, „ 6

„ £40,000 ,, „ £70,000, „ 7

These duties are chargeable upon estates of all persons dying after 1st

August 1894. Legacy duty, as shown below, payable in addition, except that

if estate does not exceed £1000 net no legacy duty chargeable.

Duties on Legacies, &c. Duty per cent.

Brother or sister, or descendants, ... £500

Uncle or aunt, or descendants, ... 10

Granduncle or aunt, or descendants, 10

All other relations or strangers, ... 10

Keoeipt given for, or upon payment of, money amounting to £2 Duty percent.

or ixpwards, ... Id.

Voting Paper. Any instnmaent for the purpose of voting by

any person entitled to vote at any meeting, ... Id.

Lease or Tack — (1.) For any definite term not exceeding a year : —

Of any dwelling-house or tenement, or part thereof, at a rent not exceeding

the rate of £10 per annxim, ... ... ... ... Id.

MESSENGERS-AT-AEMS.— WiUiam John Bond (1892), 19 High street ;

Thomas Forbes, 45 Commercial street ; J. S. Mills, 38 Whitehall street,

CUSTOMS AND EXCISE, STAMPS AND TAXES.— Offices— 29 and 31

Bank street. Alex. A. Allan, Collector of Customs and Excise and Distributor

of Stamps; E, Armstrong (Stamps and Taxes), M. Dalton (Customs and

Excise), Principal Clerks ; L. C. Hooper, and B. Opie, Clerks. Office — 31 Bank

street. Hours — from 10 a.m. till 4 p.m. ; and on Saturdays, 10a.m. till 12 noon.

Wm. Barrow, Supervisor ; Colvin Crole, Arthur Hugh Edwards, T.

Forrester, and J. Fyfe, Officers. Office— 29 Bank street ; 2nd Floor— Old

Age Pension Office.

G. C. Brown and G. W. Hare, Surveyors of Taxes ; J. Jarvis, Assistant

Surveyor ; James M. Spankie, Assessor of Income Tax ; Office — 29 Bank st.

David Buttar, 45 Commercial street, Clerk to Income Tax Commissioners.

VARIOUS STAMP DUTIES.

Agbeement, or any Memorandum of an Agreement, ... ... 6d.

Exeinptions — "Where the matter is not of the value of £5 ; Agreement for

the hire of any labourer, artificer, manufacturer, or menial servant ; re-

lating to the sale of any goods, wares, or merchandise ; between fcho

master and mariners of any ship for wages on any voyage from port to

port in the United Kingdom.

Instrument OF Apprenticeship, ... ... ... ... 23 6d,

Bill op Exchange of any kind whatsoever (ex-cept a hank note)hndi Promissory

Note of any kind Avhatsoever (except a hank note) — drawn, or expressed to be

payable, or actually paid, or endorsed, or in any way negotiated in the

United Kingdom, where the amovmt or value of the money for which the

bill or note is drawn or made

Does not exceed £5, ... ...Id.

Exceed £5, and not exceed £10,... 2d.

„ 10, „ „ 25,. ..3d.

„ 25, „ „ 50,. ..6d.

Exceed £50, and not exceed £75,... 9d,

„ 75, „ „ 100,. ..Is.

,, 100, for every £100, and

for any fractional part of £100 ... Is.

Estate Duty. — When the net value (excluding fractions of £100) of all

property, real or personal, settled or not settled,

Exceeds £100 and does not exceed £500, Duty 1 per cent.

„ £500 „ ,, £1000, „ 2

„ £1000 ,. „ £5,000, „ 3

,, - £5000 „ ,. £10,000, ,, 4

£10,000 „ „ £20,000, „ 5

„ £20,000 „ „ £40,000, „ 6

„ £40,000 ,, „ £70,000, „ 7

These duties are chargeable upon estates of all persons dying after 1st

August 1894. Legacy duty, as shown below, payable in addition, except that

if estate does not exceed £1000 net no legacy duty chargeable.

Duties on Legacies, &c. Duty per cent.

Brother or sister, or descendants, ... £500

Uncle or aunt, or descendants, ... 10

Granduncle or aunt, or descendants, 10

All other relations or strangers, ... 10

Keoeipt given for, or upon payment of, money amounting to £2 Duty percent.

or ixpwards, ... Id.

Voting Paper. Any instnmaent for the purpose of voting by

any person entitled to vote at any meeting, ... Id.

Lease or Tack — (1.) For any definite term not exceeding a year : —

Of any dwelling-house or tenement, or part thereof, at a rent not exceeding

the rate of £10 per annxim, ... ... ... ... Id.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Dundee > Dundee directory > 1910-1911 > (92) |

|---|

| Permanent URL | https://digital.nls.uk/86680027 |

|---|

| Description | Imprint varies. |

|---|---|

| Shelfmark | Various |

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|