Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

PROPERTY AND INCOME TAX.

685

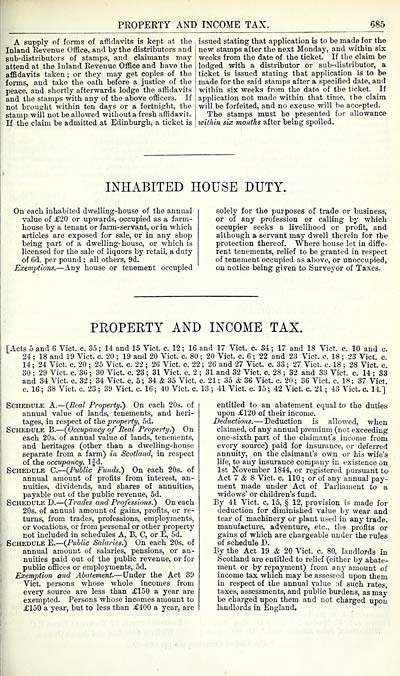

A supply of forms of affidavits is kept at the

Inland Bevenue Office, and by the distributors and

sub-distributors of stamps, and claimants may

attend at the Inland Kevenue Office and have the

affidavits taken ; or they may get copies of the

forms, and take the oath before a justice of the

peace, and shortly afterwards lodge the affidavits

and the stamps with any of the above officers. If

not brought within ten days or a fortnight, the

stamp will not be allowed without a fresh affidavit.

If the claim be admitted at Edinburgh, a ticket is

issued stating that application is to be made for the

new stamps after the next Monday, and within six

weeks from the date of the ticket. If the claim be

lodged with a distributor or sub-distributor, a

ticket is issued stating that application is to be

made for the said stamps after a specified date, and

within six weeks from the date of the ticket. If

application not made within that time, the claim

will be forfeited, and no excuse will be accepted.

The stamps must bo presented for allowance

within six months after being spoiled.

INHABITED HOUSE DUTY.

On each inhabited dwelling-house of the annual

value of £20 or upwards, occupied as a farm-

house by a tenant or farm-servant, or in which

articles are exposed for sale, or in any shop

being part of a dwelling-house, or which is

licensed for the sale of liquors by retail, a duty

of 6d. per pound ; all others, 9d.

Exemptions. — Any house or tenement occupied

solely for the purposes of trade or business,

or of any profession or calling by which

occupier seeks a livelihood or profit, and

although a servant may dwell therein for the

protection thereof. Where house let in diffe-

rent tenements, relief to be granted in respect

of tenement occupied as above, or unoccupied,

on notice being given to Surveyor of Taxes.

PROPERTY AND INCOME TAX.

[Acts 5 and 6 Vict. c. So ; 14 and 15 Vict. c. 12 ; 16 and 17 Vict. c. 34 ; 17 and 18 Vict. c. 10 and c.

24 ; 18 and 19 Vict. c. 20 ; 19 and 20 Vict. c. 80 ; 20 Vict. c. 6 ; 22 and 23 Vict. c. 18 ; 23 Vict. c.

14 ; 24 Vict. c. 20 ; 25 Vict. c. 22 ; 26 Vict. c. 22 ; 26 and 27 Vict. c. 33 ; 27 Vict. c. 18 ; 28 Vict. c.

30 ; 29 Vict. c. 36 ; 30 Vict. c. 23 ; 31 Vict. c. 2 ; 31 and 32 Vict. c. 28 ; 32 and 33 Vict. c. 14 ; 33

and 34 Vict. c. 32 ; 34 Vict.

c. 16 ; 38 Vict. c. 23 ; 39 Vict

c. 5; 34 & 35 Vict. c. 21; 35 & 36 Vict. c. 20; 36 Vict. c. 18; 37 Vict

;t. c. 16 ; 40 Vict. c. 13 ; 41 Vict. c. 15 ; 42 Vict. c. 21 ; 43 Vict. c. 14]

Schedule A. — {Real Property.) On each 20s. of

annual value of lands, tenements, and heri-

tages, in respect of the property, 5d.

Schedule B. — {Occupancy of Real Property.") On

each 20s. of annual value of lands, tenements,

and heritages (other than a dwelling-house

separate from a farm) in Scotland, in respect

of the occupancy, If d.

Schedule C. — {Public Funds.) On each 20s. of

annual amount of profits from interest, an-

nuities, dividends, and shares of annuities,

payable out of the public revenue, 5d.

Schedule D. — {Trades and Professions.) On each

20s. of annual amount of gains, profits, or re-

turns, from trades, professions, employments,

or vocations, or from personal or other property

not included in schedules A, B, C, or E, 5d.

Schedule E. — {Public Salaries.) On each 20s. of

annual amount of salaries, pensions, or au-

nuities paid out of the public revenue, or for

public offices or employments, 5d.

Exemption and Abatement. — Under the Act 39

Vict, persons whose whole incomes from

every source are less than £150 a year are

exempted. Persons whose incomes amount to

£150 a year, but to less than £400 a year, are

entitled to an abatement equal to the duties

upon £120 of their income.

Deductions. — Deduction is allowed, when

claimed, of any annual premium (not exceeding

one-sixth part of the claimant's income from

every source) paid for insurance, or deferred

annuity, on the claimant's own or his wife's

life, to any insurance company in existence on

1st November 1844, or registered pursuant to

Act 7 & 8 Vict. c. 110 ; or of any annual pay-

ment made under Act of Parliament to a

widows' or children's fund.

By 41 Vict. c. 15, § 12, provision is made for

deduction for diminished value by wear and

tear of machinery or plant used in any trade,

manufacture, adventure, etc., the profits or

gains of which are chargeable under the rules

of schedule D.

By the Act 19 & 20 Vict. c. 80, landlords in

Scotland are entitled to relief (either by abate-

ment or by repayment) from any amount of

income tax which may be assessed upon them

in respect of the annual value of such rates

taxes, assessments, and public burdens, as may

be charged upon them and not charged upon

landlords in England.

685

A supply of forms of affidavits is kept at the

Inland Bevenue Office, and by the distributors and

sub-distributors of stamps, and claimants may

attend at the Inland Kevenue Office and have the

affidavits taken ; or they may get copies of the

forms, and take the oath before a justice of the

peace, and shortly afterwards lodge the affidavits

and the stamps with any of the above officers. If

not brought within ten days or a fortnight, the

stamp will not be allowed without a fresh affidavit.

If the claim be admitted at Edinburgh, a ticket is

issued stating that application is to be made for the

new stamps after the next Monday, and within six

weeks from the date of the ticket. If the claim be

lodged with a distributor or sub-distributor, a

ticket is issued stating that application is to be

made for the said stamps after a specified date, and

within six weeks from the date of the ticket. If

application not made within that time, the claim

will be forfeited, and no excuse will be accepted.

The stamps must bo presented for allowance

within six months after being spoiled.

INHABITED HOUSE DUTY.

On each inhabited dwelling-house of the annual

value of £20 or upwards, occupied as a farm-

house by a tenant or farm-servant, or in which

articles are exposed for sale, or in any shop

being part of a dwelling-house, or which is

licensed for the sale of liquors by retail, a duty

of 6d. per pound ; all others, 9d.

Exemptions. — Any house or tenement occupied

solely for the purposes of trade or business,

or of any profession or calling by which

occupier seeks a livelihood or profit, and

although a servant may dwell therein for the

protection thereof. Where house let in diffe-

rent tenements, relief to be granted in respect

of tenement occupied as above, or unoccupied,

on notice being given to Surveyor of Taxes.

PROPERTY AND INCOME TAX.

[Acts 5 and 6 Vict. c. So ; 14 and 15 Vict. c. 12 ; 16 and 17 Vict. c. 34 ; 17 and 18 Vict. c. 10 and c.

24 ; 18 and 19 Vict. c. 20 ; 19 and 20 Vict. c. 80 ; 20 Vict. c. 6 ; 22 and 23 Vict. c. 18 ; 23 Vict. c.

14 ; 24 Vict. c. 20 ; 25 Vict. c. 22 ; 26 Vict. c. 22 ; 26 and 27 Vict. c. 33 ; 27 Vict. c. 18 ; 28 Vict. c.

30 ; 29 Vict. c. 36 ; 30 Vict. c. 23 ; 31 Vict. c. 2 ; 31 and 32 Vict. c. 28 ; 32 and 33 Vict. c. 14 ; 33

and 34 Vict. c. 32 ; 34 Vict.

c. 16 ; 38 Vict. c. 23 ; 39 Vict

c. 5; 34 & 35 Vict. c. 21; 35 & 36 Vict. c. 20; 36 Vict. c. 18; 37 Vict

;t. c. 16 ; 40 Vict. c. 13 ; 41 Vict. c. 15 ; 42 Vict. c. 21 ; 43 Vict. c. 14]

Schedule A. — {Real Property.) On each 20s. of

annual value of lands, tenements, and heri-

tages, in respect of the property, 5d.

Schedule B. — {Occupancy of Real Property.") On

each 20s. of annual value of lands, tenements,

and heritages (other than a dwelling-house

separate from a farm) in Scotland, in respect

of the occupancy, If d.

Schedule C. — {Public Funds.) On each 20s. of

annual amount of profits from interest, an-

nuities, dividends, and shares of annuities,

payable out of the public revenue, 5d.

Schedule D. — {Trades and Professions.) On each

20s. of annual amount of gains, profits, or re-

turns, from trades, professions, employments,

or vocations, or from personal or other property

not included in schedules A, B, C, or E, 5d.

Schedule E. — {Public Salaries.) On each 20s. of

annual amount of salaries, pensions, or au-

nuities paid out of the public revenue, or for

public offices or employments, 5d.

Exemption and Abatement. — Under the Act 39

Vict, persons whose whole incomes from

every source are less than £150 a year are

exempted. Persons whose incomes amount to

£150 a year, but to less than £400 a year, are

entitled to an abatement equal to the duties

upon £120 of their income.

Deductions. — Deduction is allowed, when

claimed, of any annual premium (not exceeding

one-sixth part of the claimant's income from

every source) paid for insurance, or deferred

annuity, on the claimant's own or his wife's

life, to any insurance company in existence on

1st November 1844, or registered pursuant to

Act 7 & 8 Vict. c. 110 ; or of any annual pay-

ment made under Act of Parliament to a

widows' or children's fund.

By 41 Vict. c. 15, § 12, provision is made for

deduction for diminished value by wear and

tear of machinery or plant used in any trade,

manufacture, adventure, etc., the profits or

gains of which are chargeable under the rules

of schedule D.

By the Act 19 & 20 Vict. c. 80, landlords in

Scotland are entitled to relief (either by abate-

ment or by repayment) from any amount of

income tax which may be assessed upon them

in respect of the annual value of such rates

taxes, assessments, and public burdens, as may

be charged upon them and not charged upon

landlords in England.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1880-1881 > (727) |

|---|

| Permanent URL | https://digital.nls.uk/84276001 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|