Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

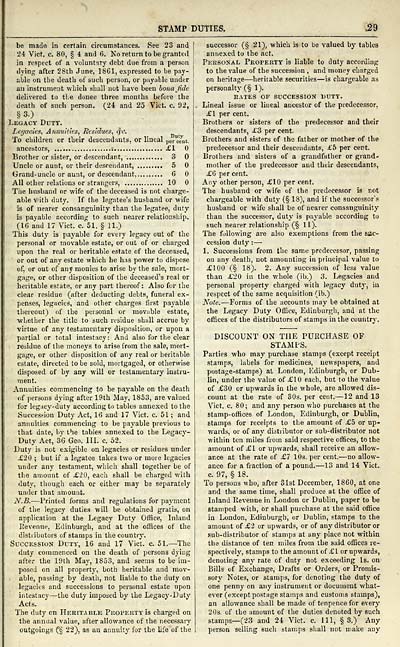

STAMP DUTIES.

^9

be made in certain circumstances. See 23 and

24. Vict. c. 80, § i and 6. No return to be granted

in respect of a voluntary debt due from a person

dying after '28th June, 1861, expressed to be pay-

able on the deatli of such person, or piiynble under

ail instrument which shall not have been bona fide

delivered to the donee three months before the

death of such person. (24 and 25 Vict. c. 92,

§3.)

Legacy Duty.

Le.ffacies, Annuities, Residues, ifc.

To ciiildren or their descendants, or lineal per'ce^nt.

ancestors, : £1

Brother or sister, or descendant, 3

Uncle or aunt, or their descendant, 5

Grand-uncle or aunt, or descendant, 6

All other relations or strangers, 10

The husband or wife of the deceased is not charge-

able vith duty. If the legatee's husband or wife

is of nearer consanguinity than the legatee, duty

is payable according to such nearer relationship.

(IC and 17 Vict. c. 51, § 11.)

This dut}' is payable for every legacy out of the

personal or movable estate, or out of or charged

upon the real or heritable estate of the deceased,

or out of any estate which he has power to dispose

of, or out of any monies to arise by the sale, mort-

gage, or other disposition of the deceased's real or

heritable estate, or any part thereof: Also for the

clear residue (after deducting debts, funeral e.x-

penses, legacies, and other charges first payable

thereout) of the personal or movable estate,

whether the title to such residue shall accrue by

virtue of any testamentary disposition, or upon a

partial or total intestacy : And also for the clear

residue of the moneys to arise from the sale, mort-

gage, or other disposition of any real or heritable

estate, directed to be sold, mortgaged, or otherwise

disposed of by any will or testamentary instru-

ment.

Annuities commencing to be payable on the death

of persons dying after 19th May, 1853, are valued

for legacy-duty according to tables annexed to the

Succession Duty Act, 16 and 17 Vict. c. 51 ; and

annuities commencing to be payable previous to

that date, by the tables annexed to the Legacy-

Duty Act, 36 Geo. HI. c. 52.

Duty is not exigible on legacies or residues under

£20 ; but if a legatee takes two or more legacies

under any testament, which shall together be of

the amount of £20, each shall be charged with

duty, though each or either may be separately

under that amount.

N.B. — Printed forms and regulations for payment

of the legacy duties will be obtained gratis, on

application at the Legacy Duty Office, Inland

Eevenue, Edinburgh, and at the offices of the

distributors of stamps in the country.

Succession Duty, 16 and 17 Vict. c. 51. — The

duty commenced on the death of persons dying

after the 19th May, 1853, and seems to be im-

posed on all property, both heritable and mov-

, able, passing by death, not liable to the duty on

legacies and successions to personal estate upon

intestacy— the duty imposed by the Legacy-Duty

Acts.

The duty on Heritable Property is charged on

the annual value, after allowance of the necessary

outgoings (§ 22), as an annuity for the life of the

successor (§ 21), which is to be valued by tables

annexed to the act.

Personal Property is liable to duty according

to the value of the succession , and money charged

on heritage — heritable securities — is chargeable as

personalty (§ 1).

rates of succession duty.

Lineal issue or lineal ancestor of the predecessor,

£1 per cent.

Brothers or sisters of the predecessor and their

descendants, X3 per cent.

Brothers and sisters of the father or mother of the

predecessor and their descendants, £5 per cent.

Brothers and sisters of a grandfather or grand-

mother of the predecessor and their descendants,

£6 per cent.

Any other person, £10 per cent.

The husband or wife of the predecessor is not

chargeable with dutj' (§ 18), and if the successor's

husband or wife shall be of nearer consanguinity

than the successor, duty is payable according to

such nearer relationship (§ 11).

The following are also exemptions from the suc-

cession duty : —

1. Successions from the same predecessor, passing

on any death, not amounting in principal value to

£100 (§ 18). 2. Any succession of less value

than £20 in the whole (ib.) 3. Legacies and

personal property charged with legacy dut}', in

respect of the same acquisition (ib.)

Note. — Forms of the accounts may be obtained at

the Legacy Duty Office, Edinburgh, and at the

offices of the distributors of stamps in the country.

DISCOUNT ON THE PURCHASE OF

STAMPS.

Parties who ma}' purchase stamps (except receipt

stamps, labels for medicines, newspapers, and

postage-stamps) at London, Edinburgh, or Dub-

lin, under the value of £10 each, but to the value

of £30 or upwards in the whole, are allowed dis-

count at the rate of 30s. per cent. — 12 and 13

Vict. c. 80; and any person who purchases at the

stamp-offices of London, Edinburgh, or Dublin,

stamps for receipts to the amount of £5 or up-

wards, or of any distributor or sub-distributor not

within ten miles from said respective offices, to the

amount of £1 or upwards, shall receive an allow-

ance at the rate of £7 10s. per cent. — no allow-

ance for a fraction of a pound. — 13 and 14 Vict.,

c. 97, § 18.

To persons who, after 31st December, 1860, at one

and the same time, shall produce at the office of

Inland Revenue in London or Dublin, paper to be

stamped with, or shall purchase at the said office

in London, Edinburgh, or Dublin, stamps to the

amount of £2 or upwards, or of any distributor or

sub-distributor of stamps at any place not within

the distance of ten miles from the said offices re-

spectively, stamps to theamount of £1 or upwards,

denoting any rate of duty not exceeding Is. on

Bills of Exchange, Drafts or Orders, or Promis-

sory Notes, or stamps, for denoting the duty of

one penny on any instrument or document what-

ever (except postage stamps and customs stamps),

an allowance shall be made of tenpence for every

20s. of the amount of the duties denoted by such

stamps— (23 and 24 Vict. c. Ill, § 3.) Any

person selling such stamps shall not make .•\ny

^9

be made in certain circumstances. See 23 and

24. Vict. c. 80, § i and 6. No return to be granted

in respect of a voluntary debt due from a person

dying after '28th June, 1861, expressed to be pay-

able on the deatli of such person, or piiynble under

ail instrument which shall not have been bona fide

delivered to the donee three months before the

death of such person. (24 and 25 Vict. c. 92,

§3.)

Legacy Duty.

Le.ffacies, Annuities, Residues, ifc.

To ciiildren or their descendants, or lineal per'ce^nt.

ancestors, : £1

Brother or sister, or descendant, 3

Uncle or aunt, or their descendant, 5

Grand-uncle or aunt, or descendant, 6

All other relations or strangers, 10

The husband or wife of the deceased is not charge-

able vith duty. If the legatee's husband or wife

is of nearer consanguinity than the legatee, duty

is payable according to such nearer relationship.

(IC and 17 Vict. c. 51, § 11.)

This dut}' is payable for every legacy out of the

personal or movable estate, or out of or charged

upon the real or heritable estate of the deceased,

or out of any estate which he has power to dispose

of, or out of any monies to arise by the sale, mort-

gage, or other disposition of the deceased's real or

heritable estate, or any part thereof: Also for the

clear residue (after deducting debts, funeral e.x-

penses, legacies, and other charges first payable

thereout) of the personal or movable estate,

whether the title to such residue shall accrue by

virtue of any testamentary disposition, or upon a

partial or total intestacy : And also for the clear

residue of the moneys to arise from the sale, mort-

gage, or other disposition of any real or heritable

estate, directed to be sold, mortgaged, or otherwise

disposed of by any will or testamentary instru-

ment.

Annuities commencing to be payable on the death

of persons dying after 19th May, 1853, are valued

for legacy-duty according to tables annexed to the

Succession Duty Act, 16 and 17 Vict. c. 51 ; and

annuities commencing to be payable previous to

that date, by the tables annexed to the Legacy-

Duty Act, 36 Geo. HI. c. 52.

Duty is not exigible on legacies or residues under

£20 ; but if a legatee takes two or more legacies

under any testament, which shall together be of

the amount of £20, each shall be charged with

duty, though each or either may be separately

under that amount.

N.B. — Printed forms and regulations for payment

of the legacy duties will be obtained gratis, on

application at the Legacy Duty Office, Inland

Eevenue, Edinburgh, and at the offices of the

distributors of stamps in the country.

Succession Duty, 16 and 17 Vict. c. 51. — The

duty commenced on the death of persons dying

after the 19th May, 1853, and seems to be im-

posed on all property, both heritable and mov-

, able, passing by death, not liable to the duty on

legacies and successions to personal estate upon

intestacy— the duty imposed by the Legacy-Duty

Acts.

The duty on Heritable Property is charged on

the annual value, after allowance of the necessary

outgoings (§ 22), as an annuity for the life of the

successor (§ 21), which is to be valued by tables

annexed to the act.

Personal Property is liable to duty according

to the value of the succession , and money charged

on heritage — heritable securities — is chargeable as

personalty (§ 1).

rates of succession duty.

Lineal issue or lineal ancestor of the predecessor,

£1 per cent.

Brothers or sisters of the predecessor and their

descendants, X3 per cent.

Brothers and sisters of the father or mother of the

predecessor and their descendants, £5 per cent.

Brothers and sisters of a grandfather or grand-

mother of the predecessor and their descendants,

£6 per cent.

Any other person, £10 per cent.

The husband or wife of the predecessor is not

chargeable with dutj' (§ 18), and if the successor's

husband or wife shall be of nearer consanguinity

than the successor, duty is payable according to

such nearer relationship (§ 11).

The following are also exemptions from the suc-

cession duty : —

1. Successions from the same predecessor, passing

on any death, not amounting in principal value to

£100 (§ 18). 2. Any succession of less value

than £20 in the whole (ib.) 3. Legacies and

personal property charged with legacy dut}', in

respect of the same acquisition (ib.)

Note. — Forms of the accounts may be obtained at

the Legacy Duty Office, Edinburgh, and at the

offices of the distributors of stamps in the country.

DISCOUNT ON THE PURCHASE OF

STAMPS.

Parties who ma}' purchase stamps (except receipt

stamps, labels for medicines, newspapers, and

postage-stamps) at London, Edinburgh, or Dub-

lin, under the value of £10 each, but to the value

of £30 or upwards in the whole, are allowed dis-

count at the rate of 30s. per cent. — 12 and 13

Vict. c. 80; and any person who purchases at the

stamp-offices of London, Edinburgh, or Dublin,

stamps for receipts to the amount of £5 or up-

wards, or of any distributor or sub-distributor not

within ten miles from said respective offices, to the

amount of £1 or upwards, shall receive an allow-

ance at the rate of £7 10s. per cent. — no allow-

ance for a fraction of a pound. — 13 and 14 Vict.,

c. 97, § 18.

To persons who, after 31st December, 1860, at one

and the same time, shall produce at the office of

Inland Revenue in London or Dublin, paper to be

stamped with, or shall purchase at the said office

in London, Edinburgh, or Dublin, stamps to the

amount of £2 or upwards, or of any distributor or

sub-distributor of stamps at any place not within

the distance of ten miles from the said offices re-

spectively, stamps to theamount of £1 or upwards,

denoting any rate of duty not exceeding Is. on

Bills of Exchange, Drafts or Orders, or Promis-

sory Notes, or stamps, for denoting the duty of

one penny on any instrument or document what-

ever (except postage stamps and customs stamps),

an allowance shall be made of tenpence for every

20s. of the amount of the duties denoted by such

stamps— (23 and 24 Vict. c. Ill, § 3.) Any

person selling such stamps shall not make .•\ny

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1862-1863 > (57) |

|---|

| Permanent URL | https://digital.nls.uk/86324946 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|