Towns > Edinburgh > 1867-1870 - New Edinburgh, Leith, and county (business) directory > 1869-1870

(700)

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

638

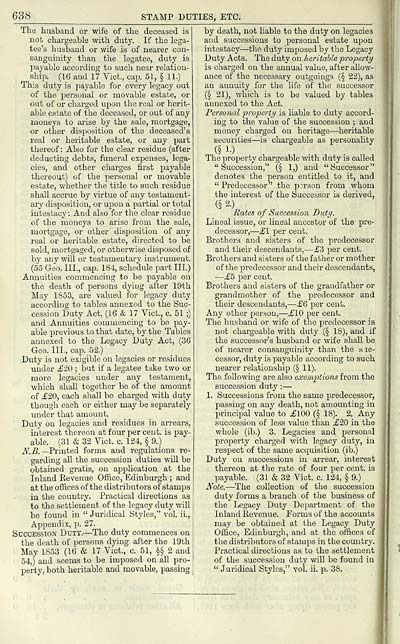

STAMP DUTIES, ETC.

The husband or wife of the deceased is

not chargeable with duty. If the lega-

tee's husband or wife is of nearer con-

sanguinity than the legatee, duty is

payable according to such near relation-

ship. (16 and 17 Vict., cap. 61, § 11.)

This duty is payable for every legacy out

of the personal or movable estate, or

out of or charged upon the real or herit-

able estate of the deceased, or out of any

moneys to arise by the sale, mortgage,

or other disposition of the deceased's

real or heritable estate, or any part

thereof : Also for the clear residue (after

deducting debts, funeral expenses, lega-

cies, and other charges first payable

thereout) of the personal or naovable

estate, whether the title to such residue

shall accrue by virtue of any testament-

ary disposition, or upon a partial or total

intestacy: And also for the clear residue

of the moneys to arise from the sale,

mortgage, or other disposition of any

real or heritable estate, directed to be

sold, mortgaged, or otherwise disposed of

by any will or testamentary instrument.

(55 Geo. III., cap. 184, schedule part III.)

Annuities commencing to be payable on

the death of persons dying after 19th

May 1853, are valued for legacy duty

according to tables annexed to the Suc-

cession Duty Act, (16 & 17 Vict., c. 51 ;)

and Annuities commencing to be pay-

able previous to that date, by the Tables

annexed to the Legacy Duty Act, (36

Geo. III., cap. 52.)

Duty is not exigible on legacies or residues

under £-20 ; but if a legatee take two or

more legacies under any testament,

which shall together be of the amount

of i/'20, each shall be charged with duty

though each or either may be separately

under that amount.

Duty on legacies and residues in arrears,

interest thereon at four per cent, is pay-

able. (31 & 32 Vict. c. 124, § 9.)

iV.^. —Printed forms and regulations re-

garding all the succession duties will be

obtained gratis, on application at the

Inland Eevenue Office, Edinburgh ; and

at the offices of the distributors of stamps

in the country. Practical directions as

to the settlement of the legacy duty will

be found in " Juridical Styles," vol. ii.,

Appendix, p. 27.

Succession Duty. — The duty commences on

the death of persons dying after the 19th

May 1853 (16 & 17 Vict., c. 51, §§ 2 and

54,) and seems to be imposed on all pro-

perty, both heritable and movable, passing

by death, not liable to the duty on legacies

and successions to personal estate upon

intestacy — the duty imposed by the Legacy

Duty Acts. The duty on heritable 'property

is charged on the annual value, after allow-

ance of the necessary outgoings (§ 22), as

an annuity for the life of the successor

(§ 21), which is to be valued by tables

annexed to the Act.

Personal property is liable to duty accord-

ing to the value of the succession ; and

money charged on heritage — heritable

securities — is chargeable as personality

(§ 1-)

The property chargeable with duty is called

"Succession," (§ 1,) and "Successor"

denotes the person entitled to it, and

" Predecessor" the psrson from whom

the interest of the Successor is derived,

(§2.)

Rates of Succession Duty.

Lineal issue, or lineal ancestor of the pre-

decessor, — £l per cent.

Brothers and sisters of the predecessor

and their descendants, — £3 per cent.

Brothers and sisters of the father or mother

of the predecessor and their descendants,

— £f> per cent.

Brothers and sisters of the grandfather or

grandmother of the predecessor and

their descendants, — £Q per cent.

Any other person, — iJlO per cent.

The husband or wife of the predecessor is

not chargeable with duty (§ 18), and if

the successor's husband or wife shall be

of nearer consanguinity than the s ac-

cessor, duty is payable according to such

nearer relationship (§ 11).

The following are also exemptions from the

succession duty : —

1. Successions from the same predecessor,

passing on any death, not amounting in

principal value to i-'lOO (§ 18). 2. Any

succession of less value than £20 in the

whole (ib.) 3. Legacies and personal

property charged with legacy duty, in

respect of the same acquisition (ib.)

Duty on successions in arrear, interest

thereon at the rate of four per cent, is

payable. (31 & 32 Vict. c. 124, § 9.)

Note. — The collection of the succession

duty forms a branch of the business of

the Legacy Duty Department of the

Inland Eevenue. Forms of the accounts

may be obtained at the Legacy Duty

Office, Edinburgh, and at the offices of

the distributors of stamps in the country.

Practical directions as to the settlement

of the succession duty will be found in

" Juridical Styles," vol. ii. p. 38.

STAMP DUTIES, ETC.

The husband or wife of the deceased is

not chargeable with duty. If the lega-

tee's husband or wife is of nearer con-

sanguinity than the legatee, duty is

payable according to such near relation-

ship. (16 and 17 Vict., cap. 61, § 11.)

This duty is payable for every legacy out

of the personal or movable estate, or

out of or charged upon the real or herit-

able estate of the deceased, or out of any

moneys to arise by the sale, mortgage,

or other disposition of the deceased's

real or heritable estate, or any part

thereof : Also for the clear residue (after

deducting debts, funeral expenses, lega-

cies, and other charges first payable

thereout) of the personal or naovable

estate, whether the title to such residue

shall accrue by virtue of any testament-

ary disposition, or upon a partial or total

intestacy: And also for the clear residue

of the moneys to arise from the sale,

mortgage, or other disposition of any

real or heritable estate, directed to be

sold, mortgaged, or otherwise disposed of

by any will or testamentary instrument.

(55 Geo. III., cap. 184, schedule part III.)

Annuities commencing to be payable on

the death of persons dying after 19th

May 1853, are valued for legacy duty

according to tables annexed to the Suc-

cession Duty Act, (16 & 17 Vict., c. 51 ;)

and Annuities commencing to be pay-

able previous to that date, by the Tables

annexed to the Legacy Duty Act, (36

Geo. III., cap. 52.)

Duty is not exigible on legacies or residues

under £-20 ; but if a legatee take two or

more legacies under any testament,

which shall together be of the amount

of i/'20, each shall be charged with duty

though each or either may be separately

under that amount.

Duty on legacies and residues in arrears,

interest thereon at four per cent, is pay-

able. (31 & 32 Vict. c. 124, § 9.)

iV.^. —Printed forms and regulations re-

garding all the succession duties will be

obtained gratis, on application at the

Inland Eevenue Office, Edinburgh ; and

at the offices of the distributors of stamps

in the country. Practical directions as

to the settlement of the legacy duty will

be found in " Juridical Styles," vol. ii.,

Appendix, p. 27.

Succession Duty. — The duty commences on

the death of persons dying after the 19th

May 1853 (16 & 17 Vict., c. 51, §§ 2 and

54,) and seems to be imposed on all pro-

perty, both heritable and movable, passing

by death, not liable to the duty on legacies

and successions to personal estate upon

intestacy — the duty imposed by the Legacy

Duty Acts. The duty on heritable 'property

is charged on the annual value, after allow-

ance of the necessary outgoings (§ 22), as

an annuity for the life of the successor

(§ 21), which is to be valued by tables

annexed to the Act.

Personal property is liable to duty accord-

ing to the value of the succession ; and

money charged on heritage — heritable

securities — is chargeable as personality

(§ 1-)

The property chargeable with duty is called

"Succession," (§ 1,) and "Successor"

denotes the person entitled to it, and

" Predecessor" the psrson from whom

the interest of the Successor is derived,

(§2.)

Rates of Succession Duty.

Lineal issue, or lineal ancestor of the pre-

decessor, — £l per cent.

Brothers and sisters of the predecessor

and their descendants, — £3 per cent.

Brothers and sisters of the father or mother

of the predecessor and their descendants,

— £f> per cent.

Brothers and sisters of the grandfather or

grandmother of the predecessor and

their descendants, — £Q per cent.

Any other person, — iJlO per cent.

The husband or wife of the predecessor is

not chargeable with duty (§ 18), and if

the successor's husband or wife shall be

of nearer consanguinity than the s ac-

cessor, duty is payable according to such

nearer relationship (§ 11).

The following are also exemptions from the

succession duty : —

1. Successions from the same predecessor,

passing on any death, not amounting in

principal value to i-'lOO (§ 18). 2. Any

succession of less value than £20 in the

whole (ib.) 3. Legacies and personal

property charged with legacy duty, in

respect of the same acquisition (ib.)

Duty on successions in arrear, interest

thereon at the rate of four per cent, is

payable. (31 & 32 Vict. c. 124, § 9.)

Note. — The collection of the succession

duty forms a branch of the business of

the Legacy Duty Department of the

Inland Eevenue. Forms of the accounts

may be obtained at the Legacy Duty

Office, Edinburgh, and at the offices of

the distributors of stamps in the country.

Practical directions as to the settlement

of the succession duty will be found in

" Juridical Styles," vol. ii. p. 38.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > New Edinburgh, Leith, and county (business) directory > 1869-1870 > (700) |

|---|

| Permanent URL | https://digital.nls.uk/85133712 |

|---|

| Description | New Edinburgh, Leith, and county directory. 1869-70. ... |

|---|---|

| Attribution and copyright: |

|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|