Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

146

ADVERTISEMENTS.

THE EQUITABLE

LIFE ASSURANCE SOCIETY OF THE UNITED STATES.

BOAKD OF REFERENCE FOR SCOTLAND.

Messrs. J. & P. Coats, Paisley.

A. F. Stodi>ard, Esq., 54 St. Vincent St., Glasgow,

and Glen Patrick, Paisley.

Jlessrs. Henderson Beoxheks (late Handyside &

Henderson), Glasgow.

Messrs. W. B. Huggins & Co., Glasgow.

Messrs. Black & Wingate, Glasgow.

Messrs. J. & A. Marshall & Co., Glasgow.

Blessrs. J. & R. Pkitchaed & Co., Glasgow.

Wm. Clark, Esq. , of Messrs. Jno. Clark, Jnn., &

Co., Mile-end, Glasgow.

John Jeffrey, Esq., Kirkcaldy.

James F. White, Esq., Castle Huntley, Perthshire.

Thos. Smith, Esq., of Messrs. Henry Smith & Co.,

Dundee.

W. E. Bartlett, Esq., Manager of the North

British Rubber Company, Edinburgh.

Col. J. T. Robeson, U.S. Consul, Leith.

ASSETS, 31st December, 1876, £6,346.987 sterling

Have been accumulated and invested only in First- Class Convertible Securities, as restricted by

the Insurance Laws of the State of New York. Such Investments are beyond the reach of

MoNETAKY Disturbance, and complete protection to Policy-holders is thus assured.

THE WHOLE OF THE PROFITS ARE RESERVED FOR THE ASSURED.

The greater earning power of money in the United States enables THE EQUITABLE of New

York to offer to Assurants UNEQUALLED ADVANTAGES.

A Popular Scheme of Life Insurance on

THE TONTINE PLAN

has originated with and is granted by THE EQUITABLE, which, upon a principle of deferred

bonus, adds very considerably to the proportionate profit of those holding these Policies. By

this plan the profits are only divided at stated periods, viz., in Ten, Fifteen, or Twenty Ybahs

from date of entry. No Profits accrue to the Policy until it has reached either of these periods,

which must be determined upon at the time of application for the insurance.

When the assured's Tontine period has arrived he becomes entitled to his share of the accu-

mulated profits, and he is then given one of the following options : —

First. — To taJce the cash value of his Policy.

Second. — To take a paid up non-participating Policy for an equivalent of its cash value.

Should this be chosen a certificate of the good health of the applicant will be required,

Third. — A yearly increasing annuity and the original sum at death to his heirs.

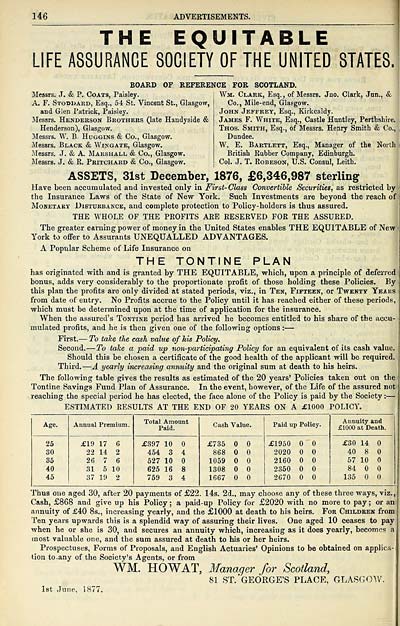

The following table gives the results as estimated of the 20 years' Policies taken out on the

Tontine Savings Fund Plan of Assurance. In the event, however, of the Life of the assured not

reaching the special period he has elected, the face alone of the Policy is paid by the Society :

ESTIMATED RESULTS AT THE END OF 20 YEARS ON A £1000 POLICY.

Age.

Annual Premium.

Total Amount

Paid.

Cash "Value.

Paid up Policy.

Annuity and

£1000 at Death.

25

SO

35

40

45

£19 17 6

22 14 2

26 7 6

.SI 5 10

37 19 2

£397 10

454 3 4

527 10

625 16 8

759 3 4

£735

868

1059

1308

1667

£1950

2020

2160

2360

2670

£30 14

40 8

57 10

84

135

Thus one aged 30, after 20 payments of £22. 14s. 2d., may choose any of these three ways, viz.,

Cash, £868 and give up his Policy ; a paid-up Policy for £2020 with no more to pay ; or an

annuity of £40 8s., increasing yearly, and the £1000 at death to his heirs. For Children from

Ten years upwards tins is a splendid way of assuring their lives. One aged 10 ceases to pay

when he or she is 30, and secures an annuity which, increasing as it does yearly, becomes a

most valuable one, and the sum assured at death to his or her heirs.

Prospectuses, Forms of Proposals, and English Actuaries' Opinions to be obtained on applica-

tion to. any of the Society's Agents, or from

WM. HOW AT, Manager for Scotland,

81 ST. 'GEORGE'S PLACE, GLASGOW.

1st June, 1877.

ADVERTISEMENTS.

THE EQUITABLE

LIFE ASSURANCE SOCIETY OF THE UNITED STATES.

BOAKD OF REFERENCE FOR SCOTLAND.

Messrs. J. & P. Coats, Paisley.

A. F. Stodi>ard, Esq., 54 St. Vincent St., Glasgow,

and Glen Patrick, Paisley.

Jlessrs. Henderson Beoxheks (late Handyside &

Henderson), Glasgow.

Messrs. W. B. Huggins & Co., Glasgow.

Messrs. Black & Wingate, Glasgow.

Messrs. J. & A. Marshall & Co., Glasgow.

Blessrs. J. & R. Pkitchaed & Co., Glasgow.

Wm. Clark, Esq. , of Messrs. Jno. Clark, Jnn., &

Co., Mile-end, Glasgow.

John Jeffrey, Esq., Kirkcaldy.

James F. White, Esq., Castle Huntley, Perthshire.

Thos. Smith, Esq., of Messrs. Henry Smith & Co.,

Dundee.

W. E. Bartlett, Esq., Manager of the North

British Rubber Company, Edinburgh.

Col. J. T. Robeson, U.S. Consul, Leith.

ASSETS, 31st December, 1876, £6,346.987 sterling

Have been accumulated and invested only in First- Class Convertible Securities, as restricted by

the Insurance Laws of the State of New York. Such Investments are beyond the reach of

MoNETAKY Disturbance, and complete protection to Policy-holders is thus assured.

THE WHOLE OF THE PROFITS ARE RESERVED FOR THE ASSURED.

The greater earning power of money in the United States enables THE EQUITABLE of New

York to offer to Assurants UNEQUALLED ADVANTAGES.

A Popular Scheme of Life Insurance on

THE TONTINE PLAN

has originated with and is granted by THE EQUITABLE, which, upon a principle of deferred

bonus, adds very considerably to the proportionate profit of those holding these Policies. By

this plan the profits are only divided at stated periods, viz., in Ten, Fifteen, or Twenty Ybahs

from date of entry. No Profits accrue to the Policy until it has reached either of these periods,

which must be determined upon at the time of application for the insurance.

When the assured's Tontine period has arrived he becomes entitled to his share of the accu-

mulated profits, and he is then given one of the following options : —

First. — To taJce the cash value of his Policy.

Second. — To take a paid up non-participating Policy for an equivalent of its cash value.

Should this be chosen a certificate of the good health of the applicant will be required,

Third. — A yearly increasing annuity and the original sum at death to his heirs.

The following table gives the results as estimated of the 20 years' Policies taken out on the

Tontine Savings Fund Plan of Assurance. In the event, however, of the Life of the assured not

reaching the special period he has elected, the face alone of the Policy is paid by the Society :

ESTIMATED RESULTS AT THE END OF 20 YEARS ON A £1000 POLICY.

Age.

Annual Premium.

Total Amount

Paid.

Cash "Value.

Paid up Policy.

Annuity and

£1000 at Death.

25

SO

35

40

45

£19 17 6

22 14 2

26 7 6

.SI 5 10

37 19 2

£397 10

454 3 4

527 10

625 16 8

759 3 4

£735

868

1059

1308

1667

£1950

2020

2160

2360

2670

£30 14

40 8

57 10

84

135

Thus one aged 30, after 20 payments of £22. 14s. 2d., may choose any of these three ways, viz.,

Cash, £868 and give up his Policy ; a paid-up Policy for £2020 with no more to pay ; or an

annuity of £40 8s., increasing yearly, and the £1000 at death to his heirs. For Children from

Ten years upwards tins is a splendid way of assuring their lives. One aged 10 ceases to pay

when he or she is 30, and secures an annuity which, increasing as it does yearly, becomes a

most valuable one, and the sum assured at death to his or her heirs.

Prospectuses, Forms of Proposals, and English Actuaries' Opinions to be obtained on applica-

tion to. any of the Society's Agents, or from

WM. HOW AT, Manager for Scotland,

81 ST. 'GEORGE'S PLACE, GLASGOW.

1st June, 1877.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1877-1878 > (1114) |

|---|

| Permanent URL | https://digital.nls.uk/84457992 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|