Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

14

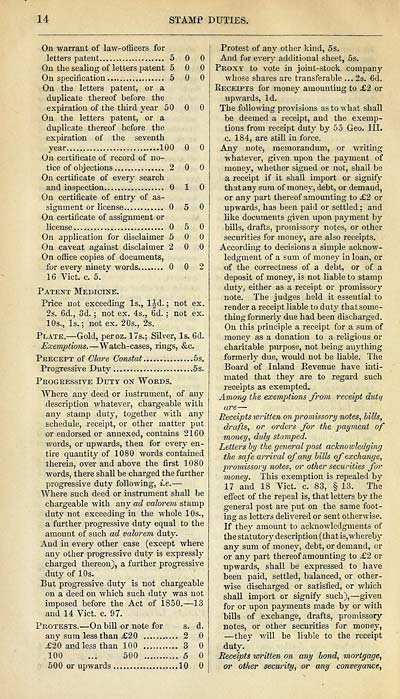

STAMP DUTIES.

On warrant of law-officers for

letters patent 5

On the sealing of letters patent 5

On specification 5

On the letters patent, or a

duplicate thereof before the

expiration of the third year 50

On the letters patent, or a

duplicate thereof before the

expiration of the seventh

year 100

On certificate of record of no-

tice of objections 2

On certificate of every search

and inspection 10

On certificate of entry of as-

signment or license 5

On certificate of assignment or

license 5

On application for disclaimer 5

On caveat against disclaimer 2

On office copies of documents,

for every ninety words 2

16 Vict. c. 5.

Patent Medicine.

Price not exceeding Is., 1 Jd. ; not ex.

2s. 6d., 3d. ; not ex. 4s., 6d. ; not ex.

10s., Is. ; not ex. 20s., 2s.

Plate. — Gold, peroz. 17s.; Silver, Is. 6d.

Exemptions. — Watch-cases, rings, &c.

Precept of Clare Constat 5s.

Progressive Duty 5s.

Progressive Duty on Words.

Where any deed or instrument, of any

description whatever, chargeable with

any stamp duty, together with any

schedule, receipt, or other matter put

or endorsed or annexed, contains 2160

words, or upwards, then for every en-

tire quantity of 1080 words contained

therein, over and above the first 1080

words, there shall be charged the further

progressive duty following, i.e. —

Where such deed or instrument shall be

chargeable with any ad valorem stamp

duty not exceeding in the whole 10s.,

a further progressive duty equal to the

amount of such ad valorem duty.

And in every other case (except where

any other progressive duty is expressly

charged thereon), a further progressive

duty of 10s.

But progressive duty is not chargeable

on a deed on which such duty was not

imposed before the Act of 1850. — 13

and 14 Vict. c. 97.

Protests. — On bill or note for s. d.

any sum less than £20 2

£20 and less than 100 3

100 ... 500 5

500 or upwards 10

Protest of any other kind, 5s.

And for every additional sheet, 5s.

Proxy to vote in joint-stock company

whose shares are transferable ... 2s. 6d.

Receipts for money amounting to £2 or

upwards, Id.

The following provisions as to what shall

be deemed a receipt, and the exemp-

tions from receipt duty by 55 Geo. III.

c. 184, are still in force.

Any note, memorandum, or writing

whatever, given upon the paj'ment of

money, whether signed or not, shall be

a receipt if it shall import or signify

that any sum of money, debt, or demaud,

or any part thereof amounting to £2 or

upwards, has been paid or settled ; and

like documents given upon payment by

bills, drafts, promissory notes, or other

securities for money, are also receipts.

According to decisions a simple acknow-

ledgment of a sum of money in loan, or

of the correctness of a debt, or of a

deposit of money, is not liable to stamp

duty, either as a receipt or promissory

note. The judges held it essential to

render a receipt liable to duty that some-

thing formerly due had been discharged.

On this principle a receipt for a sum of

money as a donation to a religious or

charitable purpose, not being anything

formerly due, would not be liable. The

Board of Inland Revenue have inti-

mated that they are to regard such

receipts as exempted.

Among the exemptions from receipt ditty

are —

Receipts written on promissory notes, hills,

drafts, or orders for the payment of

money, duly stamped.

Lettersby the general post acknowledging

the safe arrival of any bills of exchange,

promissory notes, or other securities for

■money. This exemption is repealed by

17 and 18 Vict. c. 83, § 13. The

effect of the repeal is, that letters by the

general post are put on the same foot-

ing as letters delivered or sent otherwise.

If they amount to acknowledgments of

the statutory description (that is, whereby

any sum of money, debt, or demand, or

or any part thereof amounting to £2 or

upwards, shall be expressed to have

been paid, settled, balanced, or other-

wise discharged or satisfied, or which

shall import or signify such),— given

for or upon payments made by or with

bills of exchange, drafts, promissory

notes, or other securities for money,

— they will be liable to the receipt

duty.

Receipts written on any bond, mortgage,

or other security, or any conveyance,

STAMP DUTIES.

On warrant of law-officers for

letters patent 5

On the sealing of letters patent 5

On specification 5

On the letters patent, or a

duplicate thereof before the

expiration of the third year 50

On the letters patent, or a

duplicate thereof before the

expiration of the seventh

year 100

On certificate of record of no-

tice of objections 2

On certificate of every search

and inspection 10

On certificate of entry of as-

signment or license 5

On certificate of assignment or

license 5

On application for disclaimer 5

On caveat against disclaimer 2

On office copies of documents,

for every ninety words 2

16 Vict. c. 5.

Patent Medicine.

Price not exceeding Is., 1 Jd. ; not ex.

2s. 6d., 3d. ; not ex. 4s., 6d. ; not ex.

10s., Is. ; not ex. 20s., 2s.

Plate. — Gold, peroz. 17s.; Silver, Is. 6d.

Exemptions. — Watch-cases, rings, &c.

Precept of Clare Constat 5s.

Progressive Duty 5s.

Progressive Duty on Words.

Where any deed or instrument, of any

description whatever, chargeable with

any stamp duty, together with any

schedule, receipt, or other matter put

or endorsed or annexed, contains 2160

words, or upwards, then for every en-

tire quantity of 1080 words contained

therein, over and above the first 1080

words, there shall be charged the further

progressive duty following, i.e. —

Where such deed or instrument shall be

chargeable with any ad valorem stamp

duty not exceeding in the whole 10s.,

a further progressive duty equal to the

amount of such ad valorem duty.

And in every other case (except where

any other progressive duty is expressly

charged thereon), a further progressive

duty of 10s.

But progressive duty is not chargeable

on a deed on which such duty was not

imposed before the Act of 1850. — 13

and 14 Vict. c. 97.

Protests. — On bill or note for s. d.

any sum less than £20 2

£20 and less than 100 3

100 ... 500 5

500 or upwards 10

Protest of any other kind, 5s.

And for every additional sheet, 5s.

Proxy to vote in joint-stock company

whose shares are transferable ... 2s. 6d.

Receipts for money amounting to £2 or

upwards, Id.

The following provisions as to what shall

be deemed a receipt, and the exemp-

tions from receipt duty by 55 Geo. III.

c. 184, are still in force.

Any note, memorandum, or writing

whatever, given upon the paj'ment of

money, whether signed or not, shall be

a receipt if it shall import or signify

that any sum of money, debt, or demaud,

or any part thereof amounting to £2 or

upwards, has been paid or settled ; and

like documents given upon payment by

bills, drafts, promissory notes, or other

securities for money, are also receipts.

According to decisions a simple acknow-

ledgment of a sum of money in loan, or

of the correctness of a debt, or of a

deposit of money, is not liable to stamp

duty, either as a receipt or promissory

note. The judges held it essential to

render a receipt liable to duty that some-

thing formerly due had been discharged.

On this principle a receipt for a sum of

money as a donation to a religious or

charitable purpose, not being anything

formerly due, would not be liable. The

Board of Inland Revenue have inti-

mated that they are to regard such

receipts as exempted.

Among the exemptions from receipt ditty

are —

Receipts written on promissory notes, hills,

drafts, or orders for the payment of

money, duly stamped.

Lettersby the general post acknowledging

the safe arrival of any bills of exchange,

promissory notes, or other securities for

■money. This exemption is repealed by

17 and 18 Vict. c. 83, § 13. The

effect of the repeal is, that letters by the

general post are put on the same foot-

ing as letters delivered or sent otherwise.

If they amount to acknowledgments of

the statutory description (that is, whereby

any sum of money, debt, or demand, or

or any part thereof amounting to £2 or

upwards, shall be expressed to have

been paid, settled, balanced, or other-

wise discharged or satisfied, or which

shall import or signify such),— given

for or upon payments made by or with

bills of exchange, drafts, promissory

notes, or other securities for money,

— they will be liable to the receipt

duty.

Receipts written on any bond, mortgage,

or other security, or any conveyance,

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1855-1856 > (30) |

|---|

| Permanent URL | https://digital.nls.uk/84130819 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|