Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

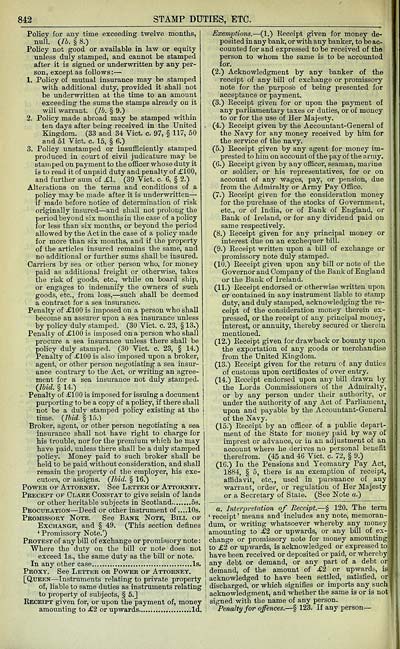

842

STAMP DUTIES, ETC.

Policy for any time exceeding twelve months,

null. {lb. § 8.)

Policy not good or available in law or equity

unless duly stamped, and cannot be stamped

after it is signed or underwritten by any per-

son, except as follows: —

1. Policy of mutual insurance may be stamped

with additional duty, provided it shall not

be underwritten at the time to an amount

exceeding the sums the stamps already on it

will warrant. (Jh. § 9.)

2. Policy made abroad may be stamped within

ten days after being received in the United

Kingdom. (33 and 34 Vict. c. 97, § 117, 50

and 51 Vict. c. 15, § 6.)

3. Policy unstamped or insufficiently stamped

produced in court of civil judicature may be

stamped on payment to the officer whose duty it

is to read it of unpaid duty and penalty of £100,

and further sum of £1. (39 Vict. c. 6, § 2.)

Alterations on the terms and conditions of a

policy may be made after it is underwritten —

if made before notice of determination of risk

originally insured — and shall not prolong the

period beyond six months in the case of a policy

for less than six months, or beyond the period

allowed by the Act in the case of a policy made

for more than six months, and if the property

of the articles insured remains the same, and

no additional or further sums shall be insured.

Carriers by sea or other person who, for money

paid as additional freight or otherwise, takes

the risk of goods, etc., while on board ship,

or engages to indemnify the owners of such

goods, etc., from loss, — such shall be deemed

a contract for a sea insurance.

Penalty of £100 is imposed on a person who shall

become an assurer upon a sea insurance unless

by policy duly stamped. (30 Vict. c. 23, § 13.)

Penalty of £100 is imposed on a person who shall

procure a sea insurance unless there shall be

policy duly stamped. (30 Vict. c. 23, § 14.)

Penalty of £100 is also imposed upon a broker,

agent, or other person negotiating a sea insur-

ance contrary to the Act, or writing an agree-

ment for a sea insurance not duly stamped.

Qbid. § 14.)

Penalty of £100 is imposed for issuing a document

purporting to be a copy of a policy, if there shall

not be a duly stamped policy existing at the

time. (Jhid. § 15.)

Broker, agent, or other person negotiating a sea

insurance shall not have right to charge for

his trouble, nor for the premium which he may

have paid, unless there shall be a duly stamped

policy. Money paid to such broker shall be

held to be paid without consideration, and shall

remain the property of the employer, his exe-

cutors, or assigns. (Ibid. § 16.)

Power op Attoeney. See Letter of Attorney.

Precept of Clare Constat to give seisin of lands

or other heritable subjects in Scotland 5s.

Procuration — Deed or other instrument of ....10s.

Promissory Note. See Bank Note, Bill of

Exchange, and § 49. (This section defines

' Promissory Note.')

Protest of any biU of exchange or promissory note :

Where the duty on the bill or note does not

exceed Is., the same duty as the bill or note.

In any other case Is.

Proxy. See Letter or PovnsR of Attorney.

[Queen — Instruments relating to private property

of, liable to same duties as instruments relating

to property of subjects, § 5.]

Receipt given for, or upon the payment of, money

amoimting to £2 or upwards Id.

Exemptions. — (1.) Eeceipt given for money de-

posited in any bank, or with any banker, to be ac-

counted for and expressed to be received of the

person to whom the same is to be accounted

for.

(2.) Acknowledgment by any banker of the

receipt of any bill of exchange or promissory

note for the purpose of being presented for

acceptance or payment.

(3.) Keceipt given for or upon the payment of

any parliamentary taxes or duties, or of money

to or for the use of Her Majesty.

(4.) Eeceipt given by the Accountant-General of

the Navy for any money received by him for

the service of the navy.

(5.) Receipt given by any agent for money im-

prested to him on account of the pay of the a.nny.

(6.) Receipt given by any officer, seaman, marine

or soldiei', or his representatives, for or on

account of any wages, pay, or pension, due

from the Admiralty or Army Pay Office.

(7.) Receipt given for the consideration money

for the pui'chase of the stocks of Government,

etc., or of India, or of Bank of England, or

Bank of Ireland, or for any dividend paid on

same respectively.

(8.) Receipt given for any principal money or

interest due on an exchequer bill.

(9.) Receipt written upon a bill of exchange or

promissory note duly stamped.

(10.) Receipt given upon any bill or note of the

Governor and Company of the Bank of England

or the Bank of Ireland.

(11.) Receipt endorsed or otherwise written upon

or contained in any instrument liable to stamp

duty, and duly stamped, acknowledging the re-

ceipt of the consideration money therein ex-

pressed, or the receipt of any principal money,

interest, or annuity, thereby secured or therein

mentioned.

(12.) Receipt given for drawback or bounty upon

the exportation of any goods or merchandise

from the United Kingdom.

(13.) Receipt given for the retui-n of any duties

of customs upon certificates of over entry.

(14.) Eeceipt endorsed upon any bill drawn by

the Lords Commissioners of the Admiralty,

or by any person under their authority, or

under the authority of any Act of Parliament,

upon and payable by the Accountant-General

of the Navy.

(15.) Receipt by an officer of a public depart-

ment of the State for money paid by way of

imprest or advance, or in an adjustment of an

account where he derives no personal benefit

therefrom. (45 and 46 Vict. c. 72, § 9.)

(16.) In the Pensions and Yeomanry Pay Act,

1884, § 5, there is an exemption of receipt,

affidavit, etc., used in pursuance of _ any

warrant, order, or regulation of Her Majesty

or a Secretary of State. (See Note a.')

a. Intei-jvetation of Eeceipt.—^ 120. The term

'receipt' means and includes anj- note, memoran-

dum, or writing whatsoever whereby any money

amounting to £2 or upwards, or any bUl of ex-

change or promissory note for money amoimting'

to £2 or upwards, is acknowledged or expressed to

have been i-eceived or deposited or paid, or whereby

any debt or demand, or any part of a debt or

demand, of the amount of £2 or upwards, is

acknowledged to have been settled, satisfied, or

discharged, or which signifies or imports any such

acknowledgment, and whether the same is or is not

signed with the name of any person.

Penalty for offences.—^ 123. If any person—

STAMP DUTIES, ETC.

Policy for any time exceeding twelve months,

null. {lb. § 8.)

Policy not good or available in law or equity

unless duly stamped, and cannot be stamped

after it is signed or underwritten by any per-

son, except as follows: —

1. Policy of mutual insurance may be stamped

with additional duty, provided it shall not

be underwritten at the time to an amount

exceeding the sums the stamps already on it

will warrant. (Jh. § 9.)

2. Policy made abroad may be stamped within

ten days after being received in the United

Kingdom. (33 and 34 Vict. c. 97, § 117, 50

and 51 Vict. c. 15, § 6.)

3. Policy unstamped or insufficiently stamped

produced in court of civil judicature may be

stamped on payment to the officer whose duty it

is to read it of unpaid duty and penalty of £100,

and further sum of £1. (39 Vict. c. 6, § 2.)

Alterations on the terms and conditions of a

policy may be made after it is underwritten —

if made before notice of determination of risk

originally insured — and shall not prolong the

period beyond six months in the case of a policy

for less than six months, or beyond the period

allowed by the Act in the case of a policy made

for more than six months, and if the property

of the articles insured remains the same, and

no additional or further sums shall be insured.

Carriers by sea or other person who, for money

paid as additional freight or otherwise, takes

the risk of goods, etc., while on board ship,

or engages to indemnify the owners of such

goods, etc., from loss, — such shall be deemed

a contract for a sea insurance.

Penalty of £100 is imposed on a person who shall

become an assurer upon a sea insurance unless

by policy duly stamped. (30 Vict. c. 23, § 13.)

Penalty of £100 is imposed on a person who shall

procure a sea insurance unless there shall be

policy duly stamped. (30 Vict. c. 23, § 14.)

Penalty of £100 is also imposed upon a broker,

agent, or other person negotiating a sea insur-

ance contrary to the Act, or writing an agree-

ment for a sea insurance not duly stamped.

Qbid. § 14.)

Penalty of £100 is imposed for issuing a document

purporting to be a copy of a policy, if there shall

not be a duly stamped policy existing at the

time. (Jhid. § 15.)

Broker, agent, or other person negotiating a sea

insurance shall not have right to charge for

his trouble, nor for the premium which he may

have paid, unless there shall be a duly stamped

policy. Money paid to such broker shall be

held to be paid without consideration, and shall

remain the property of the employer, his exe-

cutors, or assigns. (Ibid. § 16.)

Power op Attoeney. See Letter of Attorney.

Precept of Clare Constat to give seisin of lands

or other heritable subjects in Scotland 5s.

Procuration — Deed or other instrument of ....10s.

Promissory Note. See Bank Note, Bill of

Exchange, and § 49. (This section defines

' Promissory Note.')

Protest of any biU of exchange or promissory note :

Where the duty on the bill or note does not

exceed Is., the same duty as the bill or note.

In any other case Is.

Proxy. See Letter or PovnsR of Attorney.

[Queen — Instruments relating to private property

of, liable to same duties as instruments relating

to property of subjects, § 5.]

Receipt given for, or upon the payment of, money

amoimting to £2 or upwards Id.

Exemptions. — (1.) Eeceipt given for money de-

posited in any bank, or with any banker, to be ac-

counted for and expressed to be received of the

person to whom the same is to be accounted

for.

(2.) Acknowledgment by any banker of the

receipt of any bill of exchange or promissory

note for the purpose of being presented for

acceptance or payment.

(3.) Keceipt given for or upon the payment of

any parliamentary taxes or duties, or of money

to or for the use of Her Majesty.

(4.) Eeceipt given by the Accountant-General of

the Navy for any money received by him for

the service of the navy.

(5.) Receipt given by any agent for money im-

prested to him on account of the pay of the a.nny.

(6.) Receipt given by any officer, seaman, marine

or soldiei', or his representatives, for or on

account of any wages, pay, or pension, due

from the Admiralty or Army Pay Office.

(7.) Receipt given for the consideration money

for the pui'chase of the stocks of Government,

etc., or of India, or of Bank of England, or

Bank of Ireland, or for any dividend paid on

same respectively.

(8.) Receipt given for any principal money or

interest due on an exchequer bill.

(9.) Receipt written upon a bill of exchange or

promissory note duly stamped.

(10.) Receipt given upon any bill or note of the

Governor and Company of the Bank of England

or the Bank of Ireland.

(11.) Receipt endorsed or otherwise written upon

or contained in any instrument liable to stamp

duty, and duly stamped, acknowledging the re-

ceipt of the consideration money therein ex-

pressed, or the receipt of any principal money,

interest, or annuity, thereby secured or therein

mentioned.

(12.) Receipt given for drawback or bounty upon

the exportation of any goods or merchandise

from the United Kingdom.

(13.) Receipt given for the retui-n of any duties

of customs upon certificates of over entry.

(14.) Eeceipt endorsed upon any bill drawn by

the Lords Commissioners of the Admiralty,

or by any person under their authority, or

under the authority of any Act of Parliament,

upon and payable by the Accountant-General

of the Navy.

(15.) Receipt by an officer of a public depart-

ment of the State for money paid by way of

imprest or advance, or in an adjustment of an

account where he derives no personal benefit

therefrom. (45 and 46 Vict. c. 72, § 9.)

(16.) In the Pensions and Yeomanry Pay Act,

1884, § 5, there is an exemption of receipt,

affidavit, etc., used in pursuance of _ any

warrant, order, or regulation of Her Majesty

or a Secretary of State. (See Note a.')

a. Intei-jvetation of Eeceipt.—^ 120. The term

'receipt' means and includes anj- note, memoran-

dum, or writing whatsoever whereby any money

amounting to £2 or upwards, or any bUl of ex-

change or promissory note for money amoimting'

to £2 or upwards, is acknowledged or expressed to

have been i-eceived or deposited or paid, or whereby

any debt or demand, or any part of a debt or

demand, of the amount of £2 or upwards, is

acknowledged to have been settled, satisfied, or

discharged, or which signifies or imports any such

acknowledgment, and whether the same is or is not

signed with the name of any person.

Penalty for offences.—^ 123. If any person—

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1890-1891 > (890) |

|---|

| Permanent URL | https://digital.nls.uk/83519262 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|