Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

38

STAMP DUTIES.

the inventorj' recorded in the Commissarj' Court;

or inventory duty may be paid on the personal

property in Scotland, and dut}- may be paid on a

" special inventory " of the money secured on the

heritage, &c., and probate or administration may

be obtained in England and Ireland in respect of

the personal estate in these countries, and dut}'

paid in respect of such on these instruments,

la case of a person dying domiciled furth of the

United Kingdom, leaving personal estate in Scot-

land, England, and Ireland, an inventory must be

given up in Scotland, probate or administration

taken out in England and Ireland, and duty paid

on such in respect of the property in each country.

For probate and administration duty, debts and

money due from persons in the United Kingdom

to a deceased, on obligation or other specialty,

shall be estate and effects of deceased, within the

jurisdiction of the Court of Probate in England or

Ireland, in which the same would be if they were

debts upon simple contract, without regard to the

place -where the obligation or specialty shall be

at the time of the death (25 Vict. c. 2i, § 39).

Return of Inventory Dutt :

The inventory duty and probate and administra-

tion duty are paid on the whole personal property,

•without deducti^m of debts; but the Act 5 and 6

Vict. c. 79, § 23, provides for a return being given

on proof of the constitution and payment of the

debts. This return must be claimed within three

years; but the time will be prolonged on applica-

tion to the Board of Inland Revenue. A return

of the duty paid on heritable securities raaj' also

be made in certain circumstances. (>See 23 and

24 Vict. c. 80, §§ 4 and 6.) No return will be

granted in respect of a voluntary debt due from a

person dying after 28th June, 1861, expressed to

be payable on the death of such person, or payable

under an instrument which shall not have been

hona fide delivered to the donee three months be-

fore the death of such person. (24 and 25 Vict,

c. 92, § 3).

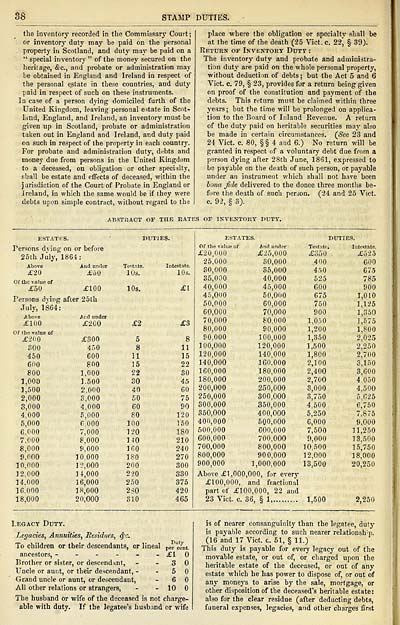

ABSTRACT OF THE RATES OF INVENTORY PUTY.

ESTATKS.

DUTIES.

Persons dying

on or before

25th July,

1864:

Above

And uniler

Testate.

Intest.ile.

£20

£50

lOs.

lOs.

Of the value of

£50

£100

10s.

£1

Persons dying

after 25th

July, 1864:

Above

,Ar.d under

£100

£200

£2

£3

Of the value of

£■200

£300

5

8

300

450

8

11

450

600

11

15

600

800

15

22

800

1,000

22

SO

1,000

1.500

30

45

1,500

2,000

40

60

2,000

8,000

50

75

3,000

4,000

60

90

4.000

5,000

80

120

5,000

6.000

100

150

6,000

7,000

120

180

7,000

8,000

1-iO

210

8,000

ti,000

160

240

9,000

10.000

180

270

10.000

12,000

200

300

12,000

14,000

220

330

14,000

16,000

250

375

IG.OOO

18,000

230

420

18,000

20,000

310

465

Of the valui

£20,000

25,000

30,000

35,000

40,000

45,000

60,000

60,000

70,000

80,000

90.000

100,000

120,000

140,000

160,000

180,000

200,000

250,000

300,000

350,000

400,000

500,000

600,000

700,000

800,000

900,000

And under

£25,000

30,000

35,000

40,000

45,000

50,000

60,000

70,000

80,000

90,000

100,000

120,000

140,000

160.000

180,000

200,000

250,000

300,000

350,000

400,000

500,000

600,000

700,000

800,000

900,000

1,000,000

Te.st.itf-.

£ooO

400

450

525

600

075

750

900

1,0-50

1,200

1,350

1,500

1,800

2,100

2,400

2,700

3,000

3,750

4,500

5,250

6,000

7,500

9,000

10.500

12,000

13,500

Above £1,000,000, for every

£100,000, and fractional

part of £100,000, 22 and

23 Vict. c. 36, § 1

1,500

IntcKtate.

£525

COO

67.3

785

900

1,010

1,125

1,350

1,575

1,800

2,025

2,250

2,700

3,150

3,600

4,050

4,500

5.025

6,760

7.875

9,000

11,250

13,500

15,750

18,000

20,250

2,250

Legacy Duty.

Legacies, Annuities, Residues, cf-c.

To children or their descendants, or lineal per 'cfnt.

ancestors, - - - - -

Brother or sister, or descendant,

Uncle or aunt, or their descendant, -

Grand uncle or aunt, or descendant,

All other relations or strangers.

The husband or wife of the deceased is not charge-

able with duty. If the legatee's husband or wife

£1

3

6

6

10

is of nearer consanguinity than the legatee, duly

is payable according to such nearer relationsh'p.

(16 and 17 Vict. c. 51, § 11.)

This duty is payable for every legacy out of the

movable estate, or out of, or charged upon the

heritable estate of the deceased, or out of any

estate which he has power to dispose of, or out of

any moneys to arise by the sale, mortgage, or

other disposition of the deceased's heritable estate:

also for the clear residue (after deducting debts,

funeral expenses, legacies, and other charges first

STAMP DUTIES.

the inventorj' recorded in the Commissarj' Court;

or inventory duty may be paid on the personal

property in Scotland, and dut}- may be paid on a

" special inventory " of the money secured on the

heritage, &c., and probate or administration may

be obtained in England and Ireland in respect of

the personal estate in these countries, and dut}'

paid in respect of such on these instruments,

la case of a person dying domiciled furth of the

United Kingdom, leaving personal estate in Scot-

land, England, and Ireland, an inventory must be

given up in Scotland, probate or administration

taken out in England and Ireland, and duty paid

on such in respect of the property in each country.

For probate and administration duty, debts and

money due from persons in the United Kingdom

to a deceased, on obligation or other specialty,

shall be estate and effects of deceased, within the

jurisdiction of the Court of Probate in England or

Ireland, in which the same would be if they were

debts upon simple contract, without regard to the

place -where the obligation or specialty shall be

at the time of the death (25 Vict. c. 2i, § 39).

Return of Inventory Dutt :

The inventory duty and probate and administra-

tion duty are paid on the whole personal property,

•without deducti^m of debts; but the Act 5 and 6

Vict. c. 79, § 23, provides for a return being given

on proof of the constitution and payment of the

debts. This return must be claimed within three

years; but the time will be prolonged on applica-

tion to the Board of Inland Revenue. A return

of the duty paid on heritable securities raaj' also

be made in certain circumstances. (>See 23 and

24 Vict. c. 80, §§ 4 and 6.) No return will be

granted in respect of a voluntary debt due from a

person dying after 28th June, 1861, expressed to

be payable on the death of such person, or payable

under an instrument which shall not have been

hona fide delivered to the donee three months be-

fore the death of such person. (24 and 25 Vict,

c. 92, § 3).

ABSTRACT OF THE RATES OF INVENTORY PUTY.

ESTATKS.

DUTIES.

Persons dying

on or before

25th July,

1864:

Above

And uniler

Testate.

Intest.ile.

£20

£50

lOs.

lOs.

Of the value of

£50

£100

10s.

£1

Persons dying

after 25th

July, 1864:

Above

,Ar.d under

£100

£200

£2

£3

Of the value of

£■200

£300

5

8

300

450

8

11

450

600

11

15

600

800

15

22

800

1,000

22

SO

1,000

1.500

30

45

1,500

2,000

40

60

2,000

8,000

50

75

3,000

4,000

60

90

4.000

5,000

80

120

5,000

6.000

100

150

6,000

7,000

120

180

7,000

8,000

1-iO

210

8,000

ti,000

160

240

9,000

10.000

180

270

10.000

12,000

200

300

12,000

14,000

220

330

14,000

16,000

250

375

IG.OOO

18,000

230

420

18,000

20,000

310

465

Of the valui

£20,000

25,000

30,000

35,000

40,000

45,000

60,000

60,000

70,000

80,000

90.000

100,000

120,000

140,000

160,000

180,000

200,000

250,000

300,000

350,000

400,000

500,000

600,000

700,000

800,000

900,000

And under

£25,000

30,000

35,000

40,000

45,000

50,000

60,000

70,000

80,000

90,000

100,000

120,000

140,000

160.000

180,000

200,000

250,000

300,000

350,000

400,000

500,000

600,000

700,000

800,000

900,000

1,000,000

Te.st.itf-.

£ooO

400

450

525

600

075

750

900

1,0-50

1,200

1,350

1,500

1,800

2,100

2,400

2,700

3,000

3,750

4,500

5,250

6,000

7,500

9,000

10.500

12,000

13,500

Above £1,000,000, for every

£100,000, and fractional

part of £100,000, 22 and

23 Vict. c. 36, § 1

1,500

IntcKtate.

£525

COO

67.3

785

900

1,010

1,125

1,350

1,575

1,800

2,025

2,250

2,700

3,150

3,600

4,050

4,500

5.025

6,760

7.875

9,000

11,250

13,500

15,750

18,000

20,250

2,250

Legacy Duty.

Legacies, Annuities, Residues, cf-c.

To children or their descendants, or lineal per 'cfnt.

ancestors, - - - - -

Brother or sister, or descendant,

Uncle or aunt, or their descendant, -

Grand uncle or aunt, or descendant,

All other relations or strangers.

The husband or wife of the deceased is not charge-

able with duty. If the legatee's husband or wife

£1

3

6

6

10

is of nearer consanguinity than the legatee, duly

is payable according to such nearer relationsh'p.

(16 and 17 Vict. c. 51, § 11.)

This duty is payable for every legacy out of the

movable estate, or out of, or charged upon the

heritable estate of the deceased, or out of any

estate which he has power to dispose of, or out of

any moneys to arise by the sale, mortgage, or

other disposition of the deceased's heritable estate:

also for the clear residue (after deducting debts,

funeral expenses, legacies, and other charges first

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1867-1868 > (70) |

|---|

| Permanent URL | https://digital.nls.uk/84151871 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|