Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

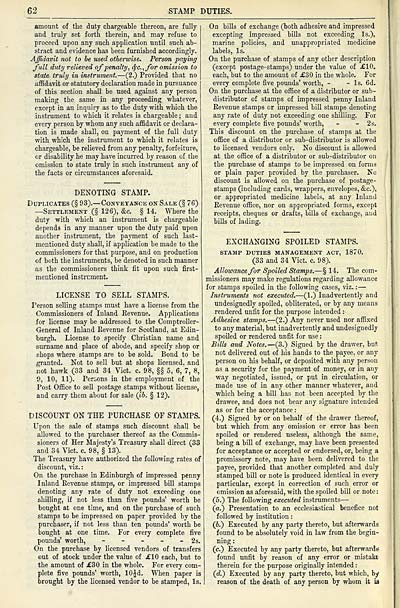

62

STAMP DUTIES.

amount of the duty chargeable thereon, are fully

and truly set forth therein, and may refuse to

proceed upon any such application until such ab-

stract and evidence has been furnished accordingly.

Affidavit not to he used otherwise. Person paying

full duty relieved of penalty, 6(c.,for omission to

state truly in instrument, — (2.) Provided that no

aiBdavit or statutory declaration made in pursuance

of this section shall be used against any person

making the same in any proceeding whatever,

except in an inquiry as to the duty with which the

instrument to which it relates is chargeable ; and

every person by whom any such affidavit or declara-

tion is made shall, on payment of the full duty

with which the instrument to which it relates is

chargeable, be relieved from any penalty, forfeiture,

or disability he may have incurred by reason of the

omission to state truly in such instmment any of

the facts or circumstances aforesaid.

DENOTING STAMP.

Duplicates (§ 93). — Conveyanck on Sale (§ 76)

— Settlement (§ 126), &c. § 14. Where the

duty with which an instrument is chargeable

depends in any manner upon the duty paid upon

another instrument, the payment of such last-

mentioned duty shall, if application be made to the

commissioners for that purpose, and on production

of both the instruments, be denoted in such manner

as the commissioners think fit upon such first-

mentioned instrument.

LICENSE TO SELL STAMPS.

Person selling stamps must have a license from the

Commissioners of Inland Revenue. Applications

for license may be addressed to the Comptroller-

General of Inland Eevenue for Scotland, at Edin-

burgh. License to specify Christian name and

surname and place of abode, and specify shop or

shops where stamps are to be sold. Bond to be

granted. Not to sell but at shops licensed, and

not hawk (33 and 34 Vict. c. 98, §§ 5, 6, 7, 8,

9, 10, 11). Persons in the employment of the

Post Office to sell postage stamps without license,

and carry them about for sale (ih. § 12).

DISCOUNT ON THE PURCHASE OF STAMPS.

Upon the sale of stamps such discount shall be

allowed to the purchaser thereof as the Commis-

sioners of Her Majesty's Treasury shall direct (33

and 34 Vict. c. 98, § 13).

The Treasury have authorized the following rates of

discount, viz. :

On the purchase in Edinburgh of impressed penny

Inland Eevenue stamps, or impressed bill stamps

denoting any rate of duty not exceeding one

shilling, if not less than five pounds' worth be

bought at one time, and on the purchase of such

stamps to be impressed on paper provided by the

purchaser, if not less than ten pomids' worth be

bought at one time. For eveiy complete five

pounds' worth, - - - - - 2 s.

On the purchase by licensed vendors of transfers

out of stock under the value of £10 each, but to

the amount of £30 in the whole. For every com-

plete five pounds' worth, 10|d. When paper is

brought by the licensed vendor to be stamped. Is.

On bills of exchange (both adhesive and impressed

excepting impressed bills not exceeding Is.),

marine policies, and unappropriated medicine

labels, Is.

On the purchase of stamps of any other description

(except postage-stamps) under the value of £10.

each, but to the amount of £30 in the whole. For

every complete five pounds' worth, - - Is. 6d.

On the purchase at the office of a distributor or sub-

distributor of stamps of impressed penny Inland

Revenue stamps or impressed bill stamps denoting

any rate of duty not exceeding one shilling. For

every complete five pounds' worth, - - 2s.

This discount on the purchase of stamps at the

office of a distributor or sub-distributor is allowed

to licensed vendors only. No discount is allowed

at the office of a distributor or sub-distributor on

the purchase of stamps to be impressed on forms

or plain paper provided by the purchaser. No

discount is allowed on the purchase of postage-

stamps (including cards, wrappers, envelopes, &c.),

or appropriated medicine labels, at any Inland

Eevenue office, nor on appropriated forms, except

receipts, cheques or drafts, bills of exchange, and

bills of lading.

EXCHANGING SPOILED STAMPS.

STAMP DUTIES MANAGEMENT ACT, 1870.

(33 and 34 Vict. c. 98).

Allowance for Spoiled Stamps. — § 14. The com-

missioners may make regulations regarding allowance

for stamps spoiled in the following cases, viz. : —

Instruments not executed. — (1.) Inadvertently and

undesignedly spoiled, obliterated, or by any means

rendered unfit for the purpose intended :

Adhesive stamps. — (2.) Any never used nor affixed

to any material, but inadvertently and undesignedly

spoiled or rendered unfit for use :

Bills and Notes. — (3.) Signed by the drawer, but

not delivered out of his hands to the payee, or any

person on his behalf, or deposited with any person

as a security for the payment of money, or in any

way negotiated, issued, or put in circulation, or

made use of in any other manner whatever, and

which being a bill has not been accepted by the

drawee, and does not bear any signatm-e intended

as or for the acceptance :

(4.) Signed by or on behalf of the drawer thereof,

but which from any omission or error has been

spoiled or rendered useless, although the same,

being a bill of exchange, may have been presented

for acceptance or accepted or endorsed, or, being a

promissory note, may have been delivered to the

payee, provided that another completed and duly

stamped bill or note is produced identical in every

particular, except in correction of such error or

omission as aforesaid, with the spoiled bill or note :

(5.) The following executed instruments —

(a.) Presentation to an ecclesiastical benefice not

followed by institution :

(6.) Executed by any party thereto, but afterwards

found to be absolutely void in law from the begin-

ning:

(c.) Executed by any party thereto, but aftei-wards

found unfit by reason of any error or mistaki'

therein for the purpose originally intended :

(d) Executed by any party thereto, but which, by

reason of the death of any person by whom it ia

STAMP DUTIES.

amount of the duty chargeable thereon, are fully

and truly set forth therein, and may refuse to

proceed upon any such application until such ab-

stract and evidence has been furnished accordingly.

Affidavit not to he used otherwise. Person paying

full duty relieved of penalty, 6(c.,for omission to

state truly in instrument, — (2.) Provided that no

aiBdavit or statutory declaration made in pursuance

of this section shall be used against any person

making the same in any proceeding whatever,

except in an inquiry as to the duty with which the

instrument to which it relates is chargeable ; and

every person by whom any such affidavit or declara-

tion is made shall, on payment of the full duty

with which the instrument to which it relates is

chargeable, be relieved from any penalty, forfeiture,

or disability he may have incurred by reason of the

omission to state truly in such instmment any of

the facts or circumstances aforesaid.

DENOTING STAMP.

Duplicates (§ 93). — Conveyanck on Sale (§ 76)

— Settlement (§ 126), &c. § 14. Where the

duty with which an instrument is chargeable

depends in any manner upon the duty paid upon

another instrument, the payment of such last-

mentioned duty shall, if application be made to the

commissioners for that purpose, and on production

of both the instruments, be denoted in such manner

as the commissioners think fit upon such first-

mentioned instrument.

LICENSE TO SELL STAMPS.

Person selling stamps must have a license from the

Commissioners of Inland Revenue. Applications

for license may be addressed to the Comptroller-

General of Inland Eevenue for Scotland, at Edin-

burgh. License to specify Christian name and

surname and place of abode, and specify shop or

shops where stamps are to be sold. Bond to be

granted. Not to sell but at shops licensed, and

not hawk (33 and 34 Vict. c. 98, §§ 5, 6, 7, 8,

9, 10, 11). Persons in the employment of the

Post Office to sell postage stamps without license,

and carry them about for sale (ih. § 12).

DISCOUNT ON THE PURCHASE OF STAMPS.

Upon the sale of stamps such discount shall be

allowed to the purchaser thereof as the Commis-

sioners of Her Majesty's Treasury shall direct (33

and 34 Vict. c. 98, § 13).

The Treasury have authorized the following rates of

discount, viz. :

On the purchase in Edinburgh of impressed penny

Inland Eevenue stamps, or impressed bill stamps

denoting any rate of duty not exceeding one

shilling, if not less than five pounds' worth be

bought at one time, and on the purchase of such

stamps to be impressed on paper provided by the

purchaser, if not less than ten pomids' worth be

bought at one time. For eveiy complete five

pounds' worth, - - - - - 2 s.

On the purchase by licensed vendors of transfers

out of stock under the value of £10 each, but to

the amount of £30 in the whole. For every com-

plete five pounds' worth, 10|d. When paper is

brought by the licensed vendor to be stamped. Is.

On bills of exchange (both adhesive and impressed

excepting impressed bills not exceeding Is.),

marine policies, and unappropriated medicine

labels, Is.

On the purchase of stamps of any other description

(except postage-stamps) under the value of £10.

each, but to the amount of £30 in the whole. For

every complete five pounds' worth, - - Is. 6d.

On the purchase at the office of a distributor or sub-

distributor of stamps of impressed penny Inland

Revenue stamps or impressed bill stamps denoting

any rate of duty not exceeding one shilling. For

every complete five pounds' worth, - - 2s.

This discount on the purchase of stamps at the

office of a distributor or sub-distributor is allowed

to licensed vendors only. No discount is allowed

at the office of a distributor or sub-distributor on

the purchase of stamps to be impressed on forms

or plain paper provided by the purchaser. No

discount is allowed on the purchase of postage-

stamps (including cards, wrappers, envelopes, &c.),

or appropriated medicine labels, at any Inland

Eevenue office, nor on appropriated forms, except

receipts, cheques or drafts, bills of exchange, and

bills of lading.

EXCHANGING SPOILED STAMPS.

STAMP DUTIES MANAGEMENT ACT, 1870.

(33 and 34 Vict. c. 98).

Allowance for Spoiled Stamps. — § 14. The com-

missioners may make regulations regarding allowance

for stamps spoiled in the following cases, viz. : —

Instruments not executed. — (1.) Inadvertently and

undesignedly spoiled, obliterated, or by any means

rendered unfit for the purpose intended :

Adhesive stamps. — (2.) Any never used nor affixed

to any material, but inadvertently and undesignedly

spoiled or rendered unfit for use :

Bills and Notes. — (3.) Signed by the drawer, but

not delivered out of his hands to the payee, or any

person on his behalf, or deposited with any person

as a security for the payment of money, or in any

way negotiated, issued, or put in circulation, or

made use of in any other manner whatever, and

which being a bill has not been accepted by the

drawee, and does not bear any signatm-e intended

as or for the acceptance :

(4.) Signed by or on behalf of the drawer thereof,

but which from any omission or error has been

spoiled or rendered useless, although the same,

being a bill of exchange, may have been presented

for acceptance or accepted or endorsed, or, being a

promissory note, may have been delivered to the

payee, provided that another completed and duly

stamped bill or note is produced identical in every

particular, except in correction of such error or

omission as aforesaid, with the spoiled bill or note :

(5.) The following executed instruments —

(a.) Presentation to an ecclesiastical benefice not

followed by institution :

(6.) Executed by any party thereto, but afterwards

found to be absolutely void in law from the begin-

ning:

(c.) Executed by any party thereto, but aftei-wards

found unfit by reason of any error or mistaki'

therein for the purpose originally intended :

(d) Executed by any party thereto, but which, by

reason of the death of any person by whom it ia

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1887-1888 > (74) |

|---|

| Permanent URL | https://digital.nls.uk/84204739 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|