Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

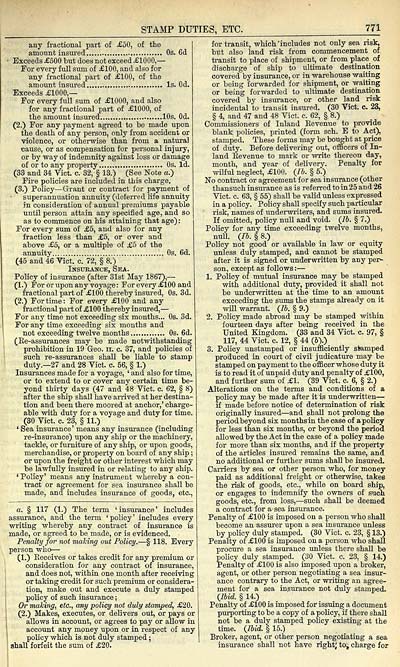

STAMP DUTIES, ETC.

771

any fractional part of £50, of the

amount insured Os. 6d

Exceeds £500 but does not exceed £1000, —

For every full sum of £100, and also for

any fractional part of £100, of the

amount insured Is. Od.

Exceeds £1000,—

For every full sum of £1000, and also

for any fractional part of £1000, of

the amount insured 10s. Od.

(2.) For any payment agreed to be made upon

the death of any person, only from accident or

violence, or otherwise than from a natural

cause, or as compensation for personal injury,

or by way of indemnity against loss or damage

of or to any property Os. Id.

(33 and 34 Vict. c. 32, § 13.) (See Note a.)

Fire policies are included in this charge.

(3.) Policy — Grant or contract for payment of

superannuation annuity (deferred life annuity

in consideration of annual premiums payable

until person attain any specified age, and so

as to commence on his attaining that age) :

For every sum of £5, and also for any

fraction less than £5, or over and

above £5, or a multiple of £5 of the

annuity... Os. 6d.

(45 and 46 Vict. c. 72, § 8.)

Insurance, Sea.

PoUcy of insurance (after 31st May 1867), —

(1.) For or upon any voyage : For every £100 and

fractional part of £100 thereby insured, Os. 3d.

(2.) For time: For every £100 and any

fractional part of £100 thereby insured, —

For any time not exceeding six months... Os. 3d.

For any time exceeding six months and

not exceeding twelve months Os. 6d.

(Ke-assurances may be made notwithstanding

prohibition in 19 Geo. n. c. 37, and policies of

such re-assurances shall be liable to stamp

duty.— 27 and 28 Vict. c. 56, § 1.)

Insurances made for a voyage, ' and also for time,

or to extend to or cover any certain time be-

yond thirty days (47 and 48 Vict. c. 62, § 8)

after the ship shall have arrived at her destina-

tion and been there moored at anchor,' charge-

able with duty for a voyage and dutv for time.

(30 Vict. c. 23, § 11.)

' Sea insurance' means any insurance (including

re-insurance) upon any ship or the machinery,

tackle, or furniture of any ship, or upon goods,

merchandise, or property on board of any ship ;

or upon the freight or other interest which may

be lawfully insured in or relating to any ship.

' Policy' means any instrument whereby a con-

tract or agreement for sea insurance shall be

made, and includes insurance of goods, etc..

a. § 117 (1.) The term ' insurance ' includes

assurance, and the term ' policy ' includes every

writing whereby any contract of insurance is

made, or agreed to be made, or is evidenced.

Penalty for not making out Policy. — § 118. Every

person who —

(1.) Eeceives or takes credit for any premium or

consideration for any contract of insurance,

and does not, within one month after receiving

or taking credit for such premium or considera-

tion, make out and execute a duly stamped

policy of such insurance ;

Or mahing, etc., any policy not duly stamped, £20.

(2.) Makes, executes, or delivers out, or pays or

allows in account, or agrees to pay or allow in

account any money upon or in respect of any

policy which is not duly stamped ;

shall forfeit the sum of £20.

for transit, which 'includes not only sea risk,

but also land risk from commencement of

transit to place of shipment, or from place_ of

discharge of ship to ultimate destinatioa

covered by insurance, or in warehoiise waiting

or being forwarded for shipment, or waiting

or being forwarded to ultimate destination

covered by insurance, or other land risk

incidental to transit insured. (30 Vict. c. 23,

g 4, and 47 and 48 Vict. c. 62, § 8.)

Commissioners of Inland Eevenue to provide

blank policies, printed (form sch. E to Act),

stamped. These forms may be bought at price

of duty. Before delivering out, ofBcers of In-

land Eevenue to mark or write thereon day,

month, and year of delivery. Penalty for

wilful neglect, £100. (/6. § 5.)

No contract or agreement for sea insurance (other

thansuch insurance as is referred to in 25 and 26

Vict. c. 63, § 55) shall be valid unless expressed

in a policy. Policy shall specify such particular

risk, names of underwriters, and sums insured.

If omitted, policy null and void. (Ih. § 7.)

Policy for any time exceeding twelve months,

null. {Ih. § 8.)

Policy not good or available in law or equity

unless duly stamped, and cannot be stamped

after it is signed or underwritten by any per-

son, except as follows: —

1. Policy of mutual insurance may be stamped

with additional duty, provided it shall not

be underwritten at the time to an amount

exceeding the sums the stamps already on it

will warrant. {Ih. § 9.)

2. Policy made abroad may be stamped within

fourteen days after being received in the

United Kingdom. (33 and 34 Vict. c. 97, §

117, 44 Vict. c. 12, § 44 (6).)

3. Policy unstamped or insufficiently stamped

produced ia court of civil judicature may be

stamped on payment to the officer whose duty it

is to read it of unpaid duty and penalty of £100,

and further sum of £1. (39 Vict. c._6, § 2.)

Alterations on the terms and conditions of a

policy may be made after it is underwritten —

if made before notice of determination of risk

originally insured — and shall not prolong the

periodbeyond six monthsin the case of apolicy

for less than six months, or beyond the period

allowed by the Act in the case of a policy made

for more than six months, and if the property

of the articles insured remains the same, and

no additional or further sums shall be insured.

Carriers by sea or other person who, for money

paid as additional freight or otherwise, takes

the risk of goods, etc., while on board ship,

or engages to indemnify the owners of such

goods, etc., from loss, — such shall be deemed

a contract for a sea insurance.

Penalty of £100 is imposed on a person who shall

become an assurer upon a sea insurance unless

by policy duly stamped. (30 Vict. c. 23, § 13.)

Penalty of £100 is imposed on a person who shall

procure a sea insurance unless there shall be

policy duly stamped. (30 Vict. c. 23, § 14.)

Penalty of £100 is also imposed upon a broker,

agent, or other person negotiating a sea insur-

ance contrary to the Act, or writing an agree-

ment for a sea insurance not duly stamped.

{Ibid. § 14.)

Penalty of £100 is imposed for issuing a document

purporting to be a copy of a policy, if there shall

not be a duly stamped policy existing at the

time. {Ibid. § 15.)

Broker, agent, or other person negotiating a sea

insurance shall not have right^ to^ charge for

771

any fractional part of £50, of the

amount insured Os. 6d

Exceeds £500 but does not exceed £1000, —

For every full sum of £100, and also for

any fractional part of £100, of the

amount insured Is. Od.

Exceeds £1000,—

For every full sum of £1000, and also

for any fractional part of £1000, of

the amount insured 10s. Od.

(2.) For any payment agreed to be made upon

the death of any person, only from accident or

violence, or otherwise than from a natural

cause, or as compensation for personal injury,

or by way of indemnity against loss or damage

of or to any property Os. Id.

(33 and 34 Vict. c. 32, § 13.) (See Note a.)

Fire policies are included in this charge.

(3.) Policy — Grant or contract for payment of

superannuation annuity (deferred life annuity

in consideration of annual premiums payable

until person attain any specified age, and so

as to commence on his attaining that age) :

For every sum of £5, and also for any

fraction less than £5, or over and

above £5, or a multiple of £5 of the

annuity... Os. 6d.

(45 and 46 Vict. c. 72, § 8.)

Insurance, Sea.

PoUcy of insurance (after 31st May 1867), —

(1.) For or upon any voyage : For every £100 and

fractional part of £100 thereby insured, Os. 3d.

(2.) For time: For every £100 and any

fractional part of £100 thereby insured, —

For any time not exceeding six months... Os. 3d.

For any time exceeding six months and

not exceeding twelve months Os. 6d.

(Ke-assurances may be made notwithstanding

prohibition in 19 Geo. n. c. 37, and policies of

such re-assurances shall be liable to stamp

duty.— 27 and 28 Vict. c. 56, § 1.)

Insurances made for a voyage, ' and also for time,

or to extend to or cover any certain time be-

yond thirty days (47 and 48 Vict. c. 62, § 8)

after the ship shall have arrived at her destina-

tion and been there moored at anchor,' charge-

able with duty for a voyage and dutv for time.

(30 Vict. c. 23, § 11.)

' Sea insurance' means any insurance (including

re-insurance) upon any ship or the machinery,

tackle, or furniture of any ship, or upon goods,

merchandise, or property on board of any ship ;

or upon the freight or other interest which may

be lawfully insured in or relating to any ship.

' Policy' means any instrument whereby a con-

tract or agreement for sea insurance shall be

made, and includes insurance of goods, etc..

a. § 117 (1.) The term ' insurance ' includes

assurance, and the term ' policy ' includes every

writing whereby any contract of insurance is

made, or agreed to be made, or is evidenced.

Penalty for not making out Policy. — § 118. Every

person who —

(1.) Eeceives or takes credit for any premium or

consideration for any contract of insurance,

and does not, within one month after receiving

or taking credit for such premium or considera-

tion, make out and execute a duly stamped

policy of such insurance ;

Or mahing, etc., any policy not duly stamped, £20.

(2.) Makes, executes, or delivers out, or pays or

allows in account, or agrees to pay or allow in

account any money upon or in respect of any

policy which is not duly stamped ;

shall forfeit the sum of £20.

for transit, which 'includes not only sea risk,

but also land risk from commencement of

transit to place of shipment, or from place_ of

discharge of ship to ultimate destinatioa

covered by insurance, or in warehoiise waiting

or being forwarded for shipment, or waiting

or being forwarded to ultimate destination

covered by insurance, or other land risk

incidental to transit insured. (30 Vict. c. 23,

g 4, and 47 and 48 Vict. c. 62, § 8.)

Commissioners of Inland Eevenue to provide

blank policies, printed (form sch. E to Act),

stamped. These forms may be bought at price

of duty. Before delivering out, ofBcers of In-

land Eevenue to mark or write thereon day,

month, and year of delivery. Penalty for

wilful neglect, £100. (/6. § 5.)

No contract or agreement for sea insurance (other

thansuch insurance as is referred to in 25 and 26

Vict. c. 63, § 55) shall be valid unless expressed

in a policy. Policy shall specify such particular

risk, names of underwriters, and sums insured.

If omitted, policy null and void. (Ih. § 7.)

Policy for any time exceeding twelve months,

null. {Ih. § 8.)

Policy not good or available in law or equity

unless duly stamped, and cannot be stamped

after it is signed or underwritten by any per-

son, except as follows: —

1. Policy of mutual insurance may be stamped

with additional duty, provided it shall not

be underwritten at the time to an amount

exceeding the sums the stamps already on it

will warrant. {Ih. § 9.)

2. Policy made abroad may be stamped within

fourteen days after being received in the

United Kingdom. (33 and 34 Vict. c. 97, §

117, 44 Vict. c. 12, § 44 (6).)

3. Policy unstamped or insufficiently stamped

produced ia court of civil judicature may be

stamped on payment to the officer whose duty it

is to read it of unpaid duty and penalty of £100,

and further sum of £1. (39 Vict. c._6, § 2.)

Alterations on the terms and conditions of a

policy may be made after it is underwritten —

if made before notice of determination of risk

originally insured — and shall not prolong the

periodbeyond six monthsin the case of apolicy

for less than six months, or beyond the period

allowed by the Act in the case of a policy made

for more than six months, and if the property

of the articles insured remains the same, and

no additional or further sums shall be insured.

Carriers by sea or other person who, for money

paid as additional freight or otherwise, takes

the risk of goods, etc., while on board ship,

or engages to indemnify the owners of such

goods, etc., from loss, — such shall be deemed

a contract for a sea insurance.

Penalty of £100 is imposed on a person who shall

become an assurer upon a sea insurance unless

by policy duly stamped. (30 Vict. c. 23, § 13.)

Penalty of £100 is imposed on a person who shall

procure a sea insurance unless there shall be

policy duly stamped. (30 Vict. c. 23, § 14.)

Penalty of £100 is also imposed upon a broker,

agent, or other person negotiating a sea insur-

ance contrary to the Act, or writing an agree-

ment for a sea insurance not duly stamped.

{Ibid. § 14.)

Penalty of £100 is imposed for issuing a document

purporting to be a copy of a policy, if there shall

not be a duly stamped policy existing at the

time. {Ibid. § 15.)

Broker, agent, or other person negotiating a sea

insurance shall not have right^ to^ charge for

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1886-1887 > (807) |

|---|

| Permanent URL | https://digital.nls.uk/83638472 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|