Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

i5k

STAMP DUTIES, ETC.

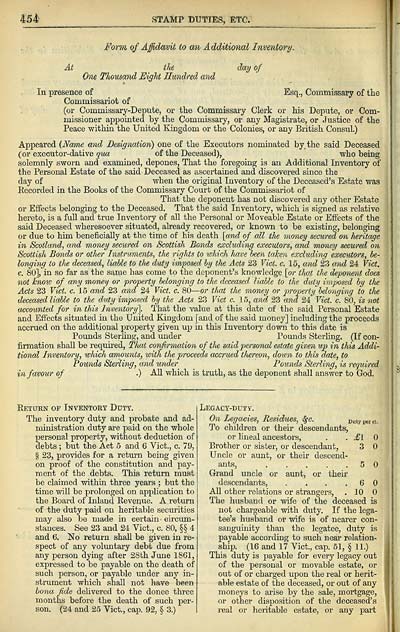

Form of Affidavit to an Additional Inventory.

At the day of

One Thousand Eight Hundred and

Esq., Commissary of the

In presence of

Commissariot of

(or Commissary-Depute, or the Commissary Clerk or his Depute, or Com-

missioner appointed by the Commissary, or any Magistrate, or Justice of the

Peace within the United Kingdom or the Colonies, or any British Consul.)

Appeared {Name and Besignatio^i) one of the Executors nominated by. the said Deceased

(or executor-dative g-MCj of the Deceased), who being

solemnly sworn and examined, depones, That the foregoing is an Additional Inventory of

the Personal Estate of the said Deceased as ascertained and discovered since the

day of when the original Inventory of the Deceased's Estate was

Recorded in the Books of the Commissary Court of the Commissariot of

That the deponent has not discovered any other Estate

or Effects belonging to the Deceased. That the said Inventory, which is signed as relative

hereto, is a fuU and true Inventory of all the Personal or Moveable Estate or Effects of the

said Deceased wheresoever situated, already recovered, or known to be existing, belonging

or due to him beneficially at the time of his death [and of all the money secured on heritage

in Scotland, and m,oney secured on Scottish Bonds excluding executors, and money secured on

Scottish Bonds or other Instruments, the rights to which have been taken excluding executors, he-

longing to the deceased, liable to the duty imposed by the Acts 23 Vict. c. 15, and 23 and 24 Vict.

c. 80], in so far as the same has come to the deponent's knowledge \or that the dejpoiient does

not knotv of any money or property belonging to the deceased Imble to the duty imposed by the

Acts 23 Vict. c. 15 and 23 and 24 Vict. c. 80 — or that the money or property belonging to the

deceased liable to the duty imposed by the Acts 23 Vict c. 15, and 23 and 24 Vict. c. 80, is not

accounted for in this Inventory^ That the value at this date of the said Personal Estate

and Effects situated in the United Kingdom [and of the said money] including the proceeds

accrued on the additional property given up in this Inventory down to this date is

Pounds Sterling, and under Pounds Sterling. (If con-

firmation shall be required, That confirmation of the said personal estate given up in this Addi-

tional Inventory, which amounts, tvith the proceeds accrtied thereon, down to this date, to

Pounds Sterling, and wider Pounds Sterling, is required

in favour of .) AU which is truth, as the deponent shall answer to God.

Return of Inventory Duty.

The inventory duty and probate and ad-

ministration duty are paid on the whole

personal property, without deduction of

debts ; but the Act 5 and 6 Vict., c. 79,

§ 23, provides for a return being given

on proof of the constitution and pay-

ment of the debts. This return must

be claimed within three years ; but the

time will be prolonged on application to

the Board of Inland Revenue. A return

of the duty paid on heritable securities

may also be made in certain circum-

stances. See 23 and 24 Vict., c. 80, §§ 4

and 6. No return shall be given in re-

spect of any voluntary debt due from

any person dying after 28th June 1861,

expressed to be payable on the death of

such person, or payable under any in-

strument which shall not have been

bona fide delivered to the donee three

months before the death of such per-

son. (24 and 25 Vict., cap. 92, § 3.)

Legacy-duty.

On Legacies, Residues, ^c. Duty per ct.

To children or their descendants,

or lineal ancestors, . .£10

Brother or sister, or descendant, 3

Uncle or aunt, or their descend-

ants, 5

Grand uncle or aunt, or their

descendants, . . . .60

All other relations or strangers, .10

The husband or wife of the deceased is

not chargeable with duty. If the lega-

tee's husband or wife is of nearer con-

sanguinity than the legatee, duty is

payable according to such near relation-

ship. (16 and 17 Vict., cap. 51, § 11.)

This duty is payable for every legacy out

of the personal or movable estate, or

out of or charged upon the real or herit-

able estate of the deceased, or out of any

moneys to arise by the sale, mortgage,

or other disposition of the deceased's

real or heritable estate, or any part

STAMP DUTIES, ETC.

Form of Affidavit to an Additional Inventory.

At the day of

One Thousand Eight Hundred and

Esq., Commissary of the

In presence of

Commissariot of

(or Commissary-Depute, or the Commissary Clerk or his Depute, or Com-

missioner appointed by the Commissary, or any Magistrate, or Justice of the

Peace within the United Kingdom or the Colonies, or any British Consul.)

Appeared {Name and Besignatio^i) one of the Executors nominated by. the said Deceased

(or executor-dative g-MCj of the Deceased), who being

solemnly sworn and examined, depones, That the foregoing is an Additional Inventory of

the Personal Estate of the said Deceased as ascertained and discovered since the

day of when the original Inventory of the Deceased's Estate was

Recorded in the Books of the Commissary Court of the Commissariot of

That the deponent has not discovered any other Estate

or Effects belonging to the Deceased. That the said Inventory, which is signed as relative

hereto, is a fuU and true Inventory of all the Personal or Moveable Estate or Effects of the

said Deceased wheresoever situated, already recovered, or known to be existing, belonging

or due to him beneficially at the time of his death [and of all the money secured on heritage

in Scotland, and m,oney secured on Scottish Bonds excluding executors, and money secured on

Scottish Bonds or other Instruments, the rights to which have been taken excluding executors, he-

longing to the deceased, liable to the duty imposed by the Acts 23 Vict. c. 15, and 23 and 24 Vict.

c. 80], in so far as the same has come to the deponent's knowledge \or that the dejpoiient does

not knotv of any money or property belonging to the deceased Imble to the duty imposed by the

Acts 23 Vict. c. 15 and 23 and 24 Vict. c. 80 — or that the money or property belonging to the

deceased liable to the duty imposed by the Acts 23 Vict c. 15, and 23 and 24 Vict. c. 80, is not

accounted for in this Inventory^ That the value at this date of the said Personal Estate

and Effects situated in the United Kingdom [and of the said money] including the proceeds

accrued on the additional property given up in this Inventory down to this date is

Pounds Sterling, and under Pounds Sterling. (If con-

firmation shall be required, That confirmation of the said personal estate given up in this Addi-

tional Inventory, which amounts, tvith the proceeds accrtied thereon, down to this date, to

Pounds Sterling, and wider Pounds Sterling, is required

in favour of .) AU which is truth, as the deponent shall answer to God.

Return of Inventory Duty.

The inventory duty and probate and ad-

ministration duty are paid on the whole

personal property, without deduction of

debts ; but the Act 5 and 6 Vict., c. 79,

§ 23, provides for a return being given

on proof of the constitution and pay-

ment of the debts. This return must

be claimed within three years ; but the

time will be prolonged on application to

the Board of Inland Revenue. A return

of the duty paid on heritable securities

may also be made in certain circum-

stances. See 23 and 24 Vict., c. 80, §§ 4

and 6. No return shall be given in re-

spect of any voluntary debt due from

any person dying after 28th June 1861,

expressed to be payable on the death of

such person, or payable under any in-

strument which shall not have been

bona fide delivered to the donee three

months before the death of such per-

son. (24 and 25 Vict., cap. 92, § 3.)

Legacy-duty.

On Legacies, Residues, ^c. Duty per ct.

To children or their descendants,

or lineal ancestors, . .£10

Brother or sister, or descendant, 3

Uncle or aunt, or their descend-

ants, 5

Grand uncle or aunt, or their

descendants, . . . .60

All other relations or strangers, .10

The husband or wife of the deceased is

not chargeable with duty. If the lega-

tee's husband or wife is of nearer con-

sanguinity than the legatee, duty is

payable according to such near relation-

ship. (16 and 17 Vict., cap. 51, § 11.)

This duty is payable for every legacy out

of the personal or movable estate, or

out of or charged upon the real or herit-

able estate of the deceased, or out of any

moneys to arise by the sale, mortgage,

or other disposition of the deceased's

real or heritable estate, or any part

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1864-1865 > (462) |

|---|

| Permanent URL | https://digital.nls.uk/85918394 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|