Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

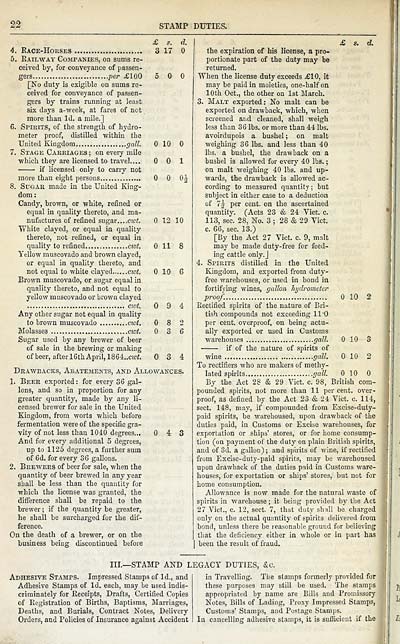

22

STAMP DUTIES.

£ s. d.

4. Race-Horses 8 17

5. Railway Companies, on sums re-

ceived by, for conveyance of passen-

gers per £100 5

[No duty is exigible on sums re-

ceived for conveyance of passen-

gers by trains running at least

six days a-week, at fares of not

more than Id. a mile.]

6. Spirits, of the strength of hydro-

meter proof, distilled within the

United Kingdom gall. 10

7. Stage Carriages ; on every mile

which they are licensed to travel.... 1

if licensed only to carry not

more than eight persons 0J

8. Sugar made in the United King-

dom:

Candy, brown, or white, refined or

equal in quality thereto, and ma-

nufactures of refined sugar.... cwt. 12 10

White clayed, or equal in quality

thereto, not refined, or equal in

quality to refined cwt. 11 8

Yellow muscovado and brown clayed,

or equal in quality thereto, and

not equal to white clayed cwt. 10 6

Brown muscovado, or sugar equal in

quality thereto, and not equal to

yellow muscovado or brown clayed

civt. 9 4

Any other sugar not equal in quality

to brown muscovado cwt. 8 2

Molasses cwt. 3 6

Sugar used by any brewer of beer

of sale in the brewing or making

of beer, after 16th April, lSQi.xwt. 3 4

Drawbacks, Abatements, and Allowances.

1. Beer exported : for every 36 gal-

lons, and so in proportion for any

greater quantity, made by any li-

censed brewer for sale in the United

Kingdom, from worts which before

fermentation were of the specific gra-

vity of not less than 1040 degrees... 4 3

And for every additional 5 degrees,

up to 1125 degrees, a further sum

of 6d. for every 36 gallons.

2. Brewers of beer for sale, when the

quantity of beer brewed in any year

shall be less than the quantity for

which the license was granted, the

difference shall be repaid to the

brewer ; if the quantity be greater,

he shall be surcharged for the dif-

ference.

On the death of a brewer, or on the

business being discontinued before

£ s. d.

the expiration of his license, a pro-

portionate part of the duty may be

returned.

When the license duty exceeds £10, it

may be paid in moieties, one-half on

10th Oct., the other on 1st March.

3. Malt exported: No malt can be

exported on drawback, which, when

screened and cleaned, shall weigh

less than 36 lbs. or more than 44 lbs.

avoirdupois a bushel ; on malt

weighing 36 lbs. and less than 40

lbs. a bushel, the drawback on a

bushel is allowed for every 40 lbs. ;

on malt weighing 40 lbs. and up-

wards, the drawback is allowed ac-

cording to measured quantity ; but

subject in either case to a deduction

of 7|- per cent, on the ascertained

quantity. (Acts 23 & 24 Vict, c.

113, sec. 28, No. 3 ; 28 & 29 Vict.

c. 66, sec. 13.)

[By the Act 27 Vict. c. 9, malt

may be made duty-free for feed-

ing cattle only.J

4. Spirits distilled in the United

Kingdom, and exported from duty-

free warehouses, or used in bond in

fortifying wines, gallon hydrometer

proof. 10 2

Rectified spirits of the nature of Bri-

tish compounds not exceeding 11*0

per cent, overproof, on being actu-

ally exported or used in Customs

warehouses gall. 10 3

if of the nature of spirits of

wine gall. 10 2

To rectifiers who are makers of methy-

lated spirits ..gall. 10

By the Act 28 & 29 Vict. c. 98, British com-

pounded spirits, not more than 11 per cent, over-

proof, as defined by the Act 23 & 24 Vict. c. 114,

sect. 148, may, if compounded from Excise-duty-

paid spirits, be warehoused, upon drawback of the

duties paid, in Customs or Excise warehouses, for

exportation or ships' stores, or for home consump-

tion (on payment of the duty on plain British spirits,

and of 3d. a gallon) ; and spirits of wine, if rectified

from Excise-duty-paid spirits, may be warehoused

upon drawback of the duties paid in Customs ware-

houses, for exportation or ships' stores, but not for

home consumption.

Allowance is now made for the natural waste of

spirits in warehouse ; it being provided by the Act

27 Vict., c. 12, sect. 7, that duty shall be charged

only on the actual quantity of spirits delivered from

bond, unless there be reasonable ground for believing

that the deficiency either in whole or in part has

been the result of fraud.

III.— STAMP AND LEGACY DUTIES, &c.

Adhesive Stamps. Impressed Stamps of 1 d., and

Adhesive Stamps of Id. each, may be used indis-

criminately for Receipts, Drafts, Certified Copies

of Registration of Births, Baptisms, Marriages,

Deaths, and Burials, Contract Notes, Delivery

Orders, and Policies of Insurance against Accident

in Travelling. Tlie stamps formerly provided for

these purposes may still be used. The stamps

appropriated by name are Bills and Promissory

Notes, Bills of Lading, Proxy Impressed Stamps,

Customs' Stamps, and Postage Stamps.

In cancelling adhesive stamps, it is sufficient if the

STAMP DUTIES.

£ s. d.

4. Race-Horses 8 17

5. Railway Companies, on sums re-

ceived by, for conveyance of passen-

gers per £100 5

[No duty is exigible on sums re-

ceived for conveyance of passen-

gers by trains running at least

six days a-week, at fares of not

more than Id. a mile.]

6. Spirits, of the strength of hydro-

meter proof, distilled within the

United Kingdom gall. 10

7. Stage Carriages ; on every mile

which they are licensed to travel.... 1

if licensed only to carry not

more than eight persons 0J

8. Sugar made in the United King-

dom:

Candy, brown, or white, refined or

equal in quality thereto, and ma-

nufactures of refined sugar.... cwt. 12 10

White clayed, or equal in quality

thereto, not refined, or equal in

quality to refined cwt. 11 8

Yellow muscovado and brown clayed,

or equal in quality thereto, and

not equal to white clayed cwt. 10 6

Brown muscovado, or sugar equal in

quality thereto, and not equal to

yellow muscovado or brown clayed

civt. 9 4

Any other sugar not equal in quality

to brown muscovado cwt. 8 2

Molasses cwt. 3 6

Sugar used by any brewer of beer

of sale in the brewing or making

of beer, after 16th April, lSQi.xwt. 3 4

Drawbacks, Abatements, and Allowances.

1. Beer exported : for every 36 gal-

lons, and so in proportion for any

greater quantity, made by any li-

censed brewer for sale in the United

Kingdom, from worts which before

fermentation were of the specific gra-

vity of not less than 1040 degrees... 4 3

And for every additional 5 degrees,

up to 1125 degrees, a further sum

of 6d. for every 36 gallons.

2. Brewers of beer for sale, when the

quantity of beer brewed in any year

shall be less than the quantity for

which the license was granted, the

difference shall be repaid to the

brewer ; if the quantity be greater,

he shall be surcharged for the dif-

ference.

On the death of a brewer, or on the

business being discontinued before

£ s. d.

the expiration of his license, a pro-

portionate part of the duty may be

returned.

When the license duty exceeds £10, it

may be paid in moieties, one-half on

10th Oct., the other on 1st March.

3. Malt exported: No malt can be

exported on drawback, which, when

screened and cleaned, shall weigh

less than 36 lbs. or more than 44 lbs.

avoirdupois a bushel ; on malt

weighing 36 lbs. and less than 40

lbs. a bushel, the drawback on a

bushel is allowed for every 40 lbs. ;

on malt weighing 40 lbs. and up-

wards, the drawback is allowed ac-

cording to measured quantity ; but

subject in either case to a deduction

of 7|- per cent, on the ascertained

quantity. (Acts 23 & 24 Vict, c.

113, sec. 28, No. 3 ; 28 & 29 Vict.

c. 66, sec. 13.)

[By the Act 27 Vict. c. 9, malt

may be made duty-free for feed-

ing cattle only.J

4. Spirits distilled in the United

Kingdom, and exported from duty-

free warehouses, or used in bond in

fortifying wines, gallon hydrometer

proof. 10 2

Rectified spirits of the nature of Bri-

tish compounds not exceeding 11*0

per cent, overproof, on being actu-

ally exported or used in Customs

warehouses gall. 10 3

if of the nature of spirits of

wine gall. 10 2

To rectifiers who are makers of methy-

lated spirits ..gall. 10

By the Act 28 & 29 Vict. c. 98, British com-

pounded spirits, not more than 11 per cent, over-

proof, as defined by the Act 23 & 24 Vict. c. 114,

sect. 148, may, if compounded from Excise-duty-

paid spirits, be warehoused, upon drawback of the

duties paid, in Customs or Excise warehouses, for

exportation or ships' stores, or for home consump-

tion (on payment of the duty on plain British spirits,

and of 3d. a gallon) ; and spirits of wine, if rectified

from Excise-duty-paid spirits, may be warehoused

upon drawback of the duties paid in Customs ware-

houses, for exportation or ships' stores, but not for

home consumption.

Allowance is now made for the natural waste of

spirits in warehouse ; it being provided by the Act

27 Vict., c. 12, sect. 7, that duty shall be charged

only on the actual quantity of spirits delivered from

bond, unless there be reasonable ground for believing

that the deficiency either in whole or in part has

been the result of fraud.

III.— STAMP AND LEGACY DUTIES, &c.

Adhesive Stamps. Impressed Stamps of 1 d., and

Adhesive Stamps of Id. each, may be used indis-

criminately for Receipts, Drafts, Certified Copies

of Registration of Births, Baptisms, Marriages,

Deaths, and Burials, Contract Notes, Delivery

Orders, and Policies of Insurance against Accident

in Travelling. Tlie stamps formerly provided for

these purposes may still be used. The stamps

appropriated by name are Bills and Promissory

Notes, Bills of Lading, Proxy Impressed Stamps,

Customs' Stamps, and Postage Stamps.

In cancelling adhesive stamps, it is sufficient if the

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1866-1867 > (54) |

|---|

| Permanent URL | https://digital.nls.uk/84382525 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|