Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

STAMP DUTIES, ETC.

507

merit of sasine or notarial instrument, where

lands held of a subject superior, written upon

such deed or instrument, 21 & 22 Vict. c. 76, §

7 ; Writ of resignation, lands held as aforesaid,

ib. § 9 ; Writ of investiture, or deed of relin-

quishment of superiority, lands held as afore

said, ib. § 24, and schedule N, No. 3, 23 & 24

Vict. c. 143. § 41— 5s.

Progressive duty of 5s.

Chaeter-Party after 5th July 1865 6d.

The Stamp may be impressed or adhesive. If

adhesive, the person who last signs, or whose

signature completes the contract, shall cancel

the stamp by writing upon it his name, or the

name of his firm, and the true date of his so

writing. If not so cancelled, the charter-party

shall not be valid for any purpose whatever.

Unstamped charter-parties may be stamped

with an impressed stamp by the Commissioners

of Inland Revenue, on payment of the duty and

4s. 6d., if brought to them within seven days ;

on payment of the duty and £10, if brought to

them after seven days and within one calendar

month after date and first signing. After the

expiry of a calendar month, no charter-party

shall be stamped on any pretence. Unstamped

charter-parties first signed abroad, may be

stamped within ten days after they are received

in the United Kingdom, by any part} 7 thereto

affixing an adhesive stamp, and cancelling the

same by writing across it his name and the date

of his so affixing the stamp. (28 & 29 Vict. c.

96, § 7.)

Collation, Institution, or Admission by a Pres-

bytery or other competent authority, to any

ecclesiastical benefice, £2. (55 Geo. in. c. 184,

and 27 Vict. c. 18.)

Composition-Deed with Creditors, £1, 15s.

Contract Note (after 28th August 1860). Any

note, memorandum, or writing, commonly

called a Contract Note, or by whatever name

the same may be designated, for or relating to

the sale or purchase of any Government or

other public stocks, funds, or securities, or any

stocks, funds, or securities, or share or shares

of or in any joint-stock or other public company,

to the amount or value of £5 or up wards.... Id.

[Duty to be denoted by impressed or adhesive

stamps. Adhesive stamp to be cancelled by

writing, stamping, or impressing in ink, upon

or across it, name or initials and date of can-

celling. Penalty for marking or signing with-

out being stamped, £20, and no charge for

brokerage, commission, agency, or otherwise,

shall be lawful. (23 & 24 Vict. c. Ill, § 7 ; 24

& 25 Vict. c. 91, § 33.)]

Contract under the Highway Acts for making,

maintaining, or repairing highways (28 & 29

Vict. c. 96,"g 30) 6d.

Conveyances.

Conveyance, whether grant, disposition, assign-

ment, transfer, renunciation, or of any other

kind whatsoever, upon the sale of any lands,

tenements, rents, annuities, or other property,

heritable or moveable, or of any right, title, in-

terest, or claim in, to, out of, or upon any such,

that is, for the principal or only deed, instru-

ment, or writing, whereby the lands or other

things sold are granted, assigned, transferred,

renounced, or otherwise conveyed to or vested

in the purchaser, or any other person, by his

direction, —

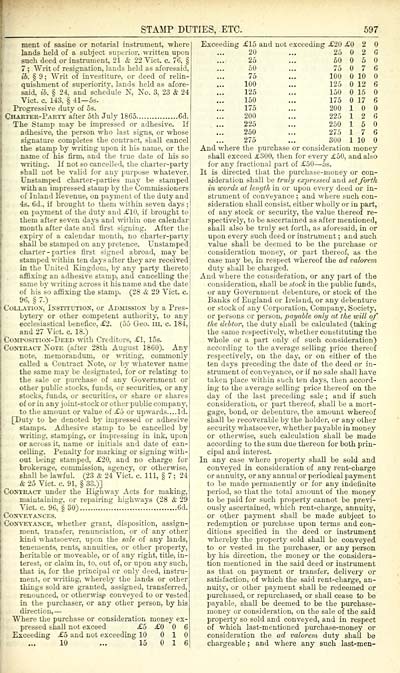

Where the purchase or consideration money ex-

pressed shall not exceed £5 £0 6

Exceeding £5 and not exceeding 10 10

... " 10 ... 15 16

Exceeding £15 and not exceeding £20 £0 2

20 ... 25 2 6

25 ... 50 5

50 ... 75 7 6

75 ... 100 10

100 ... 125 12 6

125 ... 150 15

150 ... 175 17 6

175 ... 200 1

200 ... 225 1 2 6

225 ... 250 15

250 ... 275 1 7 6

275 ... 300 1 10

And where the purchase or consideration money

shall exceed £300, then for every £50, and also

for any fractional part of £50 — 5s.

It is directed that the purchase-monej' or con-

sideration shall be truly expressed and set forth

in words at length in or upon every deed or in-

strument of conveyance ; and where such con-

sideration shall consist, either wholly or in part,

of any stock or security, the value thereof re-

spectively, to be ascertained as after mentioned,

shall also be truly set forth, as aforesaid, in or

upon every such deed or instrument ; and such

value shall be deemed to be the purchase or

consideration money, or part thereof, as the

case may be, in respect whereof the ad valorem

duty shall be charged.

And where the consideration, or any part of the

consideration, shall be stock in the public funds,

or any Government debenture, or stock of the

Banks of England or Ireland, or any debenture

or stock of any Corporation, Company, Society,

or persons or person, payable only at the will of

the debtor, the duty shall be calculated (taking

the same respectively, whether constituting the

whole or a part only of such consideration)

according to the average selling price thereof

respectively, on the day, or on either of the

ten days preceding the date of the deed or in-

strument of conveyance, or if no sale shall have

taken place within such ten days, then accord-

ing to the average selling price thereof on the

day of the last preceding sale ; and if such

consideration, or part thereof, shall be a mort-

gage, bond, or debenture, the amount whereof

shall be recoverable by the holder, or any other

security whatsoever, whether payable in money

or otherwise, such calculation shall be made

according to the sum due thereon for both prin-

cipal and interest.

In any case where property shall be sold and

conveyed in consideration of any rent-charge

or annuity, or any annual or periodical payment

to be made permanently or for any indefinite

period, so that the total amount of the money

to be paid for such property cannot be previ-

ously ascertained, which rent-charge, annuitj-,

or other payment shall be made subject to

redemption or purchase upon terms and con-

ditions specified in the deed or instrument

whereby the property sold shall be conveyed

to or vested in the purchaser, or any person

by his direction, the money or the considera-

tion mentioned in the said deed or instrument

as that on payment or transfer, delivery or

satisfaction, of which the said rent-charge, an-

nuity, or other payment shall be redeemed or

purchased, or repurchased, or shall cease to be

payable, shall be deemed to be the purchase-

money or consideration, on the sale of the said

property so sold and conveyed, and in respect

of which last-mentioned purchase-money or

consideration the ad valorem duty shall be

chargeable ; and where any such last-men-

507

merit of sasine or notarial instrument, where

lands held of a subject superior, written upon

such deed or instrument, 21 & 22 Vict. c. 76, §

7 ; Writ of resignation, lands held as aforesaid,

ib. § 9 ; Writ of investiture, or deed of relin-

quishment of superiority, lands held as afore

said, ib. § 24, and schedule N, No. 3, 23 & 24

Vict. c. 143. § 41— 5s.

Progressive duty of 5s.

Chaeter-Party after 5th July 1865 6d.

The Stamp may be impressed or adhesive. If

adhesive, the person who last signs, or whose

signature completes the contract, shall cancel

the stamp by writing upon it his name, or the

name of his firm, and the true date of his so

writing. If not so cancelled, the charter-party

shall not be valid for any purpose whatever.

Unstamped charter-parties may be stamped

with an impressed stamp by the Commissioners

of Inland Revenue, on payment of the duty and

4s. 6d., if brought to them within seven days ;

on payment of the duty and £10, if brought to

them after seven days and within one calendar

month after date and first signing. After the

expiry of a calendar month, no charter-party

shall be stamped on any pretence. Unstamped

charter-parties first signed abroad, may be

stamped within ten days after they are received

in the United Kingdom, by any part} 7 thereto

affixing an adhesive stamp, and cancelling the

same by writing across it his name and the date

of his so affixing the stamp. (28 & 29 Vict. c.

96, § 7.)

Collation, Institution, or Admission by a Pres-

bytery or other competent authority, to any

ecclesiastical benefice, £2. (55 Geo. in. c. 184,

and 27 Vict. c. 18.)

Composition-Deed with Creditors, £1, 15s.

Contract Note (after 28th August 1860). Any

note, memorandum, or writing, commonly

called a Contract Note, or by whatever name

the same may be designated, for or relating to

the sale or purchase of any Government or

other public stocks, funds, or securities, or any

stocks, funds, or securities, or share or shares

of or in any joint-stock or other public company,

to the amount or value of £5 or up wards.... Id.

[Duty to be denoted by impressed or adhesive

stamps. Adhesive stamp to be cancelled by

writing, stamping, or impressing in ink, upon

or across it, name or initials and date of can-

celling. Penalty for marking or signing with-

out being stamped, £20, and no charge for

brokerage, commission, agency, or otherwise,

shall be lawful. (23 & 24 Vict. c. Ill, § 7 ; 24

& 25 Vict. c. 91, § 33.)]

Contract under the Highway Acts for making,

maintaining, or repairing highways (28 & 29

Vict. c. 96,"g 30) 6d.

Conveyances.

Conveyance, whether grant, disposition, assign-

ment, transfer, renunciation, or of any other

kind whatsoever, upon the sale of any lands,

tenements, rents, annuities, or other property,

heritable or moveable, or of any right, title, in-

terest, or claim in, to, out of, or upon any such,

that is, for the principal or only deed, instru-

ment, or writing, whereby the lands or other

things sold are granted, assigned, transferred,

renounced, or otherwise conveyed to or vested

in the purchaser, or any other person, by his

direction, —

Where the purchase or consideration money ex-

pressed shall not exceed £5 £0 6

Exceeding £5 and not exceeding 10 10

... " 10 ... 15 16

Exceeding £15 and not exceeding £20 £0 2

20 ... 25 2 6

25 ... 50 5

50 ... 75 7 6

75 ... 100 10

100 ... 125 12 6

125 ... 150 15

150 ... 175 17 6

175 ... 200 1

200 ... 225 1 2 6

225 ... 250 15

250 ... 275 1 7 6

275 ... 300 1 10

And where the purchase or consideration money

shall exceed £300, then for every £50, and also

for any fractional part of £50 — 5s.

It is directed that the purchase-monej' or con-

sideration shall be truly expressed and set forth

in words at length in or upon every deed or in-

strument of conveyance ; and where such con-

sideration shall consist, either wholly or in part,

of any stock or security, the value thereof re-

spectively, to be ascertained as after mentioned,

shall also be truly set forth, as aforesaid, in or

upon every such deed or instrument ; and such

value shall be deemed to be the purchase or

consideration money, or part thereof, as the

case may be, in respect whereof the ad valorem

duty shall be charged.

And where the consideration, or any part of the

consideration, shall be stock in the public funds,

or any Government debenture, or stock of the

Banks of England or Ireland, or any debenture

or stock of any Corporation, Company, Society,

or persons or person, payable only at the will of

the debtor, the duty shall be calculated (taking

the same respectively, whether constituting the

whole or a part only of such consideration)

according to the average selling price thereof

respectively, on the day, or on either of the

ten days preceding the date of the deed or in-

strument of conveyance, or if no sale shall have

taken place within such ten days, then accord-

ing to the average selling price thereof on the

day of the last preceding sale ; and if such

consideration, or part thereof, shall be a mort-

gage, bond, or debenture, the amount whereof

shall be recoverable by the holder, or any other

security whatsoever, whether payable in money

or otherwise, such calculation shall be made

according to the sum due thereon for both prin-

cipal and interest.

In any case where property shall be sold and

conveyed in consideration of any rent-charge

or annuity, or any annual or periodical payment

to be made permanently or for any indefinite

period, so that the total amount of the money

to be paid for such property cannot be previ-

ously ascertained, which rent-charge, annuitj-,

or other payment shall be made subject to

redemption or purchase upon terms and con-

ditions specified in the deed or instrument

whereby the property sold shall be conveyed

to or vested in the purchaser, or any person

by his direction, the money or the considera-

tion mentioned in the said deed or instrument

as that on payment or transfer, delivery or

satisfaction, of which the said rent-charge, an-

nuity, or other payment shall be redeemed or

purchased, or repurchased, or shall cease to be

payable, shall be deemed to be the purchase-

money or consideration, on the sale of the said

property so sold and conveyed, and in respect

of which last-mentioned purchase-money or

consideration the ad valorem duty shall be

chargeable ; and where any such last-men-

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1868-1869 > (635) |

|---|

| Permanent URL | https://digital.nls.uk/84265076 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|