Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

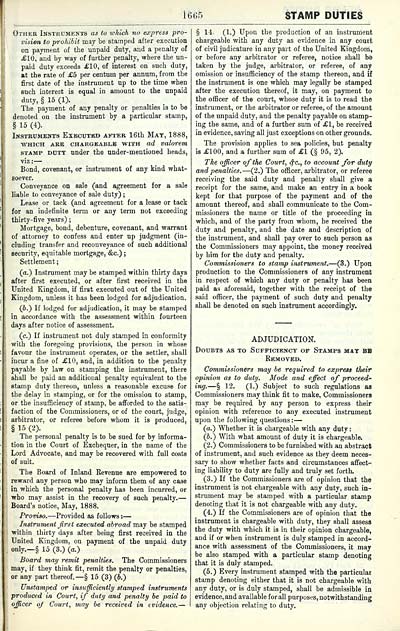

1665

STAMP DUTIES

Other Instruments as to which no express pro-

vision to prohibit may be stamped after execution

on payment of the unpaid duty, and a penalty of

£10, and by way of further penalty, where the un-

paid duty exceeds £10, of interest on such duty,

at the rate of £5 per centum per annum, from the

first date of the instrument up to the time when

such interest is equal in amount to the unpaid

duty, §15(1).

The payment of any penalty or penalties is to be

denoted on the instrument by a particular stamp,

§ 15 (4).

Instruments Executed after 16th Mat, 1888,

which are chargeable with ad valorem

stamp duty under the under-mentioned heads,

viz: —

Bond, covenant, or instrument of any kind what-

soever.

Conveyance on sale (and agreement for a sale

liable to conveyance of sale duty) ;

Lease or tack (and agreement for a lease or tack

for an indefinite term or any term not exceeding

thirty-five years) ;

Mortgage, bond, debenture, covenant, and warrant

of attorney to confess and enter up judgment (in-

cluding transfer and reconveyance of such additional

security, equitable mortgage, &c.) ;

Settlement;

(a.) Instrument may be stamped within thirty days

after first executed, or after first received in the

United Kingdom, if first executed out of the United

Kingdom, unless it has been lodged for adjudication.

(6.) If lodged for adjudication, it may be stamped

in accordance with the assessment within fourteen

days after notice of assessment.

(c.) If instrument not duly stamped in conformity

with the foregoing provisions, the person in whose

favour the instrument operates, or the settler, shall

incur a fine of £10, and, in addition to the penalty

payable by law on stamping the instrument, there

shall be paid an additional penalty equivalent to the

stamp duty thereon, unless a reasonable excuse for

the delay in stamping, or for the omission to stamp,

or the insufficiency of stamp, be afforded to the satis-

faction of the Commissioners, or of the court, judge,

arbitrator, or referee before whom it is produced,

§ 15 (2).

The personal penalty is to be sued for by informa-

tion in the Court of Exchequer, in the name of the

Lord Advocate, and may be recovered with full costs

of suit.

The Board of Inland Revenue are empowered to

reward any person who may inform them of any case

in which the personal penalty has been incurred, or

who may assist in the recovery of such penalty. —

Board's notice, May, 1888.

Proviso. — Provided as follows : —

Instrument first executed abroad may be stamped

within thirty days after being first received in the

United Kingdom, on payment of the unpaid duty

only.— § 15 (3.) (a.)

Board may remit penalties. The Commissioners

may, if they think fit, remit the penalty or penalties,

or any part thereof. — § 15 (3) (6.)

Unstamped or insufficiently stamped instruments

produced in Court, if duty and penalty be paid to

officer oj Court, may be received in evidence. —

§ 14. (1.) Upon the production of an instrument

chargeable with any duty as evidence in any court

of civil judicature in any part of the United Kingdom,

or before any arbitrator or referee, notice shall be

taken by the judge, arbitrator, or referee, of any

omission or insufficiency of the stamp thereon, and if

the instrument is one which may legally be stamped

after the execution thereof, it may, on payment to

the officer of the court, whose duty it is to read the

instrument, or the arbitrator or referee, of the amount

of the unpaid duty, and the penalty payable on stamp-

ing the same, and of a further sum of £1, be received

in evidence, saving all just exceptions on other grounds.

The provision applies to sea policies, but penalty

is £100, and a further sum of £1 (§ 95, 2).

The officer of the Court, fyc, to account for duty

and penalties. — (2.) The officer, arbitrator, or referee

receiving the said duty and penalty shall give a

receipt for the same, and make an entry in a book

kept for that purpose of the payment and of the

amount thereof, and shall communicate to the Com-

missioners the name or title of the proceeding in

which, and of the party from whom, he received the

duty and penalty, and the date and description of

the instrument, and shall pay over to such person as

the Commissioners may appoint, the money received

by him for the duty and penalty.

Commissioners to stamp instrument. — (3.) Upon

production to the Commissioners of any instrument

in respect of which any duty or penalty has been

paid as aforesaid, together with the receipt of the

said officer, the payment of such duty and penalty

shall be denoted on such instrument accordingly.

ADJUDICATION.

Doubts as to Sufficiency of Stamps may bb

Removed.

Commissioners may be required to express their

opinion as to duty. Mode and effect of proceed-

ing. — § 12. (1.) Subject to such regulations as

Commissioners may think fit to make, Commissioners

may be required by any person to express their

opinion with reference to any executed instrument

upon the following questions : —

(a.) Whether it is chargeable with any duty :

(6.) With what amount of duty it is chargeable.

(2.) Commissioners to be furnished with an abstract

of instrument, and such evidence as they deem neces-

sary to show whether facts and circumstances affect-

ing liability to duty are fully and truly set forth.

(3.) If the Commissioners are of opinion that the

instrument is not chargeable with any duty, such in-

strument may be stamped with a particular stamp

denoting that it is not chargeable with any duty.

(4.) If the Commissioners are of opinion that the

instrument is chargeable with duty, they shall assess

the duty with which it is in their opinion chargeable,

and if or when instrument is duly stamped in accord-

ance with assessment of the Commissioners, it may

be also stamped with a particular stamp denoting

that it is duly stamped.

(5.) Every instrument stamped with the particular

stamp denoting either that it is not chargeable with

any duty, or is duly stamped, shall be admissible in

evidence, and available for all purposes, notwithstanding

any objection relating to duty.

STAMP DUTIES

Other Instruments as to which no express pro-

vision to prohibit may be stamped after execution

on payment of the unpaid duty, and a penalty of

£10, and by way of further penalty, where the un-

paid duty exceeds £10, of interest on such duty,

at the rate of £5 per centum per annum, from the

first date of the instrument up to the time when

such interest is equal in amount to the unpaid

duty, §15(1).

The payment of any penalty or penalties is to be

denoted on the instrument by a particular stamp,

§ 15 (4).

Instruments Executed after 16th Mat, 1888,

which are chargeable with ad valorem

stamp duty under the under-mentioned heads,

viz: —

Bond, covenant, or instrument of any kind what-

soever.

Conveyance on sale (and agreement for a sale

liable to conveyance of sale duty) ;

Lease or tack (and agreement for a lease or tack

for an indefinite term or any term not exceeding

thirty-five years) ;

Mortgage, bond, debenture, covenant, and warrant

of attorney to confess and enter up judgment (in-

cluding transfer and reconveyance of such additional

security, equitable mortgage, &c.) ;

Settlement;

(a.) Instrument may be stamped within thirty days

after first executed, or after first received in the

United Kingdom, if first executed out of the United

Kingdom, unless it has been lodged for adjudication.

(6.) If lodged for adjudication, it may be stamped

in accordance with the assessment within fourteen

days after notice of assessment.

(c.) If instrument not duly stamped in conformity

with the foregoing provisions, the person in whose

favour the instrument operates, or the settler, shall

incur a fine of £10, and, in addition to the penalty

payable by law on stamping the instrument, there

shall be paid an additional penalty equivalent to the

stamp duty thereon, unless a reasonable excuse for

the delay in stamping, or for the omission to stamp,

or the insufficiency of stamp, be afforded to the satis-

faction of the Commissioners, or of the court, judge,

arbitrator, or referee before whom it is produced,

§ 15 (2).

The personal penalty is to be sued for by informa-

tion in the Court of Exchequer, in the name of the

Lord Advocate, and may be recovered with full costs

of suit.

The Board of Inland Revenue are empowered to

reward any person who may inform them of any case

in which the personal penalty has been incurred, or

who may assist in the recovery of such penalty. —

Board's notice, May, 1888.

Proviso. — Provided as follows : —

Instrument first executed abroad may be stamped

within thirty days after being first received in the

United Kingdom, on payment of the unpaid duty

only.— § 15 (3.) (a.)

Board may remit penalties. The Commissioners

may, if they think fit, remit the penalty or penalties,

or any part thereof. — § 15 (3) (6.)

Unstamped or insufficiently stamped instruments

produced in Court, if duty and penalty be paid to

officer oj Court, may be received in evidence. —

§ 14. (1.) Upon the production of an instrument

chargeable with any duty as evidence in any court

of civil judicature in any part of the United Kingdom,

or before any arbitrator or referee, notice shall be

taken by the judge, arbitrator, or referee, of any

omission or insufficiency of the stamp thereon, and if

the instrument is one which may legally be stamped

after the execution thereof, it may, on payment to

the officer of the court, whose duty it is to read the

instrument, or the arbitrator or referee, of the amount

of the unpaid duty, and the penalty payable on stamp-

ing the same, and of a further sum of £1, be received

in evidence, saving all just exceptions on other grounds.

The provision applies to sea policies, but penalty

is £100, and a further sum of £1 (§ 95, 2).

The officer of the Court, fyc, to account for duty

and penalties. — (2.) The officer, arbitrator, or referee

receiving the said duty and penalty shall give a

receipt for the same, and make an entry in a book

kept for that purpose of the payment and of the

amount thereof, and shall communicate to the Com-

missioners the name or title of the proceeding in

which, and of the party from whom, he received the

duty and penalty, and the date and description of

the instrument, and shall pay over to such person as

the Commissioners may appoint, the money received

by him for the duty and penalty.

Commissioners to stamp instrument. — (3.) Upon

production to the Commissioners of any instrument

in respect of which any duty or penalty has been

paid as aforesaid, together with the receipt of the

said officer, the payment of such duty and penalty

shall be denoted on such instrument accordingly.

ADJUDICATION.

Doubts as to Sufficiency of Stamps may bb

Removed.

Commissioners may be required to express their

opinion as to duty. Mode and effect of proceed-

ing. — § 12. (1.) Subject to such regulations as

Commissioners may think fit to make, Commissioners

may be required by any person to express their

opinion with reference to any executed instrument

upon the following questions : —

(a.) Whether it is chargeable with any duty :

(6.) With what amount of duty it is chargeable.

(2.) Commissioners to be furnished with an abstract

of instrument, and such evidence as they deem neces-

sary to show whether facts and circumstances affect-

ing liability to duty are fully and truly set forth.

(3.) If the Commissioners are of opinion that the

instrument is not chargeable with any duty, such in-

strument may be stamped with a particular stamp

denoting that it is not chargeable with any duty.

(4.) If the Commissioners are of opinion that the

instrument is chargeable with duty, they shall assess

the duty with which it is in their opinion chargeable,

and if or when instrument is duly stamped in accord-

ance with assessment of the Commissioners, it may

be also stamped with a particular stamp denoting

that it is duly stamped.

(5.) Every instrument stamped with the particular

stamp denoting either that it is not chargeable with

any duty, or is duly stamped, shall be admissible in

evidence, and available for all purposes, notwithstanding

any objection relating to duty.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1908-1909 > (1685) |

|---|

| Permanent URL | https://digital.nls.uk/86461750 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|