Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

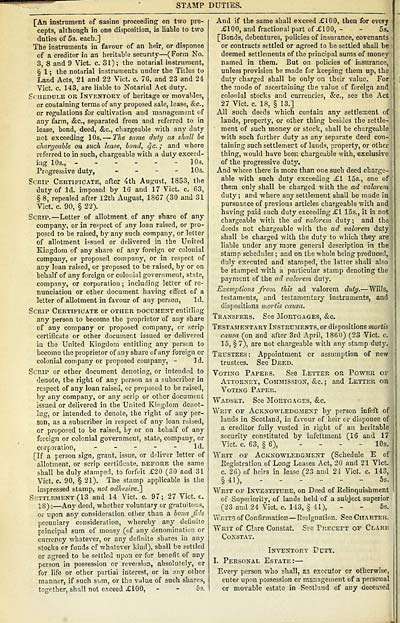

STAMP DUTIES.

[An instrnment of sasine proceeding on two pre-

cepts, although in one disposition, is liable to two

duties of 53. each.]

The instruments in favour of an heir, or disponee

of a creditor in an heritable securitj' — (Form No.

3, 8 and 9 Vict. e. 31); the notarial instrument,

§ 1 ; the notarial instruments under the Titles to

Land Acts, 21 and 22 Vict. c. 76, and 23 and 24

Vict. c. 143, are liable to Notarial Act dutj'.

Schedule or Inventory of heritage or movables,

or containing terms of any proposed sale, lease, &c.,

or regulations for cultivation and management of

any farm, &c., separated from and referred to in

lease, bond, deed, &c., chargeable with any duty

not exceeding 10s. — The same duty as shall be

charrjeable on suck lease, bond, q-a. ; and where

referred to in such, chargeable with a duty exceed-

ing 10s., - 10s.

Progressive duty, - - - - 10s.

Scrip Certificate, after 4th August, 1853, the

duty of Id. imposed by 16 and 17 Vict. c. 63,

§ 8, repealed after 12th August, 1867 (30 and 31

Vict. c. 90, § 22).

Scrip. — Letter of allotment, of any share of any

company, or in respect of any loan raised, or pro-

posed to be raised, b}' any such company, or letter

of allotment issued or delivered in the United

Kingdom of any share of any foreign or colonial

company, or proposed company, or in respect of

any loan raised, or proposed to be raised, bj' or on

behalf of any foreign or colonial government, state,

company, or corporation ; including letter of re-

nunciation or other document having effect of a

letter of allotment in favour of any person, Id.

Scrip Certificate or other document entitling

any person to become the proprietor of any share

of any company or proposed company, or scrip

certificate or other document issued or delivered

in the United Kingdom entitling any person to

become the proprietor of any share of any foreign or

colonial company or proposed company, - Id.

Scrip or other document denoting, or intended to

denote, the right of any person as a subscriber in

respect of any loan raised, or proposed to be raised,

by any company, or any scrip or other document

issued or delivered in the United Kingdom denot-

ing, or intended to denote, the right of any per-

son, as a subscriber in respect of any loan raised,

or proposed to be raised, by or on behalf of any

foreign or colonial government, state, company, or

corporatiot}, ----- Id.

[If a person sign, grant, issue, or deliver letter of

allotment, or scrip certificate, before the same

shall be duly stamped, to forfeit £20 (30 and 31

Vict. c. 90, § 21). The stamp applicable is the

impressed stamp, not adhesive.']

SETTLEMENT (13 and 14 Vict. c. 97 ; 27 Vict. c.

18) : — Any deed, whether voluntary or gratuitous,

or upon any consideration other than a bona fide

pecuniary consideration, whereby any definite

principal sum of money (of any denomination or

currency whatever, or any definite shares in any

stocbs or funds of whatever kind), shall be settled

or agreed to be settled upon or for benefit of any

person in possession or reversion, absolutely, or

for life or other partial interest, or in any olher

manner, if such sum, or tha value of such shares,

together, shall not exceed £100, - - 5s.

And if the same shall exceed £100, then for every

£100, and fractional part of £100, - - 5s,

[Bonds, debentures, policies of insurance, covenants

or contracts settled or agreed to be settled shall be

deemed settlements of the principal sums of money

named in thera. But on policies of insurance,

unless provision be made for keeping them up, the

duty charged shall be only on their value. For

the mode of ascertaining the value of foreign and

colonial stocks and currencies, &c., see the Act

27 Vict. c. 18, § 13.]

All such deeds which contain any settlement of

lands, property, or other thing besides the settle-

ment of such money or stock, shall be chargeable

with such further duty as any separate deed con-

taining such settlemert of lands, property, or other

thing, would have beeu chargeable with, exclusive

of the progressive duty.

And where there is more than one such deed charge-

able with such duty exceeding £1 15s., one of

them only shall be charged with the ad valorem

duty; and where any settlement shall be made in

pursuance of previous articles chargeable with and

having paid such duty exceeding £1 15s., it is not

chargeable with the ad valorem duty; and the

deeds not chargeable with the ad valorem duty

shall be charged with the duty to which they are

liable under any more general description in the

stamp schedules ; and on the whole being produced,

duly executed and stamped, the latter shall also

be stamped with a particular stamp denoting the

payment of the ad valorem duty.

Exemptions from this ad valorem duty. — Wills,

testaments, and testamentary instruments, and

dispositions mortis causa.

Transfers. See Mortgages, &c.

Testamentary Instruments, or dispositions mortis

causa (on and after 3rd April, 1860) (23 Vict. e.

15, § 7), are not chargeable with any stamp dutj'.

Trustees : Appointment or assumption of new

trustees. See Deed.

Voting Papbes. See Letter or Power of

Attorney', Comjiission, &q. ; and Letter or

Voting Paper.

Wadset. See Mortgages, &c.

Writ of Acknowledgment b}' person infeft of

lands in Scotland, in favour of heir or disponee of

a creditor fully vested in right of an heritable

security constituted by iufeftment (16 and 17

Vict. c. 63, § 6), - - - - 10s.

Writ of AcKKOvn.EDGMENT (Schedule E of

Eegistration of Long Leases Act, 20 and 21 Vict,

c. 26) of heirs in lease (23 and 24 Vict. c. 143,

§41), ------ 5s.

VfRiT OF Investiture, on Deed of Eelinquishment

of Superioritv, of lands held of a subject superior

(23 and 24 Vict. e. 143, § 41), - - 5s.

VfEiTSof Contirmatiori — Resignation. See Charter.

Writ of Clare Constat. See Precept of Clare

Constat.

Inatintory Duty.

I. Personal Estate: —

Every person who shall, as executor or otherwise,

enter upon possession or management of a personal

or movable estate in Scotland of any deceased

[An instrnment of sasine proceeding on two pre-

cepts, although in one disposition, is liable to two

duties of 53. each.]

The instruments in favour of an heir, or disponee

of a creditor in an heritable securitj' — (Form No.

3, 8 and 9 Vict. e. 31); the notarial instrument,

§ 1 ; the notarial instruments under the Titles to

Land Acts, 21 and 22 Vict. c. 76, and 23 and 24

Vict. c. 143, are liable to Notarial Act dutj'.

Schedule or Inventory of heritage or movables,

or containing terms of any proposed sale, lease, &c.,

or regulations for cultivation and management of

any farm, &c., separated from and referred to in

lease, bond, deed, &c., chargeable with any duty

not exceeding 10s. — The same duty as shall be

charrjeable on suck lease, bond, q-a. ; and where

referred to in such, chargeable with a duty exceed-

ing 10s., - 10s.

Progressive duty, - - - - 10s.

Scrip Certificate, after 4th August, 1853, the

duty of Id. imposed by 16 and 17 Vict. c. 63,

§ 8, repealed after 12th August, 1867 (30 and 31

Vict. c. 90, § 22).

Scrip. — Letter of allotment, of any share of any

company, or in respect of any loan raised, or pro-

posed to be raised, b}' any such company, or letter

of allotment issued or delivered in the United

Kingdom of any share of any foreign or colonial

company, or proposed company, or in respect of

any loan raised, or proposed to be raised, bj' or on

behalf of any foreign or colonial government, state,

company, or corporation ; including letter of re-

nunciation or other document having effect of a

letter of allotment in favour of any person, Id.

Scrip Certificate or other document entitling

any person to become the proprietor of any share

of any company or proposed company, or scrip

certificate or other document issued or delivered

in the United Kingdom entitling any person to

become the proprietor of any share of any foreign or

colonial company or proposed company, - Id.

Scrip or other document denoting, or intended to

denote, the right of any person as a subscriber in

respect of any loan raised, or proposed to be raised,

by any company, or any scrip or other document

issued or delivered in the United Kingdom denot-

ing, or intended to denote, the right of any per-

son, as a subscriber in respect of any loan raised,

or proposed to be raised, by or on behalf of any

foreign or colonial government, state, company, or

corporatiot}, ----- Id.

[If a person sign, grant, issue, or deliver letter of

allotment, or scrip certificate, before the same

shall be duly stamped, to forfeit £20 (30 and 31

Vict. c. 90, § 21). The stamp applicable is the

impressed stamp, not adhesive.']

SETTLEMENT (13 and 14 Vict. c. 97 ; 27 Vict. c.

18) : — Any deed, whether voluntary or gratuitous,

or upon any consideration other than a bona fide

pecuniary consideration, whereby any definite

principal sum of money (of any denomination or

currency whatever, or any definite shares in any

stocbs or funds of whatever kind), shall be settled

or agreed to be settled upon or for benefit of any

person in possession or reversion, absolutely, or

for life or other partial interest, or in any olher

manner, if such sum, or tha value of such shares,

together, shall not exceed £100, - - 5s.

And if the same shall exceed £100, then for every

£100, and fractional part of £100, - - 5s,

[Bonds, debentures, policies of insurance, covenants

or contracts settled or agreed to be settled shall be

deemed settlements of the principal sums of money

named in thera. But on policies of insurance,

unless provision be made for keeping them up, the

duty charged shall be only on their value. For

the mode of ascertaining the value of foreign and

colonial stocks and currencies, &c., see the Act

27 Vict. c. 18, § 13.]

All such deeds which contain any settlement of

lands, property, or other thing besides the settle-

ment of such money or stock, shall be chargeable

with such further duty as any separate deed con-

taining such settlemert of lands, property, or other

thing, would have beeu chargeable with, exclusive

of the progressive duty.

And where there is more than one such deed charge-

able with such duty exceeding £1 15s., one of

them only shall be charged with the ad valorem

duty; and where any settlement shall be made in

pursuance of previous articles chargeable with and

having paid such duty exceeding £1 15s., it is not

chargeable with the ad valorem duty; and the

deeds not chargeable with the ad valorem duty

shall be charged with the duty to which they are

liable under any more general description in the

stamp schedules ; and on the whole being produced,

duly executed and stamped, the latter shall also

be stamped with a particular stamp denoting the

payment of the ad valorem duty.

Exemptions from this ad valorem duty. — Wills,

testaments, and testamentary instruments, and

dispositions mortis causa.

Transfers. See Mortgages, &c.

Testamentary Instruments, or dispositions mortis

causa (on and after 3rd April, 1860) (23 Vict. e.

15, § 7), are not chargeable with any stamp dutj'.

Trustees : Appointment or assumption of new

trustees. See Deed.

Voting Papbes. See Letter or Power of

Attorney', Comjiission, &q. ; and Letter or

Voting Paper.

Wadset. See Mortgages, &c.

Writ of Acknowledgment b}' person infeft of

lands in Scotland, in favour of heir or disponee of

a creditor fully vested in right of an heritable

security constituted by iufeftment (16 and 17

Vict. c. 63, § 6), - - - - 10s.

Writ of AcKKOvn.EDGMENT (Schedule E of

Eegistration of Long Leases Act, 20 and 21 Vict,

c. 26) of heirs in lease (23 and 24 Vict. c. 143,

§41), ------ 5s.

VfRiT OF Investiture, on Deed of Eelinquishment

of Superioritv, of lands held of a subject superior

(23 and 24 Vict. e. 143, § 41), - - 5s.

VfEiTSof Contirmatiori — Resignation. See Charter.

Writ of Clare Constat. See Precept of Clare

Constat.

Inatintory Duty.

I. Personal Estate: —

Every person who shall, as executor or otherwise,

enter upon possession or management of a personal

or movable estate in Scotland of any deceased

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1868-1869 > (68) |

|---|

| Permanent URL | https://digital.nls.uk/83936397 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|