Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

672

STAJIP DUTIES, ETC.

Woods and Fotiests. — -Memorandum, contract,

or agreement and deed, receipt or other

instrument for the sale, purchase, or ex-

change of any estates, manors, etc., under the

Act— grant, lease, contract, agreement — ap-

pointment of officers — certificate for game-

keeper — bond by or for receiver (10 Geo. iv.

c 50, § 77).

[By 3 and 4 Gul. iv. c. G9, § 3, the direc-

tions, clauses, matters, things, powers, and

authorities in 10 Geo. iv. c. 50, relating to the

selling, leasing, exchanging, and general ad-

ministration of the land revenues of the

Crown in England, and all the powers, pro-

visions, and authorities given in the said Act

to the Commissioners of Her Majesty's Woods,

shall apply, in so far as applicable, as if con-

tained in the Act 3 and 4 Gul. iv., or as if the

land revenues in Scotland had been included

in the Act 10 Geo. iv. The Act 14 and 15

Vict. c. 42, separated the Commissioners of

Works and Public Buildings from the Com-

missioners of Woods and Forests and Land

Eevenues.]

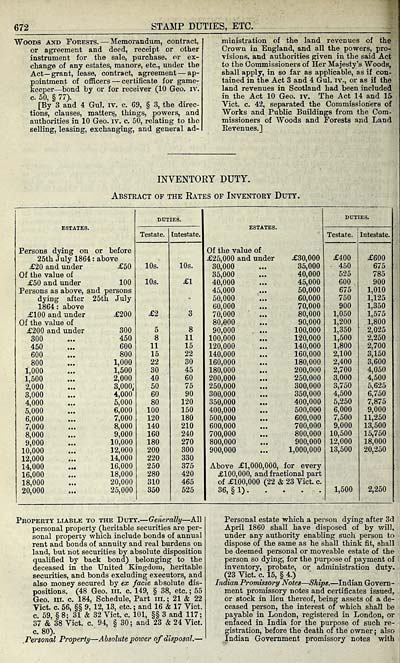

INVENTORY DUTY.

Abstract of the Rates of Inventory Duty.

Persons dying on or before

25th July 1864 : above

£20 and under £50

Of the value of

£50 and under 100

Persons as above, and persons

dying after 25th July

1864: above

£100 and under £200

Of the value of

£200 and under

300

450

600

800

1,000

1,500

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

12,000

14,000

16,000

18,000

20,000

300

450

600

800

1,000

1,500

2,000

3,000;

4,000

5,000

6,000

7,000

8,000

9,000

10,000

12,000

14,000

16,000

18,000

20,000

25,000

Of the value of

£25,000 and under

30,000

35,000

40,000

45,000

50,000

60,000

70,000

80,000

90,000

100,000

120,000

140,000

160,000

180,000

200,000

250,000

300,000

350,000

400,000

500,000

600,000

700,000

800,000

900,000

£30,000

35,000

40,000

45,000

50,000

60,000

70,000

80,000

90,000

100,000

120,000

140,000

160,000

180,000

200,000

250,000

300,000

350,000

400,000

500.000

600,000

700,000

800,000

900,000

1,000,000

Above £1,000,000, for every

£100,000, and fractional part

of £100,000 (22 & 23 Vict. c.

36, §1)

Property liable to the Duty. — Generally — All

personal property (heritable securities are per-

sonal property which include bonds of annual

rent and bonds of annuity and real burdens on

land, but not securities by absolute disposition

qualified by back bond) belonging to the

deceased in the United Kingdom, heritable

securities, and bonds excluding executors, and

also money secured by ex facie absolute dis-

positions. (48 Geo. III. c. 149, § 38, etc. ; 55

Geo. III. c. 184, Schedule, Part iii. ; 21 & 22

Vict. c. 56, §§ 9, 12, 13, etc. ; and 16 & 17 Vict.

c. 59, §8; 31 & 32 Vict. c. 101, §§ 3 and 117;

37 & 38 Vict. c. 94, § 30 ; and 23 & 24 Vict.

c. 80).

.Personal Property — Absolute power of disposal. —

Personal estate which a person dying after 3d

April 1860 shall have disposed of by will,

under any authority enabling such person to

dispose of the same as he shall think fit, shall

be deemed personal or moveable estate of the ;

person so dying, for the purpose of paj^ment of t

inventory, probate, or administration duty. .

(23 Vict. c. 15, § 4.)

Indian Promissory Notes — Ships. — Indian Govern-

ment promissory notes and certificates issued, ,

or stock in lieu thereof, being assets of a de-,-

ceased person, the interest of which shall be

payable in London, registered in London, or

enfaced in India for the purpose of such re-

gistration, before the death of the owner ; also

Jndian Government promissory notes with

STAJIP DUTIES, ETC.

Woods and Fotiests. — -Memorandum, contract,

or agreement and deed, receipt or other

instrument for the sale, purchase, or ex-

change of any estates, manors, etc., under the

Act— grant, lease, contract, agreement — ap-

pointment of officers — certificate for game-

keeper — bond by or for receiver (10 Geo. iv.

c 50, § 77).

[By 3 and 4 Gul. iv. c. G9, § 3, the direc-

tions, clauses, matters, things, powers, and

authorities in 10 Geo. iv. c. 50, relating to the

selling, leasing, exchanging, and general ad-

ministration of the land revenues of the

Crown in England, and all the powers, pro-

visions, and authorities given in the said Act

to the Commissioners of Her Majesty's Woods,

shall apply, in so far as applicable, as if con-

tained in the Act 3 and 4 Gul. iv., or as if the

land revenues in Scotland had been included

in the Act 10 Geo. iv. The Act 14 and 15

Vict. c. 42, separated the Commissioners of

Works and Public Buildings from the Com-

missioners of Woods and Forests and Land

Eevenues.]

INVENTORY DUTY.

Abstract of the Rates of Inventory Duty.

Persons dying on or before

25th July 1864 : above

£20 and under £50

Of the value of

£50 and under 100

Persons as above, and persons

dying after 25th July

1864: above

£100 and under £200

Of the value of

£200 and under

300

450

600

800

1,000

1,500

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

12,000

14,000

16,000

18,000

20,000

300

450

600

800

1,000

1,500

2,000

3,000;

4,000

5,000

6,000

7,000

8,000

9,000

10,000

12,000

14,000

16,000

18,000

20,000

25,000

Of the value of

£25,000 and under

30,000

35,000

40,000

45,000

50,000

60,000

70,000

80,000

90,000

100,000

120,000

140,000

160,000

180,000

200,000

250,000

300,000

350,000

400,000

500,000

600,000

700,000

800,000

900,000

£30,000

35,000

40,000

45,000

50,000

60,000

70,000

80,000

90,000

100,000

120,000

140,000

160,000

180,000

200,000

250,000

300,000

350,000

400,000

500.000

600,000

700,000

800,000

900,000

1,000,000

Above £1,000,000, for every

£100,000, and fractional part

of £100,000 (22 & 23 Vict. c.

36, §1)

Property liable to the Duty. — Generally — All

personal property (heritable securities are per-

sonal property which include bonds of annual

rent and bonds of annuity and real burdens on

land, but not securities by absolute disposition

qualified by back bond) belonging to the

deceased in the United Kingdom, heritable

securities, and bonds excluding executors, and

also money secured by ex facie absolute dis-

positions. (48 Geo. III. c. 149, § 38, etc. ; 55

Geo. III. c. 184, Schedule, Part iii. ; 21 & 22

Vict. c. 56, §§ 9, 12, 13, etc. ; and 16 & 17 Vict.

c. 59, §8; 31 & 32 Vict. c. 101, §§ 3 and 117;

37 & 38 Vict. c. 94, § 30 ; and 23 & 24 Vict.

c. 80).

.Personal Property — Absolute power of disposal. —

Personal estate which a person dying after 3d

April 1860 shall have disposed of by will,

under any authority enabling such person to

dispose of the same as he shall think fit, shall

be deemed personal or moveable estate of the ;

person so dying, for the purpose of paj^ment of t

inventory, probate, or administration duty. .

(23 Vict. c. 15, § 4.)

Indian Promissory Notes — Ships. — Indian Govern-

ment promissory notes and certificates issued, ,

or stock in lieu thereof, being assets of a de-,-

ceased person, the interest of which shall be

payable in London, registered in London, or

enfaced in India for the purpose of such re-

gistration, before the death of the owner ; also

Jndian Government promissory notes with

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1879-1880 > (708) |

|---|

| Permanent URL | https://digital.nls.uk/83625422 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|