Towns > Edinburgh > 1867-1870 - New Edinburgh, Leith, and county (business) directory > 1869-1870

(704)

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

642

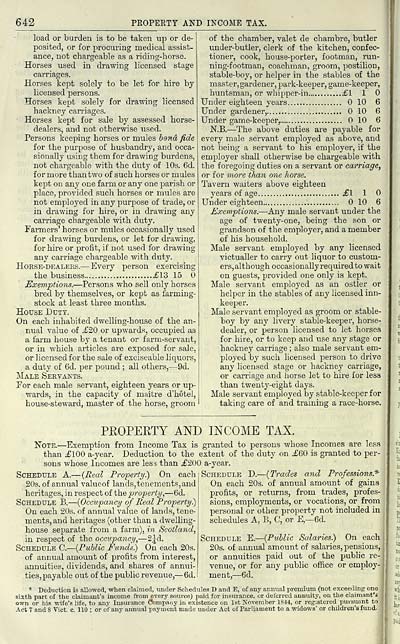

PROPERTY AND INCOME TAX.

load or burden is to be taken up or de-

posited, or for procuring medical assist-

ance, not chargeable as a riding-horse.

Horses used in drawing licensed stage

carriages.

Horses kept solely to be let for hire by

licensed persons.

Horses kept solely for drawing licensed

hackney carriages.

Horses kept for sale by assessed horse-

dealers, and not otherwise used.

Persons keeping horses or mules bond fide

for the purpose of husbandry, and occa-

sionally using them for drawing burdens,

not chargeable with the duty of 10s. 6d.

for more than two of such horses or mules

kept on any one farm or any one parish or

place, provided such horses or mules are

not employed in any purpose of trade, or

in drawing for hire, or in drawing any

carriage chargeable with duty.

Farmers' horses or mules occasionally used

for drawing burdens, or let for drawing,

for hire or profit, if not used for drawing

any carriage chargeable with duty.

HoRSE-DEALEKS.- — Every person exercising

the business £13 15

Exemptions. — Persons who sell only horses

bred by themselves, or kept as farming-

stock at least three months.

House Duty.

On each inhabited dwelling-house of the an-

nual value of .£20 or upwards, occupied as

a farm house by a tenant or farm-servant,

or in which articles are exposed for sale,

or licensed for the sale of exciseable liquors,

a duty of 6d. per pound ; all others, — 9d.

Male Servants.

For each male servant, eighteen years or up-

wards, in the capacity of maitre d'hotel,

house-steward, master of the horse, groom

of the chamber, valet de chambre, butler

under-butler, clerk of the kitchen, confec-

tioner, cook, house-porter, footman, run-

ning-footman, coachman, groom, postilion,

stable-boy, or helper in the stables of the

master, gardener, park-keeper, game-keeper,

huntsman, or whipper-in £1 1

Under eighteen years 10 6

Under gardener, 10 6

Under game-keeper, 10 6

N.B. — The above duties are payable for

every male servant employed as above, and

not being a servant to his employer, if the

employer shall otherwise be chargeable with

the foregoing duties on a servant or carriage,

or for more than one horse.

Tavern waiters above eighteen

years of age £1 1

Under eighteen 10 6

Exemptions. — Any male servant under the

age of twenty-one, being the son or

grandson of the employer, and a member

of his household.

Male servant employed by any licensed

victualler to carry out liquor to custom-

ers, although occasionally required to wait

on guests, provided one only is kept.

Male servant employed as an ostler or

helper in the stables of any licensed inn-

keeper.

Male servant employed as groom or stable-

boy by any livery stable-keeper, horse-

dealer, or person licensed to let horses

for hire, or to keep and use any stage or

hackney carriage ; also male servant em-

ployed by such licensed person to drive

any licensed stage or hackney carriage,

or carriage and horse let to hire for less

than twenty-eight days.

Male servant employed by stable-keeper for

taking care of and training a race-horse.

PROPERTY AND INCOME TAX.

Note. — Exemption from Income Tax is granted to persons whose Incomes are less

than £100 a-year. Deduction to the extent of the duty on £60 is granted to per-

sons whose Incomes are less than £200 a-year.

Schedule D. — {Trades and Professions.'^

On each 20s. of annual amount of gains

profits, or returns, from trades, profes-

sions, employments, or vocations, or from

personal or other property not included in

schedules A, B, C, or E, — 6d.

Schedule E. — {Public Salaries.) On each

20s. of annual amount of salaries, pensions,

or annuities paid out of the public re-

venue, or for any public office or employ-

ment, — 6d.

* Deduction is allowed, when claimed, under Schedules D and E, of any annual premium (not exceeding one

sixth part of the claimant's income from every source) paid for insurance, or deferred annuity, on the claimant's

own or his wife's life, to any Insurance Company in existence on 1st November 1S44, or registered pursuant to

Act 7 and 8 Vict. c. 110 ; or of any annual payment made uuder Act of Parliament to a widows' or children's fund.

Schedule A. — {Real Property) On each

20s. of annual valueof lands, tenements, and

heritages, in respect of the property, — 6d.

Schedule B. — {Occupancy of Real Property)

On each 20s. of annual value of lands, tene-

ments, and heritages (other than a dwelling-

house separate from a farm), in Scotland,

in respect of the occupancy, — 2^d.

Schedule C. — {Public Eunds) On each 20s.

of annual amount of profits from interest,

annuities, dividends, and shares of annui-

ties, payable out of the public revenue, — 6d.

PROPERTY AND INCOME TAX.

load or burden is to be taken up or de-

posited, or for procuring medical assist-

ance, not chargeable as a riding-horse.

Horses used in drawing licensed stage

carriages.

Horses kept solely to be let for hire by

licensed persons.

Horses kept solely for drawing licensed

hackney carriages.

Horses kept for sale by assessed horse-

dealers, and not otherwise used.

Persons keeping horses or mules bond fide

for the purpose of husbandry, and occa-

sionally using them for drawing burdens,

not chargeable with the duty of 10s. 6d.

for more than two of such horses or mules

kept on any one farm or any one parish or

place, provided such horses or mules are

not employed in any purpose of trade, or

in drawing for hire, or in drawing any

carriage chargeable with duty.

Farmers' horses or mules occasionally used

for drawing burdens, or let for drawing,

for hire or profit, if not used for drawing

any carriage chargeable with duty.

HoRSE-DEALEKS.- — Every person exercising

the business £13 15

Exemptions. — Persons who sell only horses

bred by themselves, or kept as farming-

stock at least three months.

House Duty.

On each inhabited dwelling-house of the an-

nual value of .£20 or upwards, occupied as

a farm house by a tenant or farm-servant,

or in which articles are exposed for sale,

or licensed for the sale of exciseable liquors,

a duty of 6d. per pound ; all others, — 9d.

Male Servants.

For each male servant, eighteen years or up-

wards, in the capacity of maitre d'hotel,

house-steward, master of the horse, groom

of the chamber, valet de chambre, butler

under-butler, clerk of the kitchen, confec-

tioner, cook, house-porter, footman, run-

ning-footman, coachman, groom, postilion,

stable-boy, or helper in the stables of the

master, gardener, park-keeper, game-keeper,

huntsman, or whipper-in £1 1

Under eighteen years 10 6

Under gardener, 10 6

Under game-keeper, 10 6

N.B. — The above duties are payable for

every male servant employed as above, and

not being a servant to his employer, if the

employer shall otherwise be chargeable with

the foregoing duties on a servant or carriage,

or for more than one horse.

Tavern waiters above eighteen

years of age £1 1

Under eighteen 10 6

Exemptions. — Any male servant under the

age of twenty-one, being the son or

grandson of the employer, and a member

of his household.

Male servant employed by any licensed

victualler to carry out liquor to custom-

ers, although occasionally required to wait

on guests, provided one only is kept.

Male servant employed as an ostler or

helper in the stables of any licensed inn-

keeper.

Male servant employed as groom or stable-

boy by any livery stable-keeper, horse-

dealer, or person licensed to let horses

for hire, or to keep and use any stage or

hackney carriage ; also male servant em-

ployed by such licensed person to drive

any licensed stage or hackney carriage,

or carriage and horse let to hire for less

than twenty-eight days.

Male servant employed by stable-keeper for

taking care of and training a race-horse.

PROPERTY AND INCOME TAX.

Note. — Exemption from Income Tax is granted to persons whose Incomes are less

than £100 a-year. Deduction to the extent of the duty on £60 is granted to per-

sons whose Incomes are less than £200 a-year.

Schedule D. — {Trades and Professions.'^

On each 20s. of annual amount of gains

profits, or returns, from trades, profes-

sions, employments, or vocations, or from

personal or other property not included in

schedules A, B, C, or E, — 6d.

Schedule E. — {Public Salaries.) On each

20s. of annual amount of salaries, pensions,

or annuities paid out of the public re-

venue, or for any public office or employ-

ment, — 6d.

* Deduction is allowed, when claimed, under Schedules D and E, of any annual premium (not exceeding one

sixth part of the claimant's income from every source) paid for insurance, or deferred annuity, on the claimant's

own or his wife's life, to any Insurance Company in existence on 1st November 1S44, or registered pursuant to

Act 7 and 8 Vict. c. 110 ; or of any annual payment made uuder Act of Parliament to a widows' or children's fund.

Schedule A. — {Real Property) On each

20s. of annual valueof lands, tenements, and

heritages, in respect of the property, — 6d.

Schedule B. — {Occupancy of Real Property)

On each 20s. of annual value of lands, tene-

ments, and heritages (other than a dwelling-

house separate from a farm), in Scotland,

in respect of the occupancy, — 2^d.

Schedule C. — {Public Eunds) On each 20s.

of annual amount of profits from interest,

annuities, dividends, and shares of annui-

ties, payable out of the public revenue, — 6d.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > New Edinburgh, Leith, and county (business) directory > 1869-1870 > (704) |

|---|

| Permanent URL | https://digital.nls.uk/85133760 |

|---|

| Description | New Edinburgh, Leith, and county directory. 1869-70. ... |

|---|---|

| Attribution and copyright: |

|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|