Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

STAMP DUTIES.

41

the whole rents of that crop fall into the executry.

In addition, from and after 1st August, 1870, the

Acts 33 and 34 Vict. 1870, c. 35, would seem to

give the executor a proportion of the rents from

the term preceding the date of death to the date of

death. That Act would also seem to give a propor-

tion of the term's rents of quarries, minerals, and

houses, and also feu-duties current at the death.

The executor's right to house-rents would not there-

fore be to the half-year's rents current at death,

but to a proportion only to the date of death.

Modes in which Dutt may be Paid. — When

deceased domiciled in Scotland. — In the case of a

person dying domiciled in Scotland, having personal

property in Scotland, England, and Ireland, and also

heritable securities excluding executors, and personal

bonds excluding executors, duty in respect of the

whole may be paid on the inventory required to

be recorded in the Sheriif Court; or inventory

duty may be paid on the personal property situated

in Scotland, including heritable securities made

movable by the Act 31 and 32 Vict. c. 101, § 117,

and duty may be paid on a "special inventory " of

the heritable securities excluding executors and

personal bonds excluding executors, and probate or

administration may be obtained in England and

Ireland in respect of the personal estate in these

countries, and duty paid in respect of such on these

instruments.

When deceased domiciled furth of the United King-

dom. — In case of a person dying domiciled furth of

the United Kingdom leaving personal estate in

Scotland, England, and Ireland, an inventory must

be given up in Scotland, probate or administration

taken out in England and Ireland, and duty paid

on such in respect of the property in each country.

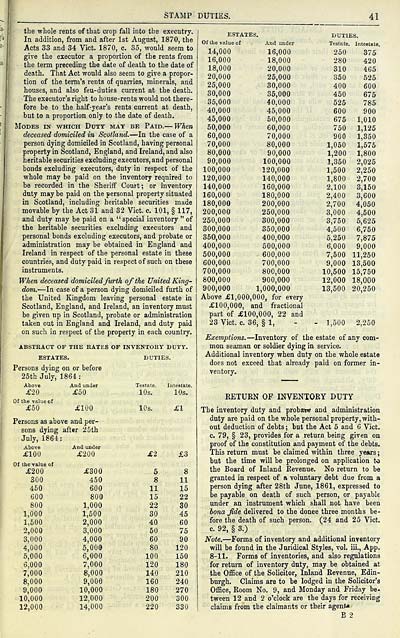

ABSTRACT OF THE KATES OF INVENTORY DUTY.

ESTATES. DUTIES.

Persons dying on or before

25th July,

1864:

Above

And under

Testate.

Intestate

£20

£50

lOs.

lOs.

Of the value of

£50

£100

lOs.

£1

Persons as above and per-

sons dying

after 25th

July, 1864

Above

And under

£100

£200

£2

£3

Of the value of

£200

£300

5

8

300

450

8

11

450

600

11

15

600

800

15

22

800

1,000

22

30

1,000

1,600

30

45

1,500

2,000

40

60

2,000

3,000

50

75

3,000

4,000

60

90

4,000

5,000

80

120

5,000

6,000

100

150

6,000

7,000

120

180

7,000

8,000

140

210

8,000

9,000

160

240

9,000

10,000

180

270

10,000

12,000

200

300

12,000

14,000

220

330

ESTATES.

DUTIES.

Ofthe value of

And under

Testate.

Intestate.

14,000

16,000

250

375

16,000

18,000

280

420

18,000

20,000

310

465

20,000

25,000

350

625

25,000

30,000

400

600

30,000

35,000

450

675

35,000

40,000

525

785

40,000

45,000

600

900

45,000

50,000

675

1,010

50,000

60,000

750

1,125

60,000

70,000

900

1,350

70,000

80,000

1,050

1,575

80,000

90,000

1,200

1,800

90,000

100,000

1,350

2,025

100,000

120,000

1,500

2,250

120,000

140,000

1,800

2,700

140,000

160,000

2,100

3,150

160,000

180,000

2,400

3,600

180,000

200,000

2,700

4,050

200,000

250,000

3,000

4,500

250,000

300,000

3,750

5,625

300,000

350,000

4,500

6,750

350,000

400,000

5,250

7,875

400,000

500,000

6,000

9,000

500,000

600,000

7,500

11,250

600,000

700,000

9,000

13,500

700,000

800,000

10,500

15,750

800,000

900,000

12,000

18,000

900,000

1,000,000

13,500

20,250

Above £1,000,000, for every

£100,000,

and fractional

part of £100,000, 22 and

23 Vict. c.

36, § 1,

- 1,500

2,250

Exemptions. — Inventory of the estate of any com-

mon seaman or soldier dying in service.

Additional inventory when duty on the whole estate

does not exceed that already paid on former in-

ventory.

RETURN OF INVENTORY DUTY

The inventory duty and probaw and administration

duty are paid on the whole personal property, with-

out deduction of debts ; but the Act 5 and Vict.

c. 79, § 23, provides for a return being given on

proof of the constitution and payment of the debts.

This return must be claimed within three years ;

but the time will be prolonged on application to

the Board of Inland Revenue. No return to be

granted in respect of a voluntary debt due from a

person dying after 28th June, 1861, expressed to

be payable on death of such person, or payable

under an instrument which shall not have been

bona fide delivered to the donee three months be-

fore the death of such person. (24 and 25 Vict.

c. 92, § 3.)

Note, — Forms of inventory and additional inventory

will be found in the Jaridical Styles, vol. iii., App.

8-11. Forms of inventories, and also regulations

for return of inventory duty, may be obtained at

the Office of the Solicitor, Inland Revenue, Edin-

burgh. Claims are to be lodged in the Solicitor's

Office, Room No. 9, and Monday and Friday be-

tween 12 and 2 o'clock are the days for receiving

claims from the claimants or their agen<«.

B 2

41

the whole rents of that crop fall into the executry.

In addition, from and after 1st August, 1870, the

Acts 33 and 34 Vict. 1870, c. 35, would seem to

give the executor a proportion of the rents from

the term preceding the date of death to the date of

death. That Act would also seem to give a propor-

tion of the term's rents of quarries, minerals, and

houses, and also feu-duties current at the death.

The executor's right to house-rents would not there-

fore be to the half-year's rents current at death,

but to a proportion only to the date of death.

Modes in which Dutt may be Paid. — When

deceased domiciled in Scotland. — In the case of a

person dying domiciled in Scotland, having personal

property in Scotland, England, and Ireland, and also

heritable securities excluding executors, and personal

bonds excluding executors, duty in respect of the

whole may be paid on the inventory required to

be recorded in the Sheriif Court; or inventory

duty may be paid on the personal property situated

in Scotland, including heritable securities made

movable by the Act 31 and 32 Vict. c. 101, § 117,

and duty may be paid on a "special inventory " of

the heritable securities excluding executors and

personal bonds excluding executors, and probate or

administration may be obtained in England and

Ireland in respect of the personal estate in these

countries, and duty paid in respect of such on these

instruments.

When deceased domiciled furth of the United King-

dom. — In case of a person dying domiciled furth of

the United Kingdom leaving personal estate in

Scotland, England, and Ireland, an inventory must

be given up in Scotland, probate or administration

taken out in England and Ireland, and duty paid

on such in respect of the property in each country.

ABSTRACT OF THE KATES OF INVENTORY DUTY.

ESTATES. DUTIES.

Persons dying on or before

25th July,

1864:

Above

And under

Testate.

Intestate

£20

£50

lOs.

lOs.

Of the value of

£50

£100

lOs.

£1

Persons as above and per-

sons dying

after 25th

July, 1864

Above

And under

£100

£200

£2

£3

Of the value of

£200

£300

5

8

300

450

8

11

450

600

11

15

600

800

15

22

800

1,000

22

30

1,000

1,600

30

45

1,500

2,000

40

60

2,000

3,000

50

75

3,000

4,000

60

90

4,000

5,000

80

120

5,000

6,000

100

150

6,000

7,000

120

180

7,000

8,000

140

210

8,000

9,000

160

240

9,000

10,000

180

270

10,000

12,000

200

300

12,000

14,000

220

330

ESTATES.

DUTIES.

Ofthe value of

And under

Testate.

Intestate.

14,000

16,000

250

375

16,000

18,000

280

420

18,000

20,000

310

465

20,000

25,000

350

625

25,000

30,000

400

600

30,000

35,000

450

675

35,000

40,000

525

785

40,000

45,000

600

900

45,000

50,000

675

1,010

50,000

60,000

750

1,125

60,000

70,000

900

1,350

70,000

80,000

1,050

1,575

80,000

90,000

1,200

1,800

90,000

100,000

1,350

2,025

100,000

120,000

1,500

2,250

120,000

140,000

1,800

2,700

140,000

160,000

2,100

3,150

160,000

180,000

2,400

3,600

180,000

200,000

2,700

4,050

200,000

250,000

3,000

4,500

250,000

300,000

3,750

5,625

300,000

350,000

4,500

6,750

350,000

400,000

5,250

7,875

400,000

500,000

6,000

9,000

500,000

600,000

7,500

11,250

600,000

700,000

9,000

13,500

700,000

800,000

10,500

15,750

800,000

900,000

12,000

18,000

900,000

1,000,000

13,500

20,250

Above £1,000,000, for every

£100,000,

and fractional

part of £100,000, 22 and

23 Vict. c.

36, § 1,

- 1,500

2,250

Exemptions. — Inventory of the estate of any com-

mon seaman or soldier dying in service.

Additional inventory when duty on the whole estate

does not exceed that already paid on former in-

ventory.

RETURN OF INVENTORY DUTY

The inventory duty and probaw and administration

duty are paid on the whole personal property, with-

out deduction of debts ; but the Act 5 and Vict.

c. 79, § 23, provides for a return being given on

proof of the constitution and payment of the debts.

This return must be claimed within three years ;

but the time will be prolonged on application to

the Board of Inland Revenue. No return to be

granted in respect of a voluntary debt due from a

person dying after 28th June, 1861, expressed to

be payable on death of such person, or payable

under an instrument which shall not have been

bona fide delivered to the donee three months be-

fore the death of such person. (24 and 25 Vict.

c. 92, § 3.)

Note, — Forms of inventory and additional inventory

will be found in the Jaridical Styles, vol. iii., App.

8-11. Forms of inventories, and also regulations

for return of inventory duty, may be obtained at

the Office of the Solicitor, Inland Revenue, Edin-

burgh. Claims are to be lodged in the Solicitor's

Office, Room No. 9, and Monday and Friday be-

tween 12 and 2 o'clock are the days for receiving

claims from the claimants or their agen<«.

B 2

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1880-1881 > (53) |

|---|

| Permanent URL | https://digital.nls.uk/84475750 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|