Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

66

STAMP DITTIES.

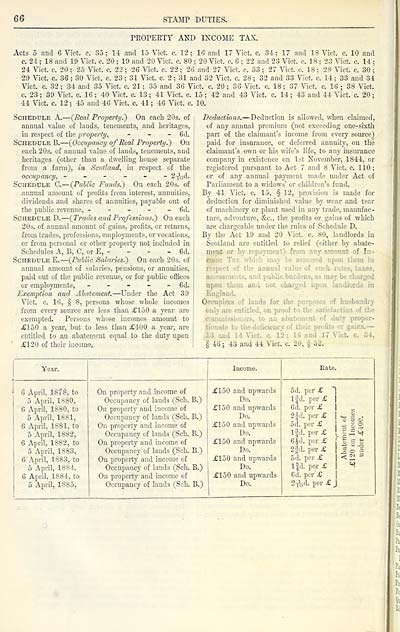

PROPERTY AND INCOME TAX.

Acts 5 and 6 Vict. c. 35; 14 and 15 Vict, c. 12; 16 and 17 Vict. c. 34; 17 and 18 Vict. c. 10 and

c. 24 ; 18 and 19 Vict, c. 20 ; 19 and 20 Vict. c. 80 ; 20 Vict. c. 6 ; 22 and 23 Vict. c. 18 ; 23 Vict. c. 14 ;

24 Vict. c. 20 ; 25 Vict. c. 22 ; 26 Vict. c. 22 ; 26 and 27 Vict, c. 33 ; 27 Vict. c. 18 ; 28 Vict. c. 30 ;

29 Vict. c. 36 ; 30 Vict. c. 23 ; 31 Vict, c. 2 ; 31 and 32 Vict. c. 28 ; 32 and 33 Vict. c. 14 ; 33 and 34

Vict. c. 32 ; 34 and 35 Vict. c. 21 ; 35 and 36 Vict, c, 20 ; 36 Vict. c. 18 ; 37 Vict. c. 16 ; 38 Vict,

c. 23 ; 39 Vict. c. 16 ; 40 Vict. c. 13 ; 41 Vict. c. 15 ; 42 and 43 Vict. c. 14 ; 43 and 44 Vict, c 20 ;

44 Vict. c. 12 ; 45 and 46 Vict. c. 41 ; 46 Vict. c. 10.

Schedule A. — (Real Property.) On each 20s. of

annual value of lauds, tenements, and heritages,

in respect of the property, - 6d.

Schedule B. — (Occupancy of Real Property.) On

each 20s. of annual value of lands, tenemeuts, and

heritages (other than a dwelling house separate

from a farm), in Scotland, in respect of the

occupancy, ------ '2 -fed.

Schedule C. — (Public Funds.) On each 20s. of

annual amount of profits from interest, annuities,

dividends and shares of annuities, payable out of

the public revenue, - - - - - 6d.

Schedule D. — (Trades and Professions.) On each

20s. of annual amount of gains, profits, or returns,

from trades, professions, employments, or vocations,

or from personal or other property not included in

Schedules A, B, C, or E, - - - - 6d.

Schedule E. — (Public Salaries.) On each 20s. of

annual amount of salaries, pensions, or annuities,

paid out of the public revenue, or for public offices

or employments, - - - - - 6d.

Exemption and Abatement. — Under the Act 39

Vict. c. 16, § 8, persons whose whole incomes

from every source are less than £150 a year are

exempted. Persons whose incomes amount to

£150 a year, but to less than £400 a year, are

entitled to an abatement equal to the duty upon

' £120 of their inoome.

Deductions. — Deduction is allowed, when claimed,

of any annual premium (not exceeding one-sixth

part of the claimant's income from every source)

paid for insurance, or deferred annuity, on the

claimant's own or his wife's life, to any insurance

company in existence on 1st November, 1844, or

registered pursuant to Act 7 and 8 Vict. c. 110 ;

or of any annual payment made under Act of

Parliament to a widows' or children's fund.

By 41 Vict. c. 15, § 12, provision is made for

deduction for diminished value by wear and tear

of machinery or plant used in any trade, manufac-

ture, adventure, &c, the profits or gains of which

are chargeable under the rules of Schedule D.

By the Act 19 and 20 Vict, c. 80, landlords in

Scotland are entitled to relief (either by abate-

ment or by repa t) from any amount of In-

'. ■ ' i I upon them in

inual value of b . ■ . taxes,

;, and public bi

a and not charged ...

England.

Qccupiei ids lor ' bandry

Only are entitled, on proof to tbj ) of the

I dnty propor-

icieney of their profits or .gains. —

o. 12; 16 and- 17 Vict, c. 34,

§ 46 ; 43 and 44 Vict. c. 20, § 52.

Year.

Income.

Rate.

6" April, J878, to

On property and income of

£150 and upwards

5d. per £ ~)

5 April, 1880,

Occupancy of lands (Sch. B.)

Do.

l|d. per £ |

6 April, 1880, to

On property and income of

£150 and upwards

6d. per £ 1

OJ

5 April, 1881,

Occupancy of lands (Sch. B.)

Do.

24d. per £ j

6 April, 1881, to

On property and income of

£150 and upwards

5d. per £

tTP

5 April, 1882,

Occupancy of lands (Sch. B.)

Do.

lfd. per £ !

6 |d. per £ [

I* 9 '" 1

6 April, 1882, to

On property and income of

£150 and upwards

-S 8 ,2

5 April, 1883,

Occupancy of lands (Sch. B.)

Do.

2fd. per£ |

Jo |

6 April, 1883, to

On property and income of

£150 and upwards

5d. per £

5 April, 1884.

Occupancy of lands (Sch. B.)

Do.

lfd. per £ j

^

6 April, 1884, to

On property and income of

£150 and upwards

6d. per £

5 April, 18S5,

Occupancy of lands (Sch. B.)

Do.

2^0. per £ j

STAMP DITTIES.

PROPERTY AND INCOME TAX.

Acts 5 and 6 Vict. c. 35; 14 and 15 Vict, c. 12; 16 and 17 Vict. c. 34; 17 and 18 Vict. c. 10 and

c. 24 ; 18 and 19 Vict, c. 20 ; 19 and 20 Vict. c. 80 ; 20 Vict. c. 6 ; 22 and 23 Vict. c. 18 ; 23 Vict. c. 14 ;

24 Vict. c. 20 ; 25 Vict. c. 22 ; 26 Vict. c. 22 ; 26 and 27 Vict, c. 33 ; 27 Vict. c. 18 ; 28 Vict. c. 30 ;

29 Vict. c. 36 ; 30 Vict. c. 23 ; 31 Vict, c. 2 ; 31 and 32 Vict. c. 28 ; 32 and 33 Vict. c. 14 ; 33 and 34

Vict. c. 32 ; 34 and 35 Vict. c. 21 ; 35 and 36 Vict, c, 20 ; 36 Vict. c. 18 ; 37 Vict. c. 16 ; 38 Vict,

c. 23 ; 39 Vict. c. 16 ; 40 Vict. c. 13 ; 41 Vict. c. 15 ; 42 and 43 Vict. c. 14 ; 43 and 44 Vict, c 20 ;

44 Vict. c. 12 ; 45 and 46 Vict. c. 41 ; 46 Vict. c. 10.

Schedule A. — (Real Property.) On each 20s. of

annual value of lauds, tenements, and heritages,

in respect of the property, - 6d.

Schedule B. — (Occupancy of Real Property.) On

each 20s. of annual value of lands, tenemeuts, and

heritages (other than a dwelling house separate

from a farm), in Scotland, in respect of the

occupancy, ------ '2 -fed.

Schedule C. — (Public Funds.) On each 20s. of

annual amount of profits from interest, annuities,

dividends and shares of annuities, payable out of

the public revenue, - - - - - 6d.

Schedule D. — (Trades and Professions.) On each

20s. of annual amount of gains, profits, or returns,

from trades, professions, employments, or vocations,

or from personal or other property not included in

Schedules A, B, C, or E, - - - - 6d.

Schedule E. — (Public Salaries.) On each 20s. of

annual amount of salaries, pensions, or annuities,

paid out of the public revenue, or for public offices

or employments, - - - - - 6d.

Exemption and Abatement. — Under the Act 39

Vict. c. 16, § 8, persons whose whole incomes

from every source are less than £150 a year are

exempted. Persons whose incomes amount to

£150 a year, but to less than £400 a year, are

entitled to an abatement equal to the duty upon

' £120 of their inoome.

Deductions. — Deduction is allowed, when claimed,

of any annual premium (not exceeding one-sixth

part of the claimant's income from every source)

paid for insurance, or deferred annuity, on the

claimant's own or his wife's life, to any insurance

company in existence on 1st November, 1844, or

registered pursuant to Act 7 and 8 Vict. c. 110 ;

or of any annual payment made under Act of

Parliament to a widows' or children's fund.

By 41 Vict. c. 15, § 12, provision is made for

deduction for diminished value by wear and tear

of machinery or plant used in any trade, manufac-

ture, adventure, &c, the profits or gains of which

are chargeable under the rules of Schedule D.

By the Act 19 and 20 Vict, c. 80, landlords in

Scotland are entitled to relief (either by abate-

ment or by repa t) from any amount of In-

'. ■ ' i I upon them in

inual value of b . ■ . taxes,

;, and public bi

a and not charged ...

England.

Qccupiei ids lor ' bandry

Only are entitled, on proof to tbj ) of the

I dnty propor-

icieney of their profits or .gains. —

o. 12; 16 and- 17 Vict, c. 34,

§ 46 ; 43 and 44 Vict. c. 20, § 52.

Year.

Income.

Rate.

6" April, J878, to

On property and income of

£150 and upwards

5d. per £ ~)

5 April, 1880,

Occupancy of lands (Sch. B.)

Do.

l|d. per £ |

6 April, 1880, to

On property and income of

£150 and upwards

6d. per £ 1

OJ

5 April, 1881,

Occupancy of lands (Sch. B.)

Do.

24d. per £ j

6 April, 1881, to

On property and income of

£150 and upwards

5d. per £

tTP

5 April, 1882,

Occupancy of lands (Sch. B.)

Do.

lfd. per £ !

6 |d. per £ [

I* 9 '" 1

6 April, 1882, to

On property and income of

£150 and upwards

-S 8 ,2

5 April, 1883,

Occupancy of lands (Sch. B.)

Do.

2fd. per£ |

Jo |

6 April, 1883, to

On property and income of

£150 and upwards

5d. per £

5 April, 1884.

Occupancy of lands (Sch. B.)

Do.

lfd. per £ j

^

6 April, 1884, to

On property and income of

£150 and upwards

6d. per £

5 April, 18S5,

Occupancy of lands (Sch. B.)

Do.

2^0. per £ j

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1885-1886 > (86) |

|---|

| Permanent URL | https://digital.nls.uk/84567793 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|