Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

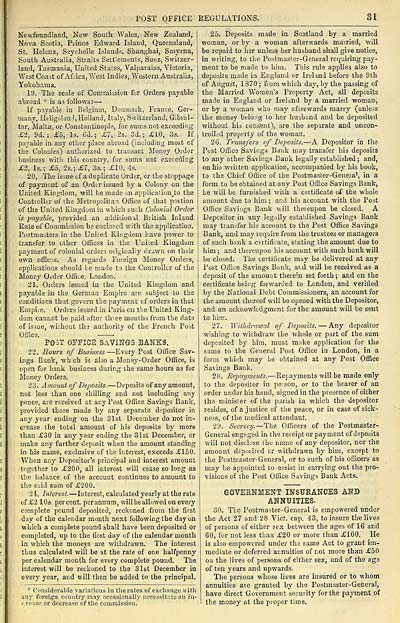

POST OFFICE REGULATIONS.

31

Newfoundland, New South Wales, New Zealand,

Nova Scotia, Prince Edwaid Island, Queensland,

St. Helena, Seychelle Islands, Shanghai, Smyrna,

South Australia, Straits Settlements, Suez, Switzer-

land, Tasmania, United States, Valparaiso, Victoria,

West Coast of Africa, West Indies, Western Australia,

Yokohama.

19. The scale of Commission fur Orders payable

abroad * is as follows: —

If payable in Belgium, Denmark, France, Ger-

many, Heligoland, Holland, Italy, Switzerland, Gibral-

tar, Malta, or Constantinople, for sums not exceeding

£2, 9d. ; £5, Is. Gd. ; £7, 2s. 3d.; £10, 3s. If

payable in- any other place abroad (including most of

the Colonies) authorized to transact Money Order

business with this country, for sums not exceeding

£2, Is.; £5, 2s.; £7, 3s.; £10, 4s.

20. The issue of a duplicate Order, or the stoppage

of payment of an Order issued by a Colony on the

United Kingdom, will be made on applicatiorfto the

Controller of the Metropolitan Office of that portion

of the United Kingdom in which such Colonial Order

is payable, provided an additional Btitish Inland

Rate of Commission be enclosed with the application.

Postmasters in the United Kingdom have power to

transfer to other Offices in the United Kingdom

payment of colonial orders otiginally drawn on their

own offics. As regards Foreign Money Orders,

applications should be made to the Controller of the

Money Oider Office, London.

21. Orders issued in the United Kingdom and

payable in the German Empire are subject to the

conditions that govern the payment cf orders in that

Empire. Orders issued in Paris on the United King-

dom cannot be paid after three months from the date

of issue, without the authority of the French Post

Office. ■

POST OFFICS SAVINGS BANKS.

22. Hours of Business. — Every Post Office Sav-

ings Bank, wh ch is also a Money-Order Office, is

open for bank business during the same hours as for

Money Orders.

23. Amount of Deposits. — Deposits of any amount,

not less than one shilling and not including any

pence, are received at any Post Office Savings Bank,

provided those made by any separate depositor in

any year ending on the 31st December do not in-

crease ihe total amount of his deposits by more

than £30 in any year ending the 31st December, or

make any further deposit when the amount standing

in his name, exclusive of the interest, exceeds £150.

When any Depositor's principal and interest amount

together to £200, all interest will cease so loDg as

the balance of the account continues to amount to

the said sum of £200.

24. Interest. — Interest, calculated yearly at the rate

of £2 10s. percent, perannum, will beallowed on every

complete pound deposited, reckoned from the first

day of the calendar month next following the day on

which a complete pound shall have been deposited or

completed, up to the first day of the calendar month

in which the moneys are withdrawn. The interest

thus calculated will be at the rate of one halfpenny

per calendar month for every complete pound. The

interest will be reckoned to the 31st December in

every year, and will then be added to the principal.

* Considerable variations in the rates of exchange with.

any foreign country may occasionally necessitate an in-

crease or decrease of the commission.

25. Deposits made in Scotland by a married

woman, or by a woman afterwards married, will

be repaid to her unless her husband shall give notice,

in writing, to the Postmaster-General requiring pay-

ment to be made to him. This rule applies also to

deposits made in England or Ireland before the 9th

of August, 1870 ; fi om which day, by the passing of

the Married Women's Property Act, sll deposits

made in England or Ireland by a married woman,

or by a woman who may afterwards marry (unless

the money belong to her husband and be deposited

without his consent), are the separate and uncon-

trolled property of the woman.

26. Transfers of Deposits. — A Depositor in the

Post Office Savings Bank may transfer his deposits

to any other Savings Bank legally established ; and,

on his written application, accompanied by his book,

to the Chief Office of the Postmaster-Genera', in a

form to be obtained at any Post Office Savings Bank,

he will be furnished with a certificate o£ the whole

amount due to him ; and his account with the Post

Office Savings Bank will thereupon be closed. A

Depositor in any legally established Savings Bank

may transfer his account to the Post Office Savings

Bank, and may require from the trustees or managers

of such bank a certificate, stating the amount due to

him ; and thereupon his account with such bank will

be closed. The certificate may be delivered at any

Post Office Savings Bank, and will be received as a

deposit of the amount therein set forth ; and on the

certificate being forwarded to London, and verified

by the National Debt Commissioners, an account for

the amount thereof will be opened with the Depositor,

and an acknowledgment for the amount will be sent

to him.

27. Withdrawal of Deposits. — Any depositor

wishing to withdraw the whole or part of the sum

deposited by him, must make application for the

same to the General Post Office in London, in a

form which may be obtained at any Post Office

Savings Bank.

28. Repayments. — Repayments will be made only

to the depositor in person, or to the bearer of an

order under his hand, signed in the presence of either

the minister of the parish in which the depositor

resides, of a justice of the peace, or in case of sick-

ness, of the medical attendant.

29. Secrecy.— The Officers of the Postmaster-

General engaged in the receipt or payment of deposits

will not disclose the name of any depositor, nor the

amount deposited or withdrawn by him, except to

the Postmaster- Genera], or to such of his officers as

may be appointed to assist in carrying out the pro-

visions of the Post Office Savings Bank Acts.

GOVERNMENT INSURANCES AND

ANNUITIES.

30. The Postmaster-General is empowered under

the Act 27 and 28 Vict. cap. 43, to insure the lives

of persons of either sex between the ages of 16 and

60, for not less than £20 or more than £100. He

is also empowered under the same Act to grant im-

mediate or deferred annuities of not more than £50

on the lives of persons of either sex, and of the age

of ten years and upwards.

The persons whose lives are insured or to whom

annuities are granted by the Postmaster-General,

have direct Government security for the payment of

the money at the proper time.

31

Newfoundland, New South Wales, New Zealand,

Nova Scotia, Prince Edwaid Island, Queensland,

St. Helena, Seychelle Islands, Shanghai, Smyrna,

South Australia, Straits Settlements, Suez, Switzer-

land, Tasmania, United States, Valparaiso, Victoria,

West Coast of Africa, West Indies, Western Australia,

Yokohama.

19. The scale of Commission fur Orders payable

abroad * is as follows: —

If payable in Belgium, Denmark, France, Ger-

many, Heligoland, Holland, Italy, Switzerland, Gibral-

tar, Malta, or Constantinople, for sums not exceeding

£2, 9d. ; £5, Is. Gd. ; £7, 2s. 3d.; £10, 3s. If

payable in- any other place abroad (including most of

the Colonies) authorized to transact Money Order

business with this country, for sums not exceeding

£2, Is.; £5, 2s.; £7, 3s.; £10, 4s.

20. The issue of a duplicate Order, or the stoppage

of payment of an Order issued by a Colony on the

United Kingdom, will be made on applicatiorfto the

Controller of the Metropolitan Office of that portion

of the United Kingdom in which such Colonial Order

is payable, provided an additional Btitish Inland

Rate of Commission be enclosed with the application.

Postmasters in the United Kingdom have power to

transfer to other Offices in the United Kingdom

payment of colonial orders otiginally drawn on their

own offics. As regards Foreign Money Orders,

applications should be made to the Controller of the

Money Oider Office, London.

21. Orders issued in the United Kingdom and

payable in the German Empire are subject to the

conditions that govern the payment cf orders in that

Empire. Orders issued in Paris on the United King-

dom cannot be paid after three months from the date

of issue, without the authority of the French Post

Office. ■

POST OFFICS SAVINGS BANKS.

22. Hours of Business. — Every Post Office Sav-

ings Bank, wh ch is also a Money-Order Office, is

open for bank business during the same hours as for

Money Orders.

23. Amount of Deposits. — Deposits of any amount,

not less than one shilling and not including any

pence, are received at any Post Office Savings Bank,

provided those made by any separate depositor in

any year ending on the 31st December do not in-

crease ihe total amount of his deposits by more

than £30 in any year ending the 31st December, or

make any further deposit when the amount standing

in his name, exclusive of the interest, exceeds £150.

When any Depositor's principal and interest amount

together to £200, all interest will cease so loDg as

the balance of the account continues to amount to

the said sum of £200.

24. Interest. — Interest, calculated yearly at the rate

of £2 10s. percent, perannum, will beallowed on every

complete pound deposited, reckoned from the first

day of the calendar month next following the day on

which a complete pound shall have been deposited or

completed, up to the first day of the calendar month

in which the moneys are withdrawn. The interest

thus calculated will be at the rate of one halfpenny

per calendar month for every complete pound. The

interest will be reckoned to the 31st December in

every year, and will then be added to the principal.

* Considerable variations in the rates of exchange with.

any foreign country may occasionally necessitate an in-

crease or decrease of the commission.

25. Deposits made in Scotland by a married

woman, or by a woman afterwards married, will

be repaid to her unless her husband shall give notice,

in writing, to the Postmaster-General requiring pay-

ment to be made to him. This rule applies also to

deposits made in England or Ireland before the 9th

of August, 1870 ; fi om which day, by the passing of

the Married Women's Property Act, sll deposits

made in England or Ireland by a married woman,

or by a woman who may afterwards marry (unless

the money belong to her husband and be deposited

without his consent), are the separate and uncon-

trolled property of the woman.

26. Transfers of Deposits. — A Depositor in the

Post Office Savings Bank may transfer his deposits

to any other Savings Bank legally established ; and,

on his written application, accompanied by his book,

to the Chief Office of the Postmaster-Genera', in a

form to be obtained at any Post Office Savings Bank,

he will be furnished with a certificate o£ the whole

amount due to him ; and his account with the Post

Office Savings Bank will thereupon be closed. A

Depositor in any legally established Savings Bank

may transfer his account to the Post Office Savings

Bank, and may require from the trustees or managers

of such bank a certificate, stating the amount due to

him ; and thereupon his account with such bank will

be closed. The certificate may be delivered at any

Post Office Savings Bank, and will be received as a

deposit of the amount therein set forth ; and on the

certificate being forwarded to London, and verified

by the National Debt Commissioners, an account for

the amount thereof will be opened with the Depositor,

and an acknowledgment for the amount will be sent

to him.

27. Withdrawal of Deposits. — Any depositor

wishing to withdraw the whole or part of the sum

deposited by him, must make application for the

same to the General Post Office in London, in a

form which may be obtained at any Post Office

Savings Bank.

28. Repayments. — Repayments will be made only

to the depositor in person, or to the bearer of an

order under his hand, signed in the presence of either

the minister of the parish in which the depositor

resides, of a justice of the peace, or in case of sick-

ness, of the medical attendant.

29. Secrecy.— The Officers of the Postmaster-

General engaged in the receipt or payment of deposits

will not disclose the name of any depositor, nor the

amount deposited or withdrawn by him, except to

the Postmaster- Genera], or to such of his officers as

may be appointed to assist in carrying out the pro-

visions of the Post Office Savings Bank Acts.

GOVERNMENT INSURANCES AND

ANNUITIES.

30. The Postmaster-General is empowered under

the Act 27 and 28 Vict. cap. 43, to insure the lives

of persons of either sex between the ages of 16 and

60, for not less than £20 or more than £100. He

is also empowered under the same Act to grant im-

mediate or deferred annuities of not more than £50

on the lives of persons of either sex, and of the age

of ten years and upwards.

The persons whose lives are insured or to whom

annuities are granted by the Postmaster-General,

have direct Government security for the payment of

the money at the proper time.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1875-1876 > (929) |

|---|

| Permanent URL | https://digital.nls.uk/84185901 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|