Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

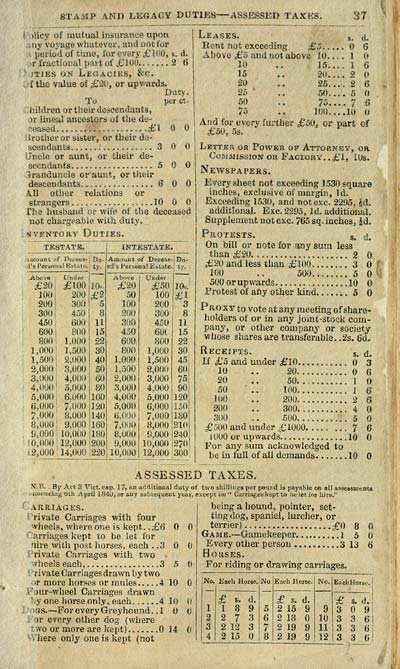

STAMP AND LEGACY DUTIES ASSESSED TAXES.

37

!. )licy of mutual insurance upon

aiy voyage whatever, and aot for

period of time, for every £100, s. d.

■r fractional part of £ 100 2 6

jTiEs ON Legacies, &c.

. f the value of £20, or upwards.

Duty.

To per ct-

i;ildren or their descendants,

3v lineal ancestors of the de- ^

neased £1

irothevor sister, or their de-

scendants .' 3

Jncle or aunt, or their de-

scendants 5

iranduncle or auut, or tlieir

descendants 6

A.11 other relations or

strangers . „ 10

The husband ui- wife of the deceased

not chargeable with duty.

MVENTORV Duties.

TESTATE.

INTESTATE.

imounl <if Deoeas-

n«-

Amount

ii Deceas-

Dn-

d's Personal est;,t.'.

ty.

ed*3 Perso

nal Estate.

ty.

Above

Under

Abi.ve

Under

£20

£100

10-

£20

£50

10s.'

100

200

£'i

50

100

£1

200

300

5

100

200

3

30<.»

450

8

200

300

8

450

600

11

300

450

11

600

800

15

450

60t

15

800

1,000

22

600

300

22

1,000

1,500

30

800

1,000

30

1,500

2,000

40

1,000

1,500

45,

2,000

3,000

50

1,500

2,000

60;

3,000

4,000

60

2,000

3,000

75!

4.000

5,000

80

3,000

4.000

.90 ;

5,000

6,000

100

4,000

5,000

120

6,000

7,000

120

5,000

6,000

150

7,000

8,000

140

■ 6,00(»

7,000

ISO

8,000

9,000

160

7,000

8,000

210|

9,000

10,(K)0

180

8,000

9,000

240!

; 0,000

12,000

200

9,000

10,000

270I

;2,000 14,000

220

10,000

12,000

300

Leases. s. j.

Rent not exceeding £5 6 6

Above £5 and not above 10 1

10 .. 15.... 1 6

15 .. 20.... 2

20 .. 25. ... 2 6

25 ■ ,. 50 5 (»

50 .. 75.... 7 6

75 .. 100.,.. 10

And for every further £50, or part of

£50, 5s,

Letter oh Power of Attorney, or

Commission or Faciorv. .£1, iOs.

Newspapers.

Every sheet not exceeding 1530 square

inches, exclusive of margin, Id.

E.\ceeding 153(», and notexc. 22.05, id.

additional. Exc. 22.95, Id. additional.

Supplement not exc. 765 sq. inches, id.

Protests. g, ^E.

On bill or note for any sum less

than £20 2

£20 and less than £100. ... 3

100 .. 500........ 5

500 or upv/ards 10

Protest of any other kind 5

P ROXY to vote at any meeting of share-

holders of or in any joint -stock com-

pany, or other company or society

whose shares are transferable. .2s. 6d.

Receipts. s. d.

If £5 and under £10 „ .... 3

10 .. 20 6

20 . . 50 1

50 .. 100 ,. 1 6

100 .. 200.. 2 6

200 . . 300. 4

300 . , 500 5

£jOO and under £1000. ,7 6

lOOO or upwards , 10

For any sum acknowledged to

be in full of all demands 10

ASSESSED TAXES.

V.B. By Aet 3 A'ict. cap. 17, an additional duly of two shilliiigs per pound is payable on all ajssosmcnta

uueacing titli April IS-lO, or any subsequent year, except on '* Carriage:* Itept to be let. foj Iiire."

VRRIAGES.

i rivate Carriages with four

'vheels, where one is kept. .£6

' arriages kept to be let for

lire with post horses, each . .3

Private Carriages with two

cheels each, 3

; ri vate Carriages drawn by two

T more horses or mules 4 10

.Four-wheel Carriages drawn

),y one horse only, each 4 10

' ' >as. — For every Greyhound. . 1

or every other dcg (where

wo or more are kept) .0 14

■ Viiere only one is kept (not

5

being a hound, pointer, set-

ting dog, spaniel, lurcher, or

terrier) £0 8

Game. — Gamekeeper. .". 1 5

Every other persou 3 13

Houses.

For riding or drawing carriages.

No.

1

2

3

4

KacU Horse.

No

Each Horse.

No.

EachHorsi'. '

£ s, d.

1 8 9

2 7 3

2 12 3

2 15

5

6

7

8

£ s. d.

2 16 9

2 18

2 19 9

2 19 9

9

10

11

12

£ s. d.

3 9

3 3 6

3 3 6

3 3 6

37

!. )licy of mutual insurance upon

aiy voyage whatever, and aot for

period of time, for every £100, s. d.

■r fractional part of £ 100 2 6

jTiEs ON Legacies, &c.

. f the value of £20, or upwards.

Duty.

To per ct-

i;ildren or their descendants,

3v lineal ancestors of the de- ^

neased £1

irothevor sister, or their de-

scendants .' 3

Jncle or aunt, or their de-

scendants 5

iranduncle or auut, or tlieir

descendants 6

A.11 other relations or

strangers . „ 10

The husband ui- wife of the deceased

not chargeable with duty.

MVENTORV Duties.

TESTATE.

INTESTATE.

imounl <if Deoeas-

n«-

Amount

ii Deceas-

Dn-

d's Personal est;,t.'.

ty.

ed*3 Perso

nal Estate.

ty.

Above

Under

Abi.ve

Under

£20

£100

10-

£20

£50

10s.'

100

200

£'i

50

100

£1

200

300

5

100

200

3

30<.»

450

8

200

300

8

450

600

11

300

450

11

600

800

15

450

60t

15

800

1,000

22

600

300

22

1,000

1,500

30

800

1,000

30

1,500

2,000

40

1,000

1,500

45,

2,000

3,000

50

1,500

2,000

60;

3,000

4,000

60

2,000

3,000

75!

4.000

5,000

80

3,000

4.000

.90 ;

5,000

6,000

100

4,000

5,000

120

6,000

7,000

120

5,000

6,000

150

7,000

8,000

140

■ 6,00(»

7,000

ISO

8,000

9,000

160

7,000

8,000

210|

9,000

10,(K)0

180

8,000

9,000

240!

; 0,000

12,000

200

9,000

10,000

270I

;2,000 14,000

220

10,000

12,000

300

Leases. s. j.

Rent not exceeding £5 6 6

Above £5 and not above 10 1

10 .. 15.... 1 6

15 .. 20.... 2

20 .. 25. ... 2 6

25 ■ ,. 50 5 (»

50 .. 75.... 7 6

75 .. 100.,.. 10

And for every further £50, or part of

£50, 5s,

Letter oh Power of Attorney, or

Commission or Faciorv. .£1, iOs.

Newspapers.

Every sheet not exceeding 1530 square

inches, exclusive of margin, Id.

E.\ceeding 153(», and notexc. 22.05, id.

additional. Exc. 22.95, Id. additional.

Supplement not exc. 765 sq. inches, id.

Protests. g, ^E.

On bill or note for any sum less

than £20 2

£20 and less than £100. ... 3

100 .. 500........ 5

500 or upv/ards 10

Protest of any other kind 5

P ROXY to vote at any meeting of share-

holders of or in any joint -stock com-

pany, or other company or society

whose shares are transferable. .2s. 6d.

Receipts. s. d.

If £5 and under £10 „ .... 3

10 .. 20 6

20 . . 50 1

50 .. 100 ,. 1 6

100 .. 200.. 2 6

200 . . 300. 4

300 . , 500 5

£jOO and under £1000. ,7 6

lOOO or upwards , 10

For any sum acknowledged to

be in full of all demands 10

ASSESSED TAXES.

V.B. By Aet 3 A'ict. cap. 17, an additional duly of two shilliiigs per pound is payable on all ajssosmcnta

uueacing titli April IS-lO, or any subsequent year, except on '* Carriage:* Itept to be let. foj Iiire."

VRRIAGES.

i rivate Carriages with four

'vheels, where one is kept. .£6

' arriages kept to be let for

lire with post horses, each . .3

Private Carriages with two

cheels each, 3

; ri vate Carriages drawn by two

T more horses or mules 4 10

.Four-wheel Carriages drawn

),y one horse only, each 4 10

' ' >as. — For every Greyhound. . 1

or every other dcg (where

wo or more are kept) .0 14

■ Viiere only one is kept (not

5

being a hound, pointer, set-

ting dog, spaniel, lurcher, or

terrier) £0 8

Game. — Gamekeeper. .". 1 5

Every other persou 3 13

Houses.

For riding or drawing carriages.

No.

1

2

3

4

KacU Horse.

No

Each Horse.

No.

EachHorsi'. '

£ s, d.

1 8 9

2 7 3

2 12 3

2 15

5

6

7

8

£ s. d.

2 16 9

2 18

2 19 9

2 19 9

9

10

11

12

£ s. d.

3 9

3 3 6

3 3 6

3 3 6

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Peterhead (and Buchan) > Peterhead almanac and directory > (51) |

|---|

| Permanent URL | https://digital.nls.uk/85193804 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|