Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

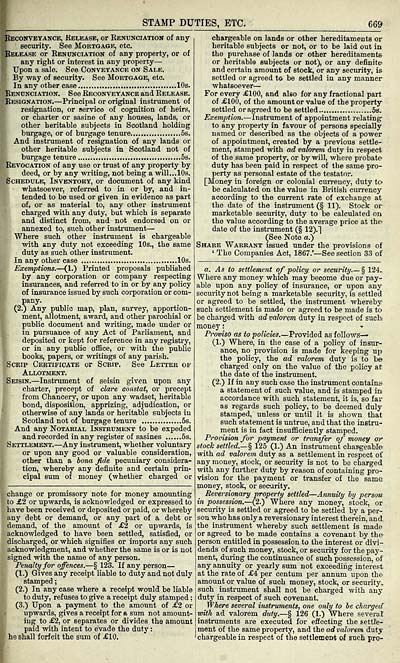

STAMP DUTIES, ETC.

Beconveyance, Kelease, or Eenunciation of any

security. See Mortgage, etc.

Belease or Rekunciation of any property, or of

any right or interest in any property —

Upon a sale. See Conveyance on Sale.

By way of security. See Mortgage, etc.

In any other case 10s.

Eenunciation. See Beconveyance and Release.

Resignation. — Principal or original instrument of

resignation, or service of cognition of heirs,

or charter or sasine of any houses, lands, or

other heritable subjects in Scotland holding

burgage, or of burgage tenure 5s.

And instrument of resignation of any lands or

other heritable subjects in Scotland not of

burgage tenure 5s.

Bevocation of any use or trust of any property by

deed, or by any writing, not being a will. ..10s.

Schedule, Inventory, or document of any kind

whatsoever, referred to in or by, and in-

tended to be used or given in evidence as part

of, or as material to, any other insti'ument

charged with any duty, but which is separate

and distinct from, and not endorsed on or

annexed to, such other instrument —

Where such other instrument is chargeable

with any duty not exceeding 10s., the same

duty as such other instrument.

In any other case 10s.

Exemptions. — (1.) Printed proposals published

by any corporation or company respecting

insurances, and referred to in or by any policy

of insurance issued by such corporation or com-

pany.

(2.) Any public map, plan, survey, apportion-

ment, allotment, award, and other parochial or

public document and writing, made under or

in pursuance of any Act of Parliament, and

deposited or kept for reference in any registry,

or in any public office, or with the public

books, papers, or writings of any parish.

Scrip Certificate or Scrip, See Letter of

Allotment.

Seisin. — Instrument of seisin given upon any

charter, precept of dare constat, or precept

from Chancery, or upon any wadset, heritable

bond, disposition, apprizing, adjudication, or

otherwise of any lands or heritable subjects iu

Scotland not of burgage tenure 5s.

And any Notarial Instrument to be expeded

and recorded in any register of sasines 5s.

Settlement. — Any instrument, whether voluntary

or upon any good or valuable consideration,

other than a bona fide pecuniary considera-

tion, whereby any definite and certain prin-

cipal sum of money (whether charged or

change or promissory note for money amoimting

to £2 or upwards, is acknowledged or expressed to

have been received or deposited or paid, or whereby

any debt or demand, or any part of a debt or

demand, of the amount of £2 or upwards, is

acknowledged to have been settled, satisfied, or

discharged, or which signifies or imports any such

acknowledgment, and whether the same is or is not

signed with the name of any person.

Penalty for offences. — § 123. If any person —

(1.) Gives any receipt liable to duty and not duly

(2.) In any case where a receipt would be liable

to duty, refuses to give a receipt duly stamped :

(3.) Upon a payment to the amount of £2 or

upwards, gives a receipt for a sum not amount-

ing to £2, or separates or divides the amount

paid with intent to evade the duty :

he shall forfeit the sum of £10.

chargeable on lands or other hereditaments or

heritable subjects or not, or to be laid out in

the purchase of lands or other hereditaments

or heritable subjects or not), or any definite-

and certain amount of stock, or any security, is

settled or agreed to be settled in any manner

whatsoever —

For every £100, and also for any fractional part

of £100, of the amount or value of the property

settled or agreed to be settled 5s.

Exemption. — Instrument of appointment relating-

to any property in favour of persons specially

named or described as the objects of a power

of appointment, created by a previous settle-

ment, stamped with ad valorem duty in respect

of the same property, or by will, whei-e probate

duty has been paid in respect of the same pro-

perty as personal estate of the testator.

[Money in foreign or colonial currency, duty to-

be calculated on the value in British cmTency

according to the current rate of exchange at

the date of the instrument (§ 11). Stock or

marketable security, duty to be calculated on

the value according to the average price at the

date of the instrument (§ 12).^

(See Note a.)

Share Warrant issued under the provisions of

' The Companies Act, 1867.' — See section 33 of

a. As to settlement of policy or security § 124.

Where any money which may become due or pay-

able upon any policy of insurance, or upon any

security not being a marketable security, is settled

or agreed to be settled, the instrument whereby

such settlement is made or agreed to be made is to

be charged with ad valorem duty in respect of such

mouey :

Proviso as to policies. — Provided as follows—

(1.) Where, in the case of a policy of insur-

ance, no provision is made for keeping up

the policy, the ad valorem duty is to b&

charged only on the value of the policy at

the date of the instrument.

(2.) If in any such case the instrument contains-

a statement of such value, and is stamped im

accordance with such statement, it is, so far

as regards such policy, to be deemed duly

stamped, unless or until it is shown that

such statement is untrue, and that the instru-

ment is in fact insufficiently stamped.

Provision for payment or transfer of money or

stock settled. — § 125 (1.) An instrument char.geable

with ad valorem duty as a settlement in respect of

any money, stock, or security is not to be charged

with any further duty by reason of containing pro-

vision for the payment or transfer of the same

money, stock, or security.

Reversionary property settled — Annuity by person

in possession. — (2.) Where any money, stock, or

security is settled or agreed to be settled by a per-

son who has only a reversionary interest therein, and.

the instrument whereby such settlement is made

or agreed to be made contains a covenant by the-

person entitled in possession to the interest or divi-

dends of such money, stock, or security for the pay-

ment, during the continuance of such possession, of

any annuity or yearly sum not exceeding interest

at the rate of £4 per centum per annum upon the

amount or value of such money, stock, or securitjv

such instrument shall not be charged with any

duty in respect of such covenant.

Where several instilments, one only to be charged

with ad valorem dttty. — § 126 (1.) Where several

instruments are executed for effecting the settle-

ment of the same property, and the ad valorem duty

chargeable in respect of the settlement of such pro-

Beconveyance, Kelease, or Eenunciation of any

security. See Mortgage, etc.

Belease or Rekunciation of any property, or of

any right or interest in any property —

Upon a sale. See Conveyance on Sale.

By way of security. See Mortgage, etc.

In any other case 10s.

Eenunciation. See Beconveyance and Release.

Resignation. — Principal or original instrument of

resignation, or service of cognition of heirs,

or charter or sasine of any houses, lands, or

other heritable subjects in Scotland holding

burgage, or of burgage tenure 5s.

And instrument of resignation of any lands or

other heritable subjects in Scotland not of

burgage tenure 5s.

Bevocation of any use or trust of any property by

deed, or by any writing, not being a will. ..10s.

Schedule, Inventory, or document of any kind

whatsoever, referred to in or by, and in-

tended to be used or given in evidence as part

of, or as material to, any other insti'ument

charged with any duty, but which is separate

and distinct from, and not endorsed on or

annexed to, such other instrument —

Where such other instrument is chargeable

with any duty not exceeding 10s., the same

duty as such other instrument.

In any other case 10s.

Exemptions. — (1.) Printed proposals published

by any corporation or company respecting

insurances, and referred to in or by any policy

of insurance issued by such corporation or com-

pany.

(2.) Any public map, plan, survey, apportion-

ment, allotment, award, and other parochial or

public document and writing, made under or

in pursuance of any Act of Parliament, and

deposited or kept for reference in any registry,

or in any public office, or with the public

books, papers, or writings of any parish.

Scrip Certificate or Scrip, See Letter of

Allotment.

Seisin. — Instrument of seisin given upon any

charter, precept of dare constat, or precept

from Chancery, or upon any wadset, heritable

bond, disposition, apprizing, adjudication, or

otherwise of any lands or heritable subjects iu

Scotland not of burgage tenure 5s.

And any Notarial Instrument to be expeded

and recorded in any register of sasines 5s.

Settlement. — Any instrument, whether voluntary

or upon any good or valuable consideration,

other than a bona fide pecuniary considera-

tion, whereby any definite and certain prin-

cipal sum of money (whether charged or

change or promissory note for money amoimting

to £2 or upwards, is acknowledged or expressed to

have been received or deposited or paid, or whereby

any debt or demand, or any part of a debt or

demand, of the amount of £2 or upwards, is

acknowledged to have been settled, satisfied, or

discharged, or which signifies or imports any such

acknowledgment, and whether the same is or is not

signed with the name of any person.

Penalty for offences. — § 123. If any person —

(1.) Gives any receipt liable to duty and not duly

(2.) In any case where a receipt would be liable

to duty, refuses to give a receipt duly stamped :

(3.) Upon a payment to the amount of £2 or

upwards, gives a receipt for a sum not amount-

ing to £2, or separates or divides the amount

paid with intent to evade the duty :

he shall forfeit the sum of £10.

chargeable on lands or other hereditaments or

heritable subjects or not, or to be laid out in

the purchase of lands or other hereditaments

or heritable subjects or not), or any definite-

and certain amount of stock, or any security, is

settled or agreed to be settled in any manner

whatsoever —

For every £100, and also for any fractional part

of £100, of the amount or value of the property

settled or agreed to be settled 5s.

Exemption. — Instrument of appointment relating-

to any property in favour of persons specially

named or described as the objects of a power

of appointment, created by a previous settle-

ment, stamped with ad valorem duty in respect

of the same property, or by will, whei-e probate

duty has been paid in respect of the same pro-

perty as personal estate of the testator.

[Money in foreign or colonial currency, duty to-

be calculated on the value in British cmTency

according to the current rate of exchange at

the date of the instrument (§ 11). Stock or

marketable security, duty to be calculated on

the value according to the average price at the

date of the instrument (§ 12).^

(See Note a.)

Share Warrant issued under the provisions of

' The Companies Act, 1867.' — See section 33 of

a. As to settlement of policy or security § 124.

Where any money which may become due or pay-

able upon any policy of insurance, or upon any

security not being a marketable security, is settled

or agreed to be settled, the instrument whereby

such settlement is made or agreed to be made is to

be charged with ad valorem duty in respect of such

mouey :

Proviso as to policies. — Provided as follows—

(1.) Where, in the case of a policy of insur-

ance, no provision is made for keeping up

the policy, the ad valorem duty is to b&

charged only on the value of the policy at

the date of the instrument.

(2.) If in any such case the instrument contains-

a statement of such value, and is stamped im

accordance with such statement, it is, so far

as regards such policy, to be deemed duly

stamped, unless or until it is shown that

such statement is untrue, and that the instru-

ment is in fact insufficiently stamped.

Provision for payment or transfer of money or

stock settled. — § 125 (1.) An instrument char.geable

with ad valorem duty as a settlement in respect of

any money, stock, or security is not to be charged

with any further duty by reason of containing pro-

vision for the payment or transfer of the same

money, stock, or security.

Reversionary property settled — Annuity by person

in possession. — (2.) Where any money, stock, or

security is settled or agreed to be settled by a per-

son who has only a reversionary interest therein, and.

the instrument whereby such settlement is made

or agreed to be made contains a covenant by the-

person entitled in possession to the interest or divi-

dends of such money, stock, or security for the pay-

ment, during the continuance of such possession, of

any annuity or yearly sum not exceeding interest

at the rate of £4 per centum per annum upon the

amount or value of such money, stock, or securitjv

such instrument shall not be charged with any

duty in respect of such covenant.

Where several instilments, one only to be charged

with ad valorem dttty. — § 126 (1.) Where several

instruments are executed for effecting the settle-

ment of the same property, and the ad valorem duty

chargeable in respect of the settlement of such pro-

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1879-1880 > (705) |

|---|

| Permanent URL | https://digital.nls.uk/83625386 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|