Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

THE QUEEN INSURANCE COMPANY (continued).

THE QUEEN INSURANCE COMPANY is founded on principles which render

Policy-holders perfectly secure, and afford them at the same time many special advantages,

some of which-are explained below.

(For information in reference to the financial and other affairs of the Company, see statement

on last Page of the Directory).

IMPORTANT ADVANTAGES.

LIFE POLICIES GRANTED ON A SPECIAL REDUCED SYSTEM.— In order to meet the

■views of persons desirous of effecting Insurances for the whole term of life, who find it in-

convenient at first to pay the full Premium, this Company has adopted the undernoted special

. scheme, whereby the Premiums payable for the first five years will be found unusually

moderate, while the Policy, at the end of that period, is entirely free from debt, thus

avoiding the evil of the half credit system. Under this Table persons may take out

Policies at earlier ages, and at lower rates, than they could do under the ordinary system.

An additional and most important advantage is thus afforded to the public, by which they are

enabled to Insure while young, whereas, if they were to defer doing so until they could pay

the full ordinary Premium, sickness or ill health might overtake them, and render them un-

assurable lives.

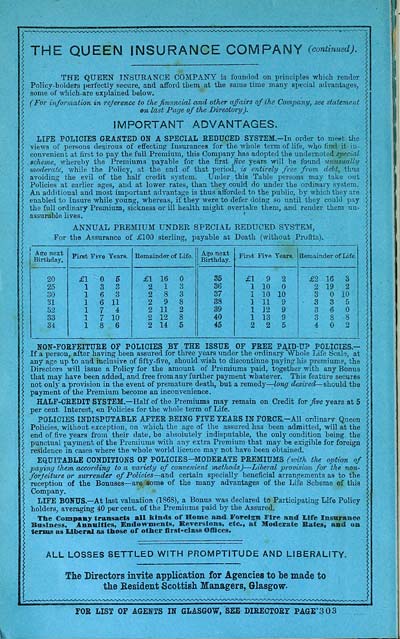

ANNUAL PREMIUM UNDER SPECIAL REDUCED SYSTEM,

For the Assurance of £100 sterling, payable at Death (without Profits).

Age next

Birthday.

First Five Years.

Remainder of Life.

Age next

Birthday.

First Five Years.

Remainder of Life.

20

£10 5

£1 16

35

£19 2

£2 16 3

25

13 3

2 13

36

1 10

2 19 2

30

16 3

2 8 3

37

1 10 10

3 10

31

1 6 11

2 9 8

38

1 11 9

3 3 5

32

17 4

2 11 2

39

1 12 9

3 6

33

1 7 10

2 12 8

40

1 13 9

3 8-8

34

18 6

2 14 5

45

2 2 5

4 2

NON-FORFEITURE OF POLICIES BT THE ISSUE OF FREE PAID-UP POLICIES.-

If a person, after having been assured for three years under the ordinary Whole Life Scale, at

any age up to and inclusive of fifty-five, should wish to discontinue paying his premiums, the

Directors will issue a Policy for the amount of Premiums paid, together with any Bonus

that may have been added, and free from any further payment whatever. This feature secures

not only a provision in the event of premature death, but a remedy — long desired— should the

payment of the Premium become an inconvenience.

HALF-CREDIT SYSTEM.— Half of the Premiums may remain on Credit for five years at 5

per cent. Interest, en Policies for the whole term of Life.

POLICIES INDISPUTABLE AFTER BEING FIVE YEARS IN F0RCE.-A11 ordinary Queen

Policies, without exception, on which the age of the assured has been admitted, will at the

end of five years from their date, be absolutely indisputable, the only condition being the

punctual payment of the Premiums with any extra Premium that may be exigible for foreign

residence in cases where the whole world licence may not have been obtained.

EQUITABLE CONDITIONS OF POLICIES-MODERATE PREMIUMS (with the option of

paying them according to a variety of convenient methods) — Liberal provision for the. non-

forfeiture or surrender of Policies — and certain specially beneficial arrangements as to the

reception of the Bonuses— are some of the many advantages of the Life Scheme of this

Company.

LIFE BONUS.— At last valuation (1868), a Bonus was declared to Participating Life Policy

holders, averaging 40 per cent, of the Premiums paid by the Assured.

The Company transacts all kinds of Home and Foreign Fire and Life Insurance

Business. Annuities, Endowments, Kererslons, etc., at Moderate Bates, and on

terms as liberal as those of other first-class Offices.

ALL LOSSES SETTLED WITH PROMPTITUDE AND LIBERALITY.

The Directors invite application for Agencies to be made to

the Resident Scottish Managers, Glasgow.

FOR LIST OF AGENTS IN GLASGOW, SEE DIRECTORY PAGE'S 03

THE QUEEN INSURANCE COMPANY is founded on principles which render

Policy-holders perfectly secure, and afford them at the same time many special advantages,

some of which-are explained below.

(For information in reference to the financial and other affairs of the Company, see statement

on last Page of the Directory).

IMPORTANT ADVANTAGES.

LIFE POLICIES GRANTED ON A SPECIAL REDUCED SYSTEM.— In order to meet the

■views of persons desirous of effecting Insurances for the whole term of life, who find it in-

convenient at first to pay the full Premium, this Company has adopted the undernoted special

. scheme, whereby the Premiums payable for the first five years will be found unusually

moderate, while the Policy, at the end of that period, is entirely free from debt, thus

avoiding the evil of the half credit system. Under this Table persons may take out

Policies at earlier ages, and at lower rates, than they could do under the ordinary system.

An additional and most important advantage is thus afforded to the public, by which they are

enabled to Insure while young, whereas, if they were to defer doing so until they could pay

the full ordinary Premium, sickness or ill health might overtake them, and render them un-

assurable lives.

ANNUAL PREMIUM UNDER SPECIAL REDUCED SYSTEM,

For the Assurance of £100 sterling, payable at Death (without Profits).

Age next

Birthday.

First Five Years.

Remainder of Life.

Age next

Birthday.

First Five Years.

Remainder of Life.

20

£10 5

£1 16

35

£19 2

£2 16 3

25

13 3

2 13

36

1 10

2 19 2

30

16 3

2 8 3

37

1 10 10

3 10

31

1 6 11

2 9 8

38

1 11 9

3 3 5

32

17 4

2 11 2

39

1 12 9

3 6

33

1 7 10

2 12 8

40

1 13 9

3 8-8

34

18 6

2 14 5

45

2 2 5

4 2

NON-FORFEITURE OF POLICIES BT THE ISSUE OF FREE PAID-UP POLICIES.-

If a person, after having been assured for three years under the ordinary Whole Life Scale, at

any age up to and inclusive of fifty-five, should wish to discontinue paying his premiums, the

Directors will issue a Policy for the amount of Premiums paid, together with any Bonus

that may have been added, and free from any further payment whatever. This feature secures

not only a provision in the event of premature death, but a remedy — long desired— should the

payment of the Premium become an inconvenience.

HALF-CREDIT SYSTEM.— Half of the Premiums may remain on Credit for five years at 5

per cent. Interest, en Policies for the whole term of Life.

POLICIES INDISPUTABLE AFTER BEING FIVE YEARS IN F0RCE.-A11 ordinary Queen

Policies, without exception, on which the age of the assured has been admitted, will at the

end of five years from their date, be absolutely indisputable, the only condition being the

punctual payment of the Premiums with any extra Premium that may be exigible for foreign

residence in cases where the whole world licence may not have been obtained.

EQUITABLE CONDITIONS OF POLICIES-MODERATE PREMIUMS (with the option of

paying them according to a variety of convenient methods) — Liberal provision for the. non-

forfeiture or surrender of Policies — and certain specially beneficial arrangements as to the

reception of the Bonuses— are some of the many advantages of the Life Scheme of this

Company.

LIFE BONUS.— At last valuation (1868), a Bonus was declared to Participating Life Policy

holders, averaging 40 per cent, of the Premiums paid by the Assured.

The Company transacts all kinds of Home and Foreign Fire and Life Insurance

Business. Annuities, Endowments, Kererslons, etc., at Moderate Bates, and on

terms as liberal as those of other first-class Offices.

ALL LOSSES SETTLED WITH PROMPTITUDE AND LIBERALITY.

The Directors invite application for Agencies to be made to

the Resident Scottish Managers, Glasgow.

FOR LIST OF AGENTS IN GLASGOW, SEE DIRECTORY PAGE'S 03

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1870-1871 > (14) |

|---|

| Permanent URL | https://digital.nls.uk/84392994 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|