Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

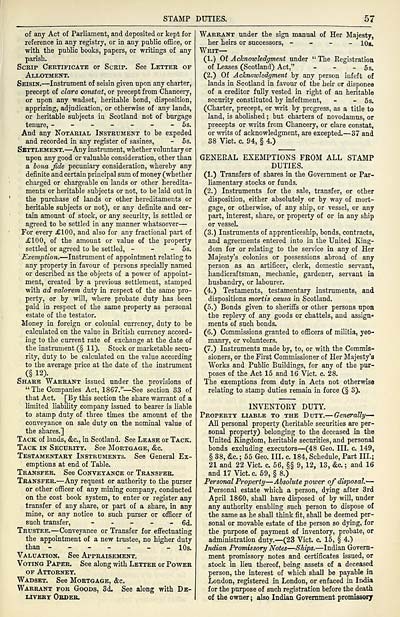

STAMP DUTIES.

57

of any Act of Parliament, and deposited or kept for

reference in any registry, or in any public office, or

with the public books, papers, or writings of any

parish.

ScEip Cbetificate or Sceip. See Letter of

Allotment.

Seisin. — Instrument of seisin given upon any charter,

precept of dare constat, or precept from Chancery,

or upon any wadset, heritable bond, disposition,

apprizing, adjudication, or otherwise of any lands,

or heritable subjects in Scotland not of burgage

tenure, ------- 6s.

And any Notakial Instrument to be expeded

and recorded in any register of sasines, - 6s.

Settlement. — Any instrument, whether voluntary or

upon any good or valuable consideration, other than

a bona jide pecuniary consideration, whereby any

definite and certain principal sum of money (whether

charged or chargeable on lands or other heredita-

ments or heritable subjects or not, to be laid out in

the purchase of lands or other hereditaments or

heritable subjects or not), or any definite and cer-

tain amount of stock, or any security, is settled or

agreed to be settled in any manner whatsoever —

For every jEIOO, and also for any fractional part of

£100, of the amount or value of the property

settled or agreed to be settled, - - - 6s.

Exemption. — Instrument of appointment relating to

any property in favour of persons specially named

or described as the objects of a power of appoint-

ment, created by a previous settlement, stamped

with ad valorem duty in respect of the same pro-

perty, or by will, where probate duty has been

paid in respect of the same property as personal

estate of the testator.

Money in foreign or colonial currency, duty to be

calculated on the value in British currency accord-

ing to the current rate of exchange at the date of

the instrument (§ 11). Stock or marketable secu-

rity, duty to be calculated on the value according

to the average price at the date of the instrument

(§ 12).

Shark Warrant issued under the provisions of

" The Companies Act, 1867." — See section 83 of

that Act, [By this section the share warrant of a

limited liability company issued to bearer is liable

to stamp duty of three times the amount of the

conveyance on sale duty on the nominal value of

the shares.]

Tack of lands, &c., in Scotland. See Lease or Tack.

Tack in Security. See Mortgage, &c.

Testamentary Instruments. See General Ex-

emptions at end of Table.

Transfer. See Conveyance or Transfer.

Transfer. — Any request or authority to the purser

or other officer of any mining company, conducted

on the cost book system, to enter or register any

transfer of any share, or part of a share, in any

mine, or any notice to such purser or officer of

such transfer, - - - - - 6d.

Trustee. — Conveyance or Transfer for efiectuating

the appointment of a new trastee, no higher duty

than ----___ lOs.

Valuation. See Appraisement.

Voting Paper. See along with Letter or Power

OF Attorney.

Wadset. See Mortgage, &c.

Warrant for Goods, 3d. See along with De-

LIVEEY OBDEB.

Warrant under the sign manual of Her Majesty,

her heirs or successors, - - - - lOg.

Writ —

(1.) Of Acknowledgment under " The Eegistratioa

of Leases (Scotland) Act," - - - 5s.

(2.) Of Aclcnowlsdgment by any person infeft of

lands in Scotland in favour of the heir or disponee

of a creditor fully vested in right of an heritable

security constituted by infeftment, - - 5s.

(Charter, precept, or writ by progress, as a title to

land, is abolished ; but charters of novodamus, or

precepts or writs from Chancery, or clare constat,

or writs of acknowledgment, are excepted. — 37 and

38 Vict. c. 94, § 4.)

GENERAL EXEMPTIONS FROM ALL STAMP

DUTIES.

(1.) Transfers of shares in the Government or Par-

liamentary stocks or funds.

(2.) Instruments for the sale, transfer, or other

disposition, either absolutely or by way of mort-

gage, or otherwise, of any ship, or vessel, or any

part, interest, share, or property of or in any ship

or vessel.

(3.) Instruments of apprenticeship, bonds, contracts,

and agreements entered into in the United King-

dom for or relating to the service in any of Her

Majesty's colonies or possessions abroad of any

person as an artificer, clerk, domestic servant,

handicraftsman, mechanic, gardener, servant in

husbandry, or labourer.

(4.) Testaments, testamentary instruments, and

dispositions mortis causa in Scotland.

(5.) Bonds given to sherifis or other persons upon

the replevy of any goods or chattels, and assign*

ments of such bonds.

(6.) Commissions granted to officers of militia, yeo-

manry, or volunteers.

(7.) Instruments made by, to, or with the Commis-

sioners, or the First Commissioner of Her Majesty's

Works and Public Buildings, for any of the pur-

poses of the Act 15 and 16 Vict. c. 28.

The exemptions from duty in Acts not otherwise

relating to stamp duties remain in force (§ 3).

INVENTORY DUTY.

Property liable to the Duty. — Genially —

AU personal property (heritable securities are per-

sonal property) belonging to the deceased in the

United Kingdom, heritable securities, and personal

bonds excluding executors — (48 Geo. III. c. 149,

§ 38, &c. ; 55 Geo. III. c. 184, Schedule, Part III.;

21 and 22 Vict. c. 56, §§ 9, 12, 13, &c. ; and 16

and 17 Vict. c. 59, § 8.)

Personal Property — Absolute power of disposal.' —

Personal estate which a person, dying after 3rd

April 1860, shall have disposed of by will, under

any authority enabling such person to dispose of

the same as he shall think fit, shall be deemed per-

sonal or movable estate of the person so dying, for

the purpose of payment of inventory, probate, or

administration duty. — (23 Vict, c, 15, § 4.)

Indian Promissory Notes — Ships. — Indian Govern-

ment promissory notes and certificates issued, or

stock in lieu thereof, being assets of a deceased

person, the interest of which shaU be payable in

London, registered in London, or enfaced in India

for the purpose of such registration before the death

of the owner ; also Indian Government promissoiy

57

of any Act of Parliament, and deposited or kept for

reference in any registry, or in any public office, or

with the public books, papers, or writings of any

parish.

ScEip Cbetificate or Sceip. See Letter of

Allotment.

Seisin. — Instrument of seisin given upon any charter,

precept of dare constat, or precept from Chancery,

or upon any wadset, heritable bond, disposition,

apprizing, adjudication, or otherwise of any lands,

or heritable subjects in Scotland not of burgage

tenure, ------- 6s.

And any Notakial Instrument to be expeded

and recorded in any register of sasines, - 6s.

Settlement. — Any instrument, whether voluntary or

upon any good or valuable consideration, other than

a bona jide pecuniary consideration, whereby any

definite and certain principal sum of money (whether

charged or chargeable on lands or other heredita-

ments or heritable subjects or not, to be laid out in

the purchase of lands or other hereditaments or

heritable subjects or not), or any definite and cer-

tain amount of stock, or any security, is settled or

agreed to be settled in any manner whatsoever —

For every jEIOO, and also for any fractional part of

£100, of the amount or value of the property

settled or agreed to be settled, - - - 6s.

Exemption. — Instrument of appointment relating to

any property in favour of persons specially named

or described as the objects of a power of appoint-

ment, created by a previous settlement, stamped

with ad valorem duty in respect of the same pro-

perty, or by will, where probate duty has been

paid in respect of the same property as personal

estate of the testator.

Money in foreign or colonial currency, duty to be

calculated on the value in British currency accord-

ing to the current rate of exchange at the date of

the instrument (§ 11). Stock or marketable secu-

rity, duty to be calculated on the value according

to the average price at the date of the instrument

(§ 12).

Shark Warrant issued under the provisions of

" The Companies Act, 1867." — See section 83 of

that Act, [By this section the share warrant of a

limited liability company issued to bearer is liable

to stamp duty of three times the amount of the

conveyance on sale duty on the nominal value of

the shares.]

Tack of lands, &c., in Scotland. See Lease or Tack.

Tack in Security. See Mortgage, &c.

Testamentary Instruments. See General Ex-

emptions at end of Table.

Transfer. See Conveyance or Transfer.

Transfer. — Any request or authority to the purser

or other officer of any mining company, conducted

on the cost book system, to enter or register any

transfer of any share, or part of a share, in any

mine, or any notice to such purser or officer of

such transfer, - - - - - 6d.

Trustee. — Conveyance or Transfer for efiectuating

the appointment of a new trastee, no higher duty

than ----___ lOs.

Valuation. See Appraisement.

Voting Paper. See along with Letter or Power

OF Attorney.

Wadset. See Mortgage, &c.

Warrant for Goods, 3d. See along with De-

LIVEEY OBDEB.

Warrant under the sign manual of Her Majesty,

her heirs or successors, - - - - lOg.

Writ —

(1.) Of Acknowledgment under " The Eegistratioa

of Leases (Scotland) Act," - - - 5s.

(2.) Of Aclcnowlsdgment by any person infeft of

lands in Scotland in favour of the heir or disponee

of a creditor fully vested in right of an heritable

security constituted by infeftment, - - 5s.

(Charter, precept, or writ by progress, as a title to

land, is abolished ; but charters of novodamus, or

precepts or writs from Chancery, or clare constat,

or writs of acknowledgment, are excepted. — 37 and

38 Vict. c. 94, § 4.)

GENERAL EXEMPTIONS FROM ALL STAMP

DUTIES.

(1.) Transfers of shares in the Government or Par-

liamentary stocks or funds.

(2.) Instruments for the sale, transfer, or other

disposition, either absolutely or by way of mort-

gage, or otherwise, of any ship, or vessel, or any

part, interest, share, or property of or in any ship

or vessel.

(3.) Instruments of apprenticeship, bonds, contracts,

and agreements entered into in the United King-

dom for or relating to the service in any of Her

Majesty's colonies or possessions abroad of any

person as an artificer, clerk, domestic servant,

handicraftsman, mechanic, gardener, servant in

husbandry, or labourer.

(4.) Testaments, testamentary instruments, and

dispositions mortis causa in Scotland.

(5.) Bonds given to sherifis or other persons upon

the replevy of any goods or chattels, and assign*

ments of such bonds.

(6.) Commissions granted to officers of militia, yeo-

manry, or volunteers.

(7.) Instruments made by, to, or with the Commis-

sioners, or the First Commissioner of Her Majesty's

Works and Public Buildings, for any of the pur-

poses of the Act 15 and 16 Vict. c. 28.

The exemptions from duty in Acts not otherwise

relating to stamp duties remain in force (§ 3).

INVENTORY DUTY.

Property liable to the Duty. — Genially —

AU personal property (heritable securities are per-

sonal property) belonging to the deceased in the

United Kingdom, heritable securities, and personal

bonds excluding executors — (48 Geo. III. c. 149,

§ 38, &c. ; 55 Geo. III. c. 184, Schedule, Part III.;

21 and 22 Vict. c. 56, §§ 9, 12, 13, &c. ; and 16

and 17 Vict. c. 59, § 8.)

Personal Property — Absolute power of disposal.' —

Personal estate which a person, dying after 3rd

April 1860, shall have disposed of by will, under

any authority enabling such person to dispose of

the same as he shall think fit, shall be deemed per-

sonal or movable estate of the person so dying, for

the purpose of payment of inventory, probate, or

administration duty. — (23 Vict, c, 15, § 4.)

Indian Promissory Notes — Ships. — Indian Govern-

ment promissory notes and certificates issued, or

stock in lieu thereof, being assets of a deceased

person, the interest of which shaU be payable in

London, registered in London, or enfaced in India

for the purpose of such registration before the death

of the owner ; also Indian Government promissoiy

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1889-1890 > (71) |

|---|

| Permanent URL | https://digital.nls.uk/84623188 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|