Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

ASSESSED TAXES.

47

sented, along with, the instrument, at

the Solicitor's Office, No. 5, Inland Ee-

venue, between 10 and 12 o'clock, on

Mondays and Wednesdays only. The

amount of duty wished to be impressed

on the instrument is to be inserted by

the applicant before being presented at

the Solicitor's Office ; and afterwards he

pays it, and the penalty, if any, to the

cashier. No. 3, Lobby. As to stamping

Agreements and Charter Parties, see

Notes under these beads.

DOUBTS AS TO THE SUFFICIENCY OF STAMPS MAY BE REMOVED.

The opinion of the Commissioners of Inland

Revenue as to the duty to which a deed,

whether previously stamped or otherwise,

is chargeable, may be obtained on the deed

being presented at their office (Edinburgh)

and a fee of 10s. paid. The duty or insuffi-

cient duty which the Commissioners may

assess, and the penalty, if any, being paid,

they shall stamp the deed with the duty so

paid, and thereupon, and also in the case

of the deed being previously sufficiently

stamped, shall also impress the deed with a

particular stamp to be provided for the pur-

pose. The deed shall then be received in

evidence notwithstanding any objection to

it as insufficiently stamped. The provision

does not apply to bonds or mortgages

for unlimited amounts, nor instruments

after being signed, prohibited from being

stamped. The opinion of the Commis-

sioners may be appealed against to the

Court of Exchequer at Westminster, on

the Stamp duties assessed being paid, and

40s. for costs being deposited. (13 and 14

Vict. c. 97, § 14 and 15). The Commis-

sioners may also adjudge on deeds not

liable to any stamp duty ; and if any duty

is assessed the party may appeaL (16 and

17 Vict. c. 59, § 13).

N.B. — Instruments are received for adjudica-

tion at the Solicitor's Office, Inland Re-

venue, Edinburgh, on the same conditions

as to duty and penalty as instruments to

be stamped merely {see above). The mode

of proceeding is as follows : — The sum of

ten shillings for the adjudication stamp is

first to be paid to the Cashier, No. 3,

Lobby. Then the schedule (the duty to

be impressed of course not being inserted

in the schedule), the instrument after ex-

ecution, and a full copy (written on fools-

cap paper) of it (omitting the bounding

description of lands, &c., and having

appended to it a table giving the substance

of the clauses and provisions, particularly

dates and sums, and a reference to the

page of the copy on which each com-

mences), are to be left at the Solicitor's

Office, No. 5, on Mondays and Wednesdays,

between 10 and 12 o'clock onl^. Between

10 and 12 o'clock on the Thursday follow-

ing, a party, who can give explanation,

must call on the chief clerk of the Solici-

tor's Department, No. 6 ; and he should be

prepared to pay the proper duty, and

penalty, if any, to the Cashier, No. 3,

Lobby.

DUPLICATES OR COUNTERPARTS.

Duplicates or counterparts of instruments

requiring to be impressed with the denot-

ing stamp to render them valid, may be

lodged at the Solicitor's Office, No 5, In-

land Revenue, Edinburgh, between 10 and

12 o'clock on Mondays and Wednesdays

only. A transmission of them is made

once a-week to the Head Office. The

principal instrument, as well as the dupli-

cate must be lodged, and both must

appear to be properly stamped, otherwise

they wUl not be transmitted.

. — The revenue takes no risk of loss or

injury connected with the custody or car-

riage of the instruments received and

transmitted to be stamped.

ASSESSED TAXES.

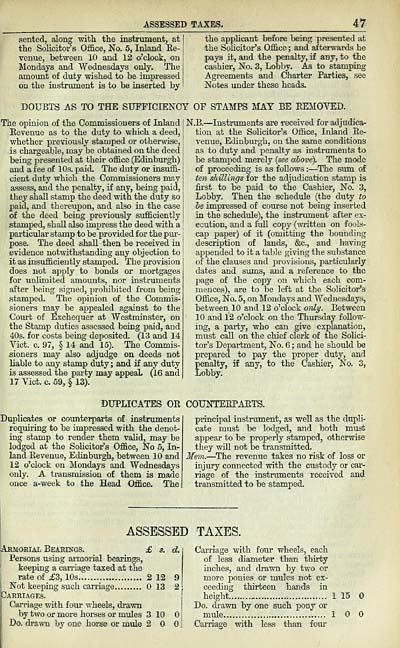

Armorial Bearings. £ s. d.

Persons using armorial bearings,

keeping a carriage taxed at the

rate of £3, 10s 2 12 9

Not keeping such carriage 13 2

Carriages.

Carriage with four wheels, drawn

by two or more horses or mules 3 10

Do. drawn by one horse or mule 2 j

Carriage with four wheels, each

of less diameter than thirty

inches, and drawn by two or

more ponies or mules not ex-

ceeding thirteen bands in

height 1 15

Do. drawn by one such pony or

mule 10

Carriage with less than four

47

sented, along with, the instrument, at

the Solicitor's Office, No. 5, Inland Ee-

venue, between 10 and 12 o'clock, on

Mondays and Wednesdays only. The

amount of duty wished to be impressed

on the instrument is to be inserted by

the applicant before being presented at

the Solicitor's Office ; and afterwards he

pays it, and the penalty, if any, to the

cashier. No. 3, Lobby. As to stamping

Agreements and Charter Parties, see

Notes under these beads.

DOUBTS AS TO THE SUFFICIENCY OF STAMPS MAY BE REMOVED.

The opinion of the Commissioners of Inland

Revenue as to the duty to which a deed,

whether previously stamped or otherwise,

is chargeable, may be obtained on the deed

being presented at their office (Edinburgh)

and a fee of 10s. paid. The duty or insuffi-

cient duty which the Commissioners may

assess, and the penalty, if any, being paid,

they shall stamp the deed with the duty so

paid, and thereupon, and also in the case

of the deed being previously sufficiently

stamped, shall also impress the deed with a

particular stamp to be provided for the pur-

pose. The deed shall then be received in

evidence notwithstanding any objection to

it as insufficiently stamped. The provision

does not apply to bonds or mortgages

for unlimited amounts, nor instruments

after being signed, prohibited from being

stamped. The opinion of the Commis-

sioners may be appealed against to the

Court of Exchequer at Westminster, on

the Stamp duties assessed being paid, and

40s. for costs being deposited. (13 and 14

Vict. c. 97, § 14 and 15). The Commis-

sioners may also adjudge on deeds not

liable to any stamp duty ; and if any duty

is assessed the party may appeaL (16 and

17 Vict. c. 59, § 13).

N.B. — Instruments are received for adjudica-

tion at the Solicitor's Office, Inland Re-

venue, Edinburgh, on the same conditions

as to duty and penalty as instruments to

be stamped merely {see above). The mode

of proceeding is as follows : — The sum of

ten shillings for the adjudication stamp is

first to be paid to the Cashier, No. 3,

Lobby. Then the schedule (the duty to

be impressed of course not being inserted

in the schedule), the instrument after ex-

ecution, and a full copy (written on fools-

cap paper) of it (omitting the bounding

description of lands, &c., and having

appended to it a table giving the substance

of the clauses and provisions, particularly

dates and sums, and a reference to the

page of the copy on which each com-

mences), are to be left at the Solicitor's

Office, No. 5, on Mondays and Wednesdays,

between 10 and 12 o'clock onl^. Between

10 and 12 o'clock on the Thursday follow-

ing, a party, who can give explanation,

must call on the chief clerk of the Solici-

tor's Department, No. 6 ; and he should be

prepared to pay the proper duty, and

penalty, if any, to the Cashier, No. 3,

Lobby.

DUPLICATES OR COUNTERPARTS.

Duplicates or counterparts of instruments

requiring to be impressed with the denot-

ing stamp to render them valid, may be

lodged at the Solicitor's Office, No 5, In-

land Revenue, Edinburgh, between 10 and

12 o'clock on Mondays and Wednesdays

only. A transmission of them is made

once a-week to the Head Office. The

principal instrument, as well as the dupli-

cate must be lodged, and both must

appear to be properly stamped, otherwise

they wUl not be transmitted.

. — The revenue takes no risk of loss or

injury connected with the custody or car-

riage of the instruments received and

transmitted to be stamped.

ASSESSED TAXES.

Armorial Bearings. £ s. d.

Persons using armorial bearings,

keeping a carriage taxed at the

rate of £3, 10s 2 12 9

Not keeping such carriage 13 2

Carriages.

Carriage with four wheels, drawn

by two or more horses or mules 3 10

Do. drawn by one horse or mule 2 j

Carriage with four wheels, each

of less diameter than thirty

inches, and drawn by two or

more ponies or mules not ex-

ceeding thirteen bands in

height 1 15

Do. drawn by one such pony or

mule 10

Carriage with less than four

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1860-1861 > (53) |

|---|

| Permanent URL | https://digital.nls.uk/84932023 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|