Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

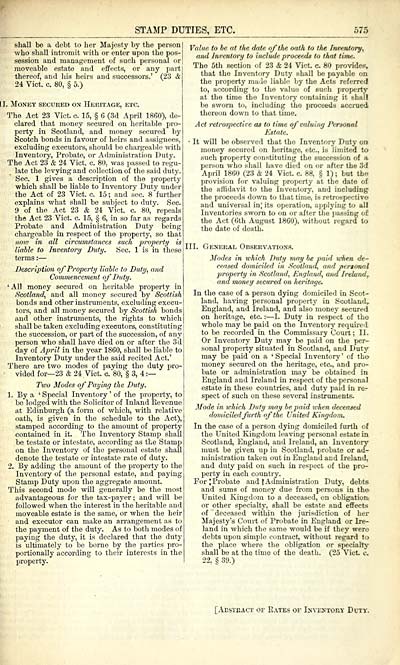

STAMP DUTIES, ETC.

575

sliall be a debt to her Maj(!Kty by the perKon

who sliall intromit with or enter upon the pos-

session and management of such personal or

moveable estate and effects, or any part

thereof, and his heirs and successors.' (23 &

24 Vict. c. 80, § 5.)

LI. Money secured on Heritage, etc.

The Act 23 Vict. c. 15, § G (3d April 1800), de-

clared that money secured on heritable pro-

perty in Scotland, and money secured by

Scotch bonds in favour of heirs and assif^noes,

excluding executors, should bo chargeable with

Inventory, Probate, or Administration Duty.

The Act 23 & 24 Vict. c. 80, was passed to regu-

late the levying and collection of the said duty.

Sec. 1 gives a description of the property

which shall be liable to Inventory Duty undiT

the Act of 23 Vict. c. 15 ; and sec. 8 further

explains what shall be subject to duty. Sec.

9 of the Act 23 & 24 Vict. c. 80, repeals

the Act 23 Vict. c. 15, § 6, in so far as regards

Probate and Administration Duty being

chai-geable in respect of the property, so that

noiij in all circumstances such properti/ is

liable to Inventor)/ Duty. Sec. 1 is in these

terms : —

Description of Property liable to Duty, and

Coinmencenient oj' Duty.

'All money secured on heritable property in

Scotland, and all money seciu-ed by Scottish

bonds and other instruments, excluding execu-

tors, and all money secured by Scottish bonds

and other instruments, the rights to which

shall be taken excluding executors, constituting

the succession, or part of the succession, of any

person who shall have died on or after the 3d

day of April in the year 1860, shall bo liable to

Inventory Duty under the said recited Act.'

There are two modes of paying the duty pro-

■ vided for— 23 & 24 Vict. c. 80, § 3, 4 :—

Two Modes of Paying the Duty.

1. By a ' Special Inventory ' of the property, to

bo lodged with the Solicitor of Inland Eevenue

at Edinburgh (a fonu of which, with relative

oath, is given in the schedule to the Act),

stamped according to the amount of property

contained in it. The Inventory Stamp shall

he testate or intestate, according as the Stamp

on the Inventoi-y of the personal estate shall

denote the testate or intestate rate of duty.

2. By adding the amount of the property to the

Inventory of the personal estate, and paying

Stamp Duty upon the aggregate amount.

This second mode will generally be tho most

advantageous for the tax-payer ; and will be

followed when the interest in the heritable and

moveable estate is the same, or when the heir

and executor can make an arrangement as to

the payment of the duty. As to both modes of

paying the duty, it is declared that the duty

is ultimately to be borne by the parties pro-

portionally according to their interests in the

property.

Value to be at the dtUe of the oath to the Inventory,

ami Inventory to include proceeds to that time.

Tho 5tli section of 23 & 24 Vict. c. 80 provides,

that tho Inventory Duty shall be payable on

the property njalc liabh- by the Acts referred

to, according to the value of such property

at tho time tho Inventory containing it shall

be sworn to, including the proceeds accrued

thereon down to that time.

Act retrospectlce as to time ofvaluin^j Personal

Estate.

• It will bo observed that tho Invent^try Duty oa

money secured on heritage, etc., in limited to

such property constituting the succession of a

person wlio sliall have died fin or after the 3(1

April 18G0 (23 & 24 Vict. c. 88, § 1) ; but tho

provision for valuing property at the date of

the aitidavit to the Inventory, and including

the proceeds down to that time, is retrospeclivo

and universal in; its operation, a])plying tjj all

Inventories sworn to on or after the passing of

the Act (Oth August 1860), without regard to

tho date of death.

III. GENEiiAL Observations.

Modes in ivhich Duty may be paid lehen de-

ceased domiciled in Scotland, and personal

property in Scotland, En'jlaiixl, and Ireland^

and money secured on heritaye.

In the case of a person dying domicileil in Scot-

land, having personal pnjperty in Scotland^

England, and Ireland, and also money secured

on heritage, etc. : — I. Duty in respect of tho

whole may be paid on the Inventorj' required

to be recorded in the Commissary Court; II.

Or Inventory Duty may be paid on the per-

sonal property situated in Scotland, and Duty

may be paid on a 'Special Inventory' of tho

money secured on the heritage, etc., and pro-

bate or administration may be obtained in

England and Ireland in respect of the poi-sonal

estate in these countries, and duty paid in re-

spect of such on these several instruments.

Mode in vhich Duty may be paid ichen deceased

domiciled furth of the United Kingdom.

In the case of a person dying domiciled furth of

the United Kingdom leaving personal estate in

Scotland, England, and Ireland, an Inventory

must be given up in Scotland, probate or ad-

ministration taken out in England and Ireland,

and duty paid on such in respect of the pro-

perty in each countrj'.

For ^Probate and f Administration Duty, debts

and sums of money due from pereons in the

United Kingdom to a deceased, on obligation

or other specialty, shall bo estate and effects

of deceased within the jm-isdiction of her

Majesty's Court of Probate in England or Ire-

land in which the same would be if they were

debts upon simple contract, without regard to

the place where the obligation or specialty

shall be at the time of the death. (25 Vict c

22, § 39.)

[Aestkact of I\Ate.s of iNVENTonv Duty.

575

sliall be a debt to her Maj(!Kty by the perKon

who sliall intromit with or enter upon the pos-

session and management of such personal or

moveable estate and effects, or any part

thereof, and his heirs and successors.' (23 &

24 Vict. c. 80, § 5.)

LI. Money secured on Heritage, etc.

The Act 23 Vict. c. 15, § G (3d April 1800), de-

clared that money secured on heritable pro-

perty in Scotland, and money secured by

Scotch bonds in favour of heirs and assif^noes,

excluding executors, should bo chargeable with

Inventory, Probate, or Administration Duty.

The Act 23 & 24 Vict. c. 80, was passed to regu-

late the levying and collection of the said duty.

Sec. 1 gives a description of the property

which shall be liable to Inventory Duty undiT

the Act of 23 Vict. c. 15 ; and sec. 8 further

explains what shall be subject to duty. Sec.

9 of the Act 23 & 24 Vict. c. 80, repeals

the Act 23 Vict. c. 15, § 6, in so far as regards

Probate and Administration Duty being

chai-geable in respect of the property, so that

noiij in all circumstances such properti/ is

liable to Inventor)/ Duty. Sec. 1 is in these

terms : —

Description of Property liable to Duty, and

Coinmencenient oj' Duty.

'All money secured on heritable property in

Scotland, and all money seciu-ed by Scottish

bonds and other instruments, excluding execu-

tors, and all money secured by Scottish bonds

and other instruments, the rights to which

shall be taken excluding executors, constituting

the succession, or part of the succession, of any

person who shall have died on or after the 3d

day of April in the year 1860, shall bo liable to

Inventory Duty under the said recited Act.'

There are two modes of paying the duty pro-

■ vided for— 23 & 24 Vict. c. 80, § 3, 4 :—

Two Modes of Paying the Duty.

1. By a ' Special Inventory ' of the property, to

bo lodged with the Solicitor of Inland Eevenue

at Edinburgh (a fonu of which, with relative

oath, is given in the schedule to the Act),

stamped according to the amount of property

contained in it. The Inventory Stamp shall

he testate or intestate, according as the Stamp

on the Inventoi-y of the personal estate shall

denote the testate or intestate rate of duty.

2. By adding the amount of the property to the

Inventory of the personal estate, and paying

Stamp Duty upon the aggregate amount.

This second mode will generally be tho most

advantageous for the tax-payer ; and will be

followed when the interest in the heritable and

moveable estate is the same, or when the heir

and executor can make an arrangement as to

the payment of the duty. As to both modes of

paying the duty, it is declared that the duty

is ultimately to be borne by the parties pro-

portionally according to their interests in the

property.

Value to be at the dtUe of the oath to the Inventory,

ami Inventory to include proceeds to that time.

Tho 5tli section of 23 & 24 Vict. c. 80 provides,

that tho Inventory Duty shall be payable on

the property njalc liabh- by the Acts referred

to, according to the value of such property

at tho time tho Inventory containing it shall

be sworn to, including the proceeds accrued

thereon down to that time.

Act retrospectlce as to time ofvaluin^j Personal

Estate.

• It will bo observed that tho Invent^try Duty oa

money secured on heritage, etc., in limited to

such property constituting the succession of a

person wlio sliall have died fin or after the 3(1

April 18G0 (23 & 24 Vict. c. 88, § 1) ; but tho

provision for valuing property at the date of

the aitidavit to the Inventory, and including

the proceeds down to that time, is retrospeclivo

and universal in; its operation, a])plying tjj all

Inventories sworn to on or after the passing of

the Act (Oth August 1860), without regard to

tho date of death.

III. GENEiiAL Observations.

Modes in ivhich Duty may be paid lehen de-

ceased domiciled in Scotland, and personal

property in Scotland, En'jlaiixl, and Ireland^

and money secured on heritaye.

In the case of a person dying domicileil in Scot-

land, having personal pnjperty in Scotland^

England, and Ireland, and also money secured

on heritage, etc. : — I. Duty in respect of tho

whole may be paid on the Inventorj' required

to be recorded in the Commissary Court; II.

Or Inventory Duty may be paid on the per-

sonal property situated in Scotland, and Duty

may be paid on a 'Special Inventory' of tho

money secured on the heritage, etc., and pro-

bate or administration may be obtained in

England and Ireland in respect of the poi-sonal

estate in these countries, and duty paid in re-

spect of such on these several instruments.

Mode in vhich Duty may be paid ichen deceased

domiciled furth of the United Kingdom.

In the case of a person dying domiciled furth of

the United Kingdom leaving personal estate in

Scotland, England, and Ireland, an Inventory

must be given up in Scotland, probate or ad-

ministration taken out in England and Ireland,

and duty paid on such in respect of the pro-

perty in each countrj'.

For ^Probate and f Administration Duty, debts

and sums of money due from pereons in the

United Kingdom to a deceased, on obligation

or other specialty, shall bo estate and effects

of deceased within the jm-isdiction of her

Majesty's Court of Probate in England or Ire-

land in which the same would be if they were

debts upon simple contract, without regard to

the place where the obligation or specialty

shall be at the time of the death. (25 Vict c

22, § 39.)

[Aestkact of I\Ate.s of iNVENTonv Duty.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1867-1868 > (581) |

|---|

| Permanent URL | https://digital.nls.uk/83593499 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|