Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

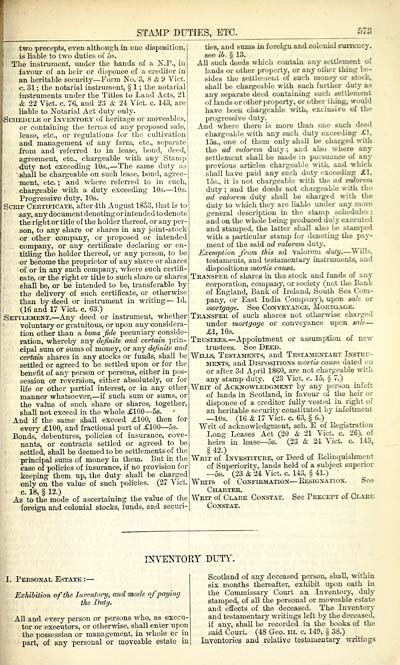

STAMP DUTIES, ETC.

two precepts, even altboiiRli in one disposition,

is liable to two duties of 5s.

The instnimuut, under the hands of a N.I'., in

fiivour of an Lcir or dispoueo of a creditor in

an heritable security — Form No. 3, H & 'J Viet.

c. 31 ; the notarial iustruinent, § 1 ; the notarial

instruments under the Titles to Laud Acts, 21

& 22 Vict. c. 7G, and 23 & 24 Vict. c. 143, are

liable to Notarial Act duty only.

Schedule or Inventopa' of lujritajje or moveables,

or containing the terms of any proposed sale,

lease, etc., or regulations for the cultivation]

and management of any farm, etc., separuti'

from and referred to in lease, bond, deed,

agreement, etc., chargeable with any Stamj)

duty not exceeding lUs.,— The same duty as

'shall be chargeable on such lease, bond, agree-

ment, etc. ; and where referred to in such,

chargeable with a duty exceeding 10s. — 10s.

Progressive duty, 10s.

Scrip Ceetificate, after 4th August 1853, that is to

say, any document denoting or intended to denote

the right or title of the holder thereof, or any per-

son, to any share or shares in any joint-stock

or other company, or proposed or intended

company, or any certificate declaring or en-

titling the holder thereof, or any person, to be

or become the proprietor of any share or shares

of or in any such company, where such certifi-

cate, or the right or title to such share or shares

shall be, or be intended to be, transferable by

the delivery of such certificate, or otherwise

than by deed or instrument in writing— Id.

(16 and 17 Vict. c. 63.)

Settlement. — Any deed or instrument, whether

voluntary or gratuitous, or upon any considera-

tion other than a bona fide pecuniary conside-

ration, whereby any definite and certain prin-

cipal sum or sums of money, or any d^nite and

certain shares in any stocks or funds, shall be

settled or agreed to be settled upon or for the

benefit of anj' person or persons, either in pos-

session or reversion, either absolutely, or for

life or other partial interest, or in any other

manner whatsoever, — if such sum or sums, or

the value of such share or shares, together,

shall not exceed in the whole £100— 5s.

And if the same .shall exceed £100, then for

every £100, and fractional part of £100 — 5s.

Bonds, debentures, policies of insurance, cove-

nants, or contracts settled or agreed to be

settled, shall be deemed to be settlements of the

principal sums of money in them. But in the

case of policies of insurance, if no provision for

keeping them up, the duty shall be charged

only on the value of such policies. (27 Vict.

c. 18, § 12.)

As to the mode of ascertaining the value of the

foreign and colonial stocks, funds, and securi-

ticB, and sums in foreign and colonial currency,

sec ib. § 13.

All such (keds which contain anj- settlement of

lands or other propm-ty, or any otlier thing be-

sides the settle- ii;iit of sucli njoney or stock,

shall be chargeable with such further duty as

any separate deid containing such eettleinent

of lauds or other property, or other thing, would

have been chargeable with, exclubivo of the

progressive duty.

And when; there is more than one such deed

cliargeable with any such duty exceeding £1,

156., one of them only shall be charged with

the ad valorem duty ; and also where any

settlement shall be made in puisuaucc of au\'

previous articles chargeable with, and which

shall have paid any such duty exceeding £1,

15s., it is not chargeable with the ad valorem

duty ; and the deeds not chargeable with f lie

ad valorem duty shall be charged with the

duty to which they are liable under any more

general description in th(; stauip schedules :

and on the whole being produced duly executed

and stamped, the latter shall ako \a: stamped

with a particular stamp for denoting the pay-

ment of the said ad valorem duty.

Exemption from this ad valorem duty. — Wills.

testaments, and testamentarj' instruiuenta, and

dispositions mortis causa.

Transfer of shares in the stock and funds of any

corporation, company, or society (not the Bank

of England, Bank of Ireland, South Sea Com-

pany, or East India Comp.my), upon gaJe or

nwrtgage. See CoNVEy^v^•cE, Moutgage.

Transfer of such shares not othenvise charged

under mortgage or conveyance upon &ale —

£1, 10s.

Trustees. — Appointment or assumption of new

trustees. See Deed.

"Wills, Testajiexts, and Testa3ientaut Instru-

ments, and Dispositions mortis causa dated on

or after 3d April 1860, are not chargeable witli

any stamp duty. (23 Vict. c. 15, § 7.)

Writ of Ackno^vledgmest by any person infeft

of lands in Scotland, in favoui- of the heir or

dispouee of a creditor fuUy vested in right of

an heritable secm-ity constituted by infeftmcnt

—10s. (16 k 17 Vict. c. 63, § 6.)

Writ of acknowledgment, sch. E of Eegistration

Long Leases Act (20 vSc 21 Vict. c. 26), of

heirs in lease— 5s. (23 & 24 Vict c. 143,

§42.)

Writ of In\'estiture, or Deed of Eelinquishment

of Superiority, lands held of a subject superior

—5s. (23 & 24 Vict. c. 143, § 41.) '

Writs of Confirslation — liEsiGXATiox. See

Charter.

Writ of Claire Constat. See Precett of Glare

Constat.

LNTENTORY DUTi'.

I. Personal Estate :

Exhibition of the Inventor]/, and mode of paging

the. Duty.

All and every person or persons who, as execu-

tor or executors, or otherwise, shall enter upon

the possession or management, in whole or in

part, of any personal or moveable estate in

Scotland of any deceased person, shall, witbin

six months thereafter, exhibit upon oath in

the Commissary Coiu-t an Inveutoiy, duly

stamped, of all the personal or moveable ost;\te

and effects of the deceased. The Inventoi-y

and testamentary writings left by the deceased,

if any, shall bo recorded in the boolis of the

said Court. (48 Geo. in. c. 140, § 38.)

Inventories and relative testamentary writings

two precepts, even altboiiRli in one disposition,

is liable to two duties of 5s.

The instnimuut, under the hands of a N.I'., in

fiivour of an Lcir or dispoueo of a creditor in

an heritable security — Form No. 3, H & 'J Viet.

c. 31 ; the notarial iustruinent, § 1 ; the notarial

instruments under the Titles to Laud Acts, 21

& 22 Vict. c. 7G, and 23 & 24 Vict. c. 143, are

liable to Notarial Act duty only.

Schedule or Inventopa' of lujritajje or moveables,

or containing the terms of any proposed sale,

lease, etc., or regulations for the cultivation]

and management of any farm, etc., separuti'

from and referred to in lease, bond, deed,

agreement, etc., chargeable with any Stamj)

duty not exceeding lUs.,— The same duty as

'shall be chargeable on such lease, bond, agree-

ment, etc. ; and where referred to in such,

chargeable with a duty exceeding 10s. — 10s.

Progressive duty, 10s.

Scrip Ceetificate, after 4th August 1853, that is to

say, any document denoting or intended to denote

the right or title of the holder thereof, or any per-

son, to any share or shares in any joint-stock

or other company, or proposed or intended

company, or any certificate declaring or en-

titling the holder thereof, or any person, to be

or become the proprietor of any share or shares

of or in any such company, where such certifi-

cate, or the right or title to such share or shares

shall be, or be intended to be, transferable by

the delivery of such certificate, or otherwise

than by deed or instrument in writing— Id.

(16 and 17 Vict. c. 63.)

Settlement. — Any deed or instrument, whether

voluntary or gratuitous, or upon any considera-

tion other than a bona fide pecuniary conside-

ration, whereby any definite and certain prin-

cipal sum or sums of money, or any d^nite and

certain shares in any stocks or funds, shall be

settled or agreed to be settled upon or for the

benefit of anj' person or persons, either in pos-

session or reversion, either absolutely, or for

life or other partial interest, or in any other

manner whatsoever, — if such sum or sums, or

the value of such share or shares, together,

shall not exceed in the whole £100— 5s.

And if the same .shall exceed £100, then for

every £100, and fractional part of £100 — 5s.

Bonds, debentures, policies of insurance, cove-

nants, or contracts settled or agreed to be

settled, shall be deemed to be settlements of the

principal sums of money in them. But in the

case of policies of insurance, if no provision for

keeping them up, the duty shall be charged

only on the value of such policies. (27 Vict.

c. 18, § 12.)

As to the mode of ascertaining the value of the

foreign and colonial stocks, funds, and securi-

ticB, and sums in foreign and colonial currency,

sec ib. § 13.

All such (keds which contain anj- settlement of

lands or other propm-ty, or any otlier thing be-

sides the settle- ii;iit of sucli njoney or stock,

shall be chargeable with such further duty as

any separate deid containing such eettleinent

of lauds or other property, or other thing, would

have been chargeable with, exclubivo of the

progressive duty.

And when; there is more than one such deed

cliargeable with any such duty exceeding £1,

156., one of them only shall be charged with

the ad valorem duty ; and also where any

settlement shall be made in puisuaucc of au\'

previous articles chargeable with, and which

shall have paid any such duty exceeding £1,

15s., it is not chargeable with the ad valorem

duty ; and the deeds not chargeable with f lie

ad valorem duty shall be charged with the

duty to which they are liable under any more

general description in th(; stauip schedules :

and on the whole being produced duly executed

and stamped, the latter shall ako \a: stamped

with a particular stamp for denoting the pay-

ment of the said ad valorem duty.

Exemption from this ad valorem duty. — Wills.

testaments, and testamentarj' instruiuenta, and

dispositions mortis causa.

Transfer of shares in the stock and funds of any

corporation, company, or society (not the Bank

of England, Bank of Ireland, South Sea Com-

pany, or East India Comp.my), upon gaJe or

nwrtgage. See CoNVEy^v^•cE, Moutgage.

Transfer of such shares not othenvise charged

under mortgage or conveyance upon &ale —

£1, 10s.

Trustees. — Appointment or assumption of new

trustees. See Deed.

"Wills, Testajiexts, and Testa3ientaut Instru-

ments, and Dispositions mortis causa dated on

or after 3d April 1860, are not chargeable witli

any stamp duty. (23 Vict. c. 15, § 7.)

Writ of Ackno^vledgmest by any person infeft

of lands in Scotland, in favoui- of the heir or

dispouee of a creditor fuUy vested in right of

an heritable secm-ity constituted by infeftmcnt

—10s. (16 k 17 Vict. c. 63, § 6.)

Writ of acknowledgment, sch. E of Eegistration

Long Leases Act (20 vSc 21 Vict. c. 26), of

heirs in lease— 5s. (23 & 24 Vict c. 143,

§42.)

Writ of In\'estiture, or Deed of Eelinquishment

of Superiority, lands held of a subject superior

—5s. (23 & 24 Vict. c. 143, § 41.) '

Writs of Confirslation — liEsiGXATiox. See

Charter.

Writ of Claire Constat. See Precett of Glare

Constat.

LNTENTORY DUTi'.

I. Personal Estate :

Exhibition of the Inventor]/, and mode of paging

the. Duty.

All and every person or persons who, as execu-

tor or executors, or otherwise, shall enter upon

the possession or management, in whole or in

part, of any personal or moveable estate in

Scotland of any deceased person, shall, witbin

six months thereafter, exhibit upon oath in

the Commissary Coiu-t an Inveutoiy, duly

stamped, of all the personal or moveable ost;\te

and effects of the deceased. The Inventoi-y

and testamentary writings left by the deceased,

if any, shall bo recorded in the boolis of the

said Court. (48 Geo. in. c. 140, § 38.)

Inventories and relative testamentary writings

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1867-1868 > (579) |

|---|

| Permanent URL | https://digital.nls.uk/83593475 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|