Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

STAMP DUTIES. ETC.

711

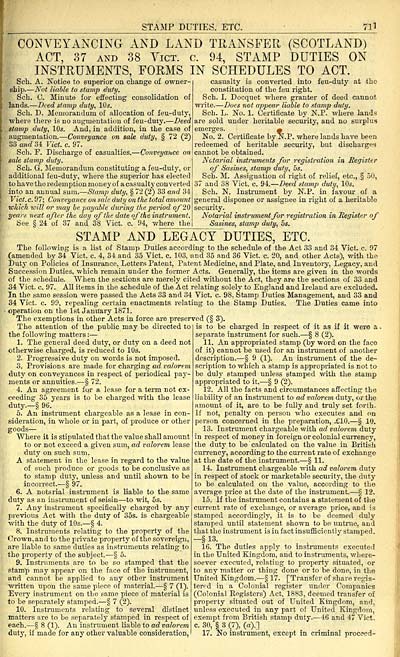

CONVEYANCING AND LAND TRANSFER (SCOTLAND)

ACT, 37 AND 38 Vict. c. 94, STAMP DUTIES ON

INSTRUMENTS, FORMS IN SCHEDULES TO ACT.

Sch. A. Notice to superior on chaaige of owner-

ship. — Not liable to stamp duty.

Sch. 0. Minute for effecting consolidation of

lands. — Deed stamp duty, lOs.

Sell. D. Memorandum of allocation of feu-duty,

■where there is no augmentation of feu-duty. — Deed

stamp duty, 10s. And, in addition, in the case of

augmentation. — Conveyance on sale duty, § 72 (2)

33 and 34 Vict. c. 97.

Sch. F. Discharge of casualties. — Conveyance on

sale stamp duty.

Sch. G. Memorandum constituting a feu-duty, or

additional feu-dutj', where the superior has elected

to have the redemption money of a casualty converted

into an annual sum. — Stamp duty, § 72 (2) 33 and 34

Vict. c. 97; Conveyance on sale duty on tJie total amount

which will or may be payable during the penod of 20

year.t next after the day of the date of the instmment.

See § 24: of 37 and 38 Vict. c. 94, where the

casualty is converted into feu-duty at the

constitution of the feu right.

Sch. I. Docquet where granter of deed cannot

write. — Dues not appear liable to stamp duty.

Sch. L. No. 1. Certificate by N.P. where lands

are sold under heritable security, and no surplus

emerges. m

No. 2. Certificate by N.P. where lands have been

redeemed of heritable security, but discharges

cannot be obtained.

Nctarial instruments for registration in Register

of Sasines, stamp duty, 5s.

Sch. M. Assignation of right of relief, etc., § .^0,

37 and 38 Vict. c. 94. — Deed stamp duty, 10s.

Sch. N. Instrument by N.P. in favour of a

general disponee or assignee in right of a heritable

security.

Notarial instrument for registration in Register of

Sasines, stamp duty, 5s.

STAMP AND LEGACY DUTIES, ETC.

The following is a list of Stamp Duties according to the schedule of the Act 33 and 34 Vict. c. 97

(amended by 34 Vict. c. 4, 34 and 35 Vict. c. 103, and 35 and 36 Vict. c. 20, and other Acts), with the

Duty on Policies of Insurance, Letters Patent, Patent Medicine, and Plate, and Inventory, Legacy, and

Succession Duties, which remain under the former Acts. Generally, the items are given in the words

of the schedule. When the sections are merely cited without the Act, they are the sections of 33 and

34 Vict. c. 97. All items in the schedule of the Act relating solely to England and Ireland are excluded.

In the same session were passed the Acts 33 and 34 Vict. c. 98, Stamp Duties Management, and 33 and

84 Vict. c. 99, repealing certain enactments relating to the Stamp Duties. The Duties came into

operation on the 1st January 1871.

The exemptions in other Acts in force are preserved (§ 3).

The attention of the public may be directed to

the following matters : —

1. The general deed duty, or duty on a deed not

otherwise charged, is reduced to 10s.

2. Progressive duty on words is not imposed.

3. Provisions are made for charging ad valorem

duty on conveyances in respect of j^eriodical pay

nients or annuities. — S 72.

4. An agreement for a lease for a term not ex-

ceeding 36 years is to be charged with the lease

duty.— § 96.

5. An instrument chargeable as a lease in con-

sideration, in whole or in part, of produce or other

Where it is stipulated that the value shall amoimt

to or not exceed a given sum, ad vcdorem lease

duty on such sum.

A statement in the lease in regard to the value

of such produce or goods to be conclusive as

to stamp duty, unless and until shown to be

incorrect. — § 97.

6. A notarial instrument is liable to the same

duty as an instrument of seisin — to wit, 5s.

7. Anj' instrument specifically charged by any

previous Act with the duty of 35s. is chargeable

with the duty of 10s. — § 4.

8. Instruments relating to the property of the

Crown, and to the private property of the sovereign,

are liable to same duties as instruments relating to

the property of the subject. — § 5.

9. Instruments are to be so stamped that the

.stamp may appear on the face of the instrument,

and cannot be applied to any other instrument

written iipon the same piece of material. — § 7 (1).

Every instrument on the same piece of material is

to be separately stamped. — § 7 (2).

10. Instruments relating to several distinct

matters are to be separately stamped in respect of

each. — § 8 (1). An instrument liable to ad valorem

duty, if made for any other valuable consideration,

is to be charged in respect of it as if it were a .

separate instrument for such. — § 8 (2).

11. An appropriated stamp (by word on the face

of it) cannot be used for an instrument of another

description. — § 9 (1). An instrument of the de-

scription to which a stamp is appropriated is not to

be dulj' stamped unless stamped with the stamp

appropriated to it. — § 9 (2).

12. All the facts and circumstances affecting the

liability of an instrument to ad valorem duty, or the

amount of it, are to be fully and truly set forth.

If not, penalty on person who executes and on

person concerned in the preparation, £10. — § 10.

13. Instrument chargeable with ad valorem duty

in respect of money in foreign or colonial currency,

the duty to be calculated on the value in British

currency, according to the current rate of exchange

at the date of the instrument. — § 11.

14. Instrument chargeable with ad valorem duty

in respect of stock or marketable security, the duty

to be calculated on the value, according to the

average price at the date of the instrument. — § 12.

15. If the instrument contains a statement of the

current rate of exchange, or average price, and is

stamped accordingly, it is to be deemed duly

stamped until statement shown to be untrue, and

that the instrument is in fact insufficiently stamped.

16. The duties apply to instruments executed

in the United Kingdom, and to instruments, where-

soever executed, relating to property situated, or

to any matter or thing done or to be done, in the

United Kingdom. — § 17. [Transfer of share regis-

tered in a Colonial register under Companies

(Colonial Kegisters) Act, 1883, deemed transfer of

property situated out of United Kingdom, and,

unless executed in any part of United Kingdom,

exempt from British stamp duty. — 46 and 47 Vict,

c. 30, § 3 (7), («).]

17. No instrument, except in criminal proceed-

711

CONVEYANCING AND LAND TRANSFER (SCOTLAND)

ACT, 37 AND 38 Vict. c. 94, STAMP DUTIES ON

INSTRUMENTS, FORMS IN SCHEDULES TO ACT.

Sch. A. Notice to superior on chaaige of owner-

ship. — Not liable to stamp duty.

Sch. 0. Minute for effecting consolidation of

lands. — Deed stamp duty, lOs.

Sell. D. Memorandum of allocation of feu-duty,

■where there is no augmentation of feu-duty. — Deed

stamp duty, 10s. And, in addition, in the case of

augmentation. — Conveyance on sale duty, § 72 (2)

33 and 34 Vict. c. 97.

Sch. F. Discharge of casualties. — Conveyance on

sale stamp duty.

Sch. G. Memorandum constituting a feu-duty, or

additional feu-dutj', where the superior has elected

to have the redemption money of a casualty converted

into an annual sum. — Stamp duty, § 72 (2) 33 and 34

Vict. c. 97; Conveyance on sale duty on tJie total amount

which will or may be payable during the penod of 20

year.t next after the day of the date of the instmment.

See § 24: of 37 and 38 Vict. c. 94, where the

casualty is converted into feu-duty at the

constitution of the feu right.

Sch. I. Docquet where granter of deed cannot

write. — Dues not appear liable to stamp duty.

Sch. L. No. 1. Certificate by N.P. where lands

are sold under heritable security, and no surplus

emerges. m

No. 2. Certificate by N.P. where lands have been

redeemed of heritable security, but discharges

cannot be obtained.

Nctarial instruments for registration in Register

of Sasines, stamp duty, 5s.

Sch. M. Assignation of right of relief, etc., § .^0,

37 and 38 Vict. c. 94. — Deed stamp duty, 10s.

Sch. N. Instrument by N.P. in favour of a

general disponee or assignee in right of a heritable

security.

Notarial instrument for registration in Register of

Sasines, stamp duty, 5s.

STAMP AND LEGACY DUTIES, ETC.

The following is a list of Stamp Duties according to the schedule of the Act 33 and 34 Vict. c. 97

(amended by 34 Vict. c. 4, 34 and 35 Vict. c. 103, and 35 and 36 Vict. c. 20, and other Acts), with the

Duty on Policies of Insurance, Letters Patent, Patent Medicine, and Plate, and Inventory, Legacy, and

Succession Duties, which remain under the former Acts. Generally, the items are given in the words

of the schedule. When the sections are merely cited without the Act, they are the sections of 33 and

34 Vict. c. 97. All items in the schedule of the Act relating solely to England and Ireland are excluded.

In the same session were passed the Acts 33 and 34 Vict. c. 98, Stamp Duties Management, and 33 and

84 Vict. c. 99, repealing certain enactments relating to the Stamp Duties. The Duties came into

operation on the 1st January 1871.

The exemptions in other Acts in force are preserved (§ 3).

The attention of the public may be directed to

the following matters : —

1. The general deed duty, or duty on a deed not

otherwise charged, is reduced to 10s.

2. Progressive duty on words is not imposed.

3. Provisions are made for charging ad valorem

duty on conveyances in respect of j^eriodical pay

nients or annuities. — S 72.

4. An agreement for a lease for a term not ex-

ceeding 36 years is to be charged with the lease

duty.— § 96.

5. An instrument chargeable as a lease in con-

sideration, in whole or in part, of produce or other

Where it is stipulated that the value shall amoimt

to or not exceed a given sum, ad vcdorem lease

duty on such sum.

A statement in the lease in regard to the value

of such produce or goods to be conclusive as

to stamp duty, unless and until shown to be

incorrect. — § 97.

6. A notarial instrument is liable to the same

duty as an instrument of seisin — to wit, 5s.

7. Anj' instrument specifically charged by any

previous Act with the duty of 35s. is chargeable

with the duty of 10s. — § 4.

8. Instruments relating to the property of the

Crown, and to the private property of the sovereign,

are liable to same duties as instruments relating to

the property of the subject. — § 5.

9. Instruments are to be so stamped that the

.stamp may appear on the face of the instrument,

and cannot be applied to any other instrument

written iipon the same piece of material. — § 7 (1).

Every instrument on the same piece of material is

to be separately stamped. — § 7 (2).

10. Instruments relating to several distinct

matters are to be separately stamped in respect of

each. — § 8 (1). An instrument liable to ad valorem

duty, if made for any other valuable consideration,

is to be charged in respect of it as if it were a .

separate instrument for such. — § 8 (2).

11. An appropriated stamp (by word on the face

of it) cannot be used for an instrument of another

description. — § 9 (1). An instrument of the de-

scription to which a stamp is appropriated is not to

be dulj' stamped unless stamped with the stamp

appropriated to it. — § 9 (2).

12. All the facts and circumstances affecting the

liability of an instrument to ad valorem duty, or the

amount of it, are to be fully and truly set forth.

If not, penalty on person who executes and on

person concerned in the preparation, £10. — § 10.

13. Instrument chargeable with ad valorem duty

in respect of money in foreign or colonial currency,

the duty to be calculated on the value in British

currency, according to the current rate of exchange

at the date of the instrument. — § 11.

14. Instrument chargeable with ad valorem duty

in respect of stock or marketable security, the duty

to be calculated on the value, according to the

average price at the date of the instrument. — § 12.

15. If the instrument contains a statement of the

current rate of exchange, or average price, and is

stamped accordingly, it is to be deemed duly

stamped until statement shown to be untrue, and

that the instrument is in fact insufficiently stamped.

16. The duties apply to instruments executed

in the United Kingdom, and to instruments, where-

soever executed, relating to property situated, or

to any matter or thing done or to be done, in the

United Kingdom. — § 17. [Transfer of share regis-

tered in a Colonial register under Companies

(Colonial Kegisters) Act, 1883, deemed transfer of

property situated out of United Kingdom, and,

unless executed in any part of United Kingdom,

exempt from British stamp duty. — 46 and 47 Vict,

c. 30, § 3 (7), («).]

17. No instrument, except in criminal proceed-

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1884-1885 > (747) |

|---|

| Permanent URL | https://digital.nls.uk/84013505 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|